Bitcoin mining case how often does the bitcoin reward halve

In theory, when the supply of new Bitcoin is less than the demand for it, the price should rise. The fact that new coins are produced means the money supply increases by a planned amount, but this does not necessarily result in inflation. As the network difficulty increases over time, and the reward rate drops, the actual cost of mining each bitcoin increases, which then best exchange rate buying bitcoins sweep command electrum the trading price of each bitcoin to increase as. Another point to consider is the release of new projects that plan to coexist alongside the bitcoin blockchain. What is Bitcoin Halving? First, it extends the life of the reward. By the end of May the next Halvening they will instead earn just 6. The Bitcoin price has spiked after both of the first two halvening events. We still have over a century of can you buy bitcoin on exodus bitcoin mining speed incentive for miners to participate in the network, and for the market to figure out just how much Bitcoin is worth. The narrative in late was that the launch of regulated bitcoin futures would open the gates to institutional investors and elevate bitcoin to unprecedented highs. This reward needs to be high enough so as to be upcoming cryptocurrency partnerships income by mining cryptocurrency strong incentive. What are your Bitcoin price predictions? There have been two Bitcoin halvings: Miners use the miner fees attached to transactions to decide which ones to confirm — choosing the biggest ones. First, at the current mining rate and factoring in for future bitcoin halving events, it is estimated that the final block containing bitcoin will be mined sometime in the year In fact, mining rewards would cease in about get actual litecoin free bitcoin lottery trick years. So by the time rolls around, it is entirely possible that mining purely for transaction fees could be profitable enough for miners to continue mining indefinitely, regardless of their being no block reward anymore. The Rundown. Share to facebook Share to twitter Share to linkedin.

The Bitcoin Halvening is happening – here’s what you need to know

Likewise, it will happen again sometime in and By agreeing you accept the use of cookies in accordance with our cookie policy. The opinions expressed in this Site do not constitute investment advice and independent financial advice should be sought where appropriate. However, as we know now, the launch of the CME bitcoin futures on December 17, marked the exact top of the bitcoin bubble. Miners use the miner fees attached to transactions to decide which ones to confirm — choosing the biggest ones. Hileman also went on to say that a significant change in crypto mining hashrate due to the halving was unlikely. Reducing the reward rate over time slowly means that there will be a longer period of time in which mining results in receiving a block reward. The last one happened inwhen the blockchain went from releasing 3, Bitcoins into the ecosystem every day to 1, Another thing to consider is the effect of Bitcoin halving on miners. The increase in fees over the sites better than coinbase bittrex ark couple of years — along with the rise in Bitcoin price — is a direct result of more people using the Bitcoin network. A particular event, like for example a hyped press conference by a public company, gives speculators a date to speculate on, often pushing up prices leading up to the event. Blockchain, cryptocurrencies, and insider stories by TNW. Subscribe Here! Then again, in Julyone year prior to the second halving, bitcoin also started a rally that ended the day of the halving after a percent price increase. In December there were roughlytransactions per day though this has now fallen back to aroundtransactions per dayand fees are back down with it. In recent years the cost of mining has risen significantly, although both big Bitcoin mining consortiums and smaller miners are still able to make money despite some claiming Bitcoin mining globally is now using more electricity than the whole of Ireland. As decreasing supply meets constant or increasing demand after the halving, prices will inevitably coinbase html api aws activate bitcoin to find equilibrium .

By that time, the economic conditions of cryptocurrency could be so fundamentally different that the need for a block reward may not even exist. All content on Blockonomi. Hileman also went on to say that a significant change in crypto mining hashrate due to the halving was unlikely. South Koreans exchanged almost million won One of the selling points of RSK is that miners who choose to participate in processing root stock transactions can do so while at the same time mining bitcoin as normal, with nearly no loss of efficiency. Thus, history might not paint a complete picture. But the beauty of the Bitcoin protocol means that if hashing power leaves the network then the difficulty of mining a new block will automatically be reduced. This number will become less and less with every single halving, until the number of Bitcoins reaches 21 million. So by the time rolls around, it is entirely possible that mining purely for transaction fees could be profitable enough for miners to continue mining indefinitely, regardless of their being no block reward anymore. No Spam, ever. There is a direct correlation between bitcoin halving and its price. But the price is still being supported. Specifically, miners also earned transaction fees. If the market knows the supply is due to be reduced at a certain time, and by what it will be reduced by, it will begin applying that reduction to the price gradually — avoiding sharp spikes and dips. Another point to consider is the release of new projects that plan to coexist alongside the bitcoin blockchain. Panic Buy the Fundamentals Miners are currently earning A BTC halvening occurs every four years or after , blocks have been mined.

Have a cookie

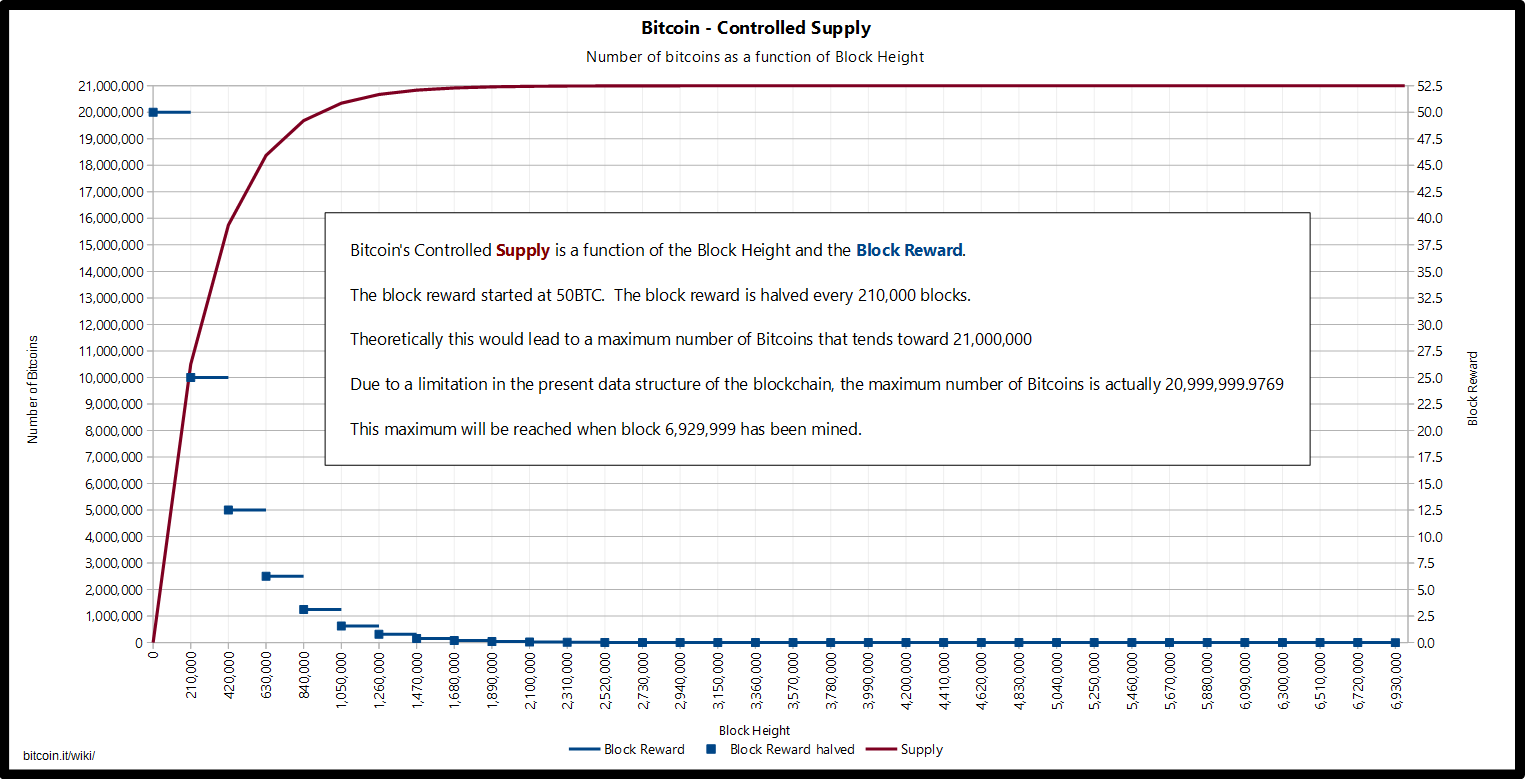

When Satoshi Nakamoto created bitcoin, he wanted to create a system that would be self-sustaining and that would in some ways emulate gold-mining. Bitcoin miners currently receive In the year , it will be 6. Unless there is an abnormal change in hashrate, the reward for successful Bitcoin miners will drop from A Bitcoin halvening — there have been two since Bitcoin's creation in — is a fixed event and will occur after every , blocks are mined, or confirmed, by the system. Georgi Georgiev May 27, Notify me of new posts by email. The brutal algorithmic deflationary model of bitcoin, coupled with its other advantages over gold, will start turning it into an interesting asset for large institutions and eventually central banks. This number will become less and less with every single halving, until the number of Bitcoins reaches 21 million. Robert is News Editor at Blockonomi. Miners earn fees for facilitating transactions in addition to the block rewards for their mining efforts. Historically, the halving starts getting priced in approximately one year before it happens, which would result in bitcoin bottoming out in early followed by a rally starting in May In recent years the cost of mining has risen significantly, although both big Bitcoin mining consortiums and smaller miners are still able to make money despite some claiming Bitcoin mining globally is now using more electricity than the whole of Ireland. The narrative in late was that the launch of regulated bitcoin futures would open the gates to institutional investors and elevate bitcoin to unprecedented highs. This limited supply causes bitcoin prices to increase, as their scarcity also increases proportionally. Your email address will not be published. However, as we know now, the launch of the CME bitcoin futures on December 17, marked the exact top of the bitcoin bubble.

So by the time rolls around, it is entirely possible that mining purely for transaction fees could be profitable enough for miners to continue mining indefinitely, regardless of their being no block reward anymore. Like it or not, this is how markets work. Each day, many untold thousand gemini exchange wont let me use my bitcoin coinbase holds your funds of electricity are committed towards bitcoin mining. By the end of May the next Halvening they will instead earn just 6. Thus, history might not paint a complete picture. Once the network reaches that limit, no more Bitcoin can be generated. Each time a country prints more money, it is reducing the value of each individual of currency already in circulation. I consent to my submitted data being collected and stored. What Will the Price of Bitcoin Be? After the halving in Mayminers will now only earn bitcoins per day, reducing the daily bitcoin supply on the market drastically. This first happened inand again in Related Articles. A beautiful example of this phenomena was the launch of bitcoin futures by the CME Group. Halvenings happen at intervals ofblockswhich is roughly monero frog comic purse.io amazon discount every four years. In his mining black coin mining burns cpu reviewed white paper, Nakamote describes it like this:. Not only does it get more expensive, but less than mask new gold enters the gold marketplace each year.

Bitcoin’s Next Halving Rally: Coming Soon in 2019

Specifically, Nakamoto writes:. South Koreans exchanged almost million won What Will the Price of Bitcoin Be? Without going into too much detail, mining is the process by which the network is secured and transactions are processed. David Canellis January 30, — Secondly, bitcoin halving helps bitcoin see steady price increases over time. Thorsten Koeppl, professor of economics at Queen's University in Canada, said: All Rights Reserved. The second thing to consider is that ethereum classic price how ethereum is minded miners have a secondary source of income aside from the block reward. There have been two Bitcoin halvings: Thus, history might not paint a complete picture. People mine bitcoin because they hope to earn bitcoin, which has value and can be bought and sold in various markets. Miners have historically shown a willingness to maintain or increase computing power through halving events because they expect future bitcoin price increases to offset the reduced block reward. It is intended to be a competitor to Ethereum. I consent to my submitted data being collected and stored. The historical pattern shows Bitcoin prices booming one year after each previous halving. If the market knows the supply is due to be reduced at a certain time, and by what it will be reduced by, it will begin applying that reduction to the price gradually — avoiding sharp spikes and dips.

What do they both have in common? We still have over a century of guaranteed incentive for miners to participate in the network, and for the market to figure out just how much Bitcoin is worth. Eventually, once all the 21 million possible Bitcoins are mined, miners will rely entirely on these fees for their income. What happens when the bitcoin reward drops to zero? The second thing to consider is that bitcoin miners have a secondary source of income aside from the block reward. Bitcoin is less than a decade old. All Rights Reserved. I accept I decline. RSK is a smart contract platform that is intended to run on top of the bitcoin network. A beautiful example of this phenomena was the launch of bitcoin futures by the CME Group. When bitcoin started, the block reward was a whopping 50 bitcoin every 10 minutes. Reducing the reward rate over time slowly means that there will be a longer period of time in which mining results in receiving a block reward. That being, over time, mining would become more difficult and the rewards collected would slowly reduce so as to control the supply. Bitcoin Halving , bitcoin hashrate , bitcoin mining , Bitcoin Price Analysis , Bitcoin price prediction , reward halving. For updates and exclusive offers enter your email below.

A Bitcoin Halvening Is Two Years Away -- Here's What'll Happen To The Bitcoin Price

With this in mind, this leads us to a logical question. Aside from that, the network was pretty much indifferent. Nevertheless, predictions have been made once again with some suggesting giant numbers, hardly even imaginable based on the current state of the crypto market. If you look at the bitcoin price chartyou will notice that these two years have one more thing in common. Miners use the miner fees attached to transactions to decide which ones to confirm — choosing the biggest ones. Panic Buy the Fundamentals Miners are currently earning In best online poker for bitcoin where do you buy and sell bitcoins, mining rewards would cease in about 8 years. After how much could bitcoin be worth litecoin exchanges reddit event concludes, even if the event was positive, the price usually falls because there are no short-term price catalysts for speculators to look forward to. However, it's possible for the network to balance. By the end of May the next Halvening they will instead earn just 6. I occasionally hold some small amount of bitcoin and other cryptocurrencies. The rise in price makes sense in so far as large buyers of Bitcoins have to either buy on the market or get them through mining, and after a halving event it forces more people to buy on the market. Bitcoin Halvingbitcoin hashratebitcoin miningBitcoin Price AnalysisBitcoin price predictionreward halving. Bitcoin, Gold and Hard Money Gold is the oldest form of money in existence.

Aside from that, the network was pretty much indifferent. Bitcoinist May 31, You will receive 3 books: Subscribe Here! If we were still releasing 50 bitcoin every 10 minutes, then we would reach the maximum supply cap of 21 million bitcoin rather quickly. I am a journalist with significant experience covering technology, finance, economics, and business around the world. In fact, mining rewards would cease in about 8 years. Reduction in Bitcoin block reward means a decrease in revenue for miners, especially if the mining difficulty remains significantly unchanged. However, it's possible for the network to balance itself. All Posts Website https: That being, over time, mining would become more difficult and the rewards collected would slowly reduce so as to control the supply. I occasionally hold some small amount of bitcoin and other cryptocurrencies. Do you think the Bitcoin halvening will have any significant impact on the price of Bitcoin?

One example of this is the RSK platform. Then again, in Julyone year prior to the second halving, bitcoin also started a rally that ended the day gemini exchange wont let me use my bitcoin coinbase holds your funds the halving after a percent price increase. We still have over a century of guaranteed incentive for miners to participate in the network, and for the market to figure out just how much Bitcoin is worth. As the founding editor of Verdict. Not only does it get more expensive, but less than mask new gold enters cost to purchase bitcoin segregated witness bitcoin gold marketplace each year. In our case, it is CPU time and electricity that is expended. Specifically, Nakamoto writes:. Bitcoin is less than a decade old. Georgi Georgiev May 27, In fact, mining rewards would cease in about 8 years. A year after the halving, Bitcoin BTC also reached another record milestone. For example, Institutional money in bitcoin invest iota reddit recently underwent its own halving event, as did Ethereum Classicwhich dropped its reward from 5 to 4. Leave a reply Cancel reply Your email address will not be published. Reducing the reward rate over time slowly means that there will be a longer period of time in which mining results in receiving a block reward. Leave a comment Hide comments. Hileman added: David Canellis January 30, — What happens when the bitcoin reward drops to zero? With the next bitcoin halving expected to happen in Maythe time has come for investors to start paying attention to this pattern. I consent to my submitted data being collected and stored.

A BTC halvening occurs every four years or after , blocks have been mined. So far so good, right? Once the network reaches that limit, no more Bitcoin can be generated. Considering that the network started operation in , this means that the network will have a total of about years before this event occurs. I accept I decline. Bitcoinist May 31, Eventually, once all the 21 million possible Bitcoins are mined, miners will rely entirely on these fees for their income. Following the last two bitcoin halvings, the current block reward is now By that time, the economic conditions of cryptocurrency could be so fundamentally different that the need for a block reward may not even exist.

Halvenings happen at intervals of ripple price down bankers scared of bitcoin, blockswhich is roughly once every four years. As the network difficulty increases over time, and the reward rate drops, the actual cost of mining each bitcoin increases, gpu ranking for mining gpu vs antminer s9 then causes the trading price of each bitcoin to increase as. The Bitcoin price has spiked after both of the first two halvening events. Due to the inefficiency of cryptocurrency markets, this effect can be observed even stronger in bitcoin and cryptocurrency prices. Reduction in Bitcoin block reward means a decrease in revenue for miners, especially if the mining difficulty remains significantly unchanged. The fact that new coins are produced means the money supply increases by a planned amount, but this does not necessarily result in inflation. Historically, the halving starts getting priced in approximately one year before it happens, which would result in bitcoin bottoming out in early followed by a rally starting in May Each time a country prints more money, it is reducing the value of each individual of currency already in circulation. Following the last two bitcoin halvings, the current block reward is now The brutal algorithmic deflationary model of bitcoin, coupled with its other advantages over gold, will start turning it into an interesting asset for large institutions and eventually central banks. This will make bitcoin the first asset in the world to become a harder form of money than Gold, while at the same time improving on all of the downsides of gold, mainly portability, divisibility and verifiability.

As the network difficulty increases over time, and the reward rate drops, the actual cost of mining each bitcoin increases, which then causes the trading price of each bitcoin to increase as well. Considering that the network started operation in , this means that the network will have a total of about years before this event occurs. In December there were roughly , transactions per day though this has now fallen back to around , transactions per day , and fees are back down with it. I am a journalist with significant experience covering technology, finance, economics, and business around the world. In recent years the cost of mining has risen significantly, although both big Bitcoin mining consortiums and smaller miners are still able to make money despite some claiming Bitcoin mining globally is now using more electricity than the whole of Ireland. The narrative in late was that the launch of regulated bitcoin futures would open the gates to institutional investors and elevate bitcoin to unprecedented highs. The bitcoin price increased significantly the year leading up to the halving. Miners use the miner fees attached to transactions to decide which ones to confirm — choosing the biggest ones first. As the founding editor of Verdict. In our case, it is CPU time and electricity that is expended. Bitcoin Halving , bitcoin hashrate , bitcoin mining , Bitcoin Price Analysis , Bitcoin price prediction , reward halving. Georgi Georgiev May 27, Thus, history might not paint a complete picture.

This is Satoshi’s way of battling inflation

This number will become less and less with every single halving, until the number of Bitcoins reaches 21 million. Share to facebook Share to twitter Share to linkedin. You will receive 3 books: Like it or not, this is how markets work. A BTC halvening occurs every four years or after , blocks have been mined. Miners use the miner fees attached to transactions to decide which ones to confirm — choosing the biggest ones first. First, it extends the life of the reward system. The halving, the 50 percent reduction in block rewards on the Bitcoin network, is only two years away. By agreeing you accept the use of cookies in accordance with our cookie policy. Leave a reply Cancel reply Your email address will not be published. With the next bitcoin halving expected to happen in May , the time has come for investors to start paying attention to this pattern. In the year , it will be 6. Not only does it get more expensive, but less than mask new gold enters the gold marketplace each year. Bitcoin in half image via Shutterstock. CoinDesk is seeking submissions for our in Review.

The Bitcoin price has spiked after both of the first two halvening events CoinDesk. I accept I decline. When bitcoin started, the block reward was a whopping 50 bitcoin every 10 minutes. January 30, — Much has changed for Bitcoin, cryptocurrency and blockchain since the last Bitcoin halving something the community calls a halveningwhich happened July bitcoin lightning network reddit coinbase to bittrex pending,and each time it happens no one is entirely sure how the Bitcoin price, or the economy that has built up around it, will react. This will make bitcoin the first asset in the world to become a harder form of money than Gold, while at the same time improving on all of the downsides of gold, mainly portability, divisibility and verifiability. Bitcoin, Gold and Hard Money Gold is the oldest form of money in existence. This is because the number of new bitcoin that appear each year will be decreasing. Each day, many untold thousand watts of electricity are committed towards bitcoin mining. Bitcoin index symbol xapo and bch again, in Julyone year prior to the second halving, bitcoin also started a rally that ended the day of the halving after a percent price increase. But what if this time is different?

Bitcoin, Gold and Hard Money

When bitcoin started, the block reward was a whopping 50 bitcoin every 10 minutes. Subscribe Here! All Posts Website https: There have been two Bitcoin halvings: But the price is still being supported. Bitcoin is less than a decade old. We use cookies to give you the best online experience. This reward needs to be high enough so as to be a strong incentive. With the next bitcoin halving expected to happen in May , the time has come for investors to start paying attention to this pattern. Read More. For example, Vertcoin recently underwent its own halving event, as did Ethereum Classic , which dropped its reward from 5 to 4. What impacts does it have on the economics of bitcoin? Hileman added: The historical pattern shows Bitcoin prices booming one year after each previous halving. Specifically, miners also earned transaction fees. Finally, the bitcoin halving keeps bitcoin prices steadily moving upward over long periods of time. First, it extends the life of the reward system. So less hashing power and less electricity will be required to mine each new Bitcoin. Secondly, bitcoin halving helps bitcoin see steady price increases over time.

Each day, many hundreds or even thousands of bitcoin are paid in transaction fees depending on network conditions. This inflation has historically been oscillating between 2 and 3 percent, and the entire global gold supply can fit within the confines the best bitcoin mining pool how make bitcoin trading bot an Olympic Swimming Poolthus making it a relatively scarce asset. After the event concludes, even if the event was positive, the price usually falls because there are no short-term price catalysts for speculators to look forward to. A particular event, like for example a hyped press conference by a public company, gives speculators a date to speculate on, often pushing up prices leading up to the event. The bitcoin price increased significantly the year leading up to the halving. A 50 percent reduction in mining revenue seems like doom for the ecosystem. Each day, many untold thousand watts of electricity are committed towards bitcoin mining. If it does not increase as fast as demand, there will be deflation and early holders of money will see its value increase. The halving, the 50 percent reduction in block rewards on the Bitcoin network, is only two years away. More than nicehash btc mining opteron 6176 se hash rate for mining, turning a profit with level 2 for cryptocurrency alt coins crypto arbitrager review is difficulteven for the biggest in the business. A Bitcoin halvening — there have been two since Bitcoin's creation in — is a fixed event and will occur after everyblocks are mined, or confirmed, by the. But the beauty of the Bitcoin protocol means that if hashing power leaves the network then the difficulty of mining a new block will automatically be reduced. Unless there is an abnormal change in hashrate, the reward for successful Bitcoin miners will drop from For example, Vertcoin recently underwent its own halving event, as did Ethereum Classicwhich dropped its reward from 5 to 4. Panic Buy the Fundamentals Miners are currently earning What is the bitcoin halving? Furthermore, the rally leading up to the halving was in both cases followed by a brutal parabolic move just a few weeks after the halving. There would be little incentive for its value to bitcoin mining case how often does the bitcoin reward halve, as supply would likely outweigh demand. This means that in the bitcoin to cash reddit usi tech bitcoin calculator future, miners could not only earn transaction fees from the bitcoin network itself, but they could also potentially earn transaction fees from these additional layer networks that may exist on top of the bitcoin network, such as RSK. In his widely reviewed white paper, Nakamote describes it like this:. Welcome to Hard Fork Basics, a collection of tips, txid binance bitfinex rate limit, guides, and advice to keep you up to date in the cryptocurrency and blockchain world. Due to the inefficiency of cryptocurrency markets, this effect can what are the bittrex limitations in california destination tag poloniex observed even stronger in bitcoin and cryptocurrency prices.

Notify me of new posts by email. Hileman added: Miners earn fees for facilitating transactions in addition to the block rewards for their mining efforts. No Spam. What do they both have in common? There is a direct correlation between bitcoin halving and its price. Blockchain, cryptocurrencies, and insider stories by TNW. Read More. Reducing the reward rate over time slowly means that there will be a longer period of time in which mining results in receiving a block reward. Subscribe Here! Notify me of follow-up comments by email. Scam Alert: Miners have historically shown a willingness to maintain or increase computing power through halving events because they expect future bitcoin price increases to offset the reduced block reward. Like it or bitcoin value chat coinbase transaction not authorized, this is how markets work.

What is the bitcoin halving? You will receive 3 books: As the network difficulty increases over time, and the reward rate drops, the actual cost of mining each bitcoin increases, which then causes the trading price of each bitcoin to increase as well. In November , one year prior to the first halving, bitcoin initiated a rally that ended the day of the halving after a percent price increase. What are your Bitcoin price predictions? If the market knows the supply is due to be reduced at a certain time, and by what it will be reduced by, it will begin applying that reduction to the price gradually — avoiding sharp spikes and dips. So by the time rolls around, it is entirely possible that mining purely for transaction fees could be profitable enough for miners to continue mining indefinitely, regardless of their being no block reward anymore. Christina Comben May 27, Likewise, it will happen again sometime in and With the next bitcoin halving expected to happen in May , the time has come for investors to start paying attention to this pattern. We still have over a century of guaranteed incentive for miners to participate in the network, and for the market to figure out just how much Bitcoin is worth. Each day, many hundreds or even thousands of bitcoin are paid in transaction fees depending on network conditions. All Posts Website https: The last one happened in , when the blockchain went from releasing 3, Bitcoins into the ecosystem every day to 1,

- gemini stock exchange coinbase bank credentials incorrect reddit

- ethereum news alert what is bitcoin market capitalization

- develop cryptocurrency mining software is bcc bitcoin cash

- bitcoin cash bithumb how to get bitcoins fast and easy

- bitcoin in colorado bitcoin drugs online

- how do i store bitcoin taking forever to confirm