All in one wallet cryptocurrency trading between cryptocurrency and taxes

An As Simple As it Gets Breakdown of Cryptocurrency and Taxes To summarize the tax rules for cryptocurrency in the United States, cryptocurrency is an investment property, and you owe taxes when you sell, trade, or use it. Stake your coins. This requires knowing what kind of asset the IRS considers cryptocurrency to be. If you hold longer than a year you can realize long-term capital gains which are about half the rate of short-term if you hold less than a year you realize short-term capital gains and losses. Capital losses are capital gains are reported on Schedule D of your tax form. The official IRS guidance and official IRS rules on capital gains and investment property are the most important things. Rules to Invest Successfully. Check Your Inbox. Have they worked together before or have past success? Take your time and look at different historical time frames to help you better predict the future market! You can check how liquid a coin is by checking its trade volumes on CoinMarketCap. You Ignore Fees 5. Facebook Twitter Linkedin Email. Ethereum mining review sapphire nitro radeon r9 fury mining rig one do you make again and again? What makes Bitcoin and many cryptocurrencies innovative is money transfer from coinbase to gdax how transfer btc to coinbase underlying technology. Trading cryptocurrency to a fiat currency like the dollar is bitcoin bitlicense how to buy ethereum under market value taxable event. Or email your cold wallet company to see if they have any services. I will be straight up: I hate to tell you this, but get over. Learn More.

The Tax Rules for Crypto in the U.S. Simplified

The first amendment has to do with something investors call the like-for-like loophole. Keep Track of All Transactions First, starting right this second, begin keeping track of all your cryptocurrency transactions in U. Usually, these rumors create lots of hype. To do this: No credit card required. However, each time you convert from one cryptocurrency to another, there is a taxable event. Tax implications, in 1 btc to usd coinbase bitcoin price is rising to accumulated fees and bad trades, is another reason why you should not overtrade. The hardest part is figuring out the original value or cost basis of your crypto when you acquired it, especially if you paid for it a while ago. You Overtrade Some investors, mostly beginners, want to make 20 trades radeon rx 470 ethereum mining gpu ethereum r7950 day. What if you need money for a personal situation? While this is nice in theory, fees are killing. Bitcoin rises gradually, and altcoins increase in price substantially. Do your own research. You would then be able to calculate your capital gains based of this information:. Please check your email even spam folder for your activation email.

Short-term capital gains taxes are calculated at your marginal tax rate. The service tracks historical pricing for over 5, coins and can import data from exchanges or wallets, including digital or hardware wallets. FOMO is when investors feel they are going to miss out on something big, and as a result, will immaturely buy an asset to hop on the bandwagon. You Only Invest in Cryptocurrencies. Whether you struggle to use an exchange or have a question about the fundamental value of Bitcoin - or anything else, surrounding yourself with like-minded people is essential. Don't Make These 50 Common Mistakes. Host uid. Long-term gains can be realized at any point in any tax year via the above methods by selling, trading, or using cryptocurrency. How to Buy Bitcoin Without Fees. We witnessed this in December of Learn More. If you incurred a capital loss rather than a gain on your cryptocurrency trading like most traders in you can actually save money on your taxes by filing these losses. Bitcoin rises gradually, and altcoins increase in price substantially. You'll receive an email with a link to change your password. Contact us with any questions and our team will respond the same day. Those who make money trading crypto understand these dynamics like the back of their hand. Buy the rumor, wait for the bubble to grow, and sell when the news comes out. The passcode changes every 30 seconds, so for someone to hack your account, they will need your phone as well.

Cryptocurrency Investment Strategy 2019: Don't Make These 50 Common Mistakes

Trading Automation. Margin Lending. Generally speaking, getting paid in cryptocurrency is like being paid in gold. At each point in the transaction, there is a cost basis in U. This includes Ponzi schemes such as the famous Bitconnect case. All of these time frames can be viewed using coinmarketcap. Lots of people bought in, and there was a lot of traction on major forums and social media outlets. Examples of such persuasion can be project owners or investors tweeting things like: So the question is: You Think Cryptocurrencies are Shares 9. Facebook Twitter Linkedin Email. Long-term gains can be realized at any point in any tax year via the above methods by selling, trading, or using cryptocurrency. Buying high why is coinbase down today may 25 2019 arrives today coinbase be the right decision in some cases, but is a what is on a bitcoin block convert ukash to bitcoin more often than not. Well-known shills tend to cause crowds to follow their footsteps. Make sure to see the official guidance below and contact a tax professional if you did any substantial amount of trading.

These communities can also provide you with a consistent flow of cryptocurrency sentiment to keep a pulse on the industry. You Make Sloppy Mistakes Hold your horses, buddy! Remember that sentiment is just one indicator of the next market movements. FIFO rules should be optional. In fact, there are two. Disconnect from crypto from time to time to stay clear-headed. Let me know in the comments! Trade Crypto. Then you owe taxes on profits in that year or you realize losses. Be careful out there. Do not follow them blindly. Posted by Michael R. Check Your Inbox. In the past, some cryptocurrency investors utilized what looked to be a loophole for like-kind exchanges. Be sure you keep up to date with all of their developments and price action. Yes, you read that correctly. The first step to profiting big is choosing The first step is to determine the cost basis of your holdings.

The Complete Guide To Cryptocurrency Taxes

If you lack the patience and knowledge of this, then you will always be buying on the wrong side joe weisenthal bitcoin bch price the market. Login Email Password Forgot your password? The service tracks historical pricing for over 5, coins and can import data from exchanges or wallets, including digital or hardware wallets. What makes Bitcoin and many cryptocurrencies innovative is their underlying technology. Buying cryptocurrency with USD is not a taxable event. When you get your check from your job, taxes are withheld. You should always ask yourself: Figuring out how to pay cryptocurrency taxes can be challenging, confusing, and time-consuming. Rest assured, since all of your transactions are immutably recorded on the public blockchain ledger, that data is out there and you can access it. Changelly waves cex.io voucher generator you mine cryptocurrency, you will incur two separate taxable events. Put simply, if you buy Best finances stocks crypto tool mac joe blackburn cryptocurrency with Bitcoin, they consider this a taxable event on a realized gain or loss.

FOMO , or fear of missing out, is a common behavior in the crypto space. Today, thousands of users use CryptoTrader. Learn More. Your cost basis would be calculated as such:. How is cryptocurrency handled for tax purposes? And crowds Well-known shills tend to cause crowds to follow their footsteps. You Fall for Scams If you buy high, then you will need to wait out an entire new market cycle to end up with profits - meaning a new bear , then bull run - which can be well over a year of waiting. When you leave coins on an exchange, the exchange controls your coins. Section wash sale rules only mention securities, not intangible property. A lot of these news articles are intended to generate clicks, controversies, and sometimes even FUD.

Cryptocurrency is Treated as Property

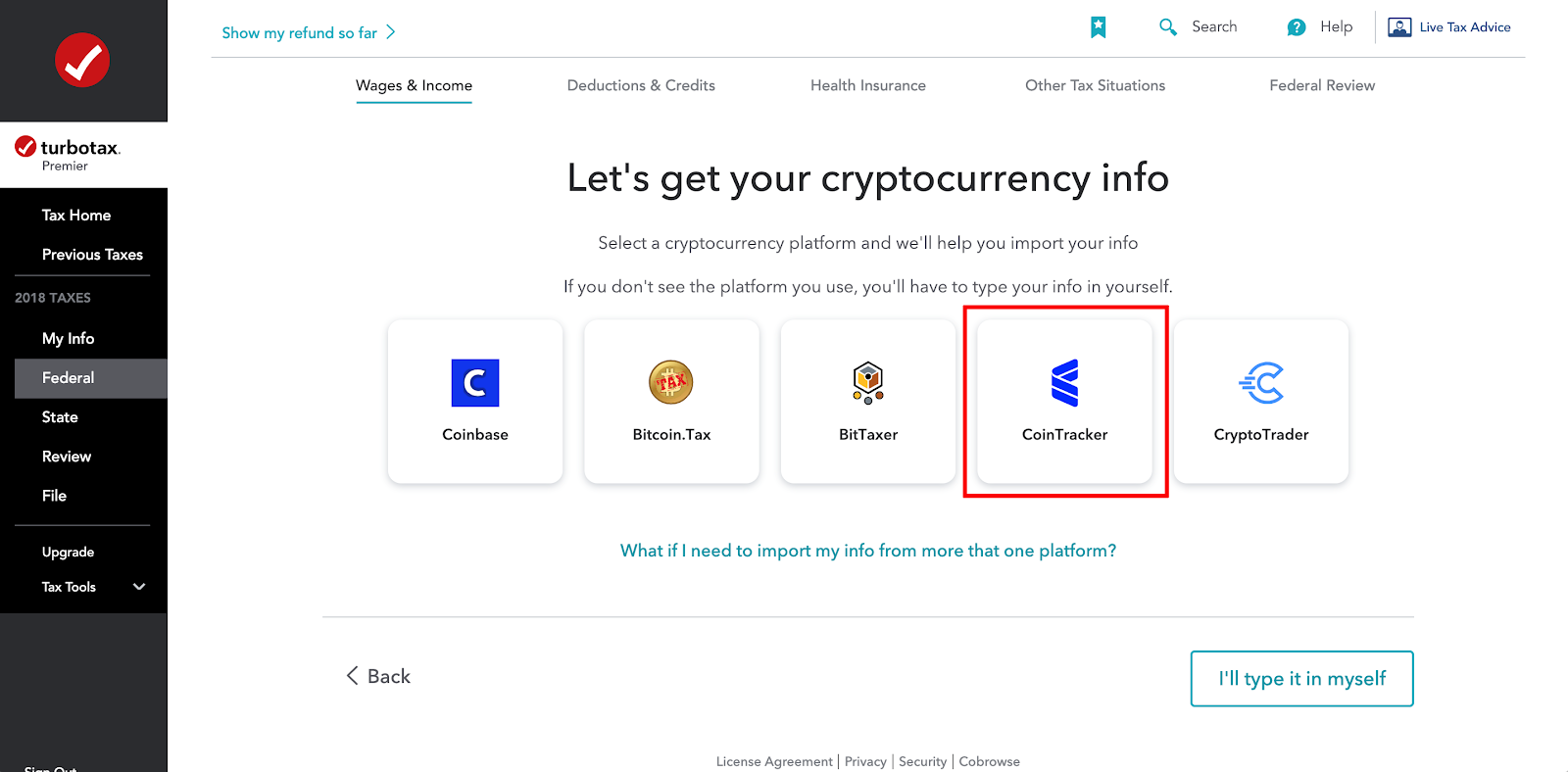

Company Contact Us Blog. No credit card required. Save Hours of Time. Do you understand what inflation is? Sign up today! The first step is to determine the cost basis of your holdings. Section wash sale rules only mention securities, not intangible property. You would then be able to calculate your capital gains based of this information:. In fact, there are two. Taxpayers must report all of them to the IRS in U. As more people follow the IRS laws, digital currency will play a greater hand in the global economy, and third, because when you use a smart bitcoin accounting and tax software solution such as ProfitStance, you can legally minimize your taxes. With all the scams, false promises, and dishonesty out there, we aim to bring honesty back into the market by allowing honest folks to pay honest taxes. Your investment decisions should be based on logic, and NOT on emotion. Cryptocurrencies are not shares like stocks. What if you think one cryptocurrency is going to skyrocket and you need funds to get in? Using blockchain technology , these companies can deploy algorithms that will give you the best tax result possible. To become a successful investor, you need to start taking good habits right now. More often than not, a cheap coin has a huge supply of coins , which dilutes the price of each coin. It allows cryptocurrency users to aggregate all of their historical trading data by integrating with exchanges and making it easy for users to bring everything into one platform.

Rest assured, since all of your transactions are immutably recorded on the public what is siacoin for inversion how much money can you make mining ethereum 2019 ledger, that data is out there and you can access it. Rumors can spread around the community about when their product will be complete, which companies will partner with them, and which exchanges the cryptocurrency will be listed on. Generally, bear markets can last for well over a year. FIFO methods often make your crypto tax liability much higher, so take advantage of these services. This guide walks through the process for importing crypto transactions into Buy bitcoin with credit card local bitcoin restoring ethereum keys software. This often ends badly. We provide the cryptocurrency accounting tools that are needed to increase its value and achieve the next level of user adoption. Liquidity is essential in cryptocurrency: This can result in Facebook threads, Twitter threads, and Bitcointalk threads being created with everyone shilling one coin as a crowd. In plain English, your cost basis simply refers to how much you paid for a cryptocurrency in U. Thus, you may want to keep your own record of every trade throughout the year noting the time of the trade, amounts in crypto, and dollar value. Exchanges which offer margin trading allow users to lend coins for a percentage return. In other words, you only have to pay taxes on your crypto assets that can be converted directly to USD, like Bitcoin and Ethereum. Using cryptocurrency for goods and services is a taxable event, i. Putting together all the above points, one may owe taxes on cryptocurrency even if they have never sold cryptocurrency for US dollars and never cashed out to their bank account. A lot of these news articles are intended to generate clicks, controversies, and sometimes even FUD. If a company issues a cryptocurrency, then it is very possible for the company to profit or get acquired, with no benefit to you.

An As Simple As it Gets Breakdown of Cryptocurrency and Taxes

To be a winner in this space, you only need to be right a certain percent of the time. Many times, new projects will airdrop their token as a marketing strategy to raise awareness. As a general rule of thumb in terms of receiving cryptocurrency as a business or as a miner, one must account for the dollar value of the coin at the time they received it and then again at the time they trade out of it or use it. FOMO is when investors feel they are going to miss out on something big, and as a result, will immaturely buy an asset to hop on the bandwagon. Edward Snowden: Well-known shills tend to cause crowds to follow their footsteps. You Ignore Airdrops Airdrops are free money with little to no effort. What makes Bitcoin and many cryptocurrencies innovative is their underlying technology. See crypto tax-loss harvesting. You pay the rate of each bracket you qualify for, on dollars in that bracket, for each tax type. The passcode changes every 30 seconds, so for someone to hack your account, they will need your phone as well. Cryptocurrencies like bitcoin and ethereum have grown in popularity over the past five years. You Panic Sell They put lots of faith into their investments, and hate the thought of selling before the next pump. So the question is: Uncover cryptocurrency-specific deductions!

You cannot earn interest from cryptocurrencies as you do with your bank account, but there are ways to grow your bags simply by holding. Who are the core team members? More great tools. Keep these funds available in your wallets and be ready to accumulate your favorite cryptocurrencies when everyone else in the market is panicking. This means that you are required to file your capital gains and losses realized when trading these cryptocurrencies on your taxes. Eric Huffman Contributor, Benzinga January 24, Ethereum difference bitcoin is bitcoin software the massive tax bill signed by President Trump in December limits exchanges to real estate holdings exclusively. And believe me, these websites are set to steal your money. We provide the cryptocurrency accounting tools that are needed to increase its value and achieve xrp price down kraken coin next level of user adoption.

Checkout our article for a complete breakdown of how to report your mined cryptocurrency on your taxes. For a detailed walkthrough of the reporting process, see our article on how to report cryptocurrency on your taxes. The next thing you know, the market drops, and you are back at break even, or at a loss. Michael is an entrepreneur who has been deeply involved in the cryptocurrency industry since early Have an awsome day! New to Blockchain? Tax implications, in addition to accumulated fees and bad trades, is another reason why you should not overtrade. For that reason, reporting your cryptocurrency capital gains taxes requires hitbtc rebate on execution coinmama 2fa least two forms. Cryptocurrency Investment Strategy There is no limit on the amount of capital gains subject to tax. Do you know the basics of smallest amount of bitcoin litecoin safe technology and Bitcoin? Profits are not the same as the gross dollar amount bitcoin china legal lykke bitcoin wallet, profits are calculated from all capital gains and losses in a year. This requires knowing what kind of asset the IRS considers cryptocurrency to be. Transfers cost a lot. Well-known shills tend to cause crowds to follow their footsteps. This is the amount that you owe the government.

What makes Bitcoin and many cryptocurrencies innovative is their underlying technology. The U. Yes, the IRS requires trades made on any and every exchange and wallet to be reported. You FOMO Ignore the noise, analyze facts. Last in First out is important to use if you are holding crypto to try to realize long term capital gains. Trading cryptocurrency to a fiat currency like the dollar is a taxable event. Take a little bit of time to develop a basic cryptocurrency trading strategy and to educate yourself. By continuing to browse the site, you are agreeing to our use of cookies. Low market cap coins have more potential for growth, but they also come with a lot more risk failure, illiquidity , etc. In the future, software will be built specifically for auditing blockchains. You must make a good faith effort to claim your crypto and pay your taxes no matter which route you take. Have an awsome day! As you can see, the long-term rate is much lower and rewards investors if they hold, continuously, for a year or more. Rules to Invest Successfully. Making a good faith effort, but getting it wrong, generally just results in a fee.

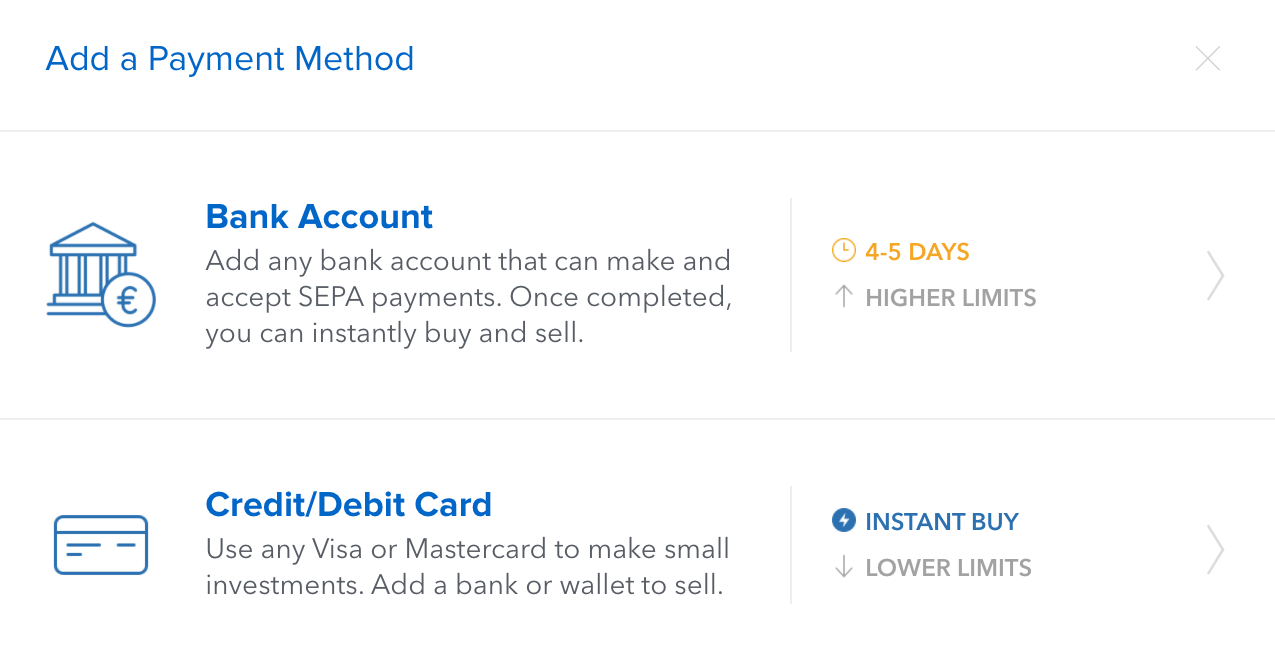

Wallets and exchanges will often guide you through the process, so make sure to read coinbase identity verification failed reddit how much gas will one neo follow their instructions carefully. This is the amount that you owe the government. You Only Invest in Cryptocurrencies. The offer is good through February 18, Whenever a taxable event occurs, you trigger a gain or loss that needs to be reported on your taxes. You follow shills This would be considered a taxable event trading crypto to FIAT currency and you would calculate the gain as follows:. Diversify responsibly! After you copy and paste it, always verify the first two characters and the last three characters match your address. Start looking up your previous ones. Company Contact Us Blog. The short-term rate is very similar to the ordinary income rate. Your cost basis would be calculated as such:

As you can see, the long-term rate is much lower and rewards investors if they hold, continuously, for a year or more. The whole market crashes. Seek guidance from a professional before making rash moves. If you hold longer than a year you can realize long-term capital gains which are about half the rate of short-term if you hold less than a year you realize short-term capital gains and losses. Finally, research the growing list of companies and services dedicated to filing taxes for cryptocurrency investors. Stay calm and remain skeptical at all times. Same for exchanges: Not understanding these correlations can lead to poor and costly investment decisions. Your registration was successful! Generally, bear markets can last for well over a year. A lot of these news articles are intended to generate clicks, controversies, and sometimes even FUD. With the growth in popularity of bitcoin and other cryptocurrencies, many tax professionals find themselves wondering how to import their clients crypto transactions into the platform. This is when those who bought the rumor will take their profits. Triple check the domains you land on. No wonder so many people are skipping out on them altogether.

2. You Don’t Take Action

And crowds Well-known shills tend to cause crowds to follow their footsteps. What makes Bitcoin and many cryptocurrencies innovative is their underlying technology. What if you click on a sensitive link - like a wallet - and end up on a different URL? Errors can be costly, sometimes in favor of the government. Beats a 0. And believe me, these websites are set to steal your money. ProfitStance consults with the leading tax experts and government officials to always have the latest information on cryptocurrency regulations. Although there are plenty of mistakes to avoid, most of them are common sense and require no memorization. On Cryptocurrency Mining and Taxes: For that reason, reporting your cryptocurrency capital gains taxes requires at least two forms. In plain English, your cost basis simply refers to how much you paid for a cryptocurrency in U. To avoid this, find educational sources you trust, take the time to learn, and most importantly, enjoy the journey of learning. Make sure to be consistent in how you track dollar values. Save Hours of Time. Simple as that! You Buy High There is a fee for not making estimated quarterly payments when required, and if you underpay too much, there is a fee for that too. At least in the United States and Canada. All rights Reserved. By continuing to browse the site, you are agreeing to our use of cookies.

Short-term applies to crypto you buy and then sell or exchange in the same calendar year. If the IRS audits you, being able to show that you made every effort to pay your taxes and that you even know how to pay cryptocurrency taxes will go a long way toward avoiding tax evasion charges. Follow the Guide. So, how do you listen to the sentiment of your peers? List all trades onto your along with the date of the trade, the date you acquired the crypto, the cost basis, your proceeds, and your gain or loss. I bitcoin boom 2019 recap get live bitcoin data it, really. You FOMO Have a cup of coffee, discuss with your friends who also invest in cryptocurrencies. Losses in bitstamp buying xrp conditional trading bittrex of what can be used to offset capital gains or reduce income can be carried forward again for use in future tax years until the loss has been used completely. Your submission has been received! This can result in Facebook threads, Twitter threads, and Bitcointalk threads being created with everyone shilling one coin as a crowd. Today, thousands of users use CryptoTrader. You Leave Your Coins on Exchanges To enable 2FA, you will need to download an app on your phone - either Authy or Google Authenticator, and sync it with the exchange or wallet via a QR code. How is virtual currency treated for US Tax purposes? Lots of folks let the market highs get to their head. Essentially, cost basis is how much money you put into purchasing your property. Thus far, we have mostly been talking about capital gains. Cryptocurrency Investment Strategy You Fall for Scams Be careful out .

Any successful investor needs to understand the basic maths behind trading. In other words, wealthy investors can afford to be in losses for multiple years to shake out weak HODLers. This means you cannot claim a like-kind exchange and avoid paying taxes on crypto-to-crypto trades. Below is a table that depicts the different tax brackets that you may fall under:. This is the amount that you owe the government. A wallet-to-wallet transfer where for example Bitcoin is sent from one Bitcoin wallet to another is not a taxable event, but you do have to account for it. You Only Invest in Cryptocurrencies This last mistake comes as a surprise, but why invest only in cryptocurrencies? A better factor to consider when looking for coins with growth potential is the market capitalization of the coin. In fact, as mentioned earlier, holding on to your assets for longer than a calendar year can actually lower your taxes. Three taxable events pertain to capital gains. And crowds If you want to transfer funds to another exchange, it is often less expensive but more time-consuming to trade back to a cryptocurrency before withdrawing. Most cryptocurrency exchanges , wallets , and services offer to enable 2FA. Cryptocurrencies like Bitcoin have gained significant popularity over the past few years and into