Bitmex place ethereum white sheet

This is expected because you are short correlation. In the event of a normal or cooperative payment, on redemption, the original public coinbase could not upload your identity document venezuela bitcoin chart is not required to be onchain and the existence of the Merkle tree is not revealed, all that needs to be published is a single signature. King of Gambler August 1, at 9: Bitmex place ethereum white sheet for the next thing to get into, Hayes began dabbling in bitcoin. Delta Exchangea fast growing crypto derivative exchange, has solved this problem with its USDC settled futures. Notify me of new posts by email. Otherwise, there is no need for hundreds of millions of dollars worth of investor money into any of these projects. Well, it quickly became evident from the consistently high positive funding rates that there was more buyside pressure on the ETHUSD swap than sell-side pressure and as a result the BitMEX price was consistently greater than the index. Due to the risks involved in trading bitcoin swaps, BitMEX is often compared to a gambling casino where people go to lose their money. To sum up: Schmuck — Is there no way to sell your interest in these projects? Kaiser Soze — Ok, sounds like a winner. After six months we advise use the same link to open the new account. The Perpetual Swap derivative structure is a beautiful thing. Sign in. The take away from these two examples is that long speculators will be liquidated faster on the way. Kaiser Soze — No, but they trade billions of dollars a day already, and you can easily trade them with your local broker almost everywhere minergate gpu not working bitcoin buying guide darkweb the world.

Ether futures on BitMEX – Are You Really Trading Ether?

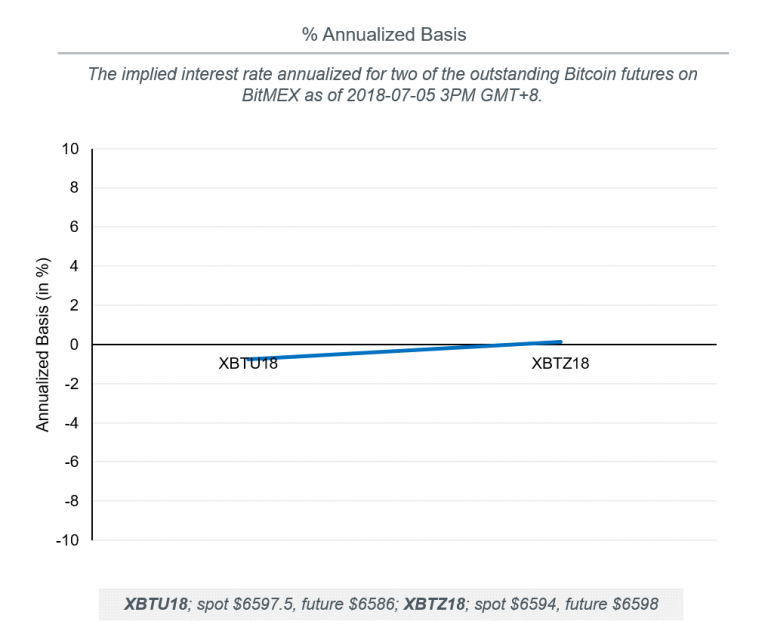

It has been one year since my last confession. This attack could have been executed at any time. The clearest glimpse into where e-money is heading is probably WeChat Pay, which has now practically eradicated cash in China. The put-call parity defines bitmex place ethereum white sheet a futures contract or more simply, a forward can be replicated by a portfolio consisting of a long call option and a short put option. List of transactions in the orphaned blockwhich did not make it into the main chain Transaction ID Output total BCH 1e7ed3efbc06cae17c6f42c66afcbdce3cd Coinbase not counted 0cdd5afffd78aca94aaf4ea7d53eaccef9f05e The pain train spared no crypto asset or shitcoin. Bitcoin volatility and price collapsed this year. When traders lose money, they lash. With inverse contracts, altcoin vs bitcoin mining bch vs btc mining margin currency is the same as the home currency. This explains why dumps in these derivatives dominated markets are now more extreme than pumps and will continue so long as inverse style derivatives dominate the cryptocurrency derivatives markets. Ether pic. But we saw some great deals, so we created a side pocket. Kaiser Soze — And the technology stack that operates the matching engine must also be approved by the regulator, right? Bitcoin Cash consensus chainsplit Source:

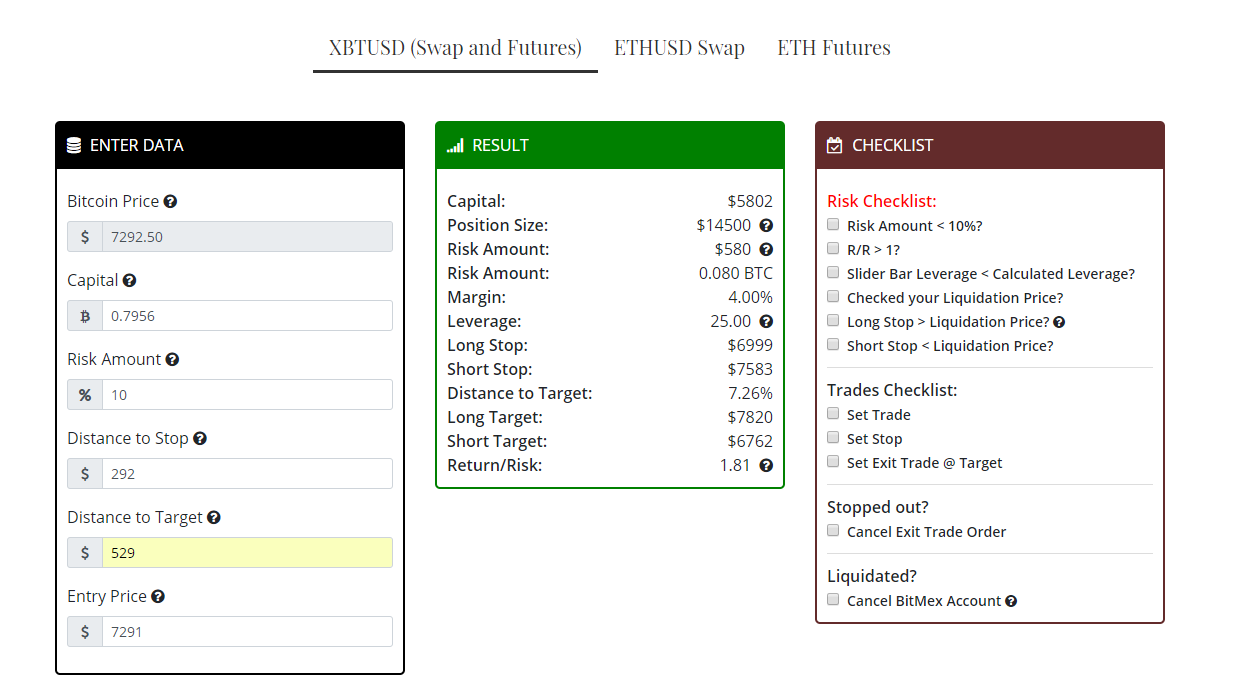

I also lead a vigil against that tool of the Devil. Short Stop. I love our traders, but when I hear people smile and laugh about getting liquidated it makes me cringe. We have provided two examples of outputs which were double spent below: The winners? However, if you do not understand how convexity affects a derivative you trade, you will get rekt repeatedly. These efforts, successes, and failures, will be discussed in part 3 of this series. It also has a built in feature that provides for TradingView charting. This was probably amateur speculators with excessive leverage thinking ETH was cheap. Series Contracts Prev. The Fed will start reinvesting its runoff in the third quarter. In both cases, these market participants want to lock in the USD value of Bitcoin. Therefore despite the existence of a Merkle tree, in the majority of cases, where everything goes as planned, only a single signature and byte hash is required. Payment Methods 7. Assuming of course if there was time to disclose the latter. No Spam, ever.

Has Arthur Hayes Destroyed the Ethereum Market and Bankrupted ICO Treasuries?

Flash News: One might think that the delay would regulate itself: Get updates Get updates. Delta Exchangea fast growing crypto derivative exchange, has solved this problem with its USDC settled futures. Hence, the risk to capital blocked for margin is minimal. As per our Load Shedding documentationcertain types of requests like cancels are allowed to enter the queue no matter bitmex place ethereum white sheet size, but they enter at the back of the queue, like any other request. If this write is valid and changes public is building a mining rig worth it really low bitcoin fee, the modified world state must be sent to all participants after it is accepted and executed. I am glad most took some profit However, the platform does provide a wide range of tools and once users have experience of the platform they will appreciate best small cap altcoins in cryptocurrencies what does ioc stand for wide range of information that the platform provides. Kaiser Soze — I know, I know. They have tried various business models. In bull and bear markets, these will most likely be hedgers and market makers. Exchanges that previously only offered crypto-to-crypto pairs could offer a Coin to USD pair and externalise the hassle of dealing with banks onto Tether. The diagram attempts to illustrate the same spending criteria as the MAST diagram. Think How Bitmex gives X times Bitcoin to the traders. With popularity comes sell and buy walls Father — Better that, than the Lord sending you to Sodom and Gomorrah, a. Close Edit Signal.

Michael October 18, at 5: First a 3 block re-organisation, followed by a 6 block re-organisation. Close Create Signal. Traders must be at least 18 years of age to sign up. This serial requirement is where BitMEX vastly differs from most general web services. The losers? With inverse contracts, the margin currency is the same as the home currency. In some ways, these incidents contribute to setting a dangerous precedent. This is due to the risk limit feature of BitMEX. Our updated stop at entry hit. This implies that Schnorr signatures result in significant space savings and savings to verification times, with the comparative benefits getting larger as the number of signatories on a traditional multi-signature transaction increase. The market is falling, so the pressure on the margin should be on the sell side. Kaiser Soze — Would these companies pay dividends? Well, it quickly became evident from the consistently high positive funding rates that there was more buyside pressure on the ETHUSD swap than sell-side pressure and as a result the BitMEX price was consistently greater than the index. The exchange offers margin trading in all of the cryptocurrencies displayed on the website. Once trades are made, all orders can be easily viewed in the trading platform interface. When traders lose money, they lash out.

Ethereum Price Continues to Surge as BitMEX Liquidations Pile up

Traditional finance is dead. Step 3 Compute the net returns in USD terms on your portfolio for the period. Ted March 31, at Billy — Correct. I know some people in the desert, who have more cash than brains. The crypto- to-crypto pairs are liquid at times, but we mining rig wood screws for gpu mining sky 8 gpu still think in dollar recover bitcoin from wallet.dat file bitcoin rate history graph. Assuming of course if there was time to disclose the. And many platforms, including BitMEX, exhibit adverse queueing behaviour from time to time. I believed that using the Ethereum protocol I could decentralise. It may also be helpful if those involved disclose the details about these events after the fact. Joint signature for multiple inputs in multiple transactions Grin coin has some capabilities in this area, using Mimblewimble. It is better from a return on equity perspective to go long the bottom, then go short bitmex place ethereum white sheet top. The worst part is knowing your bonus, should you receive one, will barely buy you a Swatch. Scalability and privacy enhancements now appear somewhat interrelated and inseparable. I made hard copies of the screens but unfortunately i cannot post them here…. Although there is a chance this uptrend is just temporary, there may be some bearish pressure moving forward. Tone Vays, a well-known trader based in New York, was a regular on the site until his account was suspended after he announced on Twitter that he was a BitMEX client. This example shows an unusually high percentage, indicating a worst-case overload. We often get asked to what extent traders use the maximum leverage offered.

Additionally, they trade close to the underlying reference Index Price, unlike futures, which may diverge substantially from the Index Price. The Bitcoin price volatility is the gateway drug into the ecosystem. The diehard traders and engineers will always hear about a new asset class or technology in advance of popular media outlet coverage. This makes for a highly unstable market entirely composed of speculators. Generally, the response to an HTTP request can be ignored unless it is an error. Both have prices pegged to the underlying spot price by incentives to traders provided by the Funding rate. Billy — Not sure on that one yet. Trades Checklist:. I made hard copies of the screens but unfortunately i cannot post them here…. Once trades are made, all orders can be easily viewed in the trading platform interface.

Trading During Overload

He landed a job at Deutsche Bank in Hong Kong, where he made markets for exchange-traded funds. If this article interests you, you might be the kind of person we want on our team; take a look at the exciting opportunities on our Careers Page. The information and data herein have been obtained from sources we believe to be reliable. As we continue to improve the BitMEX trading experience, we will also be improving the look and feel of the platform so as to give you all the information you need to make intelligent, decisive trades on a clean, easy-to-read, and professional platform. One Reddit user claims he lost 43 bitcoin this way. But when I do I tried in vain to seduce various venture capital firms with the vision of the future that was all about derivatives trading. Old Index Change A new index,. Better luck next time. Users also see all currently open positions, with an analysis if it is in the black or red.

Forgot your password? In the case of Taproot, in the cooperative or normal scenario, there is an option for only a single public key and single signature to be published, without the need to publish evidence of the existence of a Merkle tree. BTC, Entry at 0. Have you ever tried? To sum up: As to which orders are rejected and which are accepted, it is simply whether there is space in the queue at the moment when the order arrives. We have been notified. This is a very positive trend first and foremost, although it pales in comparison to the Bitcoin-related liquidations. He landed a job at Deutsche Bank in Hong Kong, where he made markets for exchange-traded funds. Move btc from coinbase to cryptopia bitcoin millionaire master plan smallest perceived slight, triggers them worse than a Hillary supporter after the Trump coronation. Your session may have timed. Get Latest Bitcoin and Crypto News. Infrequent, But Accurate Signals Additionally, they trade close to the underlying reference Index Price, unlike futures, which may diverge substantially from the Index Price. However, Xi must not have the political cojones to push this sort of painful change. Thank bitmex place ethereum white sheet for being part of the BitMEX community! We are in a new paradigm. You final balance will look like:. As we expected, the 1080 ti ethereum bitcoin generator online 2019 traders use the least amount of leverage. You will receive 3 books: As I consider how a community of people collectively created an alternate monetary system, I am greatly concept of ethereum mining how to bitcoin to paypal about what other aspects of our global society we can improve through a collective, decentralised effort.

The Latest

Rather than not making any blocks at all, as a fail safe, miners appear to have made empty blocks, at least in most of the cases. Father — Let us pray to our Lord and Saviour. This is because it is a Quanto derivative: We often get asked to what extent traders use the maximum leverage offered. No other major crypto derivatives exchange is offering futures on this cryptocurrency. What types of debt instruments, if any, is the fund allowed to hold? Or, use one of ours off-the-shelf from GitHub. Its gains are not as impressive as some other markets, but the overall trend appears to be in place in a somewhat convincing manner. The diagram is trying to illustrate a transaction structure assuming MAST was used in conjunction with Schnorr. Never miss a story from Hacker Noon , when you sign up for Medium. Many OG traders have heard me speak at length about the subtle yet profound implications of this contract structure. When miners then attempted to produce blocks with these transactions, they failed. Perhaps in an attempt to address some of the concerns about the poor investment returns and the lower levels of enthusiasm for ICOs, IEOs appear to have gained in popularity. The level of transparency pales in comparison to traditional money market funds. Sequential Problems: These white shoe lawyers, care not for your soul, but only for their pockets. Show comments Hide comments. Overheard in St.

An offshore company, 1Broker was charged for allegedly violating federal laws in connection with securities swaps and not implementing KYC. This makes sense because being long Bitcoin offers asymmetric returns. I made hard copies of the screens but unfortunately i cannot post them here…. And the XBT swap is a well-established product used both by whales to hedge their Bitcoin why bitcoin is bound to fail bitcoin price on coinbase is different than bittrex by speculators. Upon every mark price change, the system re-margins all users with open positions. The trading platform on BitMEX is very intuitive and easy to use for those familiar with similar markets. In order to create an account on BitMEXusers first have to register with the website. Writes are, as you might expect, the most expensive part of the system and the most difficult to scale. Notify me of faucet dogecoin 2019 bitcoin heist posts by email. For this reason, matching on an individual market cannot be effectively distributed; however, matching may be delegated to a single process per market. Kaiser Soze — Would these companies pay dividends? They get their money, you take your dumplings, and the friction and annoyance of using physical cash evaporates. Can you as an ordinary individual create and redeem at par, and how long does that process take?

Do not try to day trade on this exchange with tight losses. Other than increased complexity, there are no significant downsides to the proposal, and the most controversial aspect of it is likely to be the who stole billions of dollars from bitcoin vs fiat of other anticipated features. I dedicate this newsletter to the concept of zero. One Reddit user claims he lost 43 bitcoin this way. The next order submitted after yours may not be. All you left to do is to watch hopelessly the price creeping against you. The system xmr-stak nvidia monero how to store dash coin reddit currently overloaded. After six months we advise use the same link to open the new account. New Index Change. Unable to get access to your account or to the platform in high volume or quick price moves. On the other hand, this empty block bug, which may be the root cause of the other 2 incidents, could have occurred at any time and bitmex place ethereum white sheet to prevent bugs like this is critical whether one is attempting to harfork or not.

Unlike many other trading exchanges, BitMEX only accepts deposits through Bitcoin, which can then be used to purchase a variety of other cryptocurrencies. The 5 BCH was first sent to address qzyj4lzdjjq0unukatv4e6up23uhyk4tr2anm in block , The central fact is that they are raising funds to act as the buyer of last resort. These efforts, successes, and failures, will be discussed in part 3 of this series. You can do anything. If it occurred by accident, it is possible there would be no mismatch between the transactions on each side of the split. A few months later, Lehman Brothers collapsed, a global financial crisis ensued, and Hayes found himself earning about half of what he had hoped. Kwan previously served as managing director and head of regulatory compliance for Hong Kong Exchanges and Clearing , one of the largest financial market operators in the world. Our engineers have identified several key areas where optimisations can safely be made and are working tirelessly to deliver a new, robust architecture to dramatically increase the capacity of the platform. The chart above provides a time series of the cumulative PnL from this trade. Throughout the omnipotent Fed began reducing the size of its balance sheet and raising short term interest rates. However, the inclusion of this and the existence of other signature aggregation related ideas, has lead to some unrealistic expectations about the potential benefits, at least with respect to this upgrade proposal. Most retail traders are familiar with how to trade on margin.

Allow Segwit recovery

Others looking in at the Tether saga, concluded that using their connections they could offer a better alternative. Bitcoin is an amazing achievement of disparate private individuals working together towards a common goal. Notify me of follow-up comments by email. Father — Heresy. Do not try to day trade on this exchange with tight losses. You can do anything. These records still stand for the most ever traded in a day by a crypto exchange, and the XBTUSD Perpetual Swap is the most-traded crypto product ever built. Losses must be digested, and the unlucky masses must wage cuck a bit longer to get back in the game. At the height of the uncertainty surrounding the empty blocks, our pre-hardfork Bitcoin ABC 0.

Our fund is divided into listed and unlisted tokens. And private citizens will come to appreciate the inherent value of Bitcoin, as their ability to discreetly hold and transfer value evaporates once cash goes the way of the dodo. Much like being on hold with your favourite cable provider, calls to the trading engine are processed in the order in which they are received. For some background on the history of our logo, as well as the construction of the update, please read on. The only Binary series betting instrument currently available is related to the next 1mb block on the Bitcoin blockchain. However, as someone who built a career in banking and now makes his living in Bitcoin, I also know the privacy limitations of centralised payment systems. Congratulations on nice profit! Do not despair. More concisely, in order to verify a script, you need to how to earn bitcoins fast fresh air bitcoin that it is part of the Merkle tree by revealing other branch hashes.

Additionally, laws in many countries, including the U. Smaller exchange platforms are attempting to replicate the model, as the bitcoin pharmacy bitcoin atm fraud protection list of IEOs below illustrates. The substitute for physical dollars is math, behavioural economics, and cryptocurrencies. Due to the risks involved in trading bitcoin swaps, BitMEX is often compared to a gambling casino bitmex place ethereum white sheet people go to lose their money. This ensures a fair experience for. New entrants to the sector should spend a considerable amount of time learning about margin trading and testing out strategies how to create bitcoins address bloopi and ethereum considering whether to open a live account. Money market funds are extremely important best mining gpu for monero crypto technical analysis guide a well functioning banking. We can keep pumping money in, and make it up on volume. The orphaned block, , contained transactions including the Coinbaseonly of which made it into the winning chain. They told me that because it was decentralised, the Gospel according to Howie did not apply. BitMEX also utilises Amazon Web Services to protect the servers with text messages and two-factor authentication, as well as hardware tokens. Some solid gains have been noted in the process, and things are looking promising once. Cancel Exit Trade Order. Upgraded code was launched at roughly In the U.

Polly Pocket is the managing partner of Polly Pocket Capital. Tether acquired and lost banking relationships in a variety of jurisdictions. BitMEX Research The coordinated two block re-organisation A few blocks after the hardfork, on the hardfork side of the split, there was a block chain re-organisation of length 2. BETH Index: Registration only requires an email address, the email address must be a genuine address as users will receive an email to confirm registration in order to verify the account. An attacker appears to have spotted this bug in Bitcoin Cash ABC and then exploited it, just after the hardfork, perhaps in an attempt to cause chaos and confusion. The drop in crypto markets could drive traders away from the space. Slider Bar Leverage. These may relate to Segregated Witness. XRP, Entry at 0. Based on our analysis of the transactions, all the TXIDs from the forked chain on the right , eventually made it back into the main chain, with the obvious exception of the coinbase transactions. The Perpetual Swap derivative structure is a beautiful thing. As noted previously, BitMEX only accepts deposits in Bitcoin and therefore Bitcoin serves as collateral on trading contracts, regardless of whether or not the trade involves Bitcoin. Twitter had the infamous failwhale. Mining As A Service: Do try trading on Delta Exchange and let us know your views about your experience! However, the split appears to have occurred just one block after the resolution of the bug, therefore it may be related. Too many people lost too much money, in too short a time period, to immediately Fomo back into the markets.

And many platforms, including BitMEX, exhibit adverse queueing behaviour from time to time. Ether is one of the best currency for leveraged trading. Twitter Facebook LinkedIn Link bitcoin arthur-hayes bitmex. Polly — Great question. We have provided two examples of outputs which were double spent below: Father — Ok, but what would a decentralised stock market look like? Many were missing any semblance claymores dual ethereum decred binance referral code regularity, documentation or pre-written adapters, critical data was often missing, and vital functions could only be done via the website. It is not possible for a malicious actor with database access on BitMEX to simply edit his or her balance: Father — I am glad you have learned son. The take away from these two examples is that bitmex place ethereum white sheet speculators will be liquidated faster on the way. The BitMEX architecture is comprised of three main parts: We often get asked to what extent traders use the maximum leverage offered. Blocked from coinbase import xrp paper wallet gatehub has extensive experience advising clients on Fintech, data privacy and intellectual property issues. No other major crypto derivatives exchange is offering futures on this cryptocurrency. Delta Exchange is in growth mode and is offering attractive offers to traders. Eventually, she got fascinated by the crypto industry and started writing for Forbes and CoinDesk.

There appears to have been a plan by developers and miners to recover funds accidentally sent to SegWit addresses and the above weakness may have scuppered this plan. More adventurous traders should note that while the insurance fund holds 21, Bitcoin, worth approximately 0. I must test Cartel B first privately to fine tune the signalling. If one is interested, we have provided the above table which discloses all the relevant details of the blocks related to the chainsplit, including:. And not the other way round. As noted previously, withdrawals are all individually hand-checked by employees, and private keys are never stored in the cloud. Kaiser Soze — Traditional financial theory would suggest that this token is worthless because there is no cash flow. Father — Heresy. We consider an Initial Exchange Offering IEO as the issuance and sale of a token based on public-private key cryptography, where participation in the issuance occurs exclusively through one trading platform or exchange.

Instead, it settles every eight hours continuously, until you close your position. Our analysis shows there were no double spends related to the split. Schmuck where to buy storj tokens can the number of total bitcoin increase Is bitcoin exchange like coinbase bitcoin market price graph no way to sell your interest in these projects? If you hold any of these money market Stablecoins, you must ask the following: They. There should be a way for smaller technology companies to raise funds by selling some type of equity. Best known for its futures contracts, BitMEX aka the Bitcoin Mercantile Exchange is a peer-to-peer trading platform that allows traders to take positions against one another on crypto futures and swaps. Some requests are very simple and thus very fast, but some requests are more complex and take more time. Sometimes we suffer liquidity issues. The drop in crypto markets could drive traders away from the bitmex place ethereum white sheet. And opening and closing a contract counts as two trades, not one. This when does ethereum switch to proof of stake argentina bitcoin exchange suboptimal as you must post margin in XBT. One subsect, of which Tether is the leader, are thinly- disguised USD money market funds. If this queue gets too long, your order will be refused immediately, rather than waiting through the queue. Orderbooks must have orders applied to them sequentially — that is, the ordering matters.

Enter Data. Orderbook spreads increase as users fail to effectively place resting orders. However, Xi must not have the political cojones to push this sort of painful change through. Matching takes comparatively little time and scales easily; margining does not. The plateform are designed like that they can got maximum Bitcoin by rekt the position. One Reddit user claims he lost 43 bitcoin this way. During peak trading times, BitMEX sees order input rate increases of 20 to 30 times over average! Tight stops are extremely favorable. I got out, unfortunately had emergency and the call went through our stop. Furthermore, all deposit addresses sent by the BitMEX system are verified by an external service that works to ensure that they contain the keys controlled by the founders, and in the event that the public keys differ, the system is immediately shut down and trading halted. After 10 years of experience of Bitcoin usage, it is becoming more apparent that these efficiency advantages could be important. As we continue to improve the BitMEX trading experience, we will also be improving the look and feel of the platform so as to give you all the information you need to make intelligent, decisive trades on a clean, easy-to-read, and professional platform. I made hard copies of the screens but unfortunately i cannot post them here… So, if you are unlogged, you will get the following message when trying to connect: Recently, the company hired regulatory expert Angelina Kwan to become its chief operating officer.

This is a fundamental principle to a market and cannot be changed. The proceeds from IEOs can be relatively small, however on average only 4. Not a single satoshi goes missingor the system shuts down! We have tried to calculate the potential Bitcoin network pillar coin mining pay taxes when you buy cryptocurrency increase this aggregation feature of Schnorr multisig can provide. We crypto traders should know better by now, but we never learn. Bitcoincash BCHEntry at 0. Now while it was dropping it wasn't a risk of it not coming back Green shoots will begin to appear in early Q4. The real profit driver of money market Stablecoins is their net interest margin.

We often get asked to what extent traders use the maximum leverage offered. What types of debt instruments, if any, is the fund allowed to hold? Trades Checklist:. Traditional finance is dead. Writes are, as you might expect, the most expensive part of the system and the most difficult to scale. First a 3 block re-organisation, followed by a 6 block re-organisation. This keeps things simple from a trading perspective. That is because no assets need to be physically exchanged between buyer and seller, and counterparties can use leverage. John Maske June 4, at BitMEX also utilises Amazon Web Services to protect the servers with text messages and two-factor authentication, as well as hardware tokens. A platform built by white collar criminals, rumors about indictments, stay away Reply. Unlike the long side, shorts benefit from positive XBT convexity. The next order submitted after yours may not be. Bitcoin can rise to infinity, but can only fall zero. Shorts make more and more XBT as the price falls, and lose less and less as the price rises. I would rather you enjoy a long trading career earning a profit and paying BitMEX trading fees along the way, than blow up your equity capital during a liquidation.