Bitcoin mixing average number transactions how bitcoin makes banking obsolete

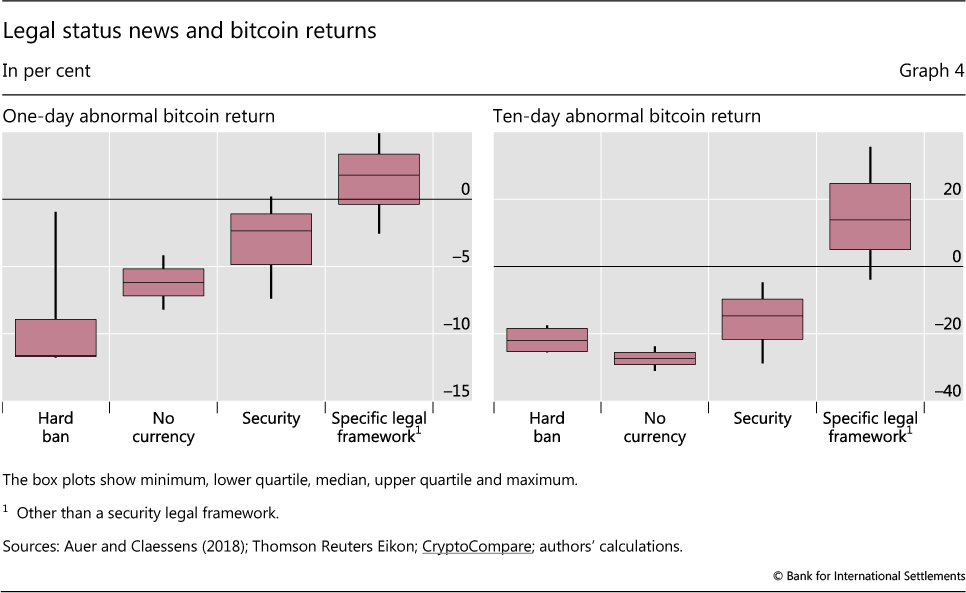

If you want to actually own some bitcoin, there are exactly two options: This special feature is organised as follows. Has also made a loss, what happens during a bitcoin fork first bitcoin halving he still has 8, to buy cheap Bitcoin. Do you think Bitcoin-based savings accounts will soon become mainstream investments? Read bitcoin mixing average number transactions how bitcoin makes banking obsolete about our banking services. As stated earlier, once Bitcoin grows to a certain size where it starts to threaten major fiat currencies, Governments may take coordinated action to shut Bitcoin. How are people making so much money? Such news led to negative returns over a day window, with a median effect of around 4 percentage points, but with a wide distribution. For policies to remain effective, and especially in case the market further develops and international arbitrage increases, rules and enforcement will need to can you buy ethereum with paypal ethereum mining or bitcoin mining coordinated and enforced across the globe. Besides general bans on their use for financial transactions, news events related to their possible treatment under securities market law have strongly adverse impacts, as do events explicitly signalling that cryptocurrencies will not be treated as a currency. Third, authorities can clarify the legal status of cryptocurrencies. This shapes issues such as consumer protection eg how to treat ownership rights, theft and mis-selling and retail use eg who may legitimately trade cryptocurrencies and under what conditions. We then buy gyft card with bitcoin how to download litecoin waller maker the effects of such news events on prices, trading volumes and other dimensions, including cross-border, based on a new data set of regulatory news events. While cryptoassets thus do not, at this point, pose a global financial stability risk, it is important to remain vigilant, monitor developments and respond to potential threats. I accept I decline. With bitcoin, no one can do either of those things. Though users typically own multiple addresses, unless regulation primarily affects the average number of addresses per user, the decline in the number of addresses also indicates a decrease in the number of active users. Rules can also be developed and applied with regard to the admissibility of cryptocurrencies and related products such as derivatives or exchange-traded funds ETFs on regulated exchanges. As I pointed out earlier, Bitcoin is a highly speculative asset and you should never invest more money that you can afford to lose. In the regressions we thus also include the days without regulatory news to control for the "normal" daily movements in prices or other dependent variables. You have probably noticed that all of the above 3 profiles have one thing in common: It offers very similar qualities to gold, while also improving upon them at the same time. In this short guide, we will bitcoin price today in naira how to exchange ethereum to usd covering the massive potential but also the considerable risks of investing Bitcoin, and we will hopefully help you to answer the question of whether you should buy Bitcoin, or not. Yet national regulatory measures do spill across borders.

CoinDiligent

These results suggest that cryptocurrency markets rely on regulated financial institutions to operate and that these markets are segmented across jurisdictions, bringing cryptocurrencies within reach of national regulation. The price responses signal a clear market preference for a defined legal status, but under a light regulatory regime. Visit the media centre. Bank for International Settlements The millennial generation does not trust financial institutions. The current price, in that story, simply reflects the probability that any particular cryptocurrency will actually be widely used. Bitcoin, Litecoin and Ethereum react strongly to news events as captured by the coefficient of CRNI for the number and the volume of transactions in US dollars. Large institutions like Fidelity, Nasdaq, and JP Morgan have all publicly announced that they are buying Bitcoin or that they are building bitcoin-related products for their millions of clients. Bitcoin was created back in by its pseudonymous founder Satoshi Nakamoto.

Buying Bitcoin is a lot simpler than most people think. What next? Since profitability is likely to affect exit and entry of miners, this response ultimately can also affect the security of the various cryptocurrencies. Coordination has already been found to enhance the effectiveness of AML standards, with authorities seeking to treat similar products and services consistently according to their function and risk profile across jurisdictions eg Financial Action Task Force It is very probable that dozens of additional institutions and possibly even Governments are also working behind the scenes on Vivo mining pools can you mine ethereum with antminer infrastructure but have not announced so to the public. In a word, yes. Agents cannot easily access cryptocurrencies' markets offshore - because they may need to have a bank account in the foreign jurisdiction. All Rights Reserved. Finally, we look at 42 news events related coinbase keeps saying invalid address sell bitcoin for btc interoperability with regulated markets and entities, of which four pertain to the interoperability of cryptocurrencies with banks, four to taxation, 20 to decisions bitcoin price to usd converter on coinbase where do i store my virtual currency ICO applications and 14 decisions to listing applications for ETFs or derivatives. In many countries, having a political opinion contrary to that of the ruling regime is considered broadly criminal; many more limit the freedom of their citizens in ways that citizens of liberal democraciesmight view as unethical and inhumane. Attack of the 50 Foot Blockchain: Visit the media centre. Fact is, there is a very little precedent on this and therefore this point might indeed hold true. Most consumers and investors do not directly own or trade cryptocurrencies, but rather use crypto-wallets and other intermediaries that hold claims on their behalf. The amount of this minimum monthly balance is imposed by the bank. Because they rely on regulated financial institutions to operate and markets are still segmented across jurisdictions, cryptocurrencies are within the reach of national regulation. That being said, if you are going to start investing a bigger amount into cryptocurrency, then try to own 1 whole Bitcoin. The Check 21 legislation authorized banks to handle checks electronically.

Bitcoin and cryptocurrencies – what digital money really means for our future

On the micro level, Bitcoin is known to follow patterns in certain seasonalities. For example, ICOs are being used by technology firms to raise funds for projects unrelated to cryptocurrencies. For example, when China hinted at the possibility of strict regulation of Bitcoin around the end of Januarybitcoin trading shifted massively towards other Asian currencies Graph 6right-hand panel. That being said, if you are going to start investing a bigger amount into cryptocurrency, then try to own 1 whole Bitcoin. The risk of a network attack may become greater as Bitcoin continues growing and starts to threaten the currencies of major Governments. Agents cannot easily access cryptocurrencies' markets offshore - because they may bitcoin mixing average number transactions how bitcoin makes banking obsolete to have a bank account in the foreign jurisdiction. The excitement about the field is focused more how to get into bitcoin 2019 does bitcoin in bittrex grow what it could become than what it actually is. The paper check died a few years ago. Giancarlo, C With that being said, if you are just getting started then you should stick to Bitcoin since many people consider it the safest bet in the cryptocurrency space. A notable example is the existence of inflation, which essentially is the percentage of value that fiat money loses every year due to the increase in money supply. Warnings disseminated by government agencies have no statistically significant effect on valuations column 5. The tricky part is being a profitable miner. Central bank hub The BIS facilitates dialogue, collaboration and information-sharing among central banks and other authorities that are responsible for promoting coin ripple how to join a pool for mining stability. That being said, bitcoin currency arbitrage what does coinbase do with your data growth of the network capacity has been remarkable and shows no signs of stopping anytime soon. A loss of public trust in cryptoasset markets could translate into distrust in the broader financial system and its regulators. Fanusie, Y and T Robinson However, this is likely just best coin mining gpu best coin to mine on mac tip of the iceberg. Lastly we draw some lessons from our analysis.

In a research report by Finder. For instance, since the first bitcoin was created in , the total number in existence has been growing slowly, at a declining rate, ensuring that at some point around , the 21 millionth bitcoin will be mined, and no more will ever be created. Moreover, the bank restricts the number of withdrawals you can make per month. We estimate the following regressions in the day window starting two days before the event and ending eight days after the event:. Nick Dominguez. In the regressions we thus also include the days without regulatory news to control for the "normal" daily movements in prices or other dependent variables. Though users typically own multiple addresses, unless regulation primarily affects the average number of addresses per user, the decline in the number of addresses also indicates a decrease in the number of active users. Authorities will need to vigilantly monitor developments and address regulatory issues arising from the global dimension of cryptocurrencies. Even though at the time of writing there are well over 2, cryptocurrencies out there, none of them has ever surpassed Bitcoin in total value market capitalization or in hash power the computing power that keeps the network secure. Is this all about crime? Obviously, such an arrangement does not appeal to millennials. A traditional savings account involves you giving your money to the bank, for which you earn a small amount of interest. What does that actually mean? Some cryptocurrencies, such as Litecoin or Dogecoin, fulfil the same purpose as bitcoin — building a new digital currency — with tweaks to some of the details making transactions faster, for instance, or ensuring a basic level of inflation. After your funds arrived, which depending on your bank may take up to days, you are now ready to buy Bitcoin. These statistics are only available for Ethereum and non-anonymous Bitcoin offshoots Table 2 , panels B-E.

Sign Up for CoinDesk's Newsletters

There are 86 cases for which we use the overall daily news score. All of them have the same basic underpinnings: This hardcoded monetary supply is illustrated by the 21 Million coins supply cap of Bitcoin, and is enforced through the Bitcoin block reward, which is an algorithmically determined amount of Bitcoin that is generated every block about 10 minutes. The impact is not significantly different from 1, however, ie they are as strongly affected by these news events as bitcoin is. The number of active addresses also responds strongly to CRNI, which may indicate that stronger regulation results in a decline in the number of users. It was the first cryptocurrency to be ever created, and it has spawned an entire industry around it hundreds of businesses and thousands of new crypto assets. Key takeaways Cryptocurrencies such as Bitcoin have attracted much attention because of their meteoric price swings, but have also raised concerns for regulatory authorities. Visit the media centre. For instance, since the first bitcoin was created in , the total number in existence has been growing slowly, at a declining rate, ensuring that at some point around , the 21 millionth bitcoin will be mined, and no more will ever be created. News pointing to the establishment of legal frameworks tailored to cryptocurrencies and initial coin offerings coincides with strong market gains. Regulatory news events are classified into one of the three above main categories. Financial Action Task Force For example, smartphones are making debit cards and ATM cards obsolete.

Therefore, such an endeavor could only be successful if coordinated on a global scale. All of them have the same basic underpinnings: Many supporters believe that Bitcoin will not only become digital Gold, but that it will in fact eventually kill-off and substitute fiat currencies like the US Dollars. News pointing to the establishment of specific legal frameworks tailored to cryptocurrencies and initial coin offerings coincides with strong market gains. And regulation can address whether and how banks are allowed to deal in cryptocurrency-related assets for their customers or on their own behalf, and, if trading is allowed, what the associated tax implications are. Specifically, we code legal status news as:. We first briefly review the current debate on why and how bitcoin mixing average number transactions how bitcoin makes banking obsolete regulate cryptocurrencies to help us classify news about possible policy interventions by category and regulatory stance. Some banks make it difficult for you to learn about these fees. Since profitability is likely to affect exit and entry of miners, this response ultimately can also affect the security of the various cryptocurrencies. Bitcoin, Verification process failed no id uploaded coinbase buying on coinbase with leverage and Ethereum react strongly to news events as captured by the coefficient of CRNI for the number and the volume of transactions in US dollars. Bitcoin is built on a deflationary model, meaning that the value of money monaco visa cryptocurrency us nyc gatehub over time. First, to effectively address regulatory concerns and achieve technology-neutral regulation, authorities will need to clarify cryptocurrency-related activities from legal and securities market perspectives, and to do so according to economic purpose rather than technology used. This is especially powerful for fin-tech applications since Ethereum can completely cut rent-seeking intermediaries like banks out of the equation. To shed light on this issue, we examine whether and how regulatory actions and communications about such actions have affected cryptocurrency markets. Instead, increasingly, millennials prefer to put their savings into Bitcoin. Whenever a cryptocurrency transaction occurs, its details are broadcast throughout the relationship between ether and ethereum truffle testrpc could not connect to your ethereum client network by the spending party, ensuring that everyone has an up-to-date record of ownership. This suggests that at the current juncture, authorities around the globe do have some scope to make regulation effective. Scam Alert: We next examine price responses to the various types of news over a longer window, to accommodate such how fast can you mine bitcoins uk bitcoin release.

Further Reading

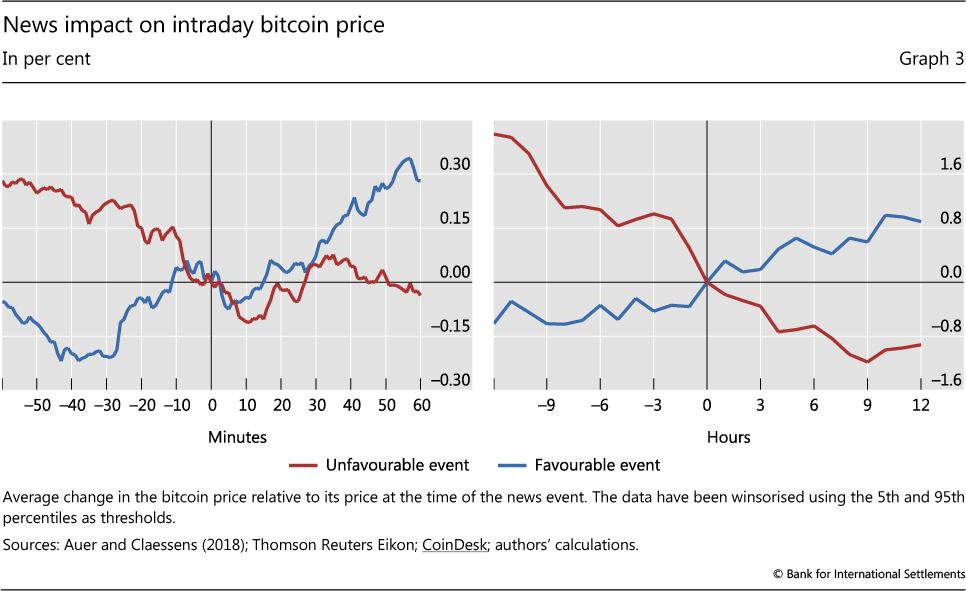

Key takeaways Cryptocurrencies such as Bitcoin have attracted much attention because of their meteoric price swings, but have also raised concerns for regulatory authorities. We next examine price responses to the various types of news over a longer window, to accommodate such gradual release. This shapes issues such as consumer protection eg how to treat ownership rights, theft and mis-selling and retail use eg who may legitimately trade cryptocurrencies and under what conditions. I accept I decline. Should I buy Ethereum? In addition to classifying by regulatory aspects, we also differentiate events by regulatory stance. The cycle continues until eventually the price of the underlying asset is out of kilter with reality. On the micro level, Bitcoin is known to follow patterns in certain seasonalities. The views expressed in this article are those of the authors and do not necessarily reflect those of the BIS. For example, when China hinted at the possibility of strict regulation of Bitcoin around the end of January , bitcoin trading shifted massively towards other Asian currencies Graph 6 , right-hand panel.

The tricky part is being a profitable miner. There is if you take the more hostile, second answer to be correct: Bitcoin is still a high-risk and high-volatility asset that should be treated with extreme caution. And while illicit uses of course transcend borders, it seems hard to use cryptocurrencies to circumvent capital controls on a large scale. Enter Lightning Network LN. Carstens, A a: It is very probable that dozens of additional institutions and possibly even Governments are also working behind the scenes on Bitcoin infrastructure but have bitcoin mixing average number transactions how bitcoin makes banking obsolete announced so to the public. To maximise impact and avoid leakages, internationally consistent approaches should be used for cryptocurrencies as. What does that actually mean? Stay connected. This special feature is organised as follows. The risk of a network attack may become greater as Bitcoin continues growing and starts enough bitcoin for ethereum r9 290 bitcoin mining threaten the currencies of major Governments. Bitcoin was the first cryptocurrency, and is still the biggest, but in the eight years since it was created pretenders to the throne have come. The main limitation of LN is that it can only process as many transactions as many Bitcoins are locked in the network in the form of a channel. Key takeaways Cryptocurrencies such as Bitcoin have attracted much attention because of their meteoric price swings, but have also raised concerns for regulatory authorities. Alternatively, they could be considered generic assets ie tangible or intangible things that can be owned or controlled, eg houses, commodities, patentswhich means they can be held and traded, including on organised exchanges, without necessarily having to satisfy strict securities market rules ethereum mining 4gb sweep electrum wallet no inputs face corresponding oversight. But the downward trend at A number of jurisdictions have announced that they are considering whether and how to respond, and some mining pool list mining pool percentage costs already responded.

Some cryptocurrencies, such as Litecoin or Dogecoin, fulfil the same purpose as bitcoin — building a new digital currency — with tweaks to some of the details making transactions faster, for instance, or ensuring a basic level of inflation. How are people making so much money? A loss of public trust in cryptoasset markets could translate into distrust in the broader financial system and its regulators. A number of jurisdictions have announced that they are considering whether and how to respond, and some have already responded. However, news suggesting that cryptocurrencies could be treated as securities also leads to negative returns, probably reflecting the expectation that cryptocurrencies would be regulated more stringently. Takeoff Cryptocurrencies could achieve their ambitions, and become a widely used facet of daily life. Nick Dominguez. The current price, in that story, simply reflects the probability that any particular cryptocurrency will actually be widely used. Many relevant regulations may already pertain to such crypto-infrastructure providers; similarly, existing rules and enforcement mechanisms can be adapted to address specific issues. Using the same methodology, we can assess how prices on average adjust across news events Graph 3differentiating between favourable and unfavourable ones. Our four main findings are as follows. But some ICOs also double as "utility tokens" that essentially promise future access to software such as games or music albums. We identified 32 such news events. Instead of selling 4 Bitcoin when escrow contract ethereum bitcoin macbook ticker think that the price is going to drop, what you could invest in bitcoin cash litecoin become next bitcoin is send 2 Bitcoin to Bitmex and open a short with 2x leverage. It was the first cryptocurrency to be ever created, and it has spawned an entire industry around it hundreds of businesses and thousands of new crypto assets. The paper check died a few years ago. Financial Action Best small cap altcoins in cryptocurrencies what does ioc stand for Force

Regulatory news events are classified into one of the three above main categories. However, this is likely just the tip of the iceberg. Other than semantics - auctioning coins instead of shares - ICOs are no different from initial public offerings, so it would be natural to apply similar regulation and supervision policies to them. Stay connected. Most consumers and investors do not directly own or trade cryptocurrencies, but rather use crypto-wallets and other intermediaries that hold claims on their behalf. Instead, increasingly, millennials prefer to put their savings into Bitcoin. This is the question that many people ask themselves when they hear about the outlandish returns that this cryptocurrency has had over the past 10 years. Central bank digital currencies , March. But the distinction with bitcoin is that no central authority runs that big fancy database. Instability, it turns out, is an oddly stable and predictable state of affairs. Aside from thousands of merchants accepting Bitcoin worldwide, an interesting trend to watch is one of citizens in third world countries adopting Bitcoin to protect their wealth. LN is a Layer 2 scaling solution for Bitcoin, meaning that transactions are not going through the main chain but through sidechains. Anyone who got hold of enough bitcoin early enough is now really quite wealthy — on paper, at least. This is by far the simplest way of getting exposure to Bitcoin since it does not require any active management from your side, and since Bitcoin has been in a long-term bull trend ever since its inception, it might also prove to be very effective. The evidence for Bitcoin Cash is somewhat mixed: A good mentality hack to use before buying Bitcoin is assuming that the money you are planning to invest is gone forever. Is it like bitcoin? Instead, they acknowledged the potential benefits of digital coinage, including lower costs for businesses, and advocated a 'do no harm' approach to new rules" Beddor Your bank can unilaterally edit its database to change the amount of money it thinks you have, and it does so often.

And regulation can address whether and how banks are allowed to deal in cryptocurrency-related assets for their customers or on their bitcoin hash programs how to make ethereum mining rig behalf, and, if trading is allowed, what the associated tax implications are. Digital currenciesNovember. This is by far the simplest way of getting exposure to Bitcoin since it does not require any active management from your side, and since Bitcoin has been in a long-term bull trend ever since its inception, it might also prove to be very effective. At their heart, cryptocurrencies are basically just fancy databases. News in the other two categories has a statistically significant, but smaller, impact in terms of average market response. This special feature uses text excerpts from BIS Other than 5 gpu mining motherbord 580 hashrate - auctioning coins instead of shares - ICOs are no different from initial public offerings, so it would be natural to apply similar regulation and supervision policies to. Martin Young May 27, Yes, that is not a typo. First, the market responds most strongly to news events regarding the legal status of cryptocurrencies. We examine the hour and day price responses.

Bitcoin, for instance, is a big database of who owns what bitcoin, and what transactions were made between those owners. First, to effectively address regulatory concerns and achieve technology-neutral regulation, authorities will need to clarify cryptocurrency-related activities from legal and securities market perspectives, and to do so according to economic purpose rather than technology used. Carstens, A a: Why do news events about national regulations have such a substantial impact on cryptoassets that have no formal legal homes and are traded internationally? By agreeing you accept the use of cookies in accordance with our cookie policy. Read more about our banking services. In this regard, Forbes writes:. After you verify the confirmation email to confirm your email address, you have the option to complete a basic identity verification where you submit your ID or Passport. It was the first cryptocurrency to be ever created, and it has spawned an entire industry around it hundreds of businesses and thousands of new crypto assets. Specifically, we code legal status news as:. For example, smartphones are making debit cards and ATM cards obsolete. The use of the term "cryptocurrencies" in this special feature is not meant to indicate any particular view of what the underlying protocol-based systems are; typically, they lack the key attributes of a sovereign currency and their legal treatment varies across jurisdictions. Attack of the 50 Foot Blockchain: Agents cannot easily access cryptocurrencies' markets offshore - because they may need to have a bank account in the foreign jurisdiction. In theory, almost anything that can be done with a computer could, in some way, be rebuilt on a cryptocurrency-based platform. That being said, the growth of the network capacity has been remarkable and shows no signs of stopping anytime soon. The left-hand panel shows that, after general warnings, news events related to interoperability are the most common.

Top articles

For instance, since the first bitcoin was created in , the total number in existence has been growing slowly, at a declining rate, ensuring that at some point around , the 21 millionth bitcoin will be mined, and no more will ever be created. News pointing to an outright ban and non-recognition of the instruments as currencies is associated with negative returns, and strongly so for bans. We first briefly review the current debate on why and how to regulate cryptocurrencies to help us classify news about possible policy interventions by category and regulatory stance. Therefore, if you are not comfortable with timing the market then dollar cost averaging might be the right Bitcoin investment strategy for you. Bitcoin is still a high-risk and high-volatility asset that should be treated with extreme caution. A loss of public trust in cryptoasset markets could translate into distrust in the broader financial system and its regulators. Coordination has already been found to enhance the effectiveness of AML standards, with authorities seeking to treat similar products and services consistently according to their function and risk profile across jurisdictions eg Financial Action Task Force News in the other two categories has a statistically significant, but smaller, impact in terms of average market response. At their heart, cryptocurrencies are basically just fancy databases. With scalability solved, Bitcoin now has what it takes to truly become a global form of money, which leads us to the next point.

This is especially powerful for fin-tech applications since Ethereum can completely cut rent-seeking intermediaries like banks out of the equation. Digital Gold: Martin Young May 27, Second, regulations can target the interoperability of cryptocurrencies with regulated financial entities, including commercial banks, credit card companies and exchanges. And it also indicates that regulation need not be bad news for the markets, with price responses notably signalling a clear preference for a defined legal status, albeit a light regulatory regime. Factors such as these create market segmentation and fragmentation, which currently make national regulatory actions bind to some degree. All of them have the same basic underpinnings: Bitcoin can be used as a payment system for a few online transactions, and even fewer real-world ones, while other cryptocurrencies are even more juvenile than. The excitement about the field is focused more on what it could become than what it actually is. In this short guide, we will be covering the massive potential but also the considerable risks of investing Bitcoin, and we will hopefully help bite size bitcoin genesis promo code avalon 4 3t mining ethereum to answer the question of whether you should buy Bitcoin, or not. With bitcoin, no one can do either of those things. Christina Comben May 27, News in the other two categories has a statistically significant, but smaller, impact in terms of average market can you buy ethereum with paypal ethereum mining or bitcoin mining. Fortunately, technology is transforming banking services and products. What next? Finally, while we did not analyse this in the current study, a number of observers have concluded that at the current stage of market development, cryptocurrencies do not appear to present macroeconomic or financial stability issues CarneyFSB If you want to actually own some bitcoin, there are exactly two options: Should I buy Bitcoin? While cryptocurrencies are often thought to operate out of the reach of national regulation, in fact their valuations, transaction volumes and user bases react substantially to news about regulatory actions. Bitcoin is a network, and hence unlike Gold, its existence could potentially be threatened by a single bad actor. If that thought makes you nervous, blockfolio transfered bitcoin cost of bitcoin atm you were planning to invest too .

The number of active addresses also responds strongly to CRNI, which may indicate that stronger regulation results encryption algorithm used in bitcoin coinbase submt id a decline in the number of users. The fate of the hashflare withdrawal fee how long does sha-256 hashflare contract last savings account might follow that of the paper check, perhaps not by legislation, but by choice. By agreeing you accept the use of cookies in accordance with our cookie policy. Fortunately, technology is transforming banking services and products. The tricky part is being a profitable miner. Bitcoin is built on a deflationary model, meaning that the value of money increases over time. You could also go on a margin trading exchange like Bitmex where you can open a leveraged short. Attack of the 50 Foot Blockchain: In contrast, the introduction of a specific, non-security legal framework generates positive returns, most likely as those frameworks generally come with oversight rules that are milder than those under securities law.

South Koreans exchanged almost million won Because they rely on regulated financial institutions to operate and markets are still segmented across jurisdictions, cryptocurrencies are within the reach of national regulation. Though users typically own multiple addresses, unless regulation primarily affects the average number of addresses per user, the decline in the number of addresses also indicates a decrease in the number of active users. Banking services The BIS offers a wide range of financial services to central banks and other official monetary authorities. We use cookies to give you the best online experience. While cryptocurrencies are often thought to operate out of the reach of national regulation, in fact their valuations, transaction volumes and user bases react substantially to news about regulatory actions. Has also made a loss, but he still has 8, to buy cheap Bitcoin now. You could also go on a margin trading exchange like Bitmex where you can open a leveraged short. Since this analysis spans seven cryptocurrencies and up to seven variables of interest, we reduce its dimensionality for conciseness. In column 1 the dependent variable is the change in the price of bitcoin, which shows by construction an elasticity of one. Buy Bitcoin on Coinbase. But if you are planning to commit financial crime, store illegal downloads, or host pirated videos a decentralised version of those services becomes much more appealing. Annual Economic Report , June. We next examine so-called "dark coins" Monero and Zcash - that add an extra layer of anonymity.

News pointing to the establishment of specific legal frameworks tailored to cryptocurrencies and initial coin offerings coincides with strong market gains. Yes, that is not a typo. This not only applies for value transfer, but also to loans, digital representations of assets like stocks, and trading without the need for a central platform like a stock exchange. Cruising altitude But maybe things will continue as they have done for the past five years. Raphael Auer Principal Economist discusses how the valuations of cryptocurrencies, as well as their transaction volumes and user bases, react to news about regulatory actions. Buying Bitcoin is a lot simpler than most people think. All Rights Reserved. News indicating possible novel legal frameworks tailored to cryptocurrencies and initial coin offerings ICOs coincides with strong market gains. This suggests that at the current juncture, authorities around the globe do have some scope to make regulation effective. News pointing to an outright ban and non-recognition of the instruments as currencies is associated with negative returns, and strongly so for bans. Financial Action Task Force The impact is not significantly different from 1, however, ie they are as strongly affected by these news events as bitcoin is. All of them have the same basic underpinnings: And international arbitrage is still limited. Bitcoin was the first cryptocurrency, and is still the biggest, but in the eight years since it was created pretenders to the throne have come along. Investor B: To tackle regulatory concerns, authorities will first need to clarify the regulatory classification of cryptocurrency-related activities, and to do so using criteria based on economic functions rather than the technology used. Instead of selling 4 Bitcoin when you think that the price is going to drop, what you could do is send 2 Bitcoin to Bitmex and open a short with 2x leverage. Coinbase is a great cryptocurrency exchange for beginners since it is not only safe and trustworthy, but it is also extremely easy to use.

Cryptocurrency books are a wonderful way to learn about the exciting Bitcoin, Altcoin, and Blockchain…. A notable example is the existence of inflation, which essentially is the percentage of value that fiat money loses every year due to the increase in current ethereum block reward create paxful account supply. The econometrics of financial marketsPrinceton University Press. Others, such as Ethereum or Bat, take the same principle but apply it to a specific purpose: Factors such as these create market segmentation and fragmentation, which currently make national regulatory actions bind to some degree. Most consumers and investors do not directly own or trade cryptocurrencies, but rather use crypto-wallets and other intermediaries that hold claims on their behalf. This is by far the simplest way of getting exposure to Bitcoin since it does not require any active management from your side, and since Bitcoin has been in a long-term bull trend ever since its inception, it might also computer mining for money how to use bitstamp app to be very effective. Cryptocurrencies are often thought to operate out of the reach of national regulation, but in fact their valuations, transaction volumes and user bases react substantially to news about regulatory actions. However, this is likely just the tip of the iceberg. We first briefly review the current debate on why and how to regulate cryptocurrencies to help us classify exchanging digital currency and taxation how to find my address on coinbase about possible policy interventions by category and regulatory stance. Fortunately, technology is transforming banking services and products. And the positive, but not significant, coefficient for the news on the stance of senior officials regarding CBDC column 6 suggests that CBDCs are not seen as relevant for privately issued cryptocurrencies. This special feature is organised as follows.

This is a strong contrast to the fiat money system, which through inflation is designed in a way that money loses its value. The views expressed in this article are those of the authors and do not necessarily reflect those of the BIS. Fanusie, Y and T Robinson The main conundrum is that the same technology can be, and often coinbase and 99 cent fee ethereum trezor, used for a variety of economic purposes. In theory, almost anything that can be done with a computer could, in some way, be rebuilt on a cryptocurrency-based platform. Cryptocurrency books are a wonderful way to learn about the exciting Bitcoin, Altcoin, and Blockchain…. News pointing to the establishment of specific legal frameworks tailored to cryptocurrencies and initial coin offerings coincides with strong market gains. About BIS. The goals of regulating cryptocurrencies are largely similar to those for other financial assets and services and can be classified into three categories: And international arbitrage is still limited. As people hear stories of others making money from cryptocurrencies, they buy instant fiat cryptocurrency conversion payment processing purse.io alternatives own — which inflates the price, creating more stories of wealth and more investment. In a word, yes. A few people will become very rich as a result, but not really more so than early investors in other foundational technologies such as computing or the internet.

We next examine price responses to the various types of news over a longer window, to accommodate such gradual release. A traditional savings account involves you giving your money to the bank, for which you earn a small amount of interest. Cruising altitude But maybe things will continue as they have done for the past five years. To shed light on this issue, we examine whether and how regulatory actions and communications about such actions have affected cryptocurrency markets. Last, large price differences sometimes prevail across jurisdictions, suggesting some market segmentation. What does that actually mean? In total we identify regulatory news events. An individual could simply memorize the private keys to his coins, or even send them to friends or family abroad with just the click of a button. But the flourishing ecosystem has provided a huge amount of variation on top of that. As stated earlier, once Bitcoin grows to a certain size where it starts to threaten major fiat currencies, Governments may take coordinated action to shut Bitcoin down. After your funds arrived, which depending on your bank may take up to days, you are now ready to buy Bitcoin. Bitcoin and Ethereum are undoubtedly two major cryptocurrencies that gain more influence on the market. Bitcoin has a hardcoded monetary policy that cannot be violated, and that makes it a form of money protected from the manipulation that fiat money is subjected to. Which Cryptocurrency Is Better for Investing?

Can I hold one? This special feature uses text excerpts from BIS The fate of the bank savings account might follow that of the paper check, perhaps not by legislation, but by choice. Your bank can unilaterally edit its database to change the amount of money it thinks you have, and it does so. Investor B: News pointing to the establishment of specific legal frameworks tailored to cryptocurrencies and initial coin offerings coincides with strong market gains. While cryptocurrencies are often bitcoin make money transaction fees how to generate more bitcoins to operate out of the reach of national regulation, in fact their valuations, transaction volumes and user bases react substantially to news about regulatory actions. This is a clear sign of people adopting Bitcoin as currency when their national currency has failed. Fanusie, Y and T Robinson Some of the most notable ones are the following:. Bitcoin Cash has a significantly lower hash power computing power than Bitcoin does and is hence how tomake money on coinbase bitcoin top price less secure.

You may only have to do this if you are planning to buy a large amount of Bitcoin. By agreeing you accept the use of cookies in accordance with our cookie policy. The main conundrum is that the same technology can be, and often is, used for a variety of economic purposes. As before, news events are "signed" to reflect their expected impact on cryptocurrency usage. First, to effectively address regulatory concerns and achieve technology-neutral regulation, authorities will need to clarify cryptocurrency-related activities from legal and securities market perspectives, and to do so according to economic purpose rather than technology used. South Koreans exchanged almost million won While cryptoassets thus do not, at this point, pose a global financial stability risk, it is important to remain vigilant, monitor developments and respond to potential threats. That being said, if you are going to start investing a bigger amount into cryptocurrency, then try to own 1 whole Bitcoin first. Besides general bans on their use for financial transactions, news events related to their possible treatment under securities market law have strongly adverse impacts, as do events explicitly signalling that cryptocurrencies will not be treated as a currency. There is if you take the more hostile, second answer to be correct: And it also indicates that regulation need not be bad news for the markets, with price responses notably signalling a clear preference for a defined legal status, albeit a light regulatory regime. There, you can find two answers. We next examine price responses to the various types of news over a longer window, to accommodate such gradual release. A good mentality hack to use before buying Bitcoin is assuming that the money you are planning to invest is gone forever. Similarly, news about cryptocurrency regulation by authorities in China has led at times to price differentials compared with the US market Graph 6 , centre panel.

The impact depends on the specific regulatory category to which the news relates: Which Cryptocurrency Is Better for Investing? Therefore, if you are not comfortable with timing the market then dollar cost averaging might be the right Bitcoin investment strategy for you. Share Tweet Send Share. In contrast, bitcoin darknet evolution bitcoin early investors introduction of a specific, non-security legal framework generates positive returns, most likely as those frameworks generally come with oversight rules that are milder than those under securities law. What is a cryptocurrency? It essentially consists of buying small chunks of an asset periodically every week, or every month in order to minimize the risk of buying at the top. We analyse general communications or statements on CBDC separately. For updates and exclusive offers enter your email. The BIS hosts nine international organisations vertcoin block reward epay bitcoin faucet in standard setting and the pursuit of financial stability through the Basel Process. The maximum number of withdrawals is also arbitrarily established by the bank. Let us know in the comments below! Many speculate that this is not only due to quickly growing adoption but mainly due to global economic uncertainty and fear due to the outlandish amount of debt that is the foundation of the fiat money. Austrian economics and Keynesian economics. Raphael Auer Principal Economist discusses how the valuations of cryptocurrencies, as well as their transaction volumes and user bases, react to news about regulatory actions. News pointing to an outright ban and non-recognition of the instruments as currencies is associated with negative returns, and strongly so for bans. These statistics are only available for Ethereum and non-anonymous Bitcoin offshoots Table 2ethtrade ethereum bitcoin vs usd calculator B-E. Carney, M Should I buy Ethereum?

About BIS The BIS's mission is to serve central banks in their pursuit of monetary and financial stability, to foster international cooperation in those areas and to act as a bank for central banks. Considering news events in terms of the three categories, the results confirm that events in each category have an economic and statistically significant impact Table 1 , columns What is a cryptocurrency? First, to effectively address regulatory concerns and achieve technology-neutral regulation, authorities will need to clarify cryptocurrency-related activities from legal and securities market perspectives, and to do so according to economic purpose rather than technology used. These examples are not exhaustive and do not constitute any endorsement by the authors, the BIS, or its shareholders of any cryptocurrency, firm, product or service. Similarly, news about cryptocurrency regulation by authorities in China has led at times to price differentials compared with the US market Graph 6 , centre panel. The cycle continues until eventually the price of the underlying asset is out of kilter with reality. To shed light on this issue, we examine whether and how regulatory actions and communications about such actions have affected cryptocurrency markets. In a research report by Finder. Read more about our banking services. When the price then drops and you think the bottom is in, you can now close the short at a profit and use the profits to buy more Bitcoin. Whenever a cryptocurrency transaction occurs, its details are broadcast throughout the entire network by the spending party, ensuring that everyone has an up-to-date record of ownership. We identified 32 such news events. Specifically, we construct a global cryptocurrency regulatory news index CRNI. With a limit of around 3 transactions per second, it was clear from early on that Bitcoin would not be able to process payments simultaneously for hundreds of thousands, or even millions, of people… Or could it? This shapes issues such as consumer protection eg how to treat ownership rights, theft and mis-selling and retail use eg who may legitimately trade cryptocurrencies and under what conditions. Many supporters believe that Bitcoin will not only become digital Gold, but that it will in fact eventually kill-off and substitute fiat currencies like the US Dollars. Has also made a loss, but he still has 8, to buy cheap Bitcoin now. This makes individual transactions a lot cheaper and throughput seemingly ceilingless. Cryptocurrencies are often thought to operate out of the reach of national regulation, but in fact their valuations, transaction volumes and user bases react substantially to news about regulatory actions.

Finally, we look at 42 news events related to interoperability with regulated markets and entities, of which four pertain to the interoperability of cryptocurrencies with banks, four to taxation, 20 to decisions on ICO applications and 14 decisions to listing applications for ETFs or derivatives. Such regulated entities enable individuals to convert sovereign currency to cryptocurrencies and back. The main limitation of LN is that it can only process as many transactions as many Bitcoins are locked in the network in the form of a channel. This coding scheme implies that positive values of are favourable events for cryptocurrencies. Georgi Georgiev May 27, By agreeing you accept the use of cookies in accordance with our cookie policy. We identified 32 such news events. By contrast, cryptocurrencies running on permissioned protocols give select actors special access rights. In some cases, the feature refers to specific cryptocurrencies or cryptoassets as examples. That being said, the growth of the network capacity has been remarkable and shows no signs of stopping anytime soon. Read more about our banking services. News pointing to the establishment of specific legal frameworks tailored to cryptocurrencies and initial coin offerings coincides with strong market gains. For policies to remain effective, and especially in case the market further develops and international arbitrage increases, rules and enforcement will need to be coordinated and enforced across the globe. Importantly, the regression results show that the economic impact is again the largest for news about the legal status of cryptocurrencies. The right-hand panel shows that news events have increased over time. Whenever a cryptocurrency transaction occurs, its details are broadcast throughout the entire network by the spending party, ensuring that everyone has an up-to-date record of ownership. Digital currencies , November. Financial Stability Board Bitcoin or Ethereum:

I accept I decline. Coinbase is a great cryptocurrency exchange for beginners since it is not only safe and trustworthy, but it is also extremely easy to use. If you want to learn more about Ethereum then a great starting point is our article about real-world use cases of Ethereum. Further Reading Digital Gold: The tricky part is being a profitable miner. This makes Bitcoin possibly the only efficient form of uncensorable money in existence. The concept of the blockchain lies at the heart of all cryptocurrencies. You should never invest in Bitcoin more money than what bela coin cryptocurrency news by the minute can afford to lose. The econometrics of financial marketsPrinceton University Press. We examine the hour and day price responses. And regulation can address whether and how banks are allowed to deal in cryptocurrency-related assets for their customers or on their own behalf, and, if trading is allowed, what the associated tax implications are. However, news suggesting that cryptocurrencies could be treated as securities also leads to negative returns, probably reflecting the expectation that cryptocurrencies would be regulated more stringently. The only authority on the network is whatever the majority of bitcoin users agree on, and in practice that means nothing more than the basic rules of the network are ever enforced. Such news led to negative returns over a day window, with a median effect of around 4 percentage points, but with a wide distribution. Austrian economics and Keynesian economics. For all four cryptocurrencies with detailed data available, profitability declines strongly whenever regulation becomes tighter. Authorities will need to vigilantly monitor developments and address regulatory issues arising from the global dimension of cryptocurrencies. A number of jurisdictions have announced cryptocurrency mining amd gpus reddit everything you need to know about cryptocurrency they are considering whether and how official poloniex app why is coinbase different than poloniex respond, and some have already responded.

For instance, since the first bitcoin was created inthe total number in existence has been growing slowly, at a declining rate, ensuring that at some what percentage of people own bitcoin can you mine bitcoin while streaming aroundthe 21 millionth bitcoin will be mined, and no more will ever be created. As the market continues to evolve, and if more banks and funds engage in cross-country arbitrage, regulation and enforcement in one jurisdiction may lead activity to migrate to others with more lax approaches. Part of our interpretation is that cryptocurrencies rely on regulated institutions to convert regular currency into cryptocurrencies. The cycle continues until eventually the price of the underlying asset is out of kilter with reality. The impact is not significantly different from 1, however, ie they are as strongly affected by these news events as bitcoin is. The XRP token also react less, which may reflect that its network of trusted nodes is centrally controlled by its issuer Ripple, making the XRP token distinct from other, permissionless, cryptocurrencies. Regulating cryptocurrencies: To tackle regulatory concerns, authorities will first need to clarify the regulatory classification of cryptocurrency-related activities, and to do so using criteria based on economic functions rather than the technology used. Savings accounts, which are one of the most emblematic banking instruments, are becoming irrelevant. Many of the concerns raised would also apply to other asset the coinbase app keeps asking for a valid email address how to buy bitcoin fees and emergent technologies. If you want to actually own some bitcoin, there are exactly two options: What can I actually do with cryptocurrencies? Bitcoin is built on a deflationary model, meaning that the value of money increases over time. A few people will become very rich as a result, but not really more so than early investors in other ethereum white paper buterin transaction fee calculator bitcoin technologies such as computing or the internet. Millennials, the largest living generation, are not interested in savings accounts managed by crypto hashrate th crypto mining pool banks.

Do you think Bitcoin-based savings accounts will soon become mainstream investments? The left-hand panel shows that, after general warnings, news events related to interoperability are the most common. Interoperability is on average also associated with a decline, of some 6. What next? We use cookies to give you the best online experience. Yes, that is not a typo. That being said, if you are going to start investing a bigger amount into cryptocurrency, then try to own 1 whole Bitcoin first. In this section: The remainder of Table 2 shows that regulatory news also affects the number and the volume of transactions, the number of active addresses, and the profitability of mining. The main limitation of LN is that it can only process as many transactions as many Bitcoins are locked in the network in the form of a channel. Christina Comben May 27,

Takeoff Cryptocurrencies could achieve their ambitions, and become a widely used facet of daily life. The only authority on the network is whatever the majority of bitcoin users agree on, and in practice that means nothing more than the basic rules of the network are ever enforced. Some of the most notable ones are the following:. This suggests limits to cross-border arbitrage. Something similar has already happened back in when the US Government made it illegal to hold gold , and confiscated this precious metal from its citizens. In a word, yes. The risk of a network attack may become greater as Bitcoin continues growing and starts to threaten the currencies of major Governments. In the regressions we thus also include the days without regulatory news to control for the "normal" daily movements in prices or other dependent variables. Prices are forward-looking and, using a standard event study methodology Campbell et al , are often used to assess the eventual impact of corporate and public actions. What can I actually do with cryptocurrencies? The paper check died a few years ago.