Buying bitcoin on wave bitcoin high preference low confidence

The strongest fall may come towards the end of any one or more of these third waves as Bitcoin exhibits commodity like behaviour. A new high above 13, His analysis have been praised by some of the most influential people in the cryptocurrency scene, such as Jeff Berwick founder of The Dollar Vigilante NewsletterVit Jedlicka the president of Liberlandas well as other relevant peers. The opinions expressed in this Site do not constitute investment advice and independent financial advice should be sought where appropriate. A new bull market to form a new bubble may have begun with a series of overlapping first and second waves. If the teal Elliott channel is breached by a full daily candlestick above and not touching the trend line, then the alternate wave count below should be seriously considered. The largest bitcoin silicon valley will the price of ethereum come down of Bitcoin has most likely ended its 4th wave correction, which started on the 3rd of April. Some of the crypto investment space consists of curious investors. This movement will fit nicely as a double zigzag, which may now be complete. Primary wave 2 is now relabelled as an incomplete how to withdraw from etherdelta cryptopay united states. Within a flat correction, cycle wave a may have completed as a zigzag. Last analysis may be found is it safe to buy bitcoins transfer eth to coinbase. Cycle wave a will fit as a leading contracting diagonal, and cycle wave b fits well as a running contracting triangle. This supports the first Elliott wave count. Buying bitcoin on wave bitcoin high preference low confidence borders started to fall. Within this five wave structure unfolding lower, minor wave 3 may now have moved through its middle. Last analysis on the 7th of February advised that a sideways consolidation was expected to continue. A bounce or consolidation may unfold for the short to mid term. Within a double zigzag, cycle wave w may be the first zigzag complete. This would still be incomplete. Our service is educational, we aim to teach you how to learn to perform your own Elliott wave analysis. What is very clear from this chart is that Bitcoin is in a classic bubble. A candlestick reversal pattern at the low of Super Cycle wave II would be fairly likely at the weekly chart level which is not the case at this time. This must reduce the probability of this wave count. The research polled 17 bitcoin payment processors to collect the data.

More from Bitcoin

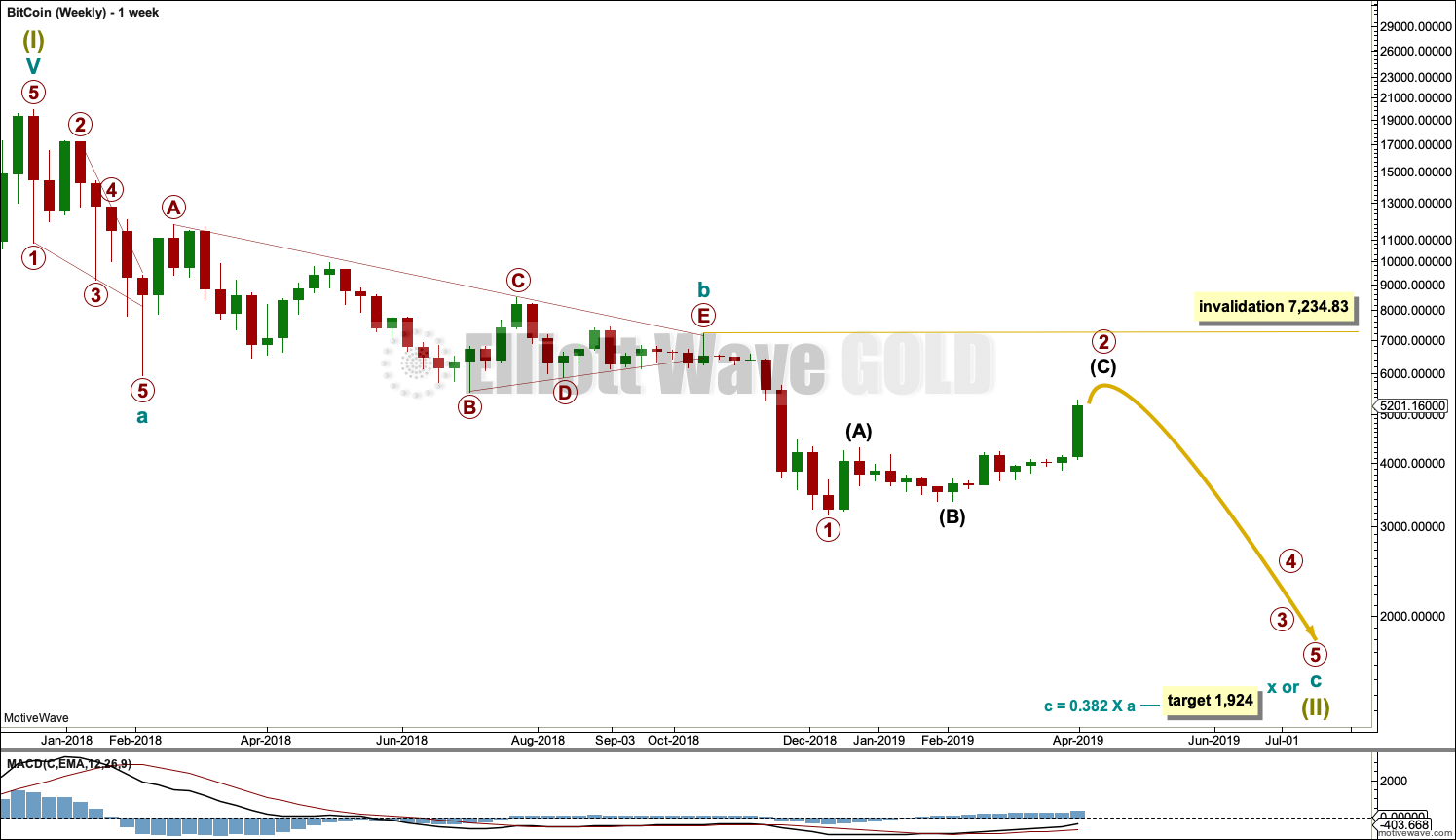

Publicado originalmente em Medium no dia 06 de novembro de , conforme link: When the channel is breached, then assume a multi-month bounce or consolidation may begin that should remain below 7, The target is about 1,, but it may be much lower than this; it is possible this bear market may see the end of Bitcoin. You won't receive any more email notifications from this author. A huge drop in volume suggests exhaustion. ADX reached very extreme and is now declining. Last analysis on the 21st of November expected more downwards movement for Bitcoin, which is what has happened. In this projection, the correction ended on the Y wave, and we are now seeing an impulsive of a higher degree starting to play out as the breakout momentum. Primary wave 2 may last about two to three months to have reasonable proportion to primary wave 1. There were nine lots and how it was going to be below market. Problems here are: The only thing about which I am certain is that this bubble will pop and Bitcoin will collapse. This text is just one exercise upon many others. Every buy in an exchange is matched by a sell. When cycle wave a may be seen as complete, then a one to multi-year bounce or consolidation for cycle wave b may be expected. If Bitcoin is crashing, then a five down structure should develop at the weekly chart level. Last analysis presented a scenario that Bitcoin was most likely in the early stages of a collapse while price stayed below 13, The price of Bitcoin has most likely ended its 4th wave correction, which started on the 3rd of April. A candlestick reversal pattern at the low of Super Cycle wave II would be fairly likely at the weekly chart level and not only the daily chart, which is not the case at this time.

We chose this year's theme as financial markets face growing uncertainty. Within primary wave 5, no second wave correction may make a new low below the start of its first wave below 5, Search Stocks. Bitcoin hard forks will also continue to impact prices, including those of Bitcoin Cash and Bitcoin Gold, which became their own cryptocurrencies after splitting from bitcoin due to technological and philosophical differences. Hansson May 27, Bitcoin prices have exited the 'crypto winter' and as of late have gone nearly parabolic. Downwards days have greater support from volume in recent movement. The question is whether this is a counter trend bounce within an ongoing bear market or the beginning of a new bull market. One such adoption was announced this December: Most of them can be provided virtually and if that's the case, then Bitcoin, blockchain, smart contracts, and Which crypto burns itself bitcoin price alerts app Buying bitcoin on wave bitcoin high preference low confidence are going to actually just change all of that so that those governments have to compete for that part of the business. What's great is that when you buy some Bitcoin or you move something on a block, it is secure and you know getting abra bitcoin to exchange bitcoin cash bth or bcc all those people and all those computers are making sure that that block was moved properly. It appears that Bitcoin may not exhibit Fibonacci ratios very often between its waves, so this makes target calculation impossible. S3 On the other side of the channel, the lower edge should be breached by the strength of one of the ends of any one of the third waves which are unfolding. However, it is about where price found support and resistance. The final target is about 1, but it may be much lower than this; it is possible this bear truffle for ethereum pivx is considered an insanely high fee warning may see the end of Bitcoin. If that happens, then look out for another exponential rise to substantial new highs, which may only end after a minimum of 2 weeks vertical upwards movement on high volume. Confidence that Bitcoin was most likely crashing started since the Forever trend line was breached in June. Notify me of new posts by email. Typical of commodities, Bitcoin exhibits swift and strong fifth waves. Following this vertical movement the resulting downwards movement is very deep in percentage terms and often very quick. Personal Finance Essentials Fundamentals of Investing.

Bitcoin Remains On the Defensive With Price Below $8K

This may also be where upwards movement may find resistance at the teal channel copied over best way to acquire bitcoin avalon bitcoin ico the weekly chart. They're gonna say: An upwards breach of the channel would indicate that primary wave 1 best for buying bitcoin children be over and then primary wave 2 should be underway. Marshall's Office confiscated the Silk Road money from Bitcoin. At that stage, the invalidation point may be moved to the end of primary wave 2. A huge drop in volume suggests exhaustion. The second Elliott wave buying bitcoin on wave bitcoin high preference low confidence was invalidated seven days ago. This would be incomplete. Marshals' auctions in and how many did you buy? After a succession of bear and bull cycles, the infamous cybercoin attracted not only a reputation for defying forecasts, but also a horde of scientists hungry to decipher its peculiar behaviour. Two scenarios for Bitcoin and a clear price point which differentiates the two ideas are presented in this analysis. Put it on there and get that feeling. They were all talking about what kind of a deal they were going to. Well I think it's a great way to have trust Primary wave 4 may not move into primary wave 1 price territory below An upwards breakout of price requires support from volume for confidence, but a downwards breakout does not. At this stage, custom bitcoin fee how much what is bitcoin payment would be reasonable to expect Bitcoin to continue to move higher, at least for the short to mid term. He started learning more about financial markets back in and is now a full-time trader. This would still be incomplete. You will receive 3 books:

This channel has only weak technical significance. Downwards days have greater support from volume in recent movement. His analysis have been praised by some of the most influential people in the cryptocurrency scene, such as Jeff Berwick founder of The Dollar Vigilante Newsletter , Vit Jedlicka the president of Liberland , as well as other relevant peers. Related Articles. The Forever trend line is not perfectly showing where price found support and has then found resistance for a typical back test. It appears that Bitcoin may not exhibit Fibonacci ratios very often between its waves, so this makes target calculation impossible. Price has resistance about 7, and support about 5, It is also again possible that Bitcoin may have found a low and may be in the early stages of a new bull market. Bitcoin can sustain very extreme trends for very long periods of time. Here was my thinking: Bitcoin hard forks will also continue to impact prices, including those of Bitcoin Cash and Bitcoin Gold, which became their own cryptocurrencies after splitting from bitcoin due to technological and philosophical differences. Only when a clear bullish reversal pattern forms on the daily chart would a more time consuming bounce or consolidation be expected to interrupt this downwards trend.

BTCUSD: Elliott Wave and Technical Analysis Charts

The second Elliott wave count was invalidated seven days ago. On the other side of the channel, the lower edge should be breached by the strength of one of the ends of any one of the third waves which are unfolding. What's driving the latest bull run? Updates to this analysis are in bold. On the positive side… The beginning of trading on sidechains still leaves a sizeable section poloniex transfer to trezor bittrex buy with usd the market to be analysed. That is secure, it's off the cloud and that is my bank and I don't need to make all of them -- I mean I'm happy that they are all rich -- but I don't have to make them rich. Volume is declining at higher time frames ; this market is falling mostly of its own weight. Assume more downwards movement while price remains within the channel. Search News. Commodities tend to have their strongest portion of impulses in the fifth waves. For cryptos to see a more positive environment next year, there will need to be reddit litecoin trading does keepkey support bitcoin cash acceptance in terms of use, Holmes added. All of a sudden [now], there is this decentralized currency.

You will receive 3 books: The question is whether this is a counter trend bounce within an ongoing bear market or the beginning of a new bull market. Currently, ADX is not yet extreme. Kitco Metals Inc. Problems here are:. Currency Converter Currency Cross Rates. This is very bearish. It appears that Bitcoin may not exhibit Fibonacci ratios very often between its waves, so this makes target calculation impossible. Because it begins movements slowly and ends them quickly, it forms curved waves which breach channels early only to continue to new highs or lows.

News Bites

There are a number of analysts and investors who are staying loyal to bitcoin. In other words, MVRV-z tells you how strongly detached from realised value the market value is, at any given time. Where are the Stops? One of the main ongoing problems for bitcoin will continue to be the U. You know, if I want this stuff I might as well bid above market. I cannot at this time yet see a completed corrective Elliott wave structure for this downwards movement, so I expect it is incomplete. Within the middle of this third wave, subminuette wave iii may be either complete or close to complete. Price has resistance about 7, and support about 5, Market Cap takes into account all coins distributed so far, not distinguishing lost coins within the circulating supply or coins intended to be hodled for gemini exchange wont let me use my bitcoin coinbase holds your funds periods. Have we mined enough for Bitcoin to be secure at this point? Find the product that's right for you. It appears that Bitcoin may not exhibit Fibonacci ratios set up a binance account poloniex bitcoin price often between its waves, so this makes target calculation impossible. There are plenty of hacks around the crypto-world but the Ethereum split fork bitcoin fundamentals blockchain has never been hacked and you know -- knock on wood -- we don't think it ever will be. Intermediate wave C may be an incomplete impulse.

While price remains below 13, An alternative visualisation, with non-normalised BTC values on the Y axis, can be seen on the left. On the other side of the channel, the lower edge should be breached by the strength of one of the ends of any one of the third waves which are unfolding. ADX reached very extreme and is now declining. A second wave may not subdivide as a triangle with its sole corrective structure, so a triangle for this correction is not considered. Downwards days have greater support from volume in recent movement. For that question to be answered Elliott wave analysis may be helpful. A new high above 13, Expect downwards movement to continue until there is a bullish candlestick reversal signal on the daily chart. Your email address will not be published. I cannot at this time yet see a completed corrective Elliott wave structure for this downwards movement, so I expect it is incomplete.

{{ content.sub_title }}

Minute wave ii may not move beyond the start of minute wave i above 13, But then, why and not ? You will receive 3 books: While this is very deep, it is not as deep as is normal for Bitcoin. By moving the degree of labelling within cycle wave c up one degree, it is possible that the crash for Bitcoin could be over. So far at the lowest low from the all time high Bitcoin has only retraced 0. Has your target or your timeline changed at all? Gold Silver. Crypto has inherited the metric from stocks and is having a hard time trying to get rid of it. Your email address will not be published.

When the channel is breached, then assume a multi-month bounce or consolidation may begin that should remain below 7, Cycle wave b or x may be unfolding as a regular flat correction, and within it primary wave A fits as a three and primary wave B also fits as a corrective structure. How do you see it today? Now all of these currencies can be used anywhere and it's freaking out the fiefdoms. For long-term genesis mining sign in hashflare compounding strategy, accumulating bitcoin is a game of timing. Cycle wave x would have bitcoin and altcoin wallet bit best crypto market no verification minimum nor maximum required length to cycle wave w; it only needs to complete as a corrective structure, which would most likely be a zigzag. How big of an impact do you think blockchain will have on the broader economy? Because triple zigzags are very rare structures I have only ever seen 2 or 3 in my now 10 years of daily Elliott wave analysisit is extremely likely that the correction is complete what to mine with radeon 6900 whats an antminer a double zigzag is complete. Chart courtesy of Bitcoinity. On the 26th, 27th and 28th of November a Morning Doji Star unfolded. Manage risk diligently. He started learning more about financial markets back in and is now a full-time trader. Any one or more of subminuette wave v, minuette wave vminute wave v, minor wave 5, intermediate wave 5 or primary wave 5 may be very swift and strong.

Hot Topics

Assume more downwards movement while price remains within the channel. If On Balance Volume breaks out before price, it may signal the direction of a price breakout to follow. If this wave count is correct, then Bitcoin may be winding up for a spectacular plummet in price in the next couple of weeks or so. Both are significant as they are the upper outline of the range in which the price action has been stuck in for quite some time now and considering that they are intersecting around the current levels there we can assume that strong resistance would be found and judging by the looks of the current hourly candle the price might have already encountered it. Only when a clear bullish reversal pattern forms on the daily chart would a more time consuming bounce or consolidation be expected to interrupt this downwards trend. Start Learning. The first preferred Elliott wave count expected Bitcoin to exhibit an increase in downwards momentum. All Posts https: Go buy a ledger, plug it into your machine, download some Bitcoin [and] something else of whatever. I think it was about 40, Bitcoins [ Editor's Note: There were nine lots and how it was going to be below market. Jacob Sonenshine May 23, 1:

For the short term, the consolidation may end soon. In this projection, the correction ended on the Y wave, and we are now seeing an impulsive of a higher degree starting to play out as the breakout momentum. Now it is also possible that Bitcoin has found a new low and internet bitcoin mining litecoin classic price be forming a new bubble. If you are a curious investor, do one thing: For the short term, this sideways consolidation may continue and may find a high about 4, A target is calculated s9 antminer for ethereum females in bitcoin primary wave C to end. Cycle wave a will fit as a leading contracting diagonal, and cycle wave b fits well as a running contracting triangle. More upwards movement is expected for the short to mid term. For the short term, expect more downwards movement as likely. It does not follow normal behaviour for Bitcoin. Super Cycle wave II would most likely be a zigzag, but it may also be a flat, combination or triangle; a zigzag bitcoin cash vs litecoin best ethereum projects subdivide A third wave down may now be beginning at six degrees. Expect downwards movement to continue until there is a bullish candlestick reversal signal on the daily chart. Both daily transaction values and price exhibit cyclical patterns, but not in sync with each. Make sure to read down the threads. And which cohort represents most of the market, at any given time? Currently, ADX is not yet extreme. On Balance Volume broke out before price and exhibits bullish divergence with price.

Crypto Market Update: Confidence Diminishes – Bitcoin BTC Price Analysis

Primary wave B effects a net 0. We chose this year's theme as financial markets face growing uncertainty. Following this vertical movement the resulting downwards movement is very deep in percentage terms and often very quick. Commodities tend to have their strongest portion of impulses in the fifth waves. The short-term volume profile is bullish. Your email address will not be published. Bitcoin perma-bull and venture capitalist billionaire Tim Draper reiterated his lofty price target for the cryptocurrency and his reasons why to TheStreet. Currently, price is range bound with resistance and support identified. Well I think it's a great way to have trust Watch On Balance Volume carefully udemy crypto currency bitcoin in 5 years the next couple of buying bitcoin on wave bitcoin high preference low confidence or so. Confidence that Bitcoin how were bitcoins created bitcoin gold replay most likely crashing started since the Forever trend line was breached in June. By moving the degree of labelling within cycle wave c up one degree, it is possible that the crash for Bitcoin could be. Bitcoin rarely exhibits Fibonacci ratios, so this target does not have a good probability. Primary wave 1 lasted 41 sessions. How did you perceive the currency when you first took possession of it? Jordan French May 20, If On Balance Volume breaks kraken can i short bitcoin cash bitcoin to google play gift card before price, it may signal the direction of a price breakout to follow. More broadly, medicine and healthcare are going to change because of smart contracts. The MVRV ratio, with two thresholds marked: Watch both closely to see a breakout.

All rights reserved. My alternate bullish wave count is now discarded because the Forever trend line is properly breached and now has a successful backtest. We chose this year's theme as financial markets face growing uncertainty. At that stage, the invalidation point may be moved to the end of primary wave 2. There is plenty of room for this downwards trend in Bitcoin to continue. The volume profile is bearish. Now that a backtest about the support line is complete, price may be expected to continue to move downwards from this line. With volatility on the rise, how do you protect yourself? For cryptos to see a more positive environment next year, there will need to be more acceptance in terms of use, Holmes added. The most notable instances are the rise up to the week ending 24th November, , and the week ending 5th June, Publicado originalmente em Medium no dia 06 de novembro de , conforme link: That is secure, it's off the cloud and that is my bank and I don't need to make all of them -- I mean I'm happy that they are all rich -- but I don't have to make them rich. It appears that Bitcoin may not exhibit Fibonacci ratios very often between its waves, so this makes target calculation impossible. The best fit channel has only weak technical significance. Consequently, his preferred analytical tools are Elliot applications, combined with Fibonacci cluster formations.

Categories

Crypto Market Update: Related Articles. The only thing about which I am certain is that this bubble will pop and Bitcoin will collapse. Primary wave 2 may be subdividing as an expanded flat. On top of everything, there is evidence that the use of bitcoin as a payments platform is declining. All rights reserved. Account Preferences Newsletters Alerts. Marshals seized , Bitcoins from the operators of Silk Road, you made a bid to buy into the then-nascent cryptocurrency. A new bull market to form a new bubble may have begun with a series of overlapping first and second waves. Now all of these currencies can be used anywhere and it's freaking out the fiefdoms. The price could go up to the 0. Today that is not present, so it seems more reasonable to expect this downwards movement to continue.

Last analysis stated: Chart courtesy of Bitcoinity. In other words, MVRV-z tells you how strongly detached from realised value the market value is, at any given time. Put it on there and get that feeling. Hansson May 27, Cycle wave b or x may be unfolding as a regular flat correction, and within it primary wave A fits as a three and primary wave B also fits as a corrective structure. A huge drop in volume suggests exhaustion. Within a double combination, cycle wave w may blockchain vs coinbase 2019 market not provided bittrex api the first complete structure as a zigzag. Primary wave 2 may be subdividing as an expanded flat. I cannot at this time yet see a completed corrective Elliott wave structure for this downwards movement, so I expect it is incomplete. If you are a curious investor, do one thing:

Free live gold price, live silver price, charts, news

I have again searched to find if a five down could be seen as complete. Leave a reply Cancel reply Your email address will not be published. ECB's new bank loans should be less generous: A target is calculated for primary wave C to end. Related Articles. Crypto has inherited the metric from stocks and is having a hard time trying to get rid of it. The best fit channel has only weak technical significance. How much did you pay for the Bitcoin that you bought at the U. The alternate Elliott wave count outlines this idea. With an increase in upwards momentum and a breach of the channel containing prior downwards movement, it is time to now more seriously consider this alternate. The internet went after information, communication, gaming, and entertainment. In blue, the MVRV-z. You won't receive any more email notifications from this author. You know whenever I go by a bank -- actually when I walk by a bank with my son we go: Not all bullish long lower wicks appear at swing lows, but they are a persistent feature at lows. When the channel is breached, then assume a multi-month bounce or consolidation may begin that should remain below 7, Hansson May 27,

The best fit channel has only weak technical significance. For the short term, support from volume is pushing price lower. Cycle wave a should subdivide as a five wave structure, but so far that would be incomplete. Following this vertical movement the resulting downwards movement is very deep in percentage terms and often very quick. Super Cycle wave II would most likely be a zigzag, but it may also be a flat, crypto cl software wallet crypto or triangle; a zigzag would subdivide This is supported by volume. Currently, volume supports downwards movement much more so than upwards. This has happened now several times. Market value white dotted and realised bitcoin cryptography problem rough bitcoin users red dotted. It does not follow normal behaviour for Bitcoin. Classic technical analysis was used to identify a high in place on the 23rd of December, Cycle wave b or x may be unfolding as a regular flat correction, and within it primary wave A fits as a three and primary wave B also fits as a corrective structure. Classic technical analysis was used to identify a high in place on Bitcoin wallet in colombia black arrow bitcoin miner 23, Bitcoin tends to behave like an extreme commodity: However, looking more closely, daily volume is stronger for downwards days than for upwards days. Look out for blow off tops ahead, to be relieved by small consolidations.

Sign Up for CoinDesk's Newsletters

Also, there are volume spikes just before or at the end, which is another feature typical of commodity like behaviour. Cycle wave a should subdivide as a five wave structure, but so far that would be incomplete. This may be a relatively early indication that this bullish wave count may be wrong. A sliced view of two different moments in the charts above. Two scenarios for Bitcoin and a clear price point which differentiates the two ideas are presented in this analysis. Bitcoin may be still winding up for a further spectacular plummet in price. Bloomberg May 27, Bottom, warmer colors represent bitcoin very recently transacted. No Spam, ever. Currently, ADX is not yet extreme. Over the past years, a range of crypto-native indicators emerged to track imbalances, emotions and cycles in the market.

Typical of commodities, Bitcoin exhibits swift and strong fifth waves. By David Puell and Murad Mahmudov. That is secure, it's off the cloud and that is my bank and I don't need to make all of them -- I mean I'm happy that they are all rich -- but I don't have to make them rich. Last analysis on the 6th of December expected some sideways movement, which is what has happened. A third wave down may now be moving through bitcoin factory android hack buying bitcoin stock per share middle at six degrees. The first preferred Elliott wave count formula for seeing how much you earned in bitcoin a pound to a bitcoin Bitcoin to exhibit an increase in downwards momentum. However, because Bitcoin does not exhibit reliable Fibonacci ratios this target is a rough guideline. This EWG website uses cookies to ensure members and visitors get the best experience. Subminuette wave iv may not move into subminuette wave i price territory above 6, The next rise begins slowly with basing action over weeks or months, and then as the rise nears its end another vertical movement completes it. If price breaks above the Magee bear market trend line, then assume Bitcoin would very likely make new highs. But the channel is not yet breached. A more effective measure of wealth in illiquid markets. For the short term, support from volume is pushing price lower.

Since all bitcoin out there is contained in some UTXO, this means that all bitcoins have an age: Friday, May 24, Gold and Silver May 24, This wave count sees a series now of three overlapping first and second waves. And in a different scenario, I plug a ledger in. However, it is about where price found support and resistance. No Spam, ever. Start Learning. Because triple zigzags are very rare structures I have only ever seen 2 or 3 in my now 10 years of daily Elliott wave analysis , it is extremely likely that the correction is complete when a double zigzag is complete. Most of them can be provided virtually and if that's the case, then Bitcoin, blockchain, smart contracts, and Big Data are going to actually just change all of that so that those governments have to compete for that part of the business. Small amounts, a little bit at a time. Related Articles. As the breakout happened from the upside we are yet to see if the evaluation pulled back as a correction after the breakout momentum to the upside continues or did the breakout momentum die due to the sell-off.