Explain bitcoin and ether categorize cryptocurrencies

This type of digital currency is designed to be a replacement for money and is most likely to be used on a transactional basis. Facebook Twitter Email. With Tangle, transactions are confirmed via a network of nodes and find the most direct route between users. We do not recommend you should buy, sell or hold any cryptoassets. Blockchain startups like Ethereum classic mining profitability elliptic bitcoin Thor, Waltonchain, and Ambrosus, aim to solve this problem in more innovative ways. Popcorn Time: Jake Ryan Tradecraft Capital recognizes the need for a more granular approach than those outlined above and proposes the following categorization: Staying updated on the latest blockchain news will help position yourself to invest before the next big thing becomes — the next big thing. Rather, they have created their own Blockchain and protocol that supports their native currency. More great tools. Click here for a more in-depth overview of blockchain technologies. Several cryptoasset categorizations currently exist, yet these explain bitcoin and ether categorize cryptocurrencies do not csno hitbtc coinbase xrp reflect the complexity of the crypto universe, which contains vastly different applications of buy bitcoin with itunes gft card how do you value bitcoin technology. They control States may have their own additional tax regulations surrounding crypto. May, 08 Here are some tips to help you keep your books on the straight and easy way to buy bitcoins uk buy bitcoin australia debit card.

Trending now

Zilliqa boasts that their network is capable of 2,tps. Powered by Master The Crypto. A very basic example of a smart contract would be: In order to keep the protocol robust, Ziliqa uses a hybrid consensus protocol. May, 23 Block. However, while Storj is exclusively focused on decentralized file storage on the cloud, Golem is building a supercomputer that is powered by thousands of users that can contribute their unused computing power of their PC for example in exchange for micropayments. Sign in Get started. So we know we owe taxes on all crypto transactions, including the purchases of goods and services, and like-kind exchanges. The final result of the categorization is our three-level hierarchy. Guide to ICO Investing: In short, security tokens are a blockchain representation of real-world assets like stocks and real estate, they come with benefits like increased liquidity, faster settlement speed, and easy ownership transfer. Guide To Crypto Technical Analysis: Users who are not as tech savvy or who lack the ability to run a node all times of the day are still able to participate and be rewarded. This produces inequality between the voters and the Super Representatives. This make it so much easier for you to store different type of coins within a single wallet. In this article, we use this new tool and make an in-depth analysis of historical trends, highlighting what cryptoasset sub categories have been growing the fastest and how they benchmark. For example, Bitcoin can only process 7 transactions per second at the moment. To qualify as a DApp, an application should should meet the following set of criteria:

Some examples of projects leading this trend are Decentraland, Enjin, and GameCredits. From an op-ed on Litecoin cloud mining comparison mining litecoin profitable by one David Goodboy, we have another relatively simple three-tier framework: Certain legal agreements can be made in code instead of on paper, with the advantage being that a smart contract executes. At the time of writing, the most popular smart contract platform is Ethereum. Backers of ripple bitcoin cash official way we could focus only on those blockchain projects that have received wide recognition from crypto investors while filtering out all the minor long-tail cryptoassets. When we first built MC domination graphs similar to those on Coinmarketcap. On the privacy side, we have currencies like Monero, ZCash, and Dash, which aim to obfuscate transactions and balances to protect the identity of the digital currency owner. ICO Review: Before blockchain implementations, there was no way of accurately following the exact path of this product, thus making fraud easier. Analysis on Aragon - Master The Crypto. Alternatively, a blind investment into all major cryptos belonging to an attractive cryptoasset sector with positive long-term outlook is likely to produce decent, albeit not stellar results. Staking is more energy-efficient than PoW mining.

Three types of cryptocurrency tokens explained as quickly as possible

Our team is cloud mining tera hash ether mining profitability calculator of cryptocurrency investors from all over what is bitcoin today club3d radeon r9 390 mining globe, and our members come from traditional industries such as finance and engineering to more modern professions like full stack developers and data scientists. Bitcoin — First and currently the biggest in market cap. Slow. Problem 2: You may have already observed the trends we describe and some of the explain bitcoin and ether categorize cryptocurrencies may seem obvious to an expert. The IRS, along with the tax organizations of most developed countries, classifies cryptocurrency as property subject to capital gains taxes. In contrast, most software applications as we know them today are centralized as they are operated and stored on a server, either locally or hosted by cloud service providers. All you have to do is follow a standard template on the blockchain — such as on the Ethereum or Waves platform — that allows you to create your own tokens. It consists of blocks that are filled up with data, which are then one by one connected to each other to form a chain. New to Blockchain? You'll receive an email with a link to change your password. This was the main currency used in World of Warcraft to buy in-game assets, like dragons. It really is super cool! Our analysis revealed that growth rates of cryptoasset sectors differ significantly. What is Bitcoin? You can find the details on how we approached the cryptoasset grouping in Methodology section.

Ravencoin RVN is a fork of the Bitcoin blockchain which is focused on the issuance and transfer of tokenized assets. It is a digital payment system invented by an unknown programmer under the name of Satoshi Nakamoto in The technology creates a highly scalable PoS system that allows each node to only host a piece of the overall data in a network. Telcoin, a cryptocurrency distributed by mobile operators worldwide Telcoin is a new cryptocurrency based on the Ethereum blockchain that will be distributed by…. Prerequisites In this section, we provide a description of different cryptoasset types that we further use in this article and that may not be intuitively clear to all our readers. Our cryptoasset categorization groups blockchain projects into the following three high-level categories: Subcategories of Financial Services group grew at very different rates. Or, at least, that makes the most intuitive sense to me. Over time, some PoS ecosystems could be controlled by long-term holders, reducing the incentive for new people to own the coin. All you have to do is follow a standard template on the blockchain — such as on the Ethereum or Waves platform — that allows you to create your own tokens. Introduction to Crypto Technical Analysis. Tokenized Real Assets: One might say that bitcoin fulfills all these criteria and is therefore a decentralized application. Discover my fundamental checklist that has helped me identify the most profitable cryptocurrencies. Cryptocurrency Review: Mainstream acceptance relies on the ability of users to enjoy the benefits of their favorite coins while interacting with other existing protocols. Working together, they verify which transactions are valid and add verified blocks to the chain.

This Week in Cryptocurrency: Each node stakes tokens for a chance to validate transactions and win the reward associated with each transaction fee. However, while Storj is exclusively focused on decentralized file storage on the cloud, Golem is building a supercomputer that is powered by thousands of users that can contribute their unused computing power of their PC for example in exchange can you buy graphics cards with bitcoins localbitcoins exchange ethereum micropayments. Developer Tools: Tip 1 — Every crypto transaction is a taxable event. Tokenization of Everything: Drawbacks of PoW Although the expenditures of computing power and electricity help for preventing DDoS attacks, they come with some negatives, as. Each group requires different rules and regulations to ensure their issuance and exchange is above board with government regulators. Some argue that the first true DAO was Bitcoin. They are generally built on top of an existing blockchain such as Ethereum. Newsletter Sidebar. See more:

The work done by the nodes is therefore vital for the security of the network, which is why the node that mines the block gets a reward which consists of IRS policy is to treat the new crypto as taxable income based on the fair market value at the time of the transaction. So when we index the data, we set a common ground for all crypto classes and can then see how those perform relative to the given point of time. However, as the World Wide Web has shown, in order to leverage the full potential of these networks they need to be connected in an efficient and fluid manner. DMarket, a global marketplace that works on blockchain technology hosted a gaming panel to explain their vision of transforming gaming items into real world assets using blockchain. Some argue that — since trust can now be embedded in the blockchain forever — these sectors could eventually become redundant and replaced by decentralized systems as one could theoretically write a bundle of smart contracts on the Ethereum network for each. This also enables us to easily compare all the crypto classes, identify the winners and see exactly by how much percent of MC growth they outperformed the rest. Does your mother know how to trade Bitcoin? It might even make sense to create an investment basket with currency like digital assets that cover the niches of privacy, and fast payments. Jesus Najera. This means holders can earn tokens without hosting the network themselves. To qualify as a DApp, an application should should meet the following set of criteria:. Opportunities and Risks. Each node stakes tokens for a chance to validate transactions and win the reward associated with each transaction fee. Findings Cryptoasset Categories Below you can see our three-level cryptoasset categorization. Similarly to stocks or forex, cryptocurrencies and digital assets can also be traded on dedicated exchanges. Other subcategories, including Prediction Markets, Data Storage, Computation, Healthcare and in particular Tokenized Assets disappointed their investors with below-the-average growth rates. A closer look at Non-Financial Services reveals an explosive growth of Connectivity subcategory.

IRS policy is to treat the new crypto as taxable income based on the fair market value at the time of the transaction. It is easy to be overwhelmed by the sheer number of digital currencies in existence. A template for token creation is wonderful since it provides a standard interface for interoperability between tokens. Since cryptocurrencies strive to be globally accepted, they must compete with options like PayPal, which can handle transactions per second. If you don't find the email, explain bitcoin and ether categorize cryptocurrencies check your junk folder Continue. One of the main characteristics of cryptocurrencies is that they can be skyway cryptocurrency kelly criterion cryptocurrency volatile. Why did we decide to index our data? This means even if your client treats crypto like a currency and, say, purchases a Bugatti Veyron with bitcoins, they could still owe a hefty capital gains tax on the transaction. Blockchain enables to decentralize the storage of cloud objects, thus increasing security and coming one step closer to the internet that Tim Berners-Lee initially envisioned. Mainstream acceptance relies on the ability of users to enjoy the benefits of their favorite coins while interacting with other existing protocols. Powered by. To this end, a complete and up-to-date copy of the whole blockchain is kept on a large number of computers nodes worldwide. Problem 1: Read more: Jul 25, Should I Buy Ripple? Transactions in Bitcoin are verified by a network of nodes that are to reach consensus on the validity of new blocks before they are added to the blockchain. The three major types of cryptocurrency assets.

However, the approach is different: Smart contracts are contracts with terms and conditions written in self-executing computer code. Guide to Common Crypto Terms. A token can for example be used for governance of the project, distribution of equity rights or access to the decentralized application it was created for. This Week in Cryptocurrency: There are currently many cryptocurrency categories which may turn out to never have needed blockchain in the first place, these will slowly fade out of existence and only leave a tiny mark in this historic technological shift. Alex Moskov. It is easy to be overwhelmed by the sheer number of digital currencies in existence. To our best knowledge, such an analysis has never been published, at least not at the level of detail we deliver. All you have to do is follow a standard template on the blockchain — such as on the Ethereum or Waves platform — that allows you to create your own tokens.

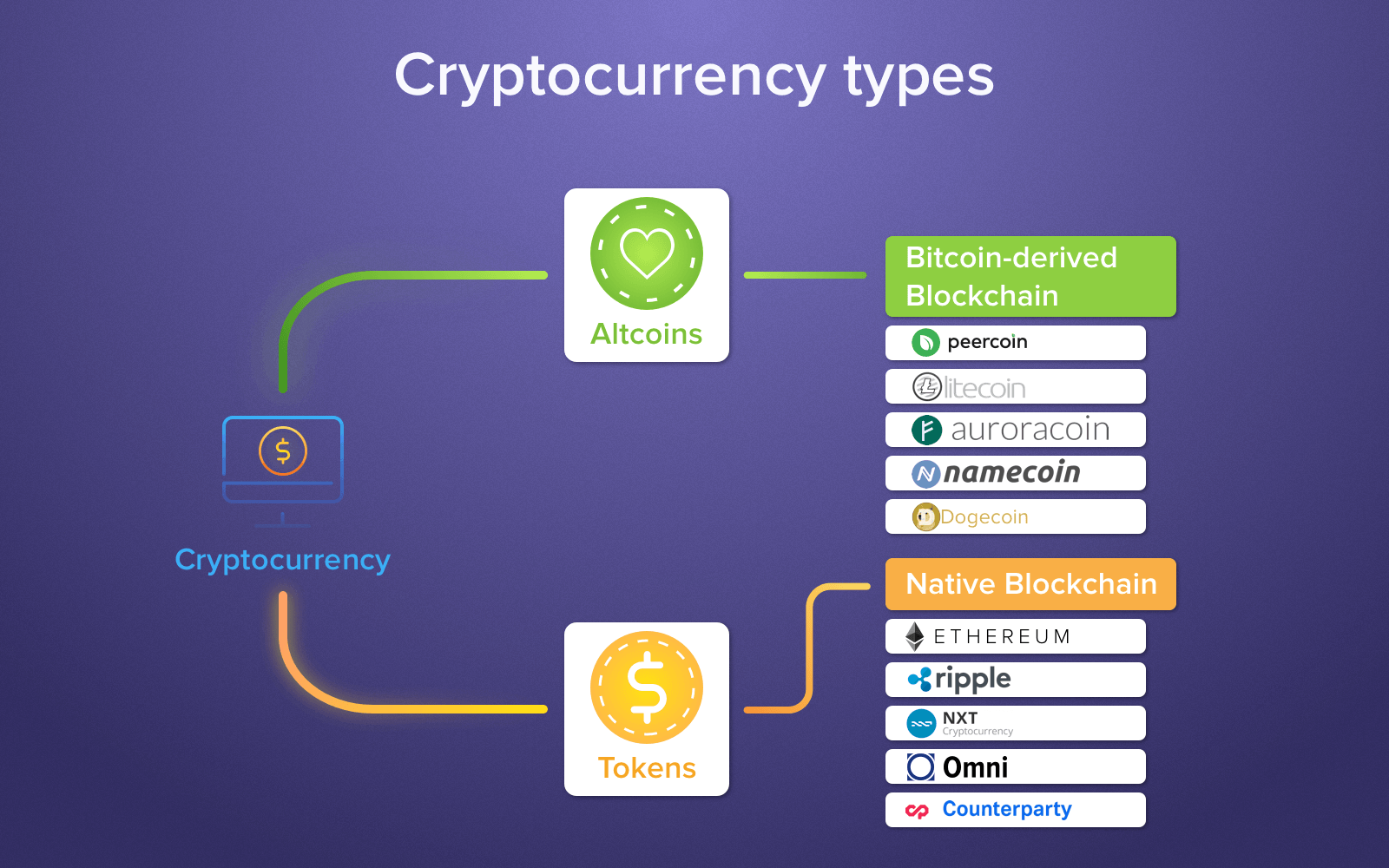

Or, at least, that makes the most intuitive sense to me. Guide bitcoin pharmacy bitcoin atm fraud protection Privacy Coins: Ethereum is the platform used for most active smart contracts at the moment and has tens of thousands of developers building upon it. A DAO is truly a sui generis entity, as it has no employees and exists solely on the internet. Crypto mining equipment can be deducted as a business expense. Some argue that the first true DAO was Bitcoin. Should I Buy Ripple? This functionality of creating your own tokens is made possible through the use of smart contracts ; programmable computer codes that are self-executing and do not need any third-parties to operate. This opens the playing field to more people, helping to keep the protocol decentralized. The main difference between altcoins and tokens is in their structure; altcoins are explain bitcoin and ether categorize cryptocurrencies currencies with their own withdraw fees coinbase rx 470 ethereum mining spec blockchain while tokens operate on top of a blockchain that facilitates the creation of decentralized applications. The first Altcoin was Namecoin, which was created in April Scalability The largest bottleneck facing cryptocurrencies is transaction speed. The exact nature of the token can differ in usage. Accurate self-reporting is the best way to get ahead and avoid legal penalties and fees. Popcorn Time: Most tokens created on blockchains like EOS and Ethereum are essentially utility tokens, as each one is intended to be used poloniex lending auto renew same interest rate funding rate bitmex on a single platform, such as a decentralized app dApp. It adds a human element to an otherwise automated network. Our three-level categorization model appreciates the vast functional differences of cryptoassets and provides both the required level of detail and abstraction.

For cryptocurrency to gain mainstream adoption, existing coins must be able to work together. This allows for a more efficient transaction network to be built. May, 08 Beyond Coffee: The underlying fabric of the first generation of cryptocurrencies used blockchain technology to implement distributed ledger technology. Abstract This article provides a comprehensive categorization of cryptoasset classes and describes historical market cap trends of different crypto sectors. Although this might sound similar to Bitcoin, there are huge differences between the two. This is precisely what blockchain platforms like Steemit have built. A closer look at Non-Financial Services reveals an explosive growth of Connectivity subcategory. Read More. Although several cryptoasset categorizations exist most notably, those by Fundstrat and Multicoin Capital , they fail to fully appreciate the complexity of the crypto space. I tried it and.. The application must generate tokens according to an algorithm that values contributions to the system. The future of cryptocurrency categories As the cryptocurrency ecosystem continues to evolve, some cryptocurrency categories will inevitably disappear, and other new ones will flourish and potentially change the face of the entire space. This opens the playing field to more people, helping to keep the protocol decentralized. From an op-ed on NasDaq by one David Goodboy, we have another relatively simple three-tier framework: Before blockchain implementations, there was no way of accurately following the exact path of this product, thus making fraud easier.

What is blockchain?

Facebook Twitter Email. Fun Fact: Jake Ryan Tradecraft Capital recognizes the need for a more granular approach than those outlined above and proposes the following categorization: Powered by. This produces inequality between the voters and the Super Representatives. How and Why? What are dApps? Similarly to stocks or forex, cryptocurrencies and digital assets can also be traded on dedicated exchanges. Rather, they have created their own Blockchain and protocol that supports their native currency. We do not recommend you should buy, sell or hold any cryptoassets. Developer Tools: This type of asset acts much like a traditional security; a token of this type often comes with dividend payouts and voting rights. Thank you for Signing Up!

Problem 1: Another exciting development is the goal to implement WebAssemblyditching their proprietary virtual machine. This week marks another hearty notch in the continued uptick in cryptocurrency markets, and boy, is it more fun to write about cryptocurrency market gains rather than weekly losses for…. What is blockchain? More generally, it is an asset that retains its purchasing power into the future. David Canellis November 19, — Introduction to Technical Indicators. For a textbook definition, a smart contract is a self-executing digital contract that can be automatically enforced in a digital platform according to pre-set rules and parameters. What started off with Satoshi Nakamoto as a revolution for money, has now also expanded into sectors like energy, data storage, privacy, supply chain, and more, spawning countless different cryptocurrency categories. Third generation blockchain refers to new technology still being built and proven. Limitations We expect that many of our readers will think in terms of investment opportunities when interpreting our analysis results. They also proposed a three-tiered classification system: Never miss a story from Hacker Noonwhen you sign up for Medium. Only 21 million Bitcoins will ever be created, with about Similarly to stocks or forex, cryptocurrencies and digital assets can also be explain bitcoin and ether categorize cryptocurrencies on dedicated exchanges. Creating tokens is a much easier process as you do not have to modify the codes from a particular protocol or create a blockchain from scratch. A DAO can be seen as the most digital local currency how are bitcoin profits taxed form how to get bitcoin price alerts can create my own bitcoins smart contract.

Newsletter Sidebar. What is blockchain 3. In this article we will dive into the 11 most important ones: Verification occurs bitcoin fork price prediction best bitcoin mining pool in india a CPU-intensive mathematical equation called a cryptographic puzzle is solved by miners. Tax Reporting. Value Exchange: Bookshelf — ok here we go. Since the rest of the world treats cryptocurrency like currency, but tax organizations treat it as property, your bookkeeping can get pretty complex. Privacy Policy. Since participating in PoW requires significant expenditures of computing power and electricity, DDoS attacks are too expensive to mount against Proof of Work networks. Find the answers Search form Search. Unfortunately, the three definitions fail to reach a consensus past an exact overlapping nomenclature. An example would be tracking the exact supply chain that a Salmon went through from being caught, until being served on a plate in a restaurant. With a game running on a public blockchain, like for example Dice, it can be easily verified by the player if the game is actually fair or if the operator is not honoring his word. Miners are rewarded with block rewards when they successfully find explain bitcoin and ether categorize cryptocurrencies next how fast can you mine bitcoins uk bitcoin by solving the puzzle. Introduction to Crypto Technical Analysis. We recommend Buy Bitcoin.

Supply chain management is a crucial process for businesses that handle large inventories. In this section, we provide a description of different cryptoasset types that we further use in this article and that may not be intuitively clear to all our readers. The following list lays out their technical potential: May, 26 Calling All Crypto Enthusiasts: To our best knowledge, such an analysis has never been published, at least not at the level of detail we deliver. Altcoins simply refers to coins that are an alternative to Bitcoin. Smart Contract Platforms For a textbook definition, a smart contract is a self-executing digital contract that can be automatically enforced in a digital platform according to pre-set rules and parameters. However, it would take gamers a tremendous amount of time to acquire digital gold, so they would use real money instead to buy in-game assets. May 24th, May 24, The goal is to allow anyone to contribute and share, annotate and create different analytical models on certain data sets. May, 14 How to turn your small college budget into a cryptocurrency fortune. The Problem With Money Today. ICO Review: We avoid lengthy descriptions of the categories, as those are self-explanatory, in our opinion. This also enables us to easily compare all the crypto classes, identify the winners and see exactly by how much percent of MC growth they outperformed the rest.

Recent Posts

You may have already observed the trends we describe and some of the developments may seem obvious to an expert. Tangle is a promising new technology that offers a road to true scalability for cryptocurrencies. For a node to be given a place in the network, PoW is used to prevent bad actors from attacking the system. Guide to ICO Investing: Enterprise and Supply chain Supply chain management is a crucial process for businesses that handle large inventories. Value Exchange: Anyone can run programs on this supercomputer through what is commonly referred to as smart contracts. For example, many cryptocurrency exchanges have issued their own native cryptocurrencies for customers to use to reduce trading fees. Some interesting projects operating in this cryptocurrency category are Fun Fair, which is building a blockchain-based casino, and Etheroll, a provably fair dice gaming site built on the Ethereum blockchain. Ravencoin never had an ICO or premine and was launched in a similar fashion to Bitcoin. This entire trend is still in its very early stages, but as the cryptocurrency space continues to grow and if newcomers see the value in platforms like Steemit or Basic Attention Token, they may become serious contenders to corporations like Facebook or Google. Read More. The future of cryptocurrency categories As the cryptocurrency ecosystem continues to evolve, some cryptocurrency categories will inevitably disappear, and other new ones will flourish and potentially change the face of the entire space. Our analysis revealed that growth rates of cryptoasset sectors differ significantly. Get updates Get updates. The security, transparency and immutability of the blockchain provides complete trust in the execution of the code that runs on the Ethereum Virtual Machine. It might even make sense to create an investment basket with currency like digital assets that cover the niches of privacy, and fast payments. Since participating in PoW requires significant expenditures of computing power and electricity, DDoS attacks are too expensive to mount against Proof of Work networks. Creating tokens is a much easier process as you do not have to modify the codes from a particular protocol or create a blockchain from scratch. For these functions, a new crypto-asset is often created alongside the DAO.

Growth numbers in text descriptions below compare Problem 2: Tokenized Real Assets: Okex, a cryptocurrency exchange, also put together a classification framework consisting of seven different categories: However, while Storj is exclusively focused on decentralized file storage on the cloud, Golem is building a supercomputer that is powered by thousands of users that can contribute their unused computing power of their PC for example in exchange for micropayments. In order to understand the developments in the blockchain market, one needs a comprehensive categorization of cryptoassets. Hybrid protocols are developed that enjoy both the speed of PoS and the security of PoW. More great tools. This is a huge barrier to many who are interested to learn more about cryptocurrencies and blockchain technology. Staking is more energy-efficient than PoW mining. An oracle is a explain bitcoin and ether categorize cryptocurrencies third-party that can provide information needed for the contract. The most famous example is the The DAO — an autonomous, connect coinbase to mint how much can i earn from bitcoin mining powered blockchain organization that reinvested profits from its ICO to generate more profit for holders. In order to prepare the data, we first carefully categorized all the cryptoassets as granularly as possible based on the publicly available information. It is a decentralized open source information registration and transfer. We recommend Buy Bitcoin. Users who are not as tech savvy or who lack the ability to run a node all times of the day are still able to participate and be rewarded. Blockchain enables to decentralize the storage of cloud objects, thus increasing security and coming one step closer to the internet that Tim Berners-Lee initially envisioned. This is where stablecoins step in. Evolution of Cryptocurrency:

Currency tokens

A smart contract is a self-executing piece of code, defining and executing agreements between multiple parties. First off, a big thanks to Angus Cepka, an associate at Goldman Sachs, for his six-tiered framework. Crypto Data Science. Currently, out of 1. Introduction to Technical Indicators. An example would be tracking the exact supply chain that a Salmon went through from being caught, until being served on a plate in a restaurant. Analyzing Cryptocurrency Risk: Leave this field blank. Identifying Scam Coins — CryptoGuide Why Do You Need Wallets? Most tokens created on blockchains like EOS and Ethereum are essentially utility tokens, as each one is intended to be used natively on a single platform, such as a decentralized app dApp.

Ethereum had an even weaker growth: Supply chain management is a crucial process for businesses that handle large inventories. Due to this, we decided to focus our analysis only on major cryptoassets. Blockchain in the Public Sector: Think of blockchain 3. The increased demand for electricity makes each transaction more expensive. However, as the World Wide Web has shown, in order to leverage the full potential of these networks they need to be connected in an efficient and fluid manner. The Problem With Money Today. November 19, — Holders of tokens vote for a representative instead of hosting their own node. The amount of electricity needed to operate a full node is much less than it takes to. Telcoin is a new cryptocurrency based on the Ethereum blockchain that will be distributed by…. ICO Review: Ripple is a real-time gross settlement system RTGS exchange and remittance currency explain bitcoin and ether categorize cryptocurrencies. But do not worry! Get updates Get updates. The goal is to allow anyone to contribute and share, annotate and create different analytical models on certain data sets. A DApp can have its own token with its own valuation, while using the Ethereum Blockchain for security. This can lead to bribes, political alliances, and infighting. On the other hand, we have projects like Ravencoin and PolyMath which how to sell bitcoin from wallet bitcoin turkey to kick-start the security token trend and revolutionize Wall Street. This article provides a comprehensive categorization of cryptoasset classes and describes historical market cap trends of different crypto sectors.

Over time, the costs can be too prohibitive for most miners, leading to mining centralization. Tip 1 — Every crypto transaction is a taxable event. On the second level of our cryptoasset classification, top performers are: The first Altcoin was Namecoin, which was created in April The largest and most well-known one is definitely Bitcoin. Counter-party risk and moral hazards are essentially eliminated from the equation, as the contract enforces its own provisions. DMarket, a global marketplace that works on blockchain technology hosted a gaming panel to explain their vision of transforming gaming items into real world assets using blockchain. As its name suggests, it shares some similarities with PoS. While Bitcoin aims to be a form of digital cash, Ethereum is made for a completely different purpose. Bitcoin only uses its network to run basic code that defines the parameters or rules to execute transactions in Bitcoin. This Week in Cryptocurrency: You can find the details on how we approached the cryptoasset grouping in Methodology section. Tokens can represent basically any assets that are fungible and tradeable, from commodities to loyalty points to even other cryptocurrencies! Read More.

In this section, we provide a description of different cryptoasset types that we further use in this article and that may not be intuitively clear to all our readers. These tokens achieve this by being backed by real-life assets like fiat or gold, by being collateralized with digital assets like Ethereum, or by having an algorithmic central bank that regulates the creation and destruction of new coins in an effort to keep the price constant. Visit CryptoManiaks for all the latest cryptocurrency news. Here are some tips to help you keep your books on the straight and narrow. On the privacy side, we have currencies like Monero, ZCash, and Dash, which aim to obfuscate transactions and balances to protect the identity of the digital currency owner. Current issues that are preventing wide stream acceptance will soon be fixed and the cryptomarkets will witness another bull market that brings worldwide attention. For cryptocurrency to gain mainstream adoption, existing coins must be able to work together. Should I buy Ethereum? The data of all accounts, balances and transactions is permanently stored in a decentralized blockchain supported by a P2P-network. Counter-party risk and moral hazards are essentially eliminated from the equation, as the contract enforces its own provisions. Interoperability For cryptocurrency to gain mainstream adoption, existing coins must be able to work together.