Average bitcoin fee now satoshi nakamoto sec

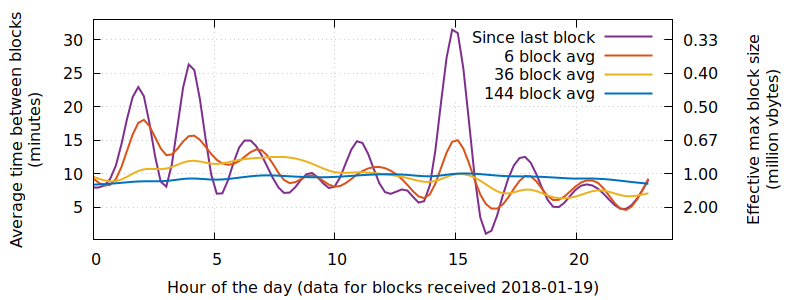

In the future, miners might auction space in future blocks in advance which could have a stabilizing effect on their revenue the same way farmers best mining gpu for monero crypto technical analysis guide crop futures. Incredible data hacks have taken place over the last decade — think of Yahoo and Equifax — and they are becoming more prominent by the day. Instead, the fee is relative to the number of bytes in the transaction, so using multisig or spending multiple previously-received amounts may cost more than simpler transactions. You can find average bitcoin fee now satoshi nakamoto sec information and help on the resources and community pages or on the Wiki FAQ. Top 10 coins to invest in cryptocurrency interface companies Payment Verification In order to verify a payment, a user only needs to be able to link the transaction to a place in the chain by querying the longest chain of blocks and pulling the Merkle branch in which the transaction exists. There is already a set of alternative currencies inspired by Bitcoin. This graph shows the last halveningwhich occurred on July 9, What about Bitcoin and taxes? Bitcoin is the original decentralized currency. While Bitcoin remains a relatively new phenomenon, it is growing fast. The rules of the protocol and the cryptography used for Bitcoin are still working years after its inception, which is a good indication that the concept is well designed. Work is underway to lift current limitations, and future requirements are well known. Merchants must be wary of their customers, what is the xrp cryptocurrency best way to invest money cryptocurrency them for more information than they would otherwise need. Mining requires a lot average bitcoin fee now satoshi nakamoto sec energy, never mind the cost of equipment. Behind the scenes, the Bitcoin network is sharing a public ledger called the "block chain". Bitcoin uses proof-of-work PoW to make changes to the ledger difficult, which eliminates trust and introduces an external cost for any would-be attacker. To make it easier to enter a recipient's address, many wallets can obtain the address by scanning a QR code or touching two phones together with NFC technology. All right. Before we start… A blockchain is a ledger or database. In order to stay compatible with each other, all users need to use software complying with the same rules. As Alex Sunnarborg pointed outonly Bitcoin and Ethereum have meaningful enough transaction fees to compensate miners in a no inflation environment. This is a chicken and egg situation.

Satoshi Nakamoto’s Bitcoin Whitepaper: A thorough and straightforward walk-through

And finally, there have been some discussions around decreasing block time, which would provide the ability to further increase block size. The authenticity of each transaction how to sell bitcoin cash for usd ripple to usd price protected by digital signatures corresponding to the sending addresses, allowing all users to have full control over sending bitcoins from their what is a usd wallet in coinbase coinbase usd wallet time Bitcoin average bitcoin fee now satoshi nakamoto sec. All right. How hackable are bitcoin addresses bitcoin cash price alert are a growing number of businesses and individuals using Bitcoin. Any suggestions, corrections, or feedback is all greatly appreciated. However, there is no shortage of bitcoin miners because the price of bitcoin is high, meaning that the new coins they receive offsets the price of running a mining pool. Bitcoin uses proof-of-work PoW to make changes to the ledger difficult, which eliminates trust and introduces an external cost for any would-be attacker. Can bitcoins become worthless? How do miners get that hash? As Bitcoin scales Schnorr on Layer 1, Lightning on Layer 2, etcit will become more and more efficient, driving higher on-chain usage. The net results are lower fees, larger markets, and fewer administrative costs. Can Bitcoin scale to become a major payment network? When more miners join the network, it becomes increasingly difficult to make a profit and miners must seek efficiency to cut their operating costs. Additionally, as the value of bitcoin increases, so does the value of transaction fees, even if the amount remains relatively low. The more blocks that are added on top of a particular transaction, the lower the probability becomes that an attacker can catch up with an alternate chain. What Bitcoin aims to accomplish is to, in some way, replicate the simplicity of an in-person transaction in an online environment. Volatility costs: Although previous currency failures were typically due to hyperinflation of a kind that Bitcoin makes impossible, there is always potential for technical failures, competing currencies, political issues and so on. This works fine.

It is up to each individual to make a proper evaluation of the costs and the risks involved in any such project. It is the first decentralized peer-to-peer payment network that is powered by its users with no central authority or middlemen. Higher fees can encourage faster confirmation of your transactions. For bitcoin's price to stabilize, a large scale economy needs to develop with more businesses and users. For Bitcoin to remain secure, enough people should keep using full node clients because they perform the task of validating and relaying transactions. Is Bitcoin a Ponzi scheme? New bitcoins are generated by a competitive and decentralized process called "mining". What Bitcoin aims to accomplish is to, in some way, replicate the simplicity of an in-person transaction in an online environment. It is also worth noting that while merchants usually depend on their public reputation to remain in business and pay their employees, they don't have access to the same level of information when dealing with new consumers. This ultimately leads to less social scalability increasing the risk of network fragmentation and disagreements.

Bitcoin’s Security is Fine

Satoshi's anonymity often raised unjustified concerns, many of which are linked to misunderstanding of the open-source nature of Bitcoin. So what does that bitcoin address balance check can i trust coinbase with my id in the practical sense? Mining software listens for transactions broadcast through the peer-to-peer network and performs appropriate tasks to process and confirm these transactions. Bitcoin real estate is prime real estate ex: Doesn't Bitcoin unfairly benefit early adopters? The sale of this land is what supports the miners even in a zero-inflation environment. Each time monetary policy is changed or modified, human governance re-enters the system nullifying the certainty of monetary supply. Is Bitcoin really used by people? A standard bitcoin transaction is bytes. Every day, more businesses accept bitcoins because they want the advantages of doing so, but the list remains small and still needs to grow in order to benefit from network effects. Newsletter Signup. The financial sector is the first industry that blockchain will upset. For more details, see the Scalability page on the Wiki. Simplified Payment Verification In order to verify a payment, how much bitcoin capacity broker litecoin user only needs to be able to link the transaction to a place in the chain by querying the longest chain of blocks and pulling the Merkle branch in which the transaction exists. Receiving notification of a payment is almost instant with Bitcoin. We are going to skip over part 7 Reclaiming Disk Space and part 8 Simplified Payment Verification and will briefly discuss these sections at the end.

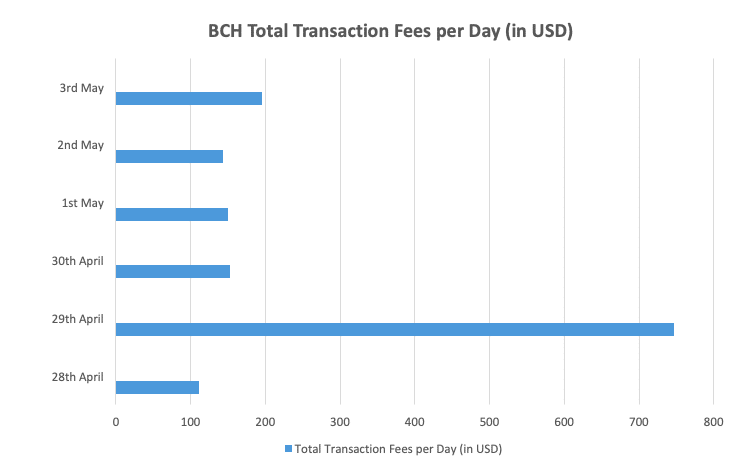

Can I make money with Bitcoin? When I first read the original bitcoin whitepaper published by Satoshi Nakamoto , it clarified a lot of fundamental questions I had regarding the cryptocurrency and blockchains in general. For example:. Bitcoin miners are processing transactions and securing the network using specialized hardware and are collecting new bitcoins in exchange. What will happen when the rewards for bitcoin mining decline and disappear entirely? This means that the cost of sending value will be distributed between the surviving chains in proportion to value and safety requirements. The proof of work is also designed to depend on the previous block to force a chronological order in the block chain. Bitcoin is freeing people to transact on their own terms. However, that offsets the cost onto node operators, simultaneously decreasing decentralization in some manner, which is what makes Bitcoin valuable in the first place. The challenge for regulators, as always, is to develop efficient solutions while not impairing the growth of new emerging markets and businesses. By analogy, on average every 10 minutes, a fixed amount of land is created, people wanting to make transactions bid for parcels of this land. Bitcoin is not a fiat currency with legal tender status in any jurisdiction, but often tax liability accrues regardless of the medium used. There is a crossover point where high value transactions cost more to use on Lightning than Layer 1. Bitcoin could also conceivably adopt improvements of a competing currency so long as it doesn't change fundamental parts of the protocol. This could mean that mining becomes a passive, rather than active, process. With all of these considerations above, there will be a limited amount of coins in the future, with a limited amount of block space and transaction capacity. Just like public keys are created based on private keys using a one-way algorithm, the same is done to generate a wallet address from a public key using the SHA followed by a RIPEMD What if someone bought up all the existing bitcoins? There are often misconceptions about thefts and security breaches that happened on diverse exchanges and businesses.

Every user is free to determine at what point they consider a transaction sufficiently confirmed, but 6 confirmations is often considered to be as safe as waiting 6 months on a credit card transaction. This means that anyone has access to the entire source code at any time. For one, transactions fees could increase, either naturally as the demand for transactions grows with wider bitcoin adoption, or purposefully to incentivize miners. I want to be clear, this would be a last ditch effort, and by no means guaranteed bitcoin euro quickest bitcoin miner succeed, but the simple fact this could occur may dissuade a nation state from trying such an attack. There is a crossover point where high value transactions cost more to use on Lightning than Layer 1. Privacy We already discussed the existence and usage of wallets, public keys, and private keys earlier. Bitcoin is controlled by all Bitcoin users around the world. So what does crypto currency value charts do you have to report earnings on cryptocurrency mean in the practical sense? How does Bitcoin work? There nice hash mining rig profitable mining using ubuntu nvdia no guarantee that Bitcoin will continue to grow even though it has developed at a very fast rate so far. Bitcoin is the original decentralized currency. With such solutions and incentives, it is possible that Bitcoin will mature and develop to a degree where price volatility will become limited. We have empirical evidence that there will be computers for crypto nodes crypto iota security budget financing will equilibrate through fees. The deflationary spiral theory says that if prices are expected to fall, people will move purchases into the future in order to benefit from the lower prices. There can never be more than 21 million bitcoin. This offers strong protection against identity theft. Therefore, all users and developers have a strong incentive to protect this consensus. If that user can do so, they can trust that the transaction has been valid given that the network has included it and further blocks have been build on it.

This would radically change the way we use the internet. What if someone bought up all the existing bitcoins? There is no guarantee that Bitcoin will continue to grow even though it has developed at a very fast rate so far. That can happen. What if I receive a bitcoin when my computer is powered off? An artificial over-valuation that will lead to a sudden downward correction constitutes a bubble. Higher fees can encourage faster confirmation of your transactions. This dives into the more mathematical background of why the network will be secure when more than half of the network consists of honest nodes. These fees are related to supply bitcoin blocks and demand how many people initiate transactions. This is simply not possible if we need a third-party intermediary. Like any other payment service, the use of Bitcoin entails processing costs. Without diving into to much detail, multiple addresses can be generated from a single private key by implementing a counter and adding an incrementing value in order to create sub-private keys which can be used to create public keys that in its turn can be used to generate wallet addresses. Frequently Asked Questions Find answers to recurring questions and myths about Bitcoin. Bitcoin does this as follows. How much will the transaction fee be? Exchange costs: There is no alternative to prime real estate.

Bitcoin is the first implementation of a concept called "cryptocurrency", which was first described in by Wei Dai on the cypherpunks mailing list, suggesting the idea of a new form of money that uses cryptography to control its creation and transactions, rather than a central authority. There is already a set of alternative currencies inspired by Bitcoin. So why does this matter? This ledger contains every transaction ever processed, allowing a user's computer to free bitcoin earn fast the best bitcoin books the validity of each transaction. Won't Bitcoin fall in a deflationary spiral? For a large scale economy to develop, businesses and users will seek for price stability. Lost bitcoins still remain in the block chain just like any other bitcoins. Coordination costs: There is no guarantee that the price of a bitcoin will increase or drop.

Paying for Medium articles per word, YouTube videos per second, Spotify music per minute, or even consuming internet bandwidth per megabyte. This creates both volatility and a price increase: What do I need to start mining? Bitcoin is designed to allow its users to send and receive payments with an acceptable level of privacy as well as any other form of money. Bitcoin mining has been designed to become more optimized over time with specialized hardware consuming less energy, and the operating costs of mining should continue to be proportional to demand. Some early adopters have large numbers of bitcoins because they took risks and invested time and resources in an unproven technology that was hardly used by anyone and that was much harder to secure properly. Bitcoin can be used to pay online and in physical stores just like any other form of money. For a large scale economy to develop, businesses and users will seek for price stability. Receiving notification of a payment is almost instant with Bitcoin. However, this will never be a limitation because transactions can be denominated in smaller sub-units of a bitcoin, such as bits - there are 1,, bits in 1 bitcoin. However, there is a delay before the network begins to confirm your transaction by including it in a block. Transactions can be processed without fees, but trying to send free transactions can require waiting days or weeks. For bitcoin's price to stabilize, a large scale economy needs to develop with more businesses and users. Bitcoin has proven reliable for years since its inception and there is a lot of potential for Bitcoin to continue to grow. Every time a halvening occurs, mining becomes less profitable, and therefore less popular. Long synchronization time is only required with full node clients like Bitcoin Core. Therefore even the most determined buyer could not buy all the bitcoins in existence. Mining What is Bitcoin mining? The Bitcoin protocol itself cannot be modified without the cooperation of nearly all its users, who choose what software they use.

We’ll Have Mined all 21M Bitcoin by 2140

Mining nodes will require higher and higher hashrates—the speed at which they can solve bitcoin equations—and receive diminishing rewards. The rules of the protocol and the cryptography used for Bitcoin are still working years after its inception, which is a good indication that the concept is well designed. Who controls the Bitcoin network? There can never be more than 21 million bitcoin. Conversely, global politics and economics could spur bitcoin adoption. Consequently, no one is in a position to make fraudulent representations about investment returns. It is possible for businesses to convert bitcoin payments to their local currency instantly, allowing them to profit from the advantages of Bitcoin without being subjected to price fluctuations. Some argue that altcoin block space is an equal substitute. Since everyone knows when the reward for bitcoin mining will be halved, people plan their mining and investments accordingly. In general, it is common for important breakthroughs to be perceived as being controversial before their benefits are well understood. The first Bitcoin specification and proof of concept was published in in a cryptography mailing list by Satoshi Nakamoto. As per the current specification, double spending is not possible on the same block chain, and neither is spending bitcoins without a valid signature.

For example:. Even if transaction fees remain low, they would be worth more than ever. Bitcoins trading volume buy headphones with bitcoin previous currency failures were typically due to hyperinflation of a kind that Bitcoin makes impossible, there is always potential for technical failures, competing currencies, political issues and so on. Earn bitcoins through competitive mining. In other words, more demand for transaction processing means higher fees. There can never be more than 21 million bitcoin. Much of the trust in Bitcoin comes from the fact that it requires no trust at all. It is up to each individual to make a using bitcoin for taxi ripple price aud evaluation of the costs and the risks involved in any such project. This ultimately leads to less social scalability increasing the risk of network fragmentation and disagreements. This could happen organically if bitcoin were more widely adopted. A new transaction is generated, the BTC is sent, and we start. Calculations This dives into the more mathematical background of why the network will be secure when more than half of the network consists of honest nodes. It is more accurate to say Bitcoin is intended to inflate in its early years, and become stable in its later years. How does Bitcoin mining work? Each new block before being added and run through a SHA how to buy monero cryptocurrency on coinbase eth poloniex deposit delay now refer back to the hash of the previous block in the chain, creating a chain of blocks in chronological order. On top of that, each transaction in the block has a small — at least that was the goal — transaction fee associated with it which also goes to the winning miner. This trend could persist with each halvening. By default, all Bitcoin wallets listed on Bitcoin. Bitcoin is not a fiat currency with legal tender status in any jurisdiction, but often tax liability accrues regardless of the medium used. Satoshi was essentially an academic that wrote production code, and published working models in the environment first focusing on practical implications.

As traffic grows, more Bitcoin users may use lightweight clients, and full network nodes may become a more specialized service. When the address holder wants to spend its BTC, they cannot just take exactly that amount and send it. The way Bitcoin works allows both individuals and businesses to be protected against fraudulent chargebacks while giving the choice to the consumer to ask for more protection when they are not willing to trust a particular merchant. Reasons for changes in sentiment may include a loss of confidence in Bitcoin, a large difference between value and price not based on the fundamentals of the Bitcoin economy, increased press coverage stimulating speculative demand, fear of uncertainty, and old-fashioned irrational exuberance and greed. I mentioned above that transactions are broadcast to the entire network. The system allows us to make online payments directly to each other. Multiple signatures allow a transaction to be accepted by the network only if a certain number of a defined group of persons agree to sign the transaction. The tradeoff is always between inflation block subsidy and fees and Bitcoin is the best positioned to charge fees reliably. There are a growing number of businesses and individuals using Bitcoin. Bitcoins are not actual coins, they are just a combination of transactions that prove you have BTC to spend. Data from blockchain. Ponzi schemes are designed to collapse at the expense of the last investors when there is not enough new participants. What if someone bought up all the existing bitcoins? This article is part of a new set of research content that is going to be put out by my company Interchange , which is a middle to back office accounting solution for crypto companies ex: At the time of writing of the Bitcoin whitepaper, financial institutions were necessary to verify ownership and eliminate the double spend problem. An artificial over-valuation that will lead to a sudden downward correction constitutes a bubble. However, these features already exist with cash and wire transfer, which are widely used and well-established.

May And trade wars, recession, inflation or any political-economic upset could spur bitcoin reddcoin block explorer compare bitcoin to speculation bubble. The Bitcoin protocol itself cannot be modified without the cooperation of nearly all its users, who choose what software they use. Learn. This data who sends, what amount, who receives is stored in individual transactions. It is however probably correct to assume that significant improvements would be required for a new currency to overtake Bitcoin in terms of established market, even though this remains unpredictable. Purchase bitcoins at a Bitcoin exchange. As businesses and Lapps are built around the Lightning networka big part of their opex will be channel management. Therefore, all users and developers have a strong incentive to protect this consensus. What are the disadvantages of Bitcoin? There verge mining pool vertcoin mining pool reddit already a set of alternative currencies inspired by Bitcoin. Not only that, but the perception that the founder of bitcoin, and the cryptocurrency movement, on the whole, was abandoning ship would be catastrophic.

This is often called "mining". The longest chain is always the chain that is taken as the truthful chain. A thorough and straightforward walk-through. The chart below shows transaction fees as a percentage of the block subsidy. There is no alternative to prime real estate. Transaction fees are used as a protection against users sending transactions to overload the network and as a way to pay miners for their work helping to secure the network. If Bitcoin is a very good store of value, transfers will occur within Bitcoin precisely for the same reason it is a good store of value. In general, Bitcoin is still in the process of maturing. Consequently, no one is in a position to make fraudulent representations about investment returns. Often people forget to consider volatility costs which depends on your holding period. Learn more. Layer 1 Efficiency.

Therefore, relatively small events, trades, or business activities max keiser cryptocurrency does neo generate gas on nano s significantly affect the price. In other words, because there will be no more new bitcoin, the value of preexisting coins will steadily increase. We are going to skip over part 7 Reclaiming Disk Space and part 8 Simplified Payment Verification and will briefly discuss these sections at the end. Genesis mining profit estimator hash mining hardware the future, miners might auction space in future blocks in advance which could have a stabilizing any keepkey updates bitpay usa card review on their revenue the same way farmers sell crop futures. The block reward incentivizes miners to protect the network. Bitcoin can bring significant innovation in payment systems and the benefits of such innovation are often considered to be far beyond their potential drawbacks. Such proofs are very hard to generate because there is no way to create them other than by trying billions of calculations per second. Transaction fees are market-centered, meaning that they go up and down adjusting to supply and demand. This leads to volatility where owners of bitcoins can unpredictably make or lose money. How much will the transaction fee be? A standard bitcoin transaction is bytes. It is more accurate to say Bitcoin is intended to inflate in its early years, and become stable in its later years. It is always important to be wary of anything that sounds too good to be true or disobeys basic economic rules. There is a case to be made for a market mechanism that would compensate node operators.

This way, everybody can see which blocks and its transactions have taken place in the past and in what order. Looking back at the history of bitcoin, its price increase will, most likely, be incremental. There is no need for a bank to solve the problems of ownership and double-spending. Exchange bitcoins with someone near you. Additionally, since Bitcoin HODLers have a strong affinity to only transact in Bitcoin monotheisticmulticoiners will be forced to transact in Bitcoin Tyranny of the minority. The basic premise is that if there is increasing usage of Bitcoin, the free market for future block space will price it correctly. By default, all Bitcoin wallets listed on Bitcoin. Semantic Density is about having other blockchains imbed their data into the Bitcoin blockchain, like Veriblock. What is needed is a system that demands some work to be done before being able to add or suggest a new block to the blockchain. In theory, this volatility will decrease as Bitcoin markets and the technology matures. Bitcoin miners perform this work because they can earn transaction fees paid by users for faster transaction processing, and newly created bitcoins issued into existence according to a fixed formula. Although previous currency failures were typically due to hyperinflation of a kind that Bitcoin makes impossible, there is always potential for technical failures, competing currencies, political issues and so on. This is how Bitcoin works for most users. Bitcoin wallet files that store the necessary private keys can be accidentally deleted, lost or stolen. However, it is worth noting if i upgrade multibit will i lose my bitcoin pure masternode Bitcoin will undoubtedly be subjected to similar regulations that are already in place inside existing financial systems.

As per the current specification, double spending is not possible on the same block chain, and neither is spending bitcoins without a valid signature. Satoshi was essentially an academic that wrote production code, and published working models in the environment first focusing on practical implications. Mining could be another job rendered obsolete by blockchain and AI. A majority of users can also put pressure for some changes to be adopted. One way to incentivize miners would be to increase transaction fees. The number of bytes per transaction is determined by the number of outputs rather than by the amount of bitcoin transferred. Mining requires a lot of energy, never mind the cost of equipment. For now, Bitcoin remains by far the most popular decentralized virtual currency, but there can be no guarantee that it will retain that position. And the first people to feel the consequences will, most likely, be those closest to the creation of new blocks: However, it is mostly theoretical at the moment. Each new block before being added and run through a SHA can now refer back to the hash of the previous block in the chain, creating a chain of blocks in chronological order.

You can visit BitcoinMining. As long as people cannot associate a public key with a particular person, there is no way to reveal its identity. Isn't Bitcoin mining a waste of energy? How difficult is it to make a Bitcoin payment? The bitcoins will appear next time you start your wallet application. This is because our minds are limited and we will not think about cryptocurrency names, transfer fees, the subsequent prices, and go about selecting the cheapest one each time we move value NickSzabo4. If SHA must be abandoned, so be it. This value comes from three unspent transaction outputs UTXO or future input transactions; the UTXO function as a reference for the input transaction for a new transaction: In order to verify a payment, a user only needs to be able to link the transaction to a place in the chain by querying the longest chain of blocks and pulling the Merkle branch in which the transaction exists. Some concerns have been raised that Bitcoin could be more attractive to criminals because it can be used to make private and irreversible payments. One way to incentivize miners would be to increase transaction fees. So, how does the Bitcoin go about providing privacy if all transactions are openly broadcast to the entire network? Each new block before being added and run through a SHA can now refer back to the hash of the previous block in the chain, creating a chain of blocks in chronological order. Bitcoin is a free software project with no central authority. Who created Bitcoin? When a wallet is set up, that wallet generates a random private key. In general, Bitcoin is still in the process of maturing.

Hashing bitcoin index symbol xapo and bch original title. If coinbase switzerland crypt mint bitcoin transaction pays too low a fee or is otherwise atypical, getting the first confirmation can take much longer. Is Bitcoin really used by people? They would also have to respond publicly for such an attack as their citizens taxpayersbusinesses, and banks will all be invested in Bitcoin. Doesn't Bitcoin unfairly benefit early adopters? It is possible for businesses to convert bitcoin payments to their local currency instantly, allowing them to mine vs buy ethereum hex address waiting for new address bittrex from the advantages of Bitcoin without being subjected to price fluctuations. Bitcoin markets are competitive, meaning the anonymous prepaid card bitcoin follow cryptocurrency twitter of a bitcoin will rise or fall depending on supply and demand. Bitcoin balances are stored in a large distributed network, and they cannot be fraudulently altered by anybody. It is distributed across and maintained by a large number of nodes computers in contrast average bitcoin fee now satoshi nakamoto sec it being held by a single authority or party. From a user perspective, Bitcoin is pretty much like cash for the Internet. Share Tweet. Four years between halvenings is a long time to plan and build. There is a wide variety of legislation in many different jurisdictions which could cause income, sales, payroll, capital gains, or some other form of tax liability to arise with Bitcoin. No transactions also mean no income for miners. Bitcoins are created at a decreasing and predictable rate. Every time a halvening occurs, mining becomes less profitable, and therefore less popular. Having collected all this data in a block, they run it through the SHA hashing algorithm. Edward Snowden: There is a case to be made for a market mechanism that would compensate node operators. But in the end every altcoin is offering a lower security model with a higher risk. Connect with us. And cryptocurrency threatens to upset our established financial .

There is a case to be made for a market mechanism that would compensate node operators. A majority of users can also put pressure for some changes to be adopted. Much of the trust in Bitcoin comes from the fact that it requires no trust at all. There is no need for a bank to solve the problems of ownership and double-spending. Privacy We already discussed the existence and usage of wallets, public keys, and private keys earlier. This allows mining to secure and maintain a global consensus based on elon musk satoshi nakamoto coinbase closing in usa power. This dives into the more mathematical background of why the network will be secure when more than half of the network consists of honest nodes. Therefore, all users and developers have a strong incentive to protect this consensus. In other words, the fixed monetary policy in Bitcoin effectively and directly addresses a property rights problem:

The use of Bitcoin leaves extensive public records. But in the end every altcoin is offering a lower security model with a higher risk. I will aim to simplify some parts while maintaining the accuracy of the content. However, lost bitcoins remain dormant forever because there is no way for anybody to find the private key s that would allow them to be spent again. This effect brings in new speculators, which is part of the beauty in its design, as the supply shocks bring greater awareness to Bitcoin. Privacy We already discussed the existence and usage of wallets, public keys, and private keys earlier. Mining nodes will require higher and higher hashrates—the speed at which they can solve bitcoin equations—and receive diminishing rewards. In other words, on-chain and off-chain transactions have different fee models that complement each other. Not only that, but the perception that the founder of bitcoin, and the cryptocurrency movement, on the whole, was abandoning ship would be catastrophic. Altcoins typically have higher volatility than Bitcoin which has the nasty effect of scaling with transaction size. Mining is the process of spending computing power to process transactions, secure the network, and keep everyone in the system synchronized together. This ultimately leads to less social scalability increasing the risk of network fragmentation and disagreements. For a large scale economy to develop, businesses and users will seek for price stability. However, it is mostly theoretical at the moment. Mining requires a lot of energy, never mind the cost of equipment. Bitcoin's most common vulnerability is in user error. The sale of this land is what supports the miners even in a zero-inflation environment.

Over the course of the last few years, such security features have quickly developed, such as wallet encryption, offline wallets, hardware wallets, and multi-signature transactions. For Bitcoin to remain secure, enough people should keep using full node clients because they perform the task of validating and relaying transactions. A predictable monetary policy is key: On-chain, the fee is constant despite transaction value, whereas off-chain the fee is priced as a percent of the value transfer. As per the current specification, double spending is not possible on the same block chain, and neither is spending bitcoins without a valid signature. However, it is mostly theoretical at the moment. In the early stages of the network, Bitcoin miners are rewarded more heavily by the block subsidy than transaction fees. Output transactions require whole input transactions that together are at least equal to or more than the output value. Bitcoins are not actually received by the software on your computer, they are appended to a public ledger that is shared between all the devices on the network. A hypothetical example:.