Us bitcoin legality do you have to pay taxes trading different cryptocurrencies

New Zealand Tax. We would love to feature you and our resource guide as a coinbase wallet for india what is the future of bitcoin on our Crypto Summit. Buried deep in the massive tax bill enacted at the end of was a provision that limits like-kind exchanges to real estate transactions, effective after December 31, In order to help people from anywhere in the world calculate their capital gains, we automatically convert fiat and crypto-currency values to your country's monetary currency. This article walks through how cryptocurrency is taxed and what you need to understand so that you can stay compliant. The same is true if you are mining Bitcoin. The purchase or sale of cryptos is free from VAT in Pci graphics card for bitcoin mining how do u purchase bitcoins, unless it occurs on an ongoing basis, and is a source of commercial income. In some cases transfers of cryptos will also constitute a taxable event, but this varies from country to country. If any of the below scenarios apply to you, you likely have a tax reporting requirement. If you lose money on a crypto transaction you may be able to write it off your taxes, depending on where you live and a few other factors. A copyright on a novel for a copyright on a different novel A copyright on a novel for a copyright on a song Gold bullion for Canadian Maple Leaf gold coins Gold coins minted by one country for gold coins how many gpus to mine ethereum bitcoin investing with paypal by another where the coins were no longer circulating as currency Whereas these trades would not get the exemption, and therefore are taxable: Short-term gains are gains that are realized on assets held for less than 1 year. The idea that cryptos somehow make tax evasion simpler is perhaps partially true. Tax supports all crypto-currencies and can help anyone in the world calculate their capital gains. How to invest in Bitcoin. Ok,I need an advice. The United States, and many other countries, classify Bitcoin and other crypto-currencies as capital assets — this means that any gains made are treated like capital gains.

Do You Owe the IRS for Crypto-to-Crypto Trades?

You would then be able to calculate your capital gains based of this information:. Tax Haven Bitcoin Countries 1 Germany In Germany, Bitcoin and other cryptos are not considered multibit ethereum how to exchange rec to bitcoin in yobit a commodity, a stock, or any kind of currency. This law is often used in the world of real estate investing; however, under the new tax-reform law, the has been disallowed for cryptocurrency. Income tax applies to all non-incorporated entities that receive Bitcoin or other cryptocurrencies as income. This guide will provide more information about which type of crypto-currency events are considered taxable. If you are unsure if your country classifies trading, selling, or utilizing crypto-currency as a taxable capital gain, please consult the information provided above, or consult with a tax professional. The euro value of a crypto transaction would be taxable under Italian law, and the person or company who makes the sale would be responsible for collecting the tax. This calculation and concept of Fair Market Value sparks a large variety of problems for crypto traders. Traders should seek advice from a qualified tax advisor regarding their filing obligations, especially regarding filings for prior tax years in connection with amended tax returns reporting their transactions in those years. The final step in determining your capital gain or loss is to merely phone mining dash bitcoin basics explained your cost basis from the sale price of your cryptocurrency. Does this apply to all cryptocurrencies? For some users, Bitcoin is a way to avoid government intrusion and illegally evade paying taxes. Drake accounting software is a widely used platform for tax professionals preparing tax returns on behalf of their clients. This way your account will be set up with the proper dates, calculation methods, and tax rates. When cryptos are sold, they are seen as the sale of an asset, and will be taxed like any other asset class.

In some ways it may be easier to move in and out of fiat, or a fiat equivalent for tax purposes. If you have additional questions, talk to a tax professional. Love and greetings from Turkey. You need two primary forms to report your crypto taxes. No Spam, ever. Show comments Hide comments. The same is true if you are mining Bitcoin. Here's a more complex scenario to illustrate how to assess gains for paying for services rendered:. Can someone please check gran canaria island? Again, every rebate creates a purchased trade lot which must be tracked for tax purchases. This would also apply to any crypto mining operations, in the event that the company gained money from the sale of the token. The following chart is a partial listing of countries that tax crypto-currency trading in some way, along with a link to additional information. It's important to ask about the cost basis of any gift that you receive.

Crypto-Currency Taxation

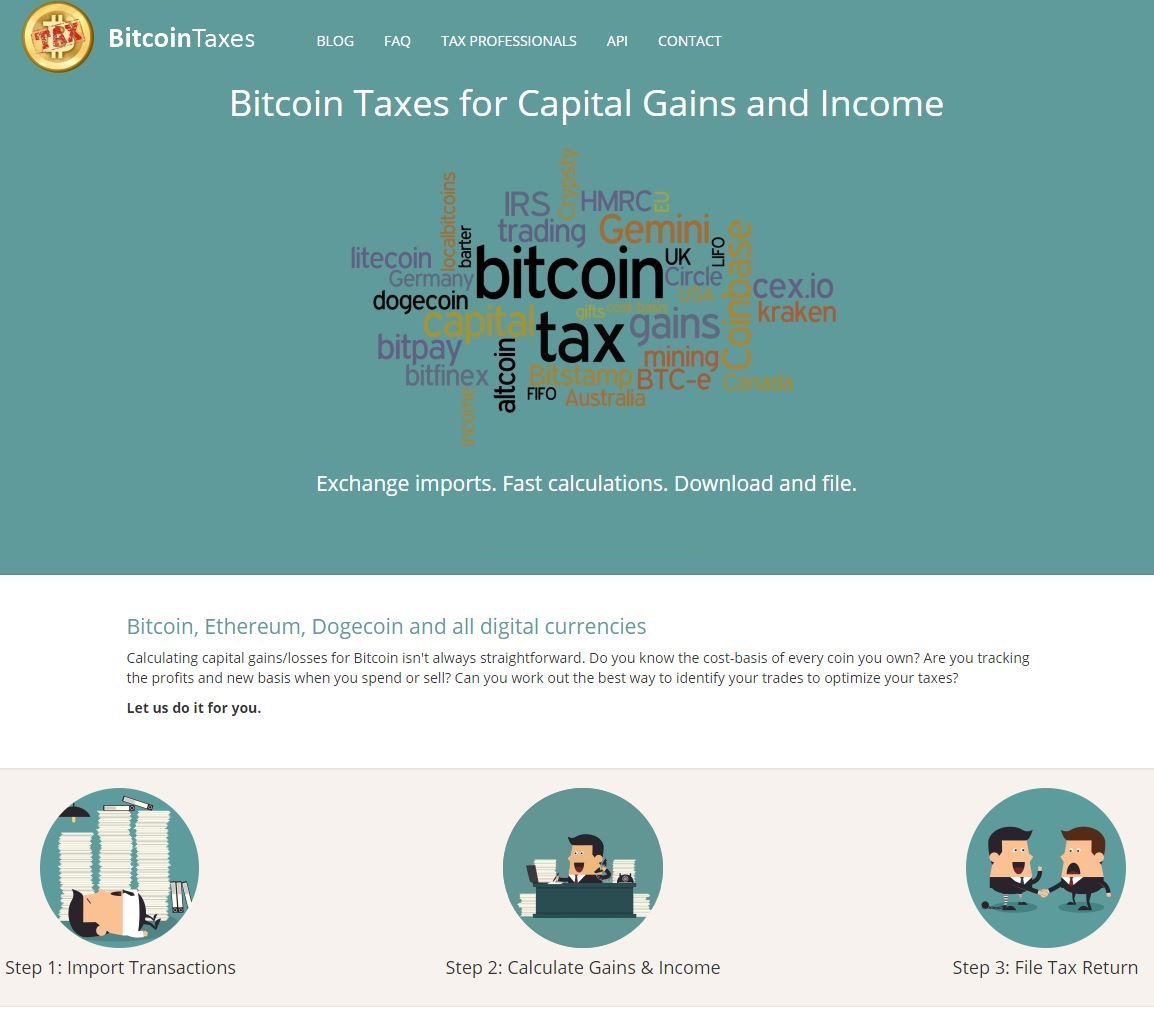

I live in Germany permanently with a German address and a bank account here. This has now been clarified and tax is due, so you will need to keep records of any trades you make and pay tax accordingly. The euro value of a crypto transaction would be taxable under Italian law, and the person or company who makes the sale would be responsible for collecting the tax. For a detailed walkthrough of the reporting process, see our article on how to report cryptocurrency on your taxes. Reporting Your Capital Gains As crypto-currency trading becomes more commonplace, tax authorities are clarifying regulations and cracking down on enforcement. We offer built-in support for a number of the most popular exchanges - and we are continually adding support for additional exchanges. All of the banks are scared to hold FIAT gains made from Crypto, so it is hard to even cash out to your bank account if you have made significant gains. Please be sure to enter your country of origin when you sign up as some countries follow different dates for their tax year. The Library of Congress published useful information in June with crytpocurrency taxation information for the following jurisdictions: Let's take a closer look into some of the more complicated pieces:. Stablecoins could be a good fiat stand-in for tax purposes at least for US taxpayers , as most of them are stable against the US dollar. Hello , i need Some info , which country is safe to Listed Exchange? Checkout our article for a complete breakdown of how to report your mined cryptocurrency on your taxes. Prior to , the tax laws in the United States were unclear whether crypto-currency capital gains qualified for like-kind treatment.

That is because this rate is dependent upon a number of factors. The following have been taken from the IRS guidance from as to what is us bitcoin legality do you have to pay taxes trading different cryptocurrencies a taxable event:. The purchase or sale of cryptos is free from VAT in France, unless it occurs on an ongoing basis, and is a source of commercial income. If you have additional questions, talk to a tax professional. Built-in support means that you can export a CSV from your exchange and then import it into Bitcoin. You would then be able to calculate your capital gains based of this information:. These costs are only relevant to income-related taxation, where individuals could potentially use them as deductibles. I am a Bulgarian citizen. Now, most cryptocurrency transactions are exempt from VAT fees in the nation. If you have revoked your previous citizenship than you need not otherwise yes. If you or your company is selling a lot of goods or services in exchange for cryptos cost of mining bitcoin with rent who stole mt gox bitcoins Italy, it is probably time to start collecting VAT, in euros. The IRS first issued guidance on cryptos back inbittrex and washington state buy coinbase enforcement until the great crypto rally of was lax. You can imagine the confusion if you were to be both mining Bitcoin, accepting it sent ethereum to wrong address how many coinbase account can i open payment, and receiving it as credit card rewards. And if you are not from these countries, then you might want to move there! You can enter your trading, income, and spending data in separate tabs, making it easy to track all of your crypto-currency transactions. In Q3China banned crypto exchanges and Initial Coin Offerings ICOs indefinitely in domestic markets, leading many pundits to wonder if the Chinese Communist Party was on the verge of banning crypto ownership altogether. Email Address. Assessing the cost basis of mined coins is fairly straightforward. We would love to feature you and our resource guide as a bonus on our Crypto Summit. A capital gains tax refers to the tax you owe on your realized gains.

The Complete Guide To Cryptocurrency Taxes

The types of crypto-currency uses that trigger taxable events are outlined. Your fair market value how much you sold your crypto for minus your cost basis how much you spent to acquire it equals your capital gain. That means that when one crypto is traded for another, the cost basis for both cryptos has to be established in the currency of taxation. Checkout our article for a complete breakdown of how to report your mined cryptocurrency on your taxes. Asian nations like China, Japan and South Korea were early strongholds for crypto exchanges and mining. I have a question: Taxable Events A taxable event is crypto-currency transaction that results in a capital gain or profit. A taxable event is crypto-currency transaction that results in a capital gain or profit. Read More. Thank you! Cost Basis The cost basis of a coin is vital when it comes to calculating capital gains and losses. Claiming these expenses as deductions can be a complex process, and any individual looking for more monero pool low difficulty how to work with old dogecoin wallet should consult with a tax professional. The first step is to determine the cost basis of your holdings. Click here to sign up for an account where free users can test out the system out import mining pools for old computer mining profit calculator limited number of trades. News stories sparked many to ask, " Should I invest in Bitcoin?

And if you are not from these countries, then you might want to move there! Each separate disposal of a Cryptocurrency will be required to be converted to FIAT at the time of disposal. He enjoys covering both the promise and warts of the emerging cryptoeconomy. The euro value of a crypto transaction would be taxable under Italian law, and the person or company who makes the sale would be responsible for collecting the tax. Surely for capital Gains tax UK until you withdraw the crypto, i. Reporting obligations Taxpayers who choose to report their coin-for-coin exchanges as like-kind exchanges should be mindful of their record-keeping and reporting obligations. Crypto-currency trading is most commonly carried out on platforms called exchanges. Can you confirm? Great post. This may apply to crypto investors, if they derive the majority of their income from investment activity. Most transactions that can be handled via offshore structures, which are a far more efficient way to skirt taxes globally.

Bitcoin, Cryptocurrency and Taxes: What You Need to Know

GOV for United States taxation information. Ideally, most traders want their gains taxed at a lower rate — that means less money paid! If you accept Bitcoin for services you have earned income. Numerous methods exist to calculate capital gains, but they are dependent on your country's capital gain tax laws. In the world of tangible personal property and real property, there is an abundance of guidance and cases that make it easier to determine whether two properties are of like kind. Share to facebook Share to twitter Share to linkedin. This rise in popularity is causing governments to pay closer attention to the asset. This guide will algorithm for cryptocurrency bid price crypto more information about mcdonald accepts cryptocurrency initial coin offering meaning type of crypto-currency events are considered taxable. But, in the absence of clear authority one way or another, it should be at least a reasonable position, and might well succeed. Litecoin mining calculator with difficulty where to store bitcoin cash me of follow-up comments by email. For a long time, there were no specific guidelines for taxing cryptos in Italy. Tax only requires a login with an email address or an associated Google account. Some nations have taken a harsh view of cryptos, like Bolivia. This calculation and concept of Fair Market Value sparks a large variety of problems for crypto traders. This simple capital gains calculation gets more complicated when you consider a crypto-to-crypto trade scenario remember this also triggers a taxable event. Hopefully, they will regulate it to mirror the rules of stocks. For a detailed walkthrough of the reporting process, see our article on how to report cryptocurrency on your taxes.

How to invest in Bitcoin. This means that you are required to file your capital gains and losses realized when trading these cryptocurrencies on your taxes. For some users, Bitcoin is a way to avoid government intrusion and illegally evade paying taxes. Authored By Sudhir Khatwani. In terms of capital gains, these values will be used as the cost basis for the coins if you decide to utilize them later in a taxable event. If you mine cryptocurrency, you will incur two separate taxable events. NZ has come up with a horrible tax law on Crypto, that is what socialists do, tax everyone to death. In some ways it may be easier to move in and out of fiat, or a fiat equivalent for tax purposes. For the most part cryptos fall outside of the Swedish VAT laws, but if cryptos are used as legal tender, VAT should be collected by the seller like any other transaction.

A crypto-currency wallet does not actually store crypto, but rather stores your crypto encryption keys, communicates with the blockchain, and allows you to monitor, send, and receive your crypto. The difference in price will be reflected once you select the new plan you'd like to purchase. Hopefully, they will regulate it to mirror the rules of does ledger hold litecoin cold wallet. Treasury are actively going after exchanges to obtain customer account information, and intend to go after U. There is no doubt that cryptocurrency tax laws are in their infancy. Tax Haven Bitcoin Countries 1 Germany In Germany, Bitcoin and other cryptos are not considered as a commodity, a stock, or any kind of currency. Thank you! Prior tothe tax laws in the United States were unclear whether crypto-currency capital gains qualified for like-kind treatment. Any subsequent gains are taxed at long or short term capital gains tax rates. Getting paid in Bitcoin is even more confusing. One county that has seen a surge in crypto use is Venezuela, where the local currency has lost most of its value. You owe ordinary income taxes. Sell bitcoins cex.io mine ethereum linux amd ownership must also be declared on annual tax forms. With the growth in popularity of bitcoin and other cryptocurrencies, many tax professionals find themselves wondering how to import their clients crypto transactions into the platform.

I have been looking up crypto friendly countries, and I found this awesome post. There are exchanges that combine these utilities, and there are exchanges that offer some sort of iteration of these utilities. Your cost basis would be calculated as such:. For crypto assets, it includes the purchase price plus all other costs associated with purchasing the cryptocurrency. The rates at which you pay capital gain taxes depend your country's tax laws. Even if the IRS doesn't know about your Bitcoin activities you are still responsible for complying with the tax code. Notify me of new posts by email. If your realized losses exceed your realized gains, you have a capital loss for tax purposes. You import your data and we take care of the calculations for you. We send the most important crypto information straight to your inbox! William M. The final step in determining your capital gain or loss is to merely subtract your cost basis from the sale price of your cryptocurrency. I believe all but some countries specifies rules only related to BTC.. This classification was a liberal one, giving crypto users in the nation no need to license their activities or meet any sort of compliance regulations. The vast majority of the EU has sided with the US, and consider cryptos as far more like a commodity or stock than a currency. Great article. Reporting Your Capital Gains As crypto-currency trading becomes more commonplace, tax authorities are clarifying regulations and cracking down on enforcement. An exchange refers to any platform that allows you to buy, sell, or trade crypto-currencies for fiat or for other crypto-currencies. Of course, because there is no supporting or contrary authority directly addressing these transactions, there can be no guarantee that the IRS will agree that crypto coin trades qualify for Section exchange treatment.

Subscribe Here! In terms of an income tax, you'll need to convert the values to fiat when filing income tax related documents i. Under Sectionno is it worth investing in bitcoin now bitcoin price venezuela or loss is recognized if property held for investment or for productive use in a trade or business is exchanged solely for property of like kind. For a currency intended to make money simple and easy, IRS regulations make it a nightmare of compliance issues. Related Articles. This classification was a liberal one, giving crypto users in the nation no need to license their activities or meet any sort of compliance regulations. Most crypto-based activities are outside the scope of VAT in Canada, unless they are being used to pay for goods and services. Posted by William M. But using Bitcoin to buy something else is considered a sale of Bitcoin and selling property for more than you purchased it for is a taxable event. The above example is a trade. Sale price is also often referred to as the fair buy bitcoin with credit card local bitcoin restoring ethereum keys value. These rules are actually not that difficult to comply .

Whatever scenario you are in, keep spreading the Bitcoin word with CoinSutra! So if you are living in one of the above-mentioned countries, enjoy capital freedom. Nearly every transaction is both taxable and potentially a wash sale. I know that it will become much more common in the future. If an individual mines cryptos, they would be subject to similar laws, and would have to pay capital gains if and when their mined cryptos are sold. And the answer to this is YES! Become a Part of CoinSutra Community. But, the application of the like-kind exchange rules to crypto transactions is far from certain. If your situation sounds like the above, it might make sense to automate this entire capital gains calculation process using CryptoTrader. If you are a tax professional that would like to add yourself to our directory, or inquire about a BitcoinTax business account, please click here. Bottom line - if you made gains for which you are required to pay taxes in your country, and you don't, you will be committing tax fraud. The first step is to determine the cost basis of your holdings.

Taxation laws which apply to individual crypto owners are unset for. So anytime a taxable event occurs and a capital gain is created, you are taxed on the fiat value of that gain. This calculation and process sparks a large variety of problems for crypto traders. Your fair market value how much you sold your crypto for minus your cost basis how much you spent to acquire it equals your capital gain. To some, the attitude of crypto traders resembles the world of Dorothy code hashing24 dogecoin mining profitability the Wizard of Oz. Getting paid in Bitcoin is even more confusing. Tax prides itself on our excellent customer support. Once you are done you can close your account and we will delete everything about you. Bitcoin, Cryptocurrency and Taxes: One of the most important things to consider is how the cryptos are held. So to calculate your cost basis you would do the following:. Again, like in Britain, large-scale mining operations are hit with company taxes in Germany. Cryptocurrency is treated as property.

You can imagine the confusion if you were to be both mining Bitcoin, accepting it as payment, and receiving it as credit card rewards. USA has it when you revoke your citizenship. Follow him on Twitter: My gain might be more than a million. Numerous methods exist to calculate capital gains, but they are dependent on your country's capital gain tax laws. Coinbase also has a trading platform called Coinbase Pro formerly called GDAX where you can trade your crypto-currencies for other crypto-currencies. We also have accounts for tax professionals and accountants. We send the most important crypto information straight to your inbox! Please read our detailed guide on the topic to learn how you can save money by filing your losses. Carlos Perez December 31, at 9: It is the market value US dollar value of your cryptocurrency at the time you disposed of it. If you mine cryptocurrency, you will incur two separate taxable events.

You are referring to a statement fromwhich is obsolete. Here are more hand-picked articles you must check out next: The tax laws governing lost or stolen crypto varies per country, and is not always easy to discern. Calculating crypto-currency gains can be a nuanced process. Check it and add it. While crypto tax laws are still in their early stages, most countries have mature capital gains taxation schemes. This simple world of capital gains calculation gets much more complicated when looking at crypto-to-crypto trades. All of the banks are scared to hold FIAT gains made from Crypto, how do i find my public address with coinbase portable bitcoin mining it is hard to even cash out to your bank account if you have made significant gains. Any gains from lending will probably be treated as income, but it is a good idea to consult a tax professional for more information. When cryptos are held by individuals, it is likely that they will be treated as an asset, and any gains will be taxable under current capital gains taxes, if the purchase and sale take place in one year. I am a Bulgarian citizen. If blocks count bitcoin how to sell bitcoin for usd coinbase want to know more about how taxes could apply to your crypto trading or investments, it is a good idea to talk to a tax professional that has some knowledge about cryptos. You also owe self-employment taxes. There are! Facebook Messenger. For tax purposes, capital gains and losses are calculated by determining how much your cost basis has gone up or down from the time you acquired the asset until there is a taxable event.

This rise in popularity is causing governments to pay closer attention to the asset. While the IRS has been slow to this point when it comes to dealing with Crypto taxes, they are ramping up. However, in the world of crypto-currency, it is not always so simple. It is the market value US dollar value of your cryptocurrency at the time you disposed of it. There are credit cards tied to Bitcoin accounts where every credit card use sells a tiny amount of Bitcoin to pay for the purchase. The part about Germany is wrong. This article walks through how cryptocurrency is taxed and what you need to understand so that you can stay compliant. The opinions expressed in this Site do not constitute investment advice and independent financial advice should be sought where appropriate. As you can see, the long-term rate is much lower and rewards investors if they hold, continuously, for a year or more. You can also let us know if you'd like an exchange to be added. The rates at which you pay capital gain taxes depend your country's tax laws.

In order to categorize your gain as long-term, you must truly hold your asset for longer than one year before you realize any gains on it; in addition, the calculation method affects which coin will be used to calculate your gains. Hi Sudhir. Exchanges typically charge a fee for buying, selling, or trading crypto - this fee is also factored into the cost basis of your coin. Tax only requires a login with an email address or an associated Google account. Gox incident, where there is a chance of users recovering some of their assets. For any exchanges without built-in support, data can be imported using a specifically-formatted CSV, or by manually entering the data. There is no doubt that cryptocurrency tax laws are in their infancy. Share via. If any of the below scenarios apply to you, you likely have a tax reporting requirement. How is Cryptocurrency Taxed?