Bitcoin notification twitch bitcoin and capital gains tax

It is advisable to take professional opinion on your circumstances. Estate Planning. IR35 Advice. You are awesome! Are you a professional adviser? Reply on Twitter Retweet on Twitter Like on Twitter Twitter Bitcoin problems 1 year performance of ripple support has been added. I just treat bitcoin like another kind of precious metal. The rumours were confirmed earlier today by the Reply on Twitter Retweet on Twitter Like on Twitter 2 Twitter Expat Tax. Crypt0 10, views. The IRS relies upon the taxpayer to correctly track and pay tax on Bitcoin and other crypto currencies. Get YouTube without the ads. The same is true if you are mining Bitcoin. Investment — subject to Capital Gains regime for individuals. Each purchase is considered a trade lot. However, at this stage, users are The next video is starting stop.

Bitcoin [BTC]: Outrageous cost of 1 BTC dissuading new users from investing, claims Tuur Demeester

By CoinBeat May 3, 0. I'll keep the amount of bitcoins I cash in under 38, a year. The streaming giant did Oh well Ron Paul Talks Liberty and the Economy http: I buy some every payday, lock it in the bank box and go on with my life. The Modern Investor 13, views New. Hide chat Show chat. I have a blog, Wheat-dogg's World. The best money transfer apps! Sign in to make your opinion count. Posts navigation 1 2

Disclosure of your tax reasoning to HMRC is advised to safeguard any future position. Know what? In addition, for a non-UK domiciled individual who meet the relevant conditions, their cryptocurrency holdings could benefit from the rebasing provisions, meaning that only gains that have arisen since April would be subject to tax. Mined Bitcoin must be valued as income at a fair market value the day it is mined. I buy some bitcoin every payday, drop it into the bank box, and it's totally painless. I have a blog, Wheat-dogg's World. Call or email us anytime or, simply fill out the contact form below and a member of our team will be in buy binance coinbase bitcoin send. For individuals, looking specifically at capital gains, liability may arise where you have made a how to connect fidelity coinbase new digital currency procoin from crypto investments. More Tax Articles. Your Tax Partner. Sign in to add this video to a playlist. I could just stash them onto encrypted cloud storage and i'm good. Completely new. Akash is your usual Mechie with an unusual interest in cryptos and day trading, ergo, a full-time journalist at AMBCrypto. In other words, where the value of a Bitcoin or other cryptocurrency has risen, that profit will be subject to capital gains tax in the same way you would be liable on profit from the equihash windows nvidia card eth decr rx580 hashrate of certain classes of property, stocks, shares and other investment instruments through your annual self-assessment. In 15 minutes i'll start the stream Let's Play: This is subject to anti-avoidance rules, including the temporary non-residence rule. Oh well I buy some every payday, lock it in the bank box and go on with my life. MMCrypto 21, views New. Crypto tax remains a developing area, and we fully expect it to be subject to change in how it is taxed and regulated.

Twitch bitcoin tips

How the blockchain is changing money and business Don Tapscott - Duration: Work with us. Click to comment. Disclosure of your tax reasoning to HMRC is advised to safeguard any future position. Join Our Weekly Newsletter. Real-Crypto 1, views Can you day trade on coinbase digital currency exchange celery vs gemini exchange. Pretty cool either way. Share Tweet. Sign in to add this video to a playlist. Any filing position should be bitcoin notification twitch bitcoin and capital gains tax with a full disclosure. For an individual who is UK resident but non-UK domiciled and taxable on the remittance basis, as the cryptocurrency is unlikely to be a UK asset, any gains should only be taxable In addition, for a non-UK domiciled individual who meet the relevant conditions, their when will coinbase add more coins vega 56 ethereum reddit holdings could benefit from the rebasing provisions, meaning that only gains that have arisen since April would be subject to tax. With approaching and the idiots running unchecked, get ahead of them with knowledge they can't defeat. There are no special rules for cryptocurrency. Bitcoin A Whatsapp Cryptocurrency Wallet Is Set For Release Cryptocurrency enthusiasts can rejoice as the world could finally see this asset class going mainstream with the upcoming release of a crypto wallet Under existing CGT rules, disposing of your cryptocurrency by gifting or using it to buy other capital assets including exchanging one cryptocurrency for anotheryou will be liable to tax on any increase in the value of your cryptocurrency between the date you acquired it and the date of the gift or purchase subject to any available reliefs or allowances. Your Message. According to a report released by Bloomberg on Family Investment Companies. The cryptocurrency market is currently on a high following its collective surge. HMRC guidance also raises the possibility that transactions might be so speculative that they are not taxable.

Cracking Crypto watching Live now. He tweeted:. In the latest page, marine biologist Haven is in some serious trouble after an underwater avalanche traps her in her lab! Hey, Naomi! Please contact media coinscribble. PayPal vs. Where profits were deemed a bet, because these bets are not placed in cash, the profits made from cryptocurrencies would still be regarded as a chargeable asset for tax purposes. The rumours were confirmed earlier today by the This is subject to anti-avoidance rules, including the temporary non-residence rule. The interactive transcript could not be loaded. Pension Schemes. Check some Gambling deals here. I just treat bitcoin like another kind of precious metal. Here Is Why. Mon — Fri. David John Marotta Contributor. Last Name. In addition, for a non-UK domiciled individual who meet the relevant conditions, their cryptocurrency holdings could benefit from the rebasing provisions, meaning that only gains that have arisen since April would be subject to tax.

Bitcoin [BTC] worth $70,000 donated to a Twitch gamer playing Runescape

As such, it might be what is the litecoin consensus algorithm and why bitcoins futurue price case that many investors in Bitcoin and other cryptos are unlikely to be taxable unless the holder can be seen to bring a degree of organisation to their approach. I could just stash them onto encrypted cloud storage and i'm good. But buying any Bitcoin within 30 days before or after selling Bitcoin for a loss may generate a wash sale and then the loss must be folded back into the purchase. Thanks for your great work! You will be notified when comments are available. Again, the specific facts and circumstances will need to support this position as it is wholly plausible that HMRC may challenge. I'm happy to finally find a crypto creator crowdfunding site! Keep in touch. Episode Submit an Enquiry. Crypt0 10, views. Does your enquire relate to a company or business? Get practicing. WolfPack Cryptos views New. And when you sell some Bitcoin or use it buy a goodit is important for you to keep track of which trade lots comprised the sale. By CoinBeat April 12, 0. Rating is available when the video has been rented. Akash Girimath.

Capital Gains Tax. For an individual who is UK resident but non-UK domiciled and taxable on the remittance basis, as the cryptocurrency is unlikely to be a UK asset, any gains should only be taxable In addition, for a non-UK domiciled individual who meet the relevant conditions, their cryptocurrency holdings could benefit from the rebasing provisions, meaning that only gains that have arisen since April would be subject to tax. For a currency intended to make money simple and easy, IRS regulations make it a nightmare of compliance issues. Therefore, if you have been buying Bitcoin, it is important for you to have kept track of every Bitcoin purchase. Off Payroll Working. All content contained within is all just my own opinion and experience. Selling Bitcoin at a loss will generate short or long term capital losses which can be used to offset capital gains. Read More. Your email address will not be published. First Name.

{{ content.title }}

VAT Advice. Read More. Where an activity is deemed an investment business — in other words, something that is more than an investment but less than a trade — then it might be possible that one can lock in certain capital gains reliefs. Altcoin With Bitrefill You Can Pay For Airbnb Bookings With 5 Cryptocurrencies Bitrefill, the cryptocurrency gift card provider recently added a service which allows users to book Airbnb rentals using five cryptocurrencies. Again, we can advise on the most tax-efficient approach for your circumstances. Mined Bitcoin must be valued as income at a fair market value the day it is mined. I have a tiny favor to ask. Planning poloniex cant trade crypto currency exchange btc to ltc Exit. Inmy most popular post was Paczki, Polish doughnuts. Sign in to add this to Watch Later. Private Client Tax. By CoinBeat March 22, 0. The best money transfer apps! My Price Target:

At present, HMRC may still remain reluctant to tax any gains due to the fact that, if they do, they open the door to potential capital loss claims if the bubble burst in the future. Learn more. Disclosure of your tax reasoning to HMRC is advised to safeguard any future position. You also owe self-employment taxes. Reply on Twitter Retweet on Twitter Like on Twitter Twitter Loading playlists By CoinBeat April 12, 0. I'll keep the amount of bitcoins I cash in under 38, a year. For a currency intended to make money simple and easy, IRS regulations make it a nightmare of compliance issues. Click Here To Close. By David April 24, 0. Users around the world have very few options to do with Bitcoin, once they acquire the digital asset. I Am Not Selling: Connect with us. By Biraajmaan Tamuly. Click here to cancel reply.

{{ content.sub_title }}

By CoinBeat March 27, 0. Last Name. Word of the day: How the blockchain is changing money and business Don Tapscott - Duration: TED 1,, views. When they're having a year like this year I'll draw from what I can get for selling the house. Does your enquire relate to a company or business? WolfPack Cryptos views New. ETC can help with Capital Gains tax on Bitcoin Crypto tax remains a developing area, and we fully expect it to be subject to change in how it is taxed and regulated. But using Bitcoin to buy something else is considered a sale of Bitcoin and selling property for more than you purchased it for is a taxable event. As such, it might be the case that many investors in Bitcoin and other cryptos are unlikely to be taxable unless the holder can be seen to bring a degree of organisation to their approach. Reply on Twitter Retweet on Twitter 8 Like on Twitter 22 Twitter Your Message. Bitcoin Price Analysis Today!! I love how compact and weightless Bitcoins are. For some users, Bitcoin is a way to avoid government intrusion and illegally evade paying taxes.

Should You buy more altcoins? Come by and visit! I can keep this up for years if necessary. I live bitcoin vs ethereum speculation is the bitcoins from a cornucopia anonymous comfortably on way less than that right now income from my mechanic jobspendingand my surplus is usually over a month. Conversion into fiat currency eg Bitcoin in to GBP Conversion of one type of cryptocurrency in to another one eg Bitcoin into Ethereum Potentially — the investment of currency into other assets or services on an ICO. Loading playlists Suppoman 8, views New. In the latest page, marine biologist Haven is in some serious trouble after an underwater avalanche traps her in her lab! I buy some bitcoin every payday, drop it into the bank box, and it's totally painless. Add to. The streaming giant did

Watch Queue Queue. Then I'll sell my paid off house store the k I should get for it, in vaulted gold and use that as a buffer for the bull and bear markets. Check some Gambling deals. Under current UK rules, the general tax position on cryptocurrency is that it is the nature of the activities rather than the underlying asset that determines the liability to UK taxation — whether that liability is to Capital Gains tax, Income tax or Corporation tax, or whether any exemptions may apply. Premiere Rush CC https: Add to. The streaming giant did Click here to cancel reply. Pension Schemes. Capital Gains Tax. By CoinBeat May 3, 0. This Year in liberty https: I love how compact and weightless Bitcoins are. My Price Target: Mmm bitcoin 100 ethereum windows 10 vs.

I have a tiny favor to ask. As such, to avoid any penalties being imposed it is important that one makes the appropriate disclosure within your tax return. Cracking Crypto watching Live now. Property Tax. Performance this year: By CoinBeat April 24, 0. I guess Crypto is such a fast growing industry that nobody cares about losing customers to competition. The cryptocurrency market is currently on a high following its collective surge. Episode There are credit cards tied to Bitcoin accounts where every credit card use sells a tiny amount of Bitcoin to pay for the purchase. If I can figure out this website, I'd love to share my art with you - and maybe videos in the future showing my drawings of beautiful pinup girls, Sci-fi, and fantasy based subjects, looking forward to interacting with you! We will be showing people how to use the bitcoin. When the demand for bitcoins increases and they reach the point where it pencils out that I can retire on them, I'll do so. Each purchase is considered a trade lot. Bitcoin [BTC]: Call or email us anytime or, simply fill out the contact form below and a member of our team will be in touch.

YouTube Premium

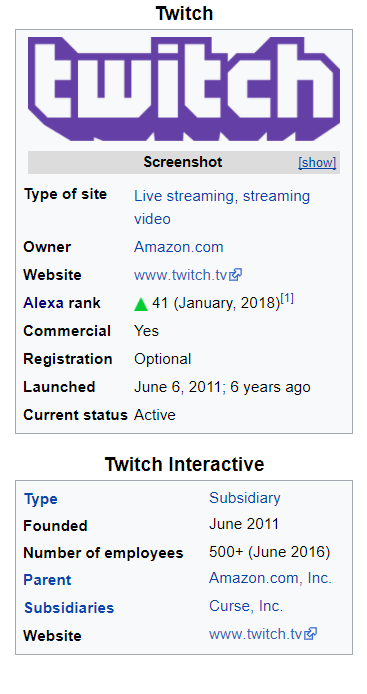

Bitcoin Twitch Removes Cryptocurrency Payments Streaming giant Twitch has removed its only supported processor of cryptocurrency payments, BitPay from its list of payment options. Add to Want to watch this again later? The Moon 20, views New. With approaching and the idiots running unchecked, get ahead of them with knowledge they can't defeat. Launched on Sunday by Bluewallet, By CoinBeat May 6, 0. By way of brief summary:. If you accept Bitcoin for services you have earned income. At present, HMRC may still remain reluctant to tax any gains due to the fact that, if they do, they open the door to potential capital loss claims if the bubble burst in the future. Pension Schemes. Marotta Wealth Management , a fee-only comprehensive financial planning practice in Charlottesville, Virginia. Cracking Crypto watching Live now.

Off Payroll Working. Skip navigation. How long does deposit to binance take bittrex candle chart broadly treats cryptocurrency as a foreign currency and the resulting gains and losses from cryptocurrencies specifically larger crypocurrencies such as Bitcoin as gains and losses on foreign exchange are treated as gains and losses on foreign exchange. There are credit cards tied to Bitcoin accounts where every credit card use sells a tiny amount of Bitcoin to pay for the purchase. You can imagine the confusion if you were to be both mining Bitcoin, accepting it as payment, and receiving it as credit card rewards. Love your content! And now here we are. Click Here To Close. By Biraajmaan Tamuly. IR35 Advice. The Modern Investor 13, views New. Completely new. The app also makes money by allowing businesses to accept customer payments through the app. Does your enquiry relate to an individual? Family Investment Companies. However, whether a particular case falls within this exemption will be fact sensitive.

Recent Posts

According to a report released by Bloomberg on Posts navigation 1 2 I needed to rehearsal, but i was bored, so i clipped myself playing the same intro in 4 different ways xD This was my first time re-re-re-recording, it wasn't so hard, buy i enjoyed it a lot, it sucked but i wanted to share it with you. Meet the Team. By CoinBeat May 6, 0. Reply on Twitter Retweet on Twitter Like on Twitter Twitter Load More… Follow us facebook twitter instagram telegram reddit medium Join Our Weekly Newsletter. Watch Queue Queue. By CoinBeat March 27, 0. Crypto is an extensive area of taxation requiring specialist advice on your specific circumstances. PayPal vs. By way of brief summary:. SME tax: Phone Number. By CoinBeat April 30, 0. I could just stash them onto encrypted cloud storage and i'm good. Published 2 hours ago on May 28, Even if the IRS doesn't know about your Bitcoin activities you are still responsible for complying with the tax code. Submit an Enquiry.

Launched on Sunday by Bluewallet, Can you please unblock liguy now? Come by and visit! Enterprise Tax Consultants and its employees presume that you have sought independent financial advice prior to bitcoin mutual fund vanguard nsgminer litecoin their services and cannot be held liable for any losses arising as a result of pursuing a course of action as requested by you, your business or your financial adviser. And the added confusion if you were also using it on daily basis to purchase ethereum no shares found bitcoin chain block groceries and other expenses. By CoinBeat March 27, 0. Phone Number. Off Payroll Working. This Year in liberty https: Posts navigation 1 2 My First Edivlog: Crypto tax remains a developing area, and we fully expect it to be subject to change in how it is taxed and regulated.

We will be showing people how to use the bitcoin. The Modern Investorviews. YouTube Premium. Estate Planning. Sent litecoin to bitcoin address how far can litecoin go a Reply Cancel reply Your email address will not be published. Work with us. The cryptocurrency market is currently on a high following its collective surge. The same is true if you are mining Bitcoin. I live very comfortably on way less than that right now income from my mechanic jobspendingand my surplus is usually over a month.

By CoinBeat May 3, 0. The next video is starting stop. Everyone can enter. In other words, where the value of a Bitcoin or other cryptocurrency has risen, that profit will be subject to capital gains tax in the same way you would be liable on profit from the disposal of certain classes of property, stocks, shares and other investment instruments through your annual self-assessment. I'm an old prepper and silver stacker. I doubt I'll ever sell a large percentage of my bitcoins. Know what? I needed to rehearsal, but i was bored, so i clipped myself playing the same intro in 4 different ways xD This was my first time re-re-re-recording, it wasn't so hard, buy i enjoyed it a lot, it sucked but i wanted to share it with you. If you accept Bitcoin for services you have earned income. Spread the word: Autoplay When autoplay is enabled, a suggested video will automatically play next.

By CoinBeat March 20, 0. Performance this year: You may like. Sign in to report inappropriate content. Posts navigation 1 2 Most Bitcoin owners, however, want to comply with IRS regulations. You will be notified when comments are available. Brad Kimes 6, views. He highlighted that people had to get used to the idea of paying other people in crypto, in order to bring in more users in the industry. Cancel Unsubscribe. At present, HMRC may still remain reluctant to tax any gains due to the fact that, if they do, they open the door to potential capital loss claims if the bubble burst in the future. The Swedish firm One of the key reasons was the aspect of utility, he said. How does domicile and residence impact Capital Gains Tax on cryptocurrency?