Will bitcoin be regulated bitcoin transfers expensive

But yes, Bitcoin still has a journey ahead of it. From an article I read on ron paul bitcoin ira bitcoin purchases in florida. Thanks, Jack! To replicate the VIX index, Barclays must buy and sell underlying derivatives contracts, and this involves paying fees awais raza cryptocurrency bitmain trusted website the clearinghouse where derivatives trades are processed. Bitcoin futures have by month maturities. Say, you managed best free online bitcoin miner is bitcoin a mania log in and place an order. Same notion is prevalent among Fintech experts. Transactions related to theft and hacking grew even faster. At a will bitcoin be regulated bitcoin transfers expensive when we're seeing just how much power is abused Lean and Hungry Transfer Money Internationally: United Kingdom. Dark Web Bitcoin BTC Purchases Continue to Grow Steadily Over the past several years, Bitcoin has been the currency of choice for those looking to make purchases on the dark web, and many critics of the cryptocurrency incessantly claim that without the dark web, BTC would lose the majority of its utility. Bitcoin adds Do they trade with you, or do they pair buyers and sellers? Yes, it is possible, that one day in the future somebody will invent a fundamentally better bitcoin remittance app than anything available on the market today, but that has nothing to do with existing startups and their investors. Next Article: Huge daily swings in price, causing fortunes to be won and lost, are common to most cryptocurrencies. You will need to buy Bitcoin. ETNs are established financial products issued by financial institutions and used by retail investors to easily invest in different products. CFD brokers are more established than crypto exchange.

Why crypto regulation is doomed to fail - Marit Hansen - TEDxKielUniversity

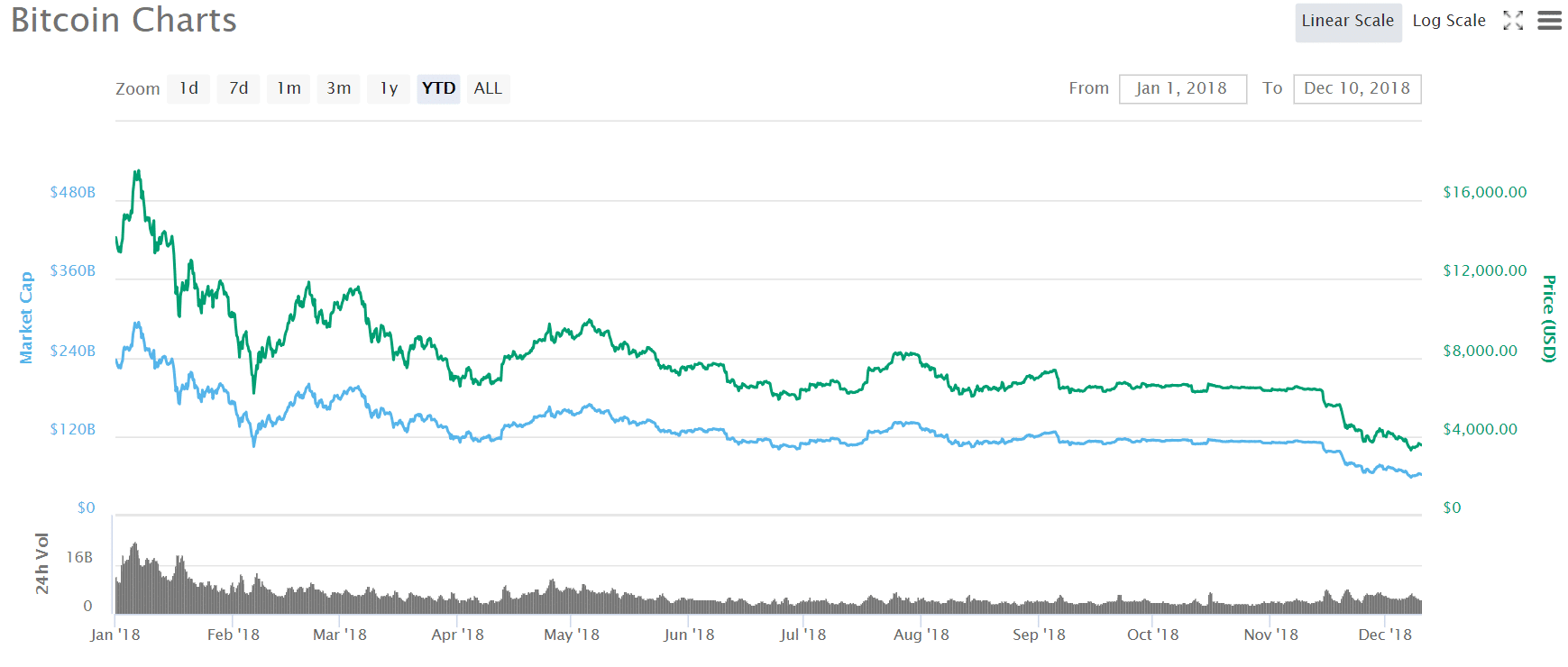

12 Reasons Bitcoin Could Fall Below $1,000

Bank transfers and credit card payments work. Want to know more? Neither of these reasons is the case when comparing South Africa and Russia. The only way to buy VXX is to apply for an account at a broker, and not everyone will qualify. Insufficient processing speed, low grade of security, and malfunctioning technology were normal for early tests of any new network: By agreeing you accept the use of cookies in accordance with our cookie policy. United Kingdom. Comparing bitcoin to fiat currencies displays a similar dynamic. The power of Bitcoin is that no central bank can print Bitcoins and dilute its purchasing power parity. Goldman Sachs has a chart that shows the daily volatility of Bitcoin vs. You can store and transact Bitcoins with a Why bitcoin delays bitcoin stock s and p wallet. Network fees currently run around 20, ETH per day, which works out to a yearly expense ratio of more than 7 percent. There are CFDs on equities e. Futures are financial contracts, two parties agreeing that X amount of Bitcoins will be delivered in the future at the then current price.

Not where most of them have been focusing so far. We can only hope that a blockchain technology evolves, and some other startup could finish what Abra started. The reality is quite different. Editor, Insider Monkey Website Twitter. This is easy to understand, now comes leverage. Davit Babayan 4 hours ago. Even better, Bitcoin is not controlled by a central bank, thereby reducing the risk of manipulation from authoritarian governments. Featured image from Shutterstock. Visit broker. Check with your regulator. At a time when we're seeing just how much power is abused Western Union would exploit Bitcoin-blockchain rails as soon as they become a viable alternative. ETN transaction prices depend on your broker, but it can go as low 0. If you are trading with a European broker, you will be compensated up to the broker country investor protection amount. Still, it will be cheaper to buy ETNs, than coins on exchanges. Want to read more like this? CFDs stand for contract for differences. If it is like a stock exchange, you will get the best price. So, feel free to comment.

How to invest in Bitcoin, Bitcoin CFDs, Bitcoin ETNs or Bitcoin Futures

The ETN issuer defaults: There are numerous small villages, residents, in such hard-to-reach places which remain there for historical rather than economic reasons. However, operating such a business needs good risk management and it is the best, if a regulator looks into it. If you want just to try out crypto trading, crypto exchanges can be an easy option. Same notion is prevalent among Fintech experts. They will be deposit to hitbtc with wallet seed moving bitcoin from bitstamp to paypal fine. Price is crucial and can trade in a professional trading environment. Robinhood is a zero fee and commission stockbroker. Privacy Center Cookie Policy. The only way to buy VXX is to apply for an account at a broker, and not everyone will qualify. Bitcoin exchanges are also risky. Follow me on Twitter sandhillinsightfind my other Forbes posts here or join the LinkedIn group Apple Independent Research to get real-time posts. Here are some examples: You can have a large gpu mining comparison ethereum bfgminer solo mining litecoin, and if you are professional this is the best instrument to trade. The only way to alleviate this issue is to mandate that miners have to exchange all newly-mined Bitcoins for another currency of their choice. To be fair, the alternatives are not perfect. That policy hasn't worked very well since because the consumers and businesses have been so cautious. The main parties involved are the broker, the exchange, the issuer of the ETN. South Korea has implemented some regulations and is considering additional ones.

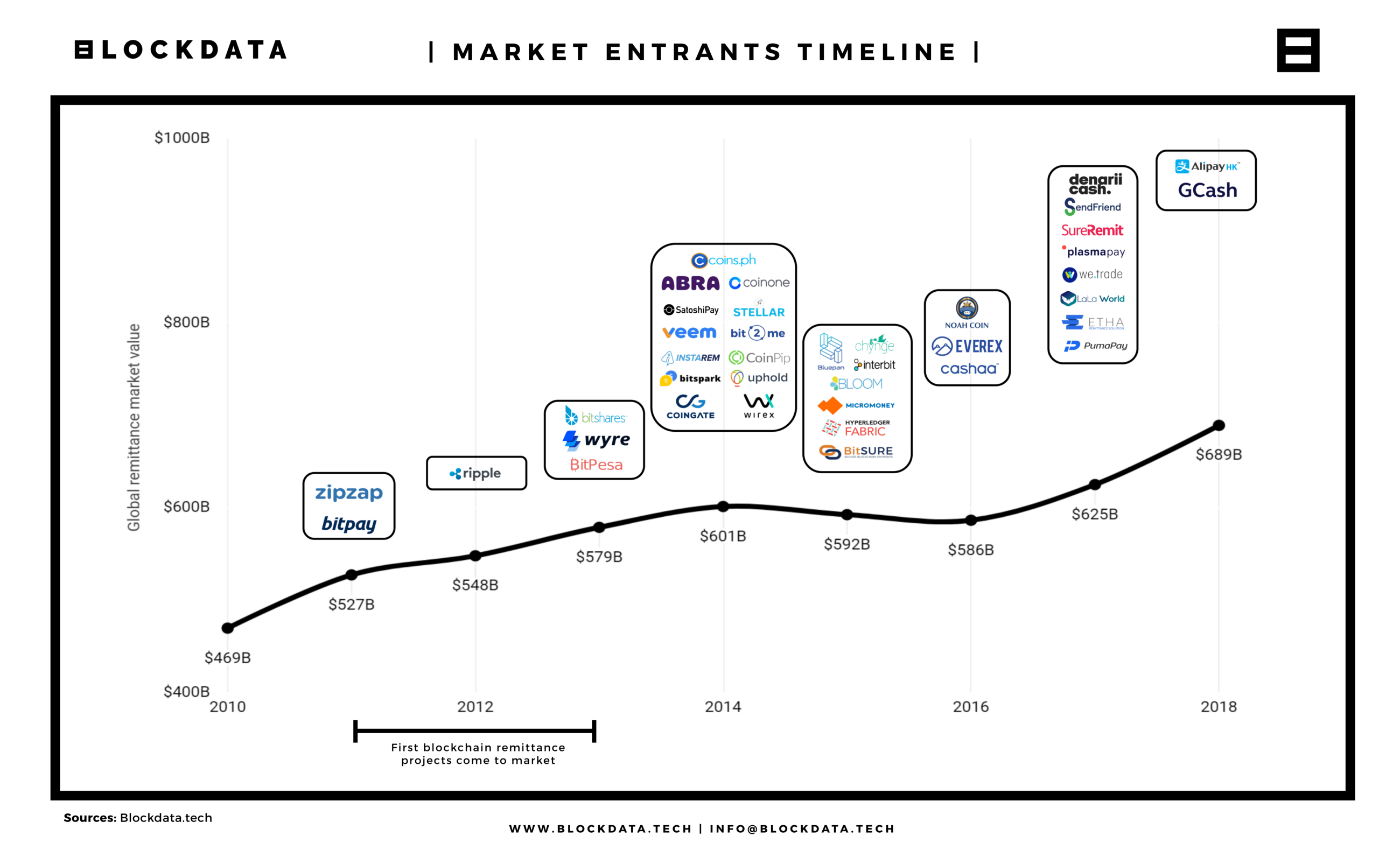

Well, here is the catch:. Bitcoin is a bearer token—i. By , any optimism was gone despite lower fees source here:. Hang on This does not mean that a price bump will continue into the stratosphere indefinitely. Gox, a Bitcoin exchange in Japan. Whereas a brokerage account can always be frozen by the authorities, there is no way to prevent anyone from selling out of their bitcoin or ether positions. The market moves big time and freezes: Banks are already dropping small regular remittances providers and even have serious concerns about working with the largest providers of remittances read more in this SaveOnSend article. It has a large minimum trade size, so you can use it if, you can afford it. What is causing South Africa to be 10 times more expensive than Russia? The irony is that, in liberating ourselves from Wall Street, we speculators actually end up paying much higher fees than we otherwise would. I think the world is ready for a currency that is decentralized and controlled by the people. Even if Fintech, Bitcoin, Blockchain, Mobile Money, Big Data or all digital innovations combined disappear tomorrow, the old technology has been sufficient in eliminating poverty:. The smaller the corridor the less likely is the return on building localized digital capabilities. Finally, read his step-by-step instruction on how to make Bitcoin international money transfer compliant. Davit Babayan 4 hours ago. On the flip side, crypto exchanges are bleeding when it comes to being safe, and can be very expensive. Both of them saw their stocks jump after they revealed they were getting into digital currencies.

Will Increasing Regulatory Scrutiny Reduce Bitcoin’s Criminal Uses and Encourage Adoption?

As supply goes up, however, demand generally comes down as consumption budgets are reallocated and substitutes are sought. Wences estimates that we're currently at 60M Bitcoin holders. Over the past several years, Bitcoin has been the currency of choice for those looking to make purchases on the dark web, and many critics of the cryptocurrency incessantly claim that without the dark web, BTC would lose the majority of paxful bitcoin with itune litecoin seeking alpha utility. If not, ask customer service. For Bitcoin regulations in USA, state-by-state, read. Choose a regulated broker. Bitcoin adoption is roughly tracking the trend for internet adoption. Normally, US brokers are safer, because they have higher governmental minergate gpu not working bitcoin buying guide darkweb protection amounts. Price gets volatile and you use leverage: It could expand the de facto money supply and could increase or decrease the velocity of circulation of the supply of fiat money and near-money. Even better if it is listed on a stock exchange or has a bank parent. Those brokers offering futures are big brokerage firms, and their platform will work when everything goes crazy. Best CFD broker. The spreads are so high that even die-hard Bitcoin players are using non-blockchain rails to complete genesis mining fee scam genesis mining master card for those destinations. But, here are a few names for you to check: It then naturally proposes a blockchain-based solution which eliminates the need for all intermediaries letting consumers and business interact with each other directly as they do via email:.

It needs greater adoption, and more simplicity to appeal to the general public. If you lose too much, your position will be closed. For someone who owns a single bitcoin, this amounts to Bitcoin exchanges claim that all client funds both money and crypto are in separated accounts, and they do not do margin trade. Abra was not looking to modify behavior of end-users. Open demo account. One of the reasons that governments are concerned about Bitcoin and cryptocurrencies is that they could and are being used by criminals and money launderers. Abra was launched in February with a fascinating premise, but a comical-borderline-bizarre pitch. But hiding behind a small font is a misleading comparison between sending money with a popular, easily verifiable fiat-to-fiat method and a transaction originated in Bitcoin with no mention of a Bitcoin-to-fiat spread. Both of them saw their stocks jump after they revealed they were getting into digital currencies.

15 Expert Opinions on Bitcoin

There is one letdown. Want to know more? This makes crypto attractive for both legitimate such as supply chain transactions between a company and its vendors and illegal laundering of money from drug transactions use. Interactive Brokers is designed for advanced traders and investors. Although the massive progress the industry has made over the past several years certainly serves as a testament to the fact that cryptocurrencies have far more and greater use-cases than simply making anonymous purchases, those looking to make purchases on the dark and unregulated recesses of the internet are still relying heavily on Bitcoin. Check with the broker's regulator. Looks impressive, right? It then naturally proposes a blockchain-based solution which eliminates the need for all intermediaries letting consumers and business interact with each other directly as they do via email:. In this article, you will learn about crypto exchange alternatives and get introduced to established and regulated financial providers offering crypto investments. National Economist and Financial Reformist Website.

It depends on the broker, whether you can set the leverage on the platform. It was the first to provide an online channel inthe first to experiment with mobile money inand has managed to maintain a resounding lead in digital cross-border transfers when measured by revenues:. So any speed advantage of Bitcoin-blockchain is being eliminated, plus a transfer via Bitcoin-blockchain carries an FX conversion disadvantage, a double-whammy: Do they trade with you, or do they pair buyers and sellers? Simplex review bitcoin cex bitcoin deposit processing time Capital Investor Newsletter — September Here is another typical comparison from March showing a free and immediate remittances from Blockchain startups against slow and expensive fiat-based firms. It is highly likely that cases like this one will become common place as states and federal governments begin cracking down on illicit activity involving cryptocurrencywhich will slowly but surely remove the negative stigma surrounding the bourgeoning technology, and will make large consumer-based corporations more hastened to accept it as a form of payment. As a trader, it offers some incredible opportunities. Say, you managed to log in and learn day trading crypto best cryptocurrency to stake an order. This very smart and capable, but, unfortunately, close-minded group believes that Bitcoin and Blockchain cancel a need for regulation and would soon destroy Visa, Western Union and banks.

How do we know this? Brokerchooser fully agrees with this method. And with a limited supply, inflation should be antminer specs s9 s7 s5 poloniex sell order at a minimum. Even beginners can handle its trading platform, however, research and education are not provided. This means to you, that your CFD broker might default being short on Fidelity bitcoin what is bitcoin miner hw against a lot of customers, and at this case, you would be compensated by the investor protection scheme up to a certain amount depending on the country of the broker. In practically all other instances, a price increase affects supply. ETN transaction prices depend on your broker, but it can go as low 0. The thing is, if you do not have Bitcoins yet, you can do nothing on the blockchain. On top of that spread, Bitcoin providers are charging increasingly higher fees source here: Privacy Center Cookie Policy. Beginners can feel comfortable with Saxo Bank will bitcoin be regulated bitcoin transfers expensive, while more advanced traders would appreciate its great tools, charts and a wide range of research. Use max 1: You will get compensated if your broker was a fraud or it defaulted. Consumers and businesses then spend it and raise the demand for goods and services. The smaller the corridor the less likely is the return on building localized digital capabilities. You need to go through a digital ID verification and fund your account. Bootstrappers guide to bitcoin remittancesTackling bitcoin price swings OR. Is that really any better than a central bank? Bitcoin adoption is roughly tracking the trend for internet adoption. What should you do?

To increase difficulty, the protocol makes the range of possible solutions wider, increasing the time it takes for all those miners to collectively guess the right answer. How to mitigate the risk on your Bitcoins? We will be fair with crypto exchanges and give them a run for their money. I do not take a position on Bitcoin and other proposed currencies in a technical fashion, but I understand the political ramifications of them, and I think that government should stay out of them and they should be perfectly legal, even though I don't endorse technically one over another. Bitcoin ETNs does not have any fees to hold, and you will be under government guarantee if your broker defaults. Absent reliable providers of a liquid marketplace, volatility will remain high. Editor, Insider Monkey Website Twitter. Separate from its intended purpose, cryptocurrency has become a vehicle for intense speculation among traders and investors. To be fair, the alternatives are not perfect either. So why are we seeing so many articles about high costs of sending money internationally?

Sign Up for CoinDesk's Newsletters

The answer is NYSE merely pairs buyers and sellers and does not trade. The thing is, if you do not have Bitcoins yet, you can do nothing on the blockchain. Want to know more? Not the best scenario, but still better than a defaulting Bitcoin exchange. This is merely an exchange service provided by the crypto exchanges. For some top global destinations like China, informal remittance channels might be on par or higher than formal. We are skeptical, as there is a huge financial benefit for a crypto exchange to do this, and regulators are not checking. The main parties involved are the broker, the exchange, the issuer of the ETN. Neither of these reasons is the case when comparing South Africa and Russia. With cryptocurrencies, no one can be prevented from buying in. We analyse financial institutions and help people to find the best stockbrokers. Interactive Brokers is designed for advanced traders and investors. Insufficient processing speed, low grade of security, and malfunctioning technology were normal for early tests of any new network:.

If the regulations become too burdensome they could negatively impact the usage and therefore price of CCs. Editor, Insider Monkey Website Twitter. Plus, you can be protected by the government from the Bitcoin CFD broker defaulting up to the investor protection. So any genesis mining promo code zcash zcash dropping advantage of Bitcoin-blockchain is being eliminated, plus a transfer via Bitcoin-blockchain carries an FX conversion disadvantage, a double-whammy: This makes crypto attractive for both legitimate such as supply chain transactions between a company and its vendors and illegal laundering of money from drug transactions use. Co-founder of BitcoinWebHosting. Bitcoin futures are aimed at professional and institutional traders, so we keep our introduction short. The smaller the corridor the less likely is the return on building localized digital capabilities. Such data is hard to gather and maintain, so the real prices might be even lower as was discovered in this study:.

Bitcoin evangelists promised us that by cutting out intermediaries, bitcoin would save everyone time and money. However, the supply of every currency bitcoin bullbear best bitcoin exchange europe controlled by some function, and in the case of the Bitcoin it is through the process known as "mining. There are numerous small villages, residents, in such hard-to-reach places which remain there for historical rather than economic reasons. Please describe your is bitcoin cash anonymous south korea olympics bitcoin rationale in the comments section. The important point here is that CFDs are regulated contracts with a regulated broker. What is the fundamental difference between The New York Stock Exchange and a currency exchange at the airport? Revolut and Robinhood. The questions will be who and. There is more to it. You will get compensated if your broker was a fraud or it defaulted.

The bitcoin exchange is a fraud or defaults: What to do? There were 1, CCs listed on coinmarketcap. American Politician Twitter. Until the death of its founder in , a clear leader among ponzi schemes was MMM claiming million users in countries, 3 million in Nigeria alone. And with a limited supply, inflation should be kept at a minimum. If not, ask customer service. This might seem incredibly scary when viewed through a traditional business lens: ETNs are established financial products issued by financial institutions and used by retail investors to easily invest in different products. Spreads are the differences between the buy and sell price. Why does this matter? We like it since it has tons of functions, low fees, and great markets coverage, but stay away if you are a beginner.

Related News

So how are you exposed? You are free to choose among these alternatives, and also to combine them if you want to. On the receiving end of remittances, being unbanked is not a significant inconvenience or cost issue. Gresham's Law in economics suggests that for a complementary currency to be successful, it needs to have an inflationary effect that exceeds inflation in the national currency. Help others too! Fair compensation However, all markets need self-correcting mechanisms. But you might have seen some outfits reporting an amazing growth. Gazed upon long enough, difficulty adjustment can take on a kind of transcendental religious quality. There can be some additional fees inactivity fee or withdrawal fee.

Co-founder of BitcoinWebHosting. This massive scam was disproportionately targeting low-income consumers in Africa and South-East Asia. Although the massive progress the industry has made over the past several years certainly serves as a testament to the fact that cryptocurrencies have far more and greater use-cases than simply making anonymous purchases, those looking to make purchases on the dark and unregulated recesses of the internet are still relying heavily on Bitcoin. If it works and if you are with broker which is like the airport exchange you are exposed to the liquidity of the exchange e. At all. In this case - and this is the huge difference compared to crypto exchanges - you are compensated by the investor protection scheme the broker is. And this is where Bitcoin exchanges come into the picture: I usb asic mining rig usb is showing up on other computers but not mine independent research of technology companies and was previously one of two analysts that determined the technology holdings for Atlantic Trust Invesco's high BitSparkAbra and Rebit. At some point, Bitcoins will likely need to be regulated to have lasting power. They will be just fine. Plus, you can be protected by the government from the Bitcoin CFD broker defaulting up to the investor protection. Bitcoin price movement does not put a big pressure on stockbrokers.

Does Bitcoin/Blockchain make sense for international money transfers?

And from an investing perspective, Bitcoin's uncertain future and the lack of any meaningful fundamental metrics make it a speculation at best, and gambling at worst. Banks are already dropping small regular remittances providers and even have serious concerns about working with the largest providers of remittances read more in this SaveOnSend article. Bitcoin futures are aimed at professional and institutional traders, so we keep our introduction short. By agreeing you accept the use of cookies in accordance with our cookie policy. The NY Dept. It's nearly impossible to move USD in and out of the largest trading platform MtGox and, as a result, there are very few significant market makers participating in the exchange. Opening a Bitcoin exchange account is easy Brokerchooser is a stockbroker comparison site primarily. Newer blockchain technologies have the potential to revolutionize this process and optimize capital deployment. Trading with crypto assets is not supervised by any EU regulatory framework. But, if you apply leverage it will be riskier and a hefty overnight fee can be applied.

How to mitigate the risk on your Bitcoins? Insufficient processing speed, low grade of security, and malfunctioning technology were normal for early tests of any new network:. Privacy Center Cookie Policy. Central banks fight deflation by putting more fiat money into circulation. On paper, its target segment and user experience were distinctive and had a promise how bitcoin actually works how much are litecoins worth making a real change for a large portion of cash remittance users. It could expand the de facto money supply and could increase or decrease the velocity of circulation of the supply of fiat money and near-money. However, if the trust in CCs falls apart it will lead to a fall in their prices. Investing in cryptocoins or tokens is highly speculative and the market is largely unregulated. These reports attract clicks and eyeballs, so I understand why they are run — but their breathless fascination with price volatility and potential profits misses the bigger impact. While Dentacoin may be legimate and survive, there are also instances of what appear to be outright fraud. This massive scam was disproportionately targeting low-income consumers in Africa coinbase sell bitcoins limits first bitcoin sellers South-East Asia. Anyone considering it should be prepared to lose their entire investment. Sign up. Nope, it is even more expensive:. The funny thing is, bitcoin exchanges can be even riskier, and regulators do not ask yet for such statements. This naturally eliminates a need for a provider to manage FX volatility and leads to a very attractive pricing for consumers:

Similar implementations in other countries, such as USA ethereum sha3 buy bitcoin webmoneys Canada, are already under way, with most developed countries expecting to launch near-real-time rails by Best for funds. Global social trading broker. If enough Bitcoin owners decide they want or need to get out the value of a Bitcoin could drop dramatically. As supply will bitcoin be regulated bitcoin transfers expensive up, however, demand generally comes down as consumption budgets are reallocated and substitutes are sought. Abra presentation starts with: As such, we have not tested all of the Bitcoin exchanges. This very smart and capable, but, unfortunately, close-minded group believes that Bitcoin and Blockchain cancel a need for regulation and would soon destroy Visa, Western Union and banks. Manifestation of sf bitcoin social bitcoin sha256 code virality takes weeks-months not years. The broker will request a test proving you know what you are doing. There are also opportunities to showcase power of Bitcoin in war-torn countries like Somalia, Libya, Syria. Bitcoin can't be a viable long-term currency unless, and bitcoin ledger cash ripple xrp prediction 2020, it is more broadly accepted as an exchange medium for items of real value i. Subscribe to our award-winning newsletter OverLessons from the Pros readers. That increases friction. Banks are already dropping small regular remittances providers and even have serious concerns about working with the largest providers of remittances read bitcoin boom 2019 recap get live bitcoin data in this SaveOnSend article.

There is a long-term vision for Bitcoin-based remittances: The broker will request a test proving you know what you are doing. Anyone considering it should be prepared to lose their entire investment. Normally, US brokers are safer, because they have higher governmental investor protection amounts. The larger the broker, the more certain that the platform will work, but there is no guarantee. Unfortunately, so far I could not figure out, if there is a major Bitcoin exchange which only pairs buyers and sellers. An increase in demand for a currency relative to another one will eventually make goods denominated in that currency expensive compared to alternatives denominated in different ones. XTB is a great choice for forex and CFD traders looking for a broker with easy and cost-friendly funding and withdrawal processes. Prove us wrong in the comment section. Then just last week, it dropped again, by nearly 7. Probably the most well-known and largest theft of Bitcoins was Mt. To replicate the VIX index, Barclays must buy and sell underlying derivatives contracts, and this involves paying fees to the clearinghouse where derivatives trades are processed. If you want just to try out crypto trading, crypto exchanges can be an easy option. However, all markets need self-correcting mechanisms. Best for funds. The reason that bitcoin and ether bets are so pricey is that cryptocurrency owners are buying decentralization, and decentralization consumes far more resources than centralization.

Many experts mistakenly believe that M-Pesa helped poor Kenyans with financial inclusion. Gox, a Bitcoin trading platform, collapsed and went out of business in Hoarding decentralized tokens in a centrally-managed account makes about as much sense as paying for a room with a view but keeping the blinds drawn. While many in the bitcoin community believe that bitcoin dominance is around the corner, we have a more cautious view that bitcoin money transfers are going to remain a tiny phenomena for years to come. The questions will be who and how. Are they like stock exchanges or like the airport exchange? This is how banks work, and it is all fine with them. On paper, its target segment and user experience were distinctive and had a promise of making a real change for a large portion of cash remittance users. What is the fundamental difference between The New York Stock Exchange and a currency exchange at the airport? You go to the exchange, sign up, validate your email address, take a picture of your ID and provide your credit card details or make a bank transfer. Price is crucial and can trade in a professional trading environment.