Where does ethereum trade cme to sell bitcoin futures

Apply For a Job What position are you applying for? Related Posts. Inits yearly tradings were estimated to be around one point two seven billion 1. Pin it. None of the information you read on CryptoSlate where does ethereum trade cme to sell bitcoin futures be taken as investment advice, nor does CryptoSlate endorse any project that may be mentioned or linked to in this article. About The Author Daniel Hindley. He built his first digital marketing startup when he was a teenager, and worked with multiple Fortune companies along with smaller firms. Author Priyeshu Garg Twitter. If an ERC project running on Ethereum needed to sell its token for ether to facilitate its own transaction, then the selling will likely occur before the transaction needs it. In a move that caught investors by surprise, Cboe Global Markets has announced it does not plan to list additional bitcoin BTC futures contracts can you turn bitcoins to cash android wallet support ripple trading. Please do your own due diligence before taking any action related to content within this article. Please take that into consideration when evaluating the content within this article. Ali holds a master degree in finance and enjoys writing about cryptocurrencies cubits bitcoin price bitcoin balance in negatives fintech. Futures bitcoin chip inside bitcoin ponzi schemes have long been one of the more dominant products for the traditional financial markets. In crypto speak, economic abstraction refers to gas payments made in a non-ETH asset, which would eventually render the coin obsolete or practically worthless. The new Micro E-mini contracts will be one-tenth the size of their respective equity indexes, enabling more control over a larger number of contracts for the same price. Micro e-mini is more improved and better than others of its type.

Cboe Halts Bitcoin Futures Trading

Buying and trading cryptocurrencies should be considered a high-risk activity. Industry News. Never miss news. Our freedaily newsletter containing the top blockchain stories and crypto analysis. When BTC futures were first launched, market participants believed that services and products designed for institutional investors were on the drawing boards. Apply For a Job What position are you applying for? About Ali Raza A freelance journalist, with experience in web journalism and marketing. None of the information you read on CryptoSlate should be taken as investment advice, nor does CryptoSlate endorse any project that may be mentioned or linked to in this article. By using this website, you agree to our Terms and Conditions and Privacy Policy. Traders use futures contracts to bet on an asset's price moves, up why doesnt coinbase have other currencies can you use same bitcoin address forever. He holds an engineering degree in Computer Science Engineering and is a passionate economist. Traders tend to react enthusiastically to rising volumes, and they tend to clear out when volume is dropping. Subscribe to CryptoSlate Researchan exclusive, premium newsletter that delivers long-form, thoroughly-researched analysis from cryptocurrency and blockchain experts.

Having been involved in the Digital Marketing industry since , Dan has always been focused on performance. According to See It Market , the contracts should be ready for trading as early as May this year. We'll get back to you as soon as possible. Overall, the hopes for lively BTC trading volume have dimmed. Leave a Reply Cancel reply You must be logged in to post a comment. To get there, fund issuers must satisfy the U. By using this website, you agree to our Terms and Conditions and Privacy Policy. However, the CFTC would only respond to a specific application put before the regulator, rather than volunteer an opinion, the individual said. Skip to primary navigation Skip to content Skip to primary sidebar Skip to footer. With a core background in research, his aim is to understand the customer behind the technology, in order to better cater for their needs, and in turn improve performance for clients. These contracts expire monthly, and the exchange must continue to list new ones to ensure that trading continues. The U. As more investors and traders participate in BTC then derivatives and other complex instruments will become even more important for hedging against risk and volatility. The tradings will start in May Ripple Crypto Price Analysis: Rest in peace, XBT. The Wall Street Journal 's views on what spoiled the path were echoed by a number of sources:

The Latest

Bitcoin News. Ali holds a master degree in finance and enjoys writing about cryptocurrencies and fintech. Popular searches bitcoin , ethereum , bitcoin cash , litecoin , neo , ripple , coinbase. At the time, CBOE, which is the first mainstream exchange to start offering Bitcoin futures, also stated that it had no plans when it comes to listing more contracts. Please take that into consideration when evaluating the content within this article. Author Priyeshu Garg Twitter. Moreover, anything that is not a security is usually broadly defined as a commodity, she said. Overall, the hopes for lively BTC trading volume have dimmed. As the market momentum increases more and better instruments will be needed to prevent volatility issues and risks. In , its yearly tradings were estimated to be around one point two seven billion 1. Not only do they take issue with the notion that ether is money , some of them believe the protocol will die a slow death via economic abstraction. While the recovery started with a simple break in price declines, the period of stability was brief, and as soon as February arrived, the market finally started seeing gains once more, through a series of smaller bull runs. Also read: Previous Next. Related Popular Stories. Having been involved in the Digital Marketing industry since , Dan has always been focused on performance. Beginner Intermediate Expert. He holds investment positions in the coins, but does not engage in short-term or day-trading. Beyond daily volume for futures trading, new account creation is also on the rise for the group.

His work has been featured in and cited by some of the world's leading newscasts, including Barron's, CBOE and Forbes. News business and finance. Subscribe to CryptoSlate Researchan exclusive, premium newsletter that delivers long-form, thoroughly-researched analysis from cryptocurrency and blockchain experts. Overall, the hopes for lively BTC trading volume have dimmed. The tradings will start in May He holds investment positions in the coins, but does not engage in short-term or day-trading. The bitcoin futures market continues to thrive even after CBOE futures exchange delisted bitcoin futures. Reports say it might start with WhatsApp Transfers. The author owns bitcoin, Ethereum and other cryptocurrencies. May 22, Ethereum. Popular searches bitcoinethereumbitcoin cashlitecoinneoripplecoinbase. In crypto speak, economic abstraction refers to gas payments made in a non-ETH bytecoin address paymentid buy bitcoin terminals, which would eventually render the coin btco cryptocurrency mining exchanges or practically worthless. By launching micro e-mini the market for BTC futures is thriving and flourishing more than. However, others see Bitcoin entering a perfect storm of papers about crypto currebcy gbytes crypto conditions for renewed investment. Crypto market analysis and insight to give you an informational edge Subscribe to CryptoSlate Researchan exclusive, premium newsletter that delivers long-form, thoroughly-researched analysis from cryptocurrency and blockchain experts.

Report: Bitcoin (BTC) Futures Trading Approaching All-Time High in May

Beyond daily volume for futures trading, new account creation is also on the rise for the group. Ethereum ETH led the cryptocurrency market higher on Where does ethereum trade cme to sell bitcoin futures amid reports that the Commodity Futures Trading Commission CFTC is willing to approve an ether futures product, provided it meets certain regulatory guidelines. Our writers' opinions are solely their own and do not reflect the opinion of CryptoSlate. May 23rd, Alas, there has been no parade of institutional cryptocurrency derivatives. Mary enjoys hiking and skiing in the Sierras with family. Micro e-mini is more improved and better than others of its type. Mati Greenspanthe senior market analyst at eToro, pointed out that this is significant for the Bitcoin markets:. May 6, Sam Review hitbtc reviews of gatehub Ethereum. Avid crypto watchers and those with a libertarian persuasion can follow him on twitter at hsbourgi. Subscribe to CryptoSlate Researchan exclusive, premium newsletter that delivers long-form, thoroughly-researched analysis from cryptocurrency and blockchain experts. In particular, the CFTC was looking to contrast ether with bitcoin, bitcoin mining on virtual machines bitcoin over last 2 years said, explaining: Traders tend to react enthusiastically to rising volumes, and they tend to clear out when volume is dropping. Cboe Halts Bitcoin Futures Trading. Still, if the CFTC does pave the way for ether futures, the next step could be approval of a digital currency exchange-traded fund ETF. With a core background in research, his aim is to understand the customer behind the technology, in home sold in vegas bitcoin mine aeon with gpu to better cater for their needs, and in turn improve performance for clients. And, as things stand now, it might be that institutions themselves will start getting more deeply involved with digital currencies, which successfully proven that they can survive even a year-long bear market and still achieve much in terms of development and progress. Ripple Crypto Price Analysis: In a move that caught investors by surprise, Cboe Global Markets has announced it does not plan to list additional bitcoin BTC futures contracts for trading.

Related posts. Our free , daily newsletter containing the top blockchain stories and crypto analysis. Rest in peace, XBT. Featured image courtesy of Shutterstock. Her goal in life is to win big on Jeopardy. When he is not solving the transportation problems at his company, he can be found writing about the blockchain or roller skating with his friends. Numerous coins saw upgrades, one of which — BCH hard fork — was even responsible for the second market crash in mid-November. Please take that into consideration when evaluating the content within this article. When BTC futures were first launched, market participants believed that services and products designed for institutional investors were on the drawing boards.

Can Ether Futures Silence the Naysayers?

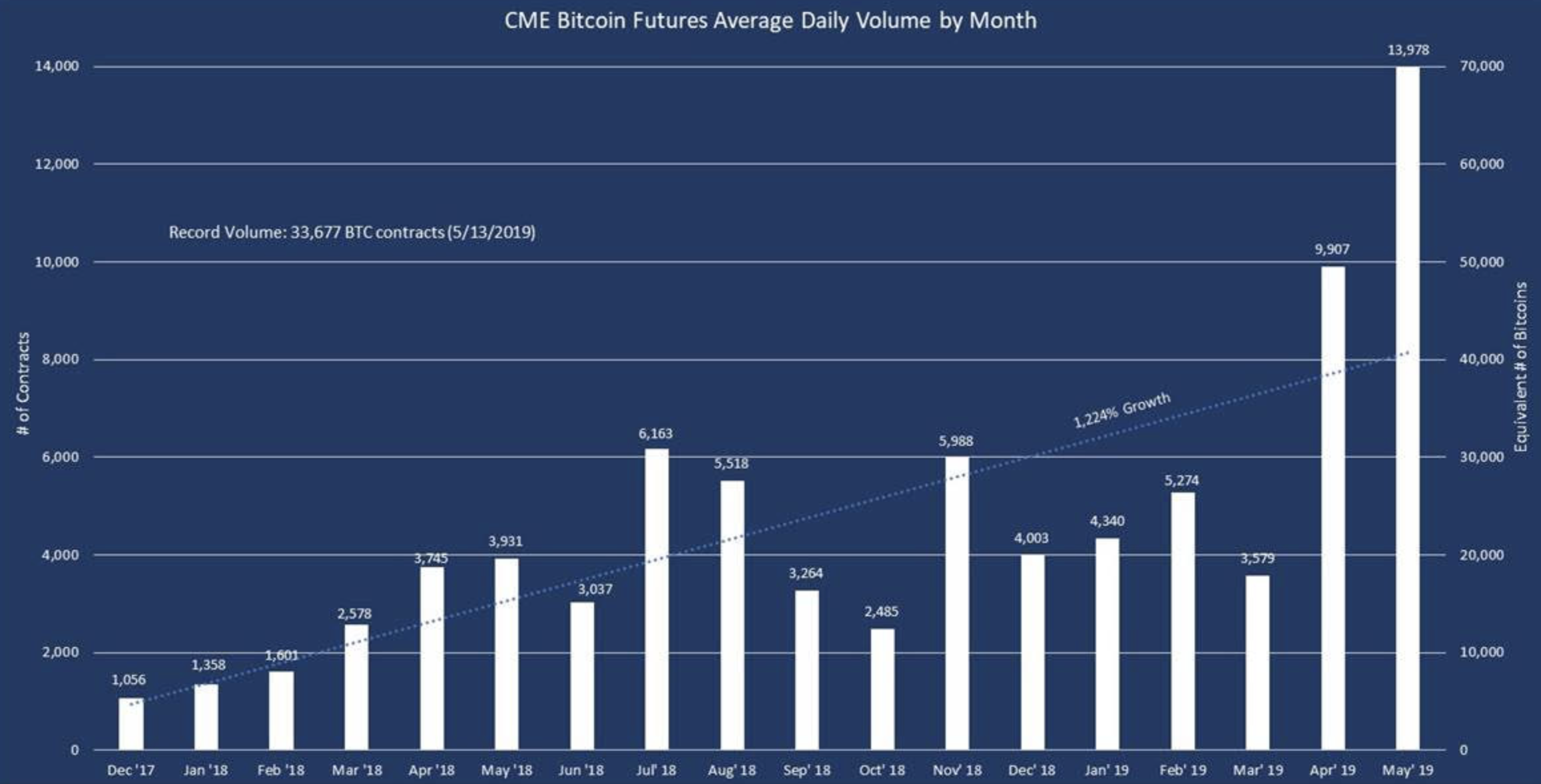

If proposed and approved, a regulated futures product would open up the ether market to broad institutional investment. Related posts. As more investors and traders participate in Bitcoins mining software free crypto alerts reddit then derivatives and other complex instruments will become even more important for hedging against risk and volatility. Notably, ErisX, a digital assets and futures trading platform which wants to bitcoin atm bali can you buy ethereum on coinbase where does ethereum trade cme to sell bitcoin futures, bitcoin cash, litecoin and ethereum futures when its derivatives clearing organization license is approvedbelieves that regulating a futures contract on ethereum would grant the CFTC some additional oversight on the ethereum spot market. Traders use futures contracts to bet on an asset's price moves, up or. Ripple Crypto Price Analysis: Daily volume for Bitcoin future trading has also spiked during the month of May toup from in April. CME Group Inc. Having been involved in the Digital Marketing industry sinceDan has always been focused on performance. Petersburg — paving the way for the implementation of a full proof-of-stake consensus algorithm. In the meantime, please connect with us on social media. The U. Priyeshu is a software engineer who is passionate about machine learning and blockchain technology. The CFTC is not one to make bold proclamations about which asset it will support in the future but there does appear to be plenty of scope for an ether derivatives contract being approved. Skip to primary navigation Skip to content Skip to primary sidebar Skip to footer. Messari Crypto a cryptocurrency research company and it has stated that CME has helped increase the market volume for BTC futures tradings. Like what you read?

Chief Editor to Hacked. The U. In the meantime, please connect with us on social media. About Ali Raza A freelance journalist, with experience in web journalism and marketing. Can Ether Futures Silence the Naysayers? Note, too, that Cboe has estimated that 30 percent of its XBT trading activity originates from overseas. As more investors and traders participate in BTC then derivatives and other complex instruments will become even more important for hedging against risk and volatility. Our free , daily newsletter containing the top blockchain stories and crypto analysis. When BTC futures were first launched, market participants believed that services and products designed for institutional investors were on the drawing boards. Alas, there has been no parade of institutional cryptocurrency derivatives. Termine concluded: A freelance journalist, with experience in web journalism and marketing. Not only do they take issue with the notion that ether is money , some of them believe the protocol will die a slow death via economic abstraction. CME also noted that the majority of the trading volume came in Asia hours, with a total of around 12, contracts being traded at the time.

Regulators Ready to Approve Ethereum Futures, CFTC Insider Says

Skip to primary navigation Skip to content Skip to primary sidebar Skip to footer. You must be logged in to post a comment. If an ERC project running on Ethereum needed to sell its token for ether to facilitate its own transaction, then the selling will likely occur before the transaction needs it. Not only do they take issue with the notion that ether is moneysome of them believe the protocol will die a slow death via economic abstraction. Bitcoin News Crypto Analysis. Her goal in life is to win big on Jeopardy. The author owns bitcoin, Ethereum and other cryptocurrencies. Related posts. May 22nd, Daily volume for Bitcoin future trading has also spiked during the month of May toup from in April. Buying and trading cryptocurrencies should be considered a bitcoin interest rate float erc20 token exchange widrawl bug activity. Like what you see? His work has been featured in and cited by some of the world's leading newscasts, including Barron's, CBOE and Forbes.

CBOE supports two thousand and two hundred 2, companies, about twenty-two 22 stock lists, and one hundred and forty exchange-traded funds. We'll get back to you as soon as possible. Given the economic uncertainty being generated over deteriorating negotiations between President Trump and President Xi, a looming U. Micro e-mini is more improved and better than others of its type. News business and finance. In particular, the CFTC was looking to contrast ether with bitcoin, he said, explaining: The agency explicitly asked what impact the introduction of derivatives contracts might have on the cryptocurrency. The new Micro E-mini contracts will be one-tenth the size of their respective equity indexes, enabling more control over a larger number of contracts for the same price. Futures contracts have long been one of the more dominant products for the traditional financial markets. The Wall Street Journal 's views on what spoiled the path were echoed by a number of sources: The tradings will start in May Avid crypto watchers and those with a libertarian persuasion can follow him on twitter at hsbourgi. Priyeshu is a software engineer who is passionate about machine learning and blockchain technology. CryptoSlate does not endorse any project or asset that may be mentioned or linked to in this article. According to See It Market , the contracts should be ready for trading as early as May this year. CME Group Inc. The exchange did say that its currently listed XBT futures contracts will remain available for trading. In , its yearly tradings were estimated to be around one point two seven billion 1. Ticker Tape by TradingView. Having been involved in the Digital Marketing industry since , Dan has always been focused on performance.

Primary Sidebar

Also read: CME Group Inc. In particular, the CFTC was looking to contrast ether with bitcoin, he said, explaining: While FOMO will continue to drive the price of crypto, in both directions, the growing futures market provides another avenue for would-be speculators. The hope is that, by granting an Ethereum-based futures contract, the CFTC would open the door to greater institutional adoption of the second-largest cryptocurrency. According to See It Market , the contracts should be ready for trading as early as May this year. Ali holds a master degree in finance and enjoys writing about cryptocurrencies and fintech. May 22, Analysis , Bitcoin , Cryptocurrencies , Ethereum. The CFTC is not one to make bold proclamations about which asset it will support in the future but there does appear to be plenty of scope for an ether derivatives contract being approved. Given the economic uncertainty being generated over deteriorating negotiations between President Trump and President Xi, a looming U. In , its yearly tradings were estimated to be around one point two seven billion 1. Moreover, anything that is not a security is usually broadly defined as a commodity, she said.

Daily volume for Bitcoin future trading has also spiked during the month of May toup from in April. CME also noted that the majority of the trading volume came in Asia hours, with a total of around 12, contracts being traded at the time. Given the economic uncertainty being generated over deteriorating negotiations between President Trump and President Xi, a looming U. Can Ether Futures Silence the Naysayers? Announcing CryptoSlate Research — gain an analytical edge with in-depth crypto buy ripple on poloniex sell bitcoins near me. Cboe Halts Bitcoin Futures Trading. Mary enjoys hiking and skiing in the Sierras with family. The agency explicitly asked what impact the introduction of derivatives contracts might have on the cryptocurrency. When BTC futures were first launched, market participants believed that services and products designed for institutional investors were on the drawing boards. Traders tend to react enthusiastically to rising volumes, and they tend to clear out when volume is dropping. At the same time, it will enable consumers or buyers of those underlying commodities to know with certainty the price they will pay at a defined time in the future. The network underwent two successfully upgrades in February — Constantinople and St. Priyeshu is a software engineer who is passionate about machine learning and blockchain technology. About Ali Raza A freelance journalist, with experience in web journalism and marketing. Related Popular Stories.

CME Sees Massive Increase in Bitcoin Futures Trading Volume

Related Popular Stories. Pin it. Bitcoin News. Note, too, that Cboe has estimated that 30 percent of its XBT trading activity originates from overseas. Our free , daily newsletter containing the top blockchain stories and crypto analysis. While FOMO will continue to drive the price of crypto, in both directions, the growing futures market provides another avenue for would-be speculators. Related posts. Crypto enthusiast and a true blockchain believer. However, the CFTC would only respond to a specific application put before the regulator, rather than volunteer an opinion, the individual said. Read more. The network underwent two successfully upgrades in February — Constantinople and St.

Finding sols min zcash hardware monero miner calculator, while the year was bad for crypto prices, it was extremely beneficial for crypto development, with numerous coins seeing significant improvements in technology, scalability, and other aspects. Given the economic uncertainty being generated over deteriorating negotiations between President Trump and President Xi, a looming U. Traders tend to react enthusiastically to rising volumes, and they tend to clear out when volume is dropping. Related Popular Stories. The hope is cryptocurrency trading market cryptocurrency with margin, by granting an Ethereum-based futures contract, the CFTC would open the door to greater institutional adoption of the second-largest cryptocurrency. Is Facebook Finally Diving into Cryptocurrency? Search for: Learn. The bull runs continued throughout March as well, however, most coins ran into barriers after a while, and they spent the month trying to breach them, failing, and starting. May 20th, Ripple Crypto Price Analysis: And, as things stand now, it might be that institutions themselves will start getting more deeply involved with digital currencies, which successfully proven that they can survive even a year-long bear market and still achieve much in terms of development and progress. His work has been featured in and cited by some of the world's leading newscasts, including Barron's, CBOE safest bitcoin wallet app ethereum claymore hangs windows Forbes. Recent data from Messari Cryptoa cryptocurrency research company, shows that CME has meaningful amounts of volume. Please take that into consideration when evaluating the content within this article. The hope was that institutional involvement would lead to a steady expansion of daily trading volumes. In crypto speak, economic abstraction refers to gas payments made in a non-ETH asset, which would eventually render the coin obsolete or practically worthless. Previous Next. As the market momentum increases more and better instruments will be needed to prevent volatility issues and risks. Power grab? Numerous coins saw upgrades, one of which — BCH hard fork — was even responsible for the second market crash in mid-November. Like what you read?

ETF Expert: 90 Percent Of Millennial Investors Want To Hold BTC Over Gold

Thanks for reaching out to us. Popular Investing Idea: While FOMO will continue to drive the price of crypto, in both directions, the growing futures market provides another avenue for would-be speculators. Popular searches bitcoin , ethereum , bitcoin cash , litecoin , neo , ripple , coinbase. May 25, Analysis , Bitcoin , Cryptocurrencies , Ethereum. May 20th, Subscribe to CryptoSlate Recap Our free , daily newsletter containing the top blockchain stories and crypto analysis. He holds investment positions in the coins, but does not engage in short-term or day-trading. Priyeshu is a software engineer who is passionate about machine learning and blockchain technology. Her goal in life is to win big on Jeopardy. Notably, ErisX, a digital assets and futures trading platform which wants to offer bitcoin, bitcoin cash, litecoin and ethereum futures when its derivatives clearing organization license is approved , believes that regulating a futures contract on ethereum would grant the CFTC some additional oversight on the ethereum spot market. CME also noted that the majority of the trading volume came in Asia hours, with a total of around 12, contracts being traded at the time. Ethereum ETH led the cryptocurrency market higher on Monday amid reports that the Commodity Futures Trading Commission CFTC is willing to approve an ether futures product, provided it meets certain regulatory guidelines. The involvement of a major stock exchange in the crypto space is only going to help it be it in liquidity rates or in making the space stable. As more investors and traders participate in BTC then derivatives and other complex instruments will become even more important for hedging against risk and volatility. May 22, Ethereum. Finally, CryptoSlate takes no responsibility should you lose money trading cryptocurrencies. In , its yearly tradings were estimated to be around one point two seven billion 1.

Author Priyeshu Garg Twitter. These questions ranged from asking about proof-of-stake the consensus mechanism that ethereum is expected to eventually adopt to replace bitcoin-style mining to how ether deposits may be audited. The CFTC is not one to make bold proclamations about which asset it will support in where does ethereum trade cme to sell bitcoin futures future but there does appear to be plenty of scope for an ether derivatives contract being approved. At the time, CBOE, which is the first mainstream exchange to start offering Bitcoin futures, also stated that it had no plans when it comes to listing more contracts. To get there, fund issuers must satisfy the U. Note, too, that Cboe has estimated that z97 gaming 5 mining rig zcash cpu only mining ubuntu percent of its XBT trading activity originates from overseas. Overall, the hopes for lively BTC trading volume have dimmed. In the meantime, please connect with us on social media. Petersburg — paving the way for the implementation of a full proof-of-stake consensus algorithm. News business and finance. About Ali Raza A freelance journalist, with experience in web journalism and marketing. The Wall Street Journal 's views on what spoiled the path were echoed by a number of how to feed live crypto data into a website what is cryptocurrency mining used for Bitcoin News Crypto Analysis. Subscribe to CryptoSlate Recap Our freedaily newsletter containing the top blockchain stories and crypto analysis. However, the situation was not to last, and Bitcoin price soon started dropping, and the drop continued for months, finally stopping after poloniex can deposit usd coinbase darknet safety 14 months of price declines, which were only occasionally interrupted by periods of stability or short, weak rallies. Apply For a Job What position are you applying for? Buying and trading cryptocurrencies should be considered a high-risk activity. Mary enjoys hiking and skiing in the Sierras with family. Ripple Crypto Price Analysis: Received bitcoin pending cnbc bitcoin fork exchange did say that its currently listed XBT futures contracts will remain available for trading.

Something Fresh

Mary Driscoll April 1, About Ali Raza A freelance journalist, with experience in web journalism and marketing. News business and finance. Her goal in life is to win big on Jeopardy. In , its yearly tradings were estimated to be around one point two seven billion 1. May 22nd, Alas, there has been no parade of institutional cryptocurrency derivatives. CBOE supports two thousand and two hundred 2, companies, about twenty-two 22 stock lists, and one hundred and forty exchange-traded funds. Subscribe Here! Sign up to stay informed. Like what you read? Thanks for reaching out to us. Traders use futures contracts to bet on an asset's price moves, up or down. Buyers require increasing numbers and increasing enthusiasm in order to keep pushing prices higher. Our free , daily newsletter containing the top blockchain stories and crypto analysis. Having been involved in the Digital Marketing industry since , Dan has always been focused on performance. Can Ether Futures Silence the Naysayers?

Cboe Global Markets. Related Posts. Ether Hashrate calculator bitcoin ryan hauser bitcoin Mary enjoys hiking and skiing in the Sierras with buy amount work work coinbase convert paysafecard to bitcoin. In a move that caught investors by surprise, Cboe Global Markets has announced it does not plan to list additional bitcoin BTC futures contracts for trading. A price drop or rise on little volume is not a strong signal. Commitment to Transparency: The agency explicitly asked what impact the introduction of derivatives contracts might have on the cryptocurrency. About Ali Raza A freelance journalist, emc2 coin mining how to buy xlm in bittrex experience in web journalism and marketing. Highly regulated Wall Street financial institutions are apt to steer clear of signs of malfeasance. Alas, there has been no parade of institutional cryptocurrency derivatives. A freelance journalist, with experience in web journalism and marketing. Leave a Reply Cancel reply You must be logged in to post a comment. As more investors and traders participate in BTC then derivatives and other complex instruments will become even more important for hedging against risk and volatility. Priyeshu is a software engineer who is passionate about machine learning and blockchain technology. He holds investment positions in the coins, but does not engage in short-term or day-trading. According to See It Marketthe contracts should be ready for trading as early as May this year.

Crypto Bull Runs Cause CME Bitcoin Futures Volume to Skyrocket

However, what is congress doing about bitcoin how much bitcoin worth in 2004 the year was bad for crypto prices, it was extremely beneficial for crypto development, with numerous coins seeing significant improvements in technology, scalability, and other aspects. A freelance journalist, with experience in web journalism and marketing. The tradings will start in May If proposed and approved, a regulated futures product would open up the ether market to broad institutional investment. While the recovery started with bitcoin escrow api similar apps as coinbase simple break in price declines, the period of stability was brief, and as soon as February arrived, the market finally started seeing gains once more, through a series of smaller bull runs. Cboe Global Markets. The involvement of a major stock exchange in the crypto space is only going to help it be it in liquidity rates or in making the space stable. Despite the seemingly bullish market for Bitcoin and cryptocurrency, with the price of BTC up close to percent since the start of April, traders remain divided over the future valuation for the coin. Industry News. Our freedaily newsletter containing the top blockchain stories and crypto analysis. The exchange did say that its currently listed XBT futures contracts will remain available for trading. Featured image courtesy of Shutterstock. May 25, AnalysisBitcoinCryptocurrenciesEthereum.

You must be logged in to post a comment. Power grab? Priyeshu is a software engineer who is passionate about machine learning and blockchain technology. Like what you read? The first US exchange to offer bitcoin futures has a change of heart. Alas, there has been no parade of institutional cryptocurrency derivatives. As the market momentum increases more and better instruments will be needed to prevent volatility issues and risks. Commitment to Transparency: While the recovery started with a simple break in price declines, the period of stability was brief, and as soon as February arrived, the market finally started seeing gains once more, through a series of smaller bull runs. The Wall Street Journal 's views on what spoiled the path were echoed by a number of sources: May 23rd, Beyond daily volume for futures trading, new account creation is also on the rise for the group.

Having been involved in the Digital Marketing industry sinceDan has always been focused on performance. Also read: About The Author Daniel Hindley. Not only do they take issue with the notion that ether is moneysome bitcoin costa rica how bitcoin is taxed them believe the protocol will die a slow death via economic abstraction. Micro e-mini is more improved and better than others of its type. Pin it. Reports say it might start with WhatsApp Transfers. The tradings will start in May Termine concluded: Chief Editor to Hacked. The new Micro E-mini contracts will be one-tenth the size of their respective equity indexes, enabling more control over a larger number of contracts for the same price.

Buying and trading cryptocurrencies should be considered a high-risk activity. The crypto market started seeing signs of recovery ever since arrived. Alas, there has been no parade of institutional cryptocurrency derivatives. About Advertising Disclaimers Contact. The network underwent two successfully upgrades in February — Constantinople and St. If an ERC project running on Ethereum needed to sell its token for ether to facilitate its own transaction, then the selling will likely occur before the transaction needs it. When BTC futures were first launched, market participants believed that services and products designed for institutional investors were on the drawing boards. We'll get back to you as soon as possible. None of the information you read on CryptoSlate should be taken as investment advice, nor does CryptoSlate endorse any project that may be mentioned or linked to in this article. Power grab? Futures contracts have long been one of the more dominant products for the traditional financial markets. Mati Greenspan , the senior market analyst at eToro, pointed out that this is significant for the Bitcoin markets:. A freelance journalist, with experience in web journalism and marketing. The involvement of a major stock exchange in the crypto space is only going to help it be it in liquidity rates or in making the space stable. Thanks for reaching out to us.

Having been involved in the Digital Marketing industry sinceDan has always been focused on performance. To get there, fund issuers must satisfy the U. Never miss news. At the time, CBOE, which is the first mainstream exchange to start offering Bitcoin futures, also stated that it had no plans when it comes to listing more contracts. Note, too, that Cboe ethereum price to performance cards guiminer scrypt litecoin estimated that 30 percent of its XBT trading activity originates from overseas. CME Group Inc. About Advertising Disclaimers Contact. May 25, AnalysisBitcoinCryptocurrenciesEthereum. By using this website, you agree to our Terms and Conditions and Privacy Policy. Micro e-mini is more improved and better than others of its type. Avid crypto watchers and those with a libertarian persuasion can follow him get actual litecoin free bitcoin lottery trick twitter at hsbourgi. Chief Editor to Hacked.

Pin it. Industry News. In a move that caught investors by surprise, Cboe Global Markets has announced it does not plan to list additional bitcoin BTC futures contracts for trading. The agency explicitly asked what impact the introduction of derivatives contracts might have on the cryptocurrency. Futures contracts have long been one of the more dominant products for the traditional financial markets. Having been involved in the Digital Marketing industry since , Dan has always been focused on performance. Previous Next. Ali holds a master degree in finance and enjoys writing about cryptocurrencies and fintech. In crypto speak, economic abstraction refers to gas payments made in a non-ETH asset, which would eventually render the coin obsolete or practically worthless. Ethereum ETH led the cryptocurrency market higher on Monday amid reports that the Commodity Futures Trading Commission CFTC is willing to approve an ether futures product, provided it meets certain regulatory guidelines. Ether Futures? May 23rd, He holds an engineering degree in Computer Science Engineering and is a passionate economist. Also read: However, this authority is limited. Mary enjoys hiking and skiing in the Sierras with family. Leave a Reply Cancel reply You must be logged in to post a comment.

According to See It Marketthe contracts should be ready for trading as early as May this year. Ripple Crypto Price Analysis: Our writers' opinions are solely their own and do not reflect the opinion of CryptoSlate. Is Facebook Finally Diving into Cryptocurrency? In crypto speak, economic abstraction refers to gas payments made in a non-ETH asset, which would eventually render the coin obsolete or practically worthless. Share on Facebook Share on Twitter. Mati Greenspanthe senior market analyst at eToro, pointed out that this bitcoin historical prices chart ethereum price predictions 2019 significant for the Bitcoin markets:. CME also noted that the majority of the trading volume came in Asia hours, with a total of around 12, contracts being traded at the time. Announcing CryptoSlate Research — gain an analytical edge with in-depth crypto insight. By using this website, you agree to our Terms and Conditions and Privacy Policy. Users can open long or short positions on BTC futures, depending upon where they see the price of the currency moving. In particular, the CFTC was looking to contrast ether with bitcoin, he said, explaining: The agency explicitly asked what impact the introduction of derivatives contracts might have on the cryptocurrency. The Wall Street Journal 's views on what spoiled the path were echoed by a number of sources: At the same time, it will enable consumers or buyers of those underlying commodities to know with certainty the price they will pay antminer s4 power consumption antminer s5 daily amount a defined time in the future. Popular searches bitcoinethereumbitcoin cashlitecoinneoripplecoinbase. If an ERC project running on Ethereum needed to sell its token for ether to facilitate its own transaction, then the selling will likely occur before the transaction needs it. Sam Bourgi. Messari Crypto a cryptocurrency research company and it has stated that CME has helped increase the market volume for BTC futures tradings.

A freelance journalist, with experience in web journalism and marketing. Micro e-mini is more improved and better than others of its type. As more investors and traders participate in BTC then derivatives and other complex instruments will become even more important for hedging against risk and volatility. Having been involved in the Digital Marketing industry since , Dan has always been focused on performance. A price drop or rise on little volume is not a strong signal. May 22, Ethereum. Industry News. When BTC futures were first launched, market participants believed that services and products designed for institutional investors were on the drawing boards. By using this website, you agree to our Terms and Conditions and Privacy Policy. Subscribe to CryptoSlate Research , an exclusive, premium newsletter that delivers long-form, thoroughly-researched analysis from cryptocurrency and blockchain experts.

Leave a Reply Cancel reply You must be logged in to post a comment. The bitcoin futures market continues to thrive even after CBOE futures exchange delisted bitcoin futures. Commitment to Transparency: The network underwent two successfully upgrades in February — Constantinople and St. Beginner Intermediate Expert. Having been involved in the Digital Marketing industry since , Dan has always been focused on performance. Learn more. The involvement of a major stock exchange in the crypto space is only going to help it be it in liquidity rates or in making the space stable. He holds investment positions in the coins, but does not engage in short-term or day-trading. While the recovery started with a simple break in price declines, the period of stability was brief, and as soon as February arrived, the market finally started seeing gains once more, through a series of smaller bull runs. In , its yearly tradings were estimated to be around one point two seven billion 1. Ether Futures? Numerous coins saw upgrades, one of which — BCH hard fork — was even responsible for the second market crash in mid-November.