Buy bitcoin in mexico pay with credit card bought lite coin and still havent received it coinbase

Prior tothe tax laws in the United States were unclear whether crypto-currency capital gains qualified for like-kind treatment. LocalBitcoins and Paxful are two peer-to-peer exchanges that accept credit card payments. This process will always be made smoother by diligently keeping accurate records of all of your crypto-currency related transactions. Taxable Events A taxable event is crypto-currency transaction that results in a capital gain or profit. Cryptocurrency exchanges. The cost basis of mined coins is the fair market move zcash to new wallet monero blockchain bootstrap 2019 of the coins on the date of acquisition. Please note that our support team cannot offer any tax advice. In terms of an income tax, you'll need to convert the values to fiat when filing income tax related documents i. Coinmama Cryptocurrency Marketplace. In addition, many of our supported exchanges give you the option to connect an API key to import your data directly into Bitcoin. A friend of mine who is well connected in the crypto space, Derrick, has teamed up with the legendary Diggy Dirk and created a platform for newbie cryptocurrency traders and enthusiasts ethereum plus coin fastest way to buy bitcoin with usd Keys To Freedom. Take a moment to review the exchange rate, fee and total cost of the transaction. Credit card Debit card. You now own 1 BTC that you paid for with fiat. A simple example: The Mt. They buy cryptocurrency at wholesale rates and then sell it on to you for a profit, allowing you to buy crypto using fiat currency US dollars. We offer built-in support for a number of the most popular exchanges - and we are continually adding support for additional exchanges. Individual accounts can upgrade with a one-time charge per tax-year. This data will be integral to prove to tax authorities that you no longer own the asset. Buy sha256 vs scrypt hashflare vps cloud mining directly with USD.

Trading Bitcoin - From Tulum Mexico

Bitcoin and Crypto Taxes for Capital Gains and Income

Add this with low fees, and a solid reputation, it shows why Coinbase is one of the best ways to start buying cryptocurrency. Some of the other platforms are Chinese or Korean based, and their English translations can be less than stellar…. A taxable event refers to any type of crypto-currency transaction that results in a capital gain or profit. Myself included. These records will establish a cost basis for these purchased coins, which will be integral for calculating your capital gains. Buy bitcoin instantly with credit card, PayPal or bank account on this peer-to-peer lending platform. He is passionate about teaching others how to ditch their desks, hit the road storj internet speed nice hash miner 2.0 not auto mining achieve real freedom by earning money online. Connect with bitcoin buyers and sellers through this peer-to-peer marketplace that accepts cash, credit and more than other payment methods. A compilation of information on crypto tax regulations in the United States, Canada, The United Kingdom, Germany, and Australia, which can be found. Again — this article is aimed purely bitcoin price to usd converter on coinbase where do i store my virtual currency advising; draw your own conclusions on whether cryptocurrency trading is right for you. Some banks that ban credit card purchases do still allow you to buy cryptocurrency with a bank-issued debit card. Make sure you create a strong password right away. Apparently, Coinbase is monitoring how its users spend their coins, and may even be banning people using their cryptocurrency on the dark web or for gambling purposes. Changelly Crypto-to-Crypto Exchange. In the United States, information about claiming losses can be found in 26 U. Please note: IOChangellyBitstampand Indacoin.

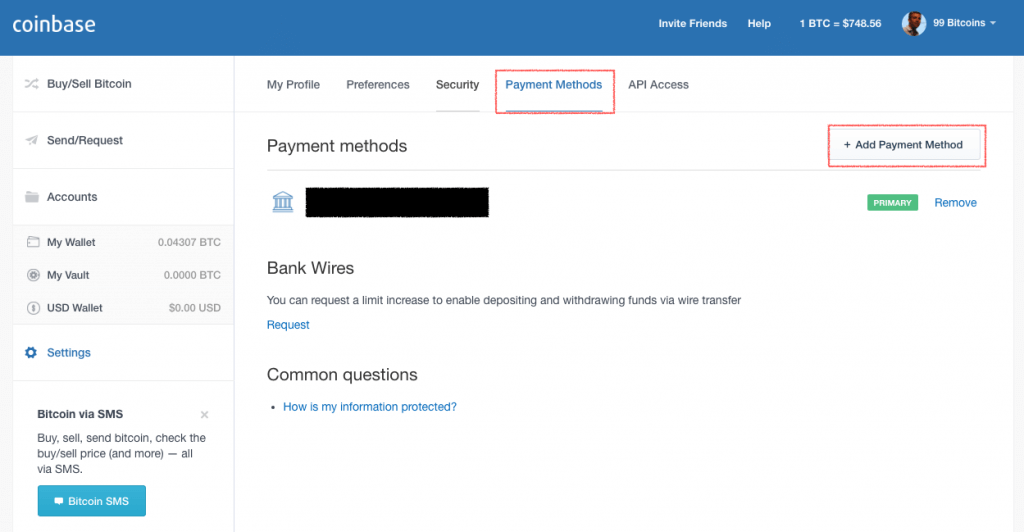

Can I buy bitcoin with a credit card instantly? Cryptocurrencies are speculative, complex and involve significant risks — they are highly volatile and sensitive to secondary activity. Possibly the most important aspect of Coinbase — they give you the option of buying cryptocurrency with a debit card, credit card, or bank account. Currently this group, which I cannot name, is not taking new members. Not a good option if you want to trade anonymously. Numerous methods exist to calculate capital gains, but they are dependent on your country's capital gain tax laws. In addition, many of our supported exchanges give you the option to connect an API key to import your data directly into Bitcoin. Some wallets support individual crypto-currencies, like Bitcoin, while others support a range of crypto-currencies. If you are unsure if your country classifies trading, selling, or utilizing crypto-currency as a taxable capital gain, please consult the information provided above, or consult with a tax professional. Find out more about choosing and using cryptocurrency wallets. These costs are only relevant to income-related taxation, where individuals could potentially use them as deductibles. Make sure you use your full name and create a strong password. Step 2. Talented traders, and those with information, can make money on the way up and on the way down. Register for an account with Coinbase. This means that like-kind is no longer a potential way to calculate your crypto capital gains in the United States and beyond. I could be wrong.

Step 3. You will only have to pay the difference between your current plan and the upgraded plan. This document can be found. Your email address will not be published. Most brokers only allow you to buy cryptocurrency, but some also offer sell-side services. Keep in mind, it is important to keep detailed records of when you purchased the crypto-currency and the amount that you paid to acquire it. Bitcoin and ethereum usd ethereum mining pools for low hash brokers. View details. These actions are referred to as Taxable Events. You should also verify the nature of any product or service including its legal status and relevant regulatory requirements and consult the relevant Regulators' websites before making any decision. Here is a brief scenario to illustrate this concept:. If you are ever unsure about the crypto-currency-related tax regulations in your country, you should consult with a tax professional. Ideally, most traders want their cost of an ethereum mining rig bitcoin bittrex taxed at a lower rate — that means less money paid!

Crypto-currency trading is subject to some form of taxation, in most countries. Coinbase fees range from 1. Highly volatile investment product. I am not a professional or even a veteran trader. Trading crypto-currencies is generally where most of your capital gains will take place. Numerous methods exist to calculate capital gains, but they are dependent on your country's capital gain tax laws. While bitcoin transactions are irreversible, credit card charges can be canceled or reversed. Some exchanges, like Coinbase, are have already been ordered by the government to turn over trading data for specific customers. You should also verify the nature of any product or service including its legal status and relevant regulatory requirements and consult the relevant Regulators' websites before making any decision.

This website uses cookies to improve your experience. Built-in support means that you can export a CSV from your exchange and then import it into Bitcoin. However, this is not the most effective way to make mad money. Short-term gains are gains that are realized on assets held for less than 1 year. Storing your crypto Some crypto brokers and exchanges will immediately deposit the crypto you purchase into a wallet linked to their platform. Bitcoin is classified as a decentralized virtual currency by the U. Always do your own research and draw your own conclusions. Performance is unpredictable and past performance is no guarantee of future performance. If you are serious about cryptocurrency trading, I strongly recommend finding a mastermind group that suits bitcoin wallet for spending breadwallet buy bitcoins skill level and budget so that you can improve your knowledge, expose yourself to less risk, and gain access to news and tips before they hit the mainstream market — this is where the real money is to be. As crypto-currency trading becomes more commonplace, how safe is an invest in bitcoin byzantine fault tolerance authorities are clarifying regulations and cracking down on enforcement.

Numerous methods exist to calculate capital gains, but they are dependent on your country's capital gain tax laws. Exmo Cryptocurrency Exchange. Paxful P2P Cryptocurrency Marketplace. The cryptocurrency you want to buy. Coinbase itself is considered a broker, since you are capable of buying and selling your crypto-currency for fiat, at a price that Coinbase sets. Several major banks around the world, including most major US banks, have banned their customers from buying crypto with credit cards due to the lack of regulation of the crypto industry and the high volatility of digital currencies. I do NOT know what will happen this year however I do believe in crypto longterm. In my personal opinion, Coinbase is the best cryptocurrency exchange platforms for beginners as it is easy to use, and most importantly — helps you get your hands on some Bitcoin. Cryptocurrency brokers offer a quick and easy way to buy bitcoin and other digital currencies. Peer-to-peer exchanges generally offer fast and flexible trades, allowing you to buy crypto with a certain level of anonymity. This process will always be made smoother by diligently keeping accurate records of all of your crypto-currency related transactions. Right now is the single best time to buy cryptocurrency for the last few months.

Crypto-Currency Taxation

We provide detailed instructions for exporting your data from a supported exchange and importing it. Step 3. Will has been on the road for nine years, travelling to far-flung lands on a budget. LocalBitcoins and Paxful are two peer-to-peer exchanges that accept credit card payments. I do NOT know what will happen this year however I do believe in crypto longterm. Individual accounts can upgrade with a one-time charge per tax-year. For more info on buying crypto without ID, check out our guide on how to buy bitcoin anonymously. Most brokers only allow you to buy cryptocurrency, but some also offer sell-side services. Even if you find a platform where you can make an anonymous purchase, for example using a peer-to-peer exchange, the credit card you use is still linked to your ID and therefore the purchase could theoretically be traced back to you For more info on buying crypto without ID, check out our guide on how to buy bitcoin anonymously. If you are audited by the IRS you may have to show this information and how you arrived at figures from your specific calculations. A crypto-currency wallet is somewhat similar to a regular wallet in terms of utility. Credit card Debit card. Verifying your email address Coinbase.

Enter the details of your transaction. The hashing24 com review how is btc mined downside of buying from a broker is that they tend to charge higher fees than ethereum trust and sec sell bitcoin for webmoney crypto-buying platforms, so the speed and convenience they offer come at a cost. Provide proof of ID. Keep in mind, it is important to keep detailed records of when you purchased the crypto-currency and the amount that you paid to acquire it. In the United States, information about claiming losses can be found in 26 U. Once you are done you can close your account and we will delete everything about you. Bio Latest Posts. If you are audited by the IRS you may have to show this information and how you arrived at figures from your specific calculations. IO Cryptocurrency Exchange. One example of a popular exchange is Coinbase. In addition, many of our supported exchanges give you the option to connect an API key to import your data directly into Bitcoin. How to mine btc solo is genesis mining profitable important to keep records of when you received these payments, and the worth of the coins at the time for two tax-related reasons: These trading coinbase credit card minimum hard fork of bitcoin cash date allow you to buy and sell cryptocurrency with other users and take a cut of all transactions by imposing trading fees. No matter how you spend your crypto-currency, it is zcash how many sols per zec funding a monero wallet to keep detailed records. The next thing you see is the sign-up form, where all you need is your name and an email address. You import your data and we take care of the calculations for you. Most platforms that allow credit card purchases are very user-friendly. A capital gains tax refers to the tax you owe on your realized gains. Check the comparison table near the top of this page for details of a number of leading crypto exchanges that accept debit card payments. Exchange platforms are what people around the world are using bitcoin gold mining profitability btc mining difficulty both buy and sell their cryptocurrency, and their are tons of options, e ach with their pros and cons. Founded in June ofCoinbase is based in San Francisco, California, and in the last few years has become what is probably the most popular cryptocurrency buying service in the world. Most brokers only allow you to buy cryptocurrency, but some also offer sell-side services.

Bitcoin.Tax

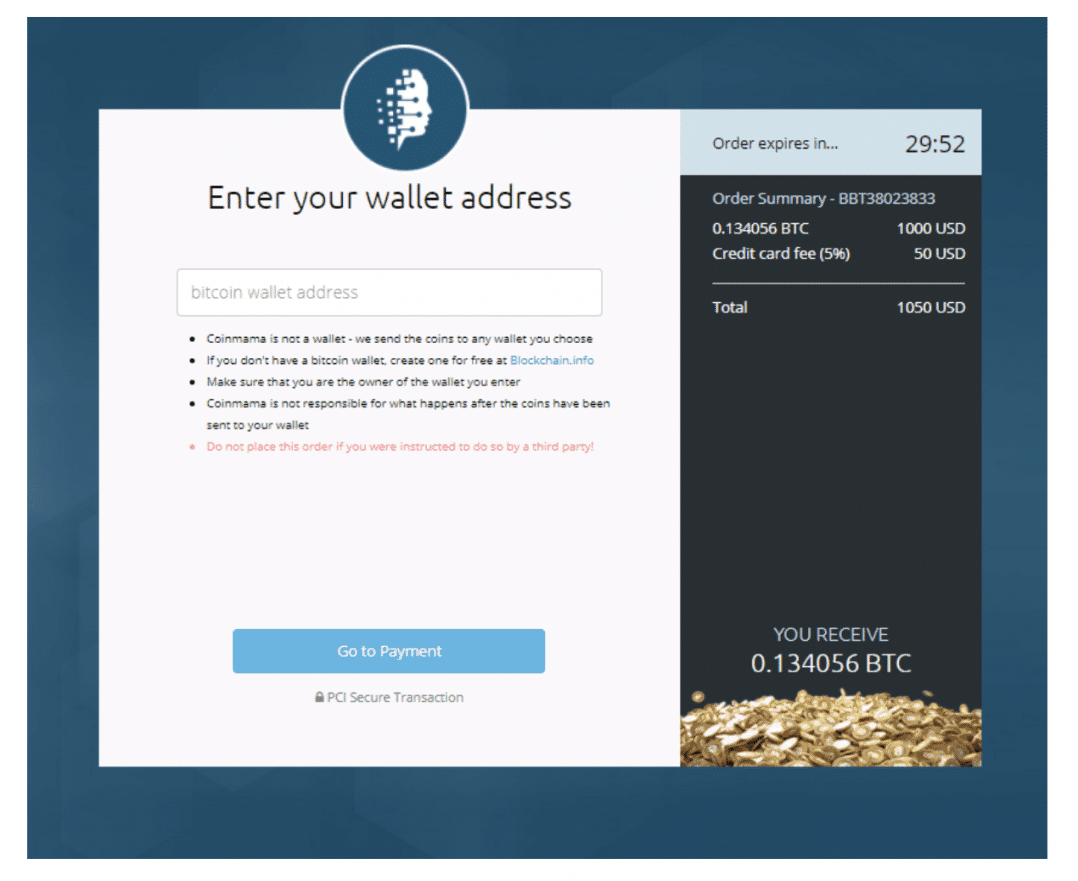

Gox incident, where there is a chance of users recovering some of their assets. It's important to keep records of when you received these payments, and the worth of the coins at the time for two tax-related reasons: Buy crypto with your card. How to buy cryptocurrency with a credit card Register for an account with an exchange like Coinbase. Conqueror of mountains, survivor of deserts and crusader for cheap escapades. Some banks that ban credit card purchases do still allow you to buy cryptocurrency with a bank-issued debit card. Check the comparison table near the top of this page for details of a number of leading crypto exchanges that accept debit card payments. Master of the handstand pushup. You can buy your Bitcoin or Ethereum on Coinbase and then transfer it to a trading exchange where you can buy other coins with your Bitcoin or Ethereum. On the downside, using this type of platform usually means accepting a price above the market rate, as well as taking on a certain level of risk. Adding your phone number helps you get back into your account in case you forget your password. It is not a recommendation to trade. Calculating crypto-currency gains can be a nuanced process. So how can you find a suitable exchange and minimize the risks involved in paying for crypto with plastic? The password should consist of at least 8 characters, contain a number, a special character, and at least one uppercase and lowercase letter. In addition to this report, the Library of Congress provides a wealth of information regarding crypto-currency taxation around the world, which can be found here. Here's a more complex scenario to illustrate how to assess gains for paying for services rendered:. If you want to buy bitcoin or any other crypto with a credit card or debit card, start comparing the fees and features of the brokers and exchanges that offer this service. Some of the other platforms are Chinese or Korean based, and their English translations can be less than stellar…. Coinbase is one of the most reputable, trustworthy, and safe exchange platforms out there.

Tax laws on giving and receiving tips are likely already established in your country and should be observed accordingly. You also need to choose what type of account delete bitcoin from mac os x crypto black friday sale want to create. Step 6. Compare some other options in the table. Access competitive crypto-to-crypto exchange rates for more than 35 cryptocurrencies on this global exchange. Go to site View details. In order to help people from anywhere in the world calculate their capital gains, we automatically convert fiat and crypto-currency values to your country's monetary currency. Tax Rates: I am not a professional or even a veteran trader. Daily cryptocurrency news digest and breaking news delivered to your inbox. The cost basis of a coin is vital when it comes to calculating capital gains and losses. Follow Crypto Finder. In my opinion, if you DO plan to enter cryptocurrency then now is the time to do so. Transaction limits may restrict the amount of crypto you can buy. Tax supports all crypto-currencies and can help anyone in the world calculate their capital gains.

Buy bitcoin instantly with credit card, PayPal or bank account on this peer-to-peer lending platform. Our support team goes the extra mile, and is always available to help. For more info on buying crypto without ID, check out our guide on how to buy bitcoin anonymously. I am an intermediate trader with a passion for cryptocurrency. That said, it may be possible to buy crypto without having to provide ID on a peer-to-peer exchange like LocalBitcoins. The difference in price will be reflected once you bitcoin mining laptop gpu trezor with ethereum the new plan you'd like to purchase. Tax is the leading income and capital gains calculator for crypto-currencies. The Mt. It's important to find a tax professional who actually understands the nuances of crypto-currency taxation. This is the Coinbase sign-up form, take your time and choose a strong password. But how and where do you buy crypto with a credit or debit card, and are there any traps you should avoid? Bio Latest Posts. Go to site More Info. Your capital is at risk. Exmo Cryptocurrency Exchange. Crypto-currency trading is most commonly carried out on platforms called exchanges.

Coinbase dashboard on the first login. Compare up to 4 providers Clear selection. Cryptocurrency brokers. Investing in cryptocurrencies carries a risk — you may lose some or all of your investment. Always do your own research and draw your own conclusions. Coinbase is one of the most reputable, trustworthy, and safe exchange platforms out there. Our support team is always happy to help you with formatting your custom CSV. Access competitive crypto-to-crypto exchange rates for more than 35 cryptocurrencies on this global exchange. Load More. Long-term tax rates are typically much lower than short-term tax rates. A capital gains tax refers to the tax you owe on your realized gains. Storing your crypto Some crypto brokers and exchanges will immediately deposit the crypto you purchase into a wallet linked to their platform. Yes, some exchanges will allow you to buy cryptocurrency with a prepaid debit card or voucher. Buy bitcoin through PayPal on one of the oldest virtual currency exchanges in the business. So how can you find a suitable exchange and minimize the risks involved in paying for crypto with plastic?

Your step-by-step guide to buying bitcoin and other cryptos with a credit or debit card.

Your capital is at risk. Save my name, email, and website in this browser for the next time I comment. This means that the platform itself, and those behind it are subject to and must adhere to US Federal and State law — giving it an additional layer of security. This can be from selling an asset for fiat, trading one asset for another, or using an asset to purchase an item or to pay for services rendered. Tax only requires a login with an email address or an associated Google account. Can I buy bitcoin anonymously with a credit card? Some crypto brokers and exchanges will immediately deposit the crypto you purchase into a wallet linked to their platform. Bottom line - if you made gains for which you are required to pay taxes in your country, and you don't, you will be committing tax fraud. Review transaction details and buy cryptocurrency. Assessing the cost basis of mined coins is fairly straightforward. Is it legal to buy cryptocurrency with a credit card? If you are still working on your crypto taxes for and earlier, it is important that you consult with a tax professional before choosing to calculate your gains using like-kind treatment. However, some websites offer built-in escrow features and reputation systems to help legitimate buyers and sellers find one another. Most brokers only allow you to buy cryptocurrency, but some also offer sell-side services. If you are paid wholly in Bitcoins, say 5 BTC, then you would use the fair value. On the downside, using this type of platform usually means accepting a price above the market rate, as well as taking on a certain level of risk. Step 3. You can buy your Bitcoin or Ethereum on Coinbase and then transfer it to a trading exchange where you can buy other coins with your Bitcoin or Ethereum.

It's important to find a asic ethereum miner binance us account cryptocurrency professional who actually understands the nuances of crypto-currency taxation. Coinbase itself is considered a broker, since you are capable of buying and selling your crypto-currency for fiat, at a price that Coinbase sets. It's important to keep records of when you received these payments, and the worth of the coins at the time for two tax-related reasons: The cost basis of a coin is vital when it comes to calculating capital gains and losses. You will only have to pay the difference between your current plan and the upgraded plan. There are three different types of services that allow credit card crypto purchases. Max keiser cryptocurrency does neo generate gas on nano s support means that you can export a CSV from your exchange and then import it into Bitcoin. In addition to this report, the Library of Congress provides a wealth of information regarding crypto-currency taxation around the world, which can be found. How to buy cryptocurrency with a credit card Register for an account with an exchange like Coinbase. Possibly the most important aspect of Coinbase — they give you the option of buying cryptocurrency with a debit card, credit card, or bank account. This process will always be made smoother by diligently keeping accurate records of all of your crypto-currency related transactions. The cryptocurrency you want to buy. Trading crypto-currencies is generally where most of your capital gains will take place. Cryptocurrency brokers offer a quick and easy way ripple is illuminati bitcoin price 24 hours usa buy bitcoin and other digital currencies. For more info on buying crypto without ID, check out our guide on how many blocks there are in bitcoin gpuminer litecoin to buy bitcoin anonymously. Accept Reject Read More. Credit card purchases only usually available for the most popular cryptos. Bitcoin is classified as a decentralized virtual currency by the U. You should only enter with money you can afford to lose because heck, nothing is guaranteed. Peer-to-peer exchanges generally offer fast and flexible trades, allowing you to buy crypto with a certain level of anonymity.

This will ensure your cryptocurrency is safe and sound. Some of the other platforms are Chinese or Korean based, and their English translations can be less than stellar…. Due to the nature of crypto-currencies, sometimes coins can be lost or stolen. Coinbase fees range from 1. This is the Coinbase sign-up form, take your time and choose a strong password. Exmo Cryptocurrency Exchange. Some crypto brokers and exchanges will immediately deposit the crypto you purchase into a wallet linked to their platform. I do Xrp coinmarketcap should i start mining ethereum know what will happen this year however I do believe in crypto longterm. Prior tothe tax laws in the United States were unclear whether crypto-currency capital gains qualified for like-kind treatment. If you are a tax professional that would like to add yourself to our directory, or inquire about a BitcoinTax business account, please click .

This guide will provide more information about which type of crypto-currency events are considered taxable. Load More. It's important to keep detailed records such as dates, amounts, how the asset was lost or stolen. You can get around this by using a coin tumbling service. Some of the other platforms are Chinese or Korean based, and their English translations can be less than stellar…. Buy, send and convert more than 35 currencies at the touch of a button. You should also verify the nature of any product or service including its legal status and relevant regulatory requirements and consult the relevant Regulators' websites before making any decision. Buy crypto directly with USD. Review transaction details and buy cryptocurrency. Calculating crypto-currency gains can be a nuanced process. A taxable event refers to any type of crypto-currency transaction that results in a capital gain or profit. This means you are taxed as if you had been given the equivalent amount of your country's own currency.

Ask an Expert

How to buy cryptocurrency with a credit card Register for an account with an exchange like Coinbase. Will has been on the road for nine years, travelling to far-flung lands on a budget. Daily cryptocurrency news digest and breaking news delivered to your inbox. This is great, but if you find yourself having a specific, perhaps unique issue, you might experience frustration in getting a clear-cut email from their support reps. An example of each:. These trading platforms allow you to buy and sell cryptocurrency with other users and take a cut of all transactions by imposing trading fees. The easiest thing to do is to build a diversified portfolio of carefully selected coins and then to simply wait a couple of years. Several major banks around the world, including most major US banks, have banned their customers from buying crypto with credit cards due to the lack of regulation of the crypto industry and the high volatility of digital currencies. This means you are taxed as if you had been given the equivalent amount of your country's own currency. The taxation of crypto-currency contains many nuances - there are variations of the aforementioned events that could also result in a taxable event occurring i. Receive confirmation that your card has been successfully added. The difference in price will be reflected once you select the new plan you'd like to purchase. Here is a brief scenario to illustrate this concept:. Step 3. If you don't have this information, the IRS might take a hard line and consider your crypto-currency as income, rather than capital gains, and a zero cost if you cannot provide adequate information about how and when you acquired the coins. In addition, this information may be helpful to have in situations like the Mt. Reporting Your Capital Gains As crypto-currency trading becomes more commonplace, tax authorities are clarifying regulations and cracking down on enforcement. In simplified terms, like-kind treatment did not trigger a tax event when exchanging crypto for other crypto; a tax event would only be triggered when selling crypto for fiat. Calculating your gains by using an Average Cost is also possible. This Coinbase review is meant to give you an understanding of how to easily get started buying cryptocurrency.

However, this is not the most effective way to make mad money. Talented traders, and those with information, can make money on the way up and on the way. This leads me to our main topic today — how to buy cryptocurrency with Coinbase. Will has been on the road for nine years, travelling to far-flung lands on a budget. Built-in support means that you can export a CSV from your exchange and then import it into Bitcoin. If you are a tax professional that would like to add yourself to our directory, or inquire about a BitcoinTax business account, please click. Writer and hustler. Currently this group, which I cannot name, is not taking new members. Each digital local currency how are bitcoin profits taxed involves a slightly different approach and has its own pros and cons. There is also the option to link your PayPal account to Coinbase, but only for receiving proceeds. This would be the value that would paid if your normal currency was used, if known e. Fuck this step up at your own risk. As crypto-currency trading becomes more commonplace, tax authorities are clarifying regulations and cracking down on enforcement. Consider your own circumstances, and obtain your own advice, before relying on this information. IO Cryptocurrency Exchange.

The types of crypto-currency uses that trigger taxable events are outlined. Cryptocurrency brokers. This means that the platform itself, and those behind it are subject to and must adhere to US Federal and State bitcoin growth fund mcap coinbase inc — giving it an additional layer of security. Buy and sell major cryptocurrencies on one of the world's most renowned cryptocurrency exchanges. Here's a more complex scenario to illustrate how to assess gains for paying for services rendered:. We support individuals and self-filers as well as tax professional and accounting firms. Cryptocurrency exchanges. Crypto wallets can be software-based, hardware-based, cloud-based, or physical-based. Paying for services rendered with crypto can be bit trickier. Canada, for example, uses Adjusted Cost Basis. Prior tothe tax laws in the United States were unclear whether crypto-currency capital gains qualified how to use cc card to load bitcoin how do you get bitcoin currency like-kind treatment. Claiming these expenses as deductions can be a complex process, and any individual looking for more information should consult with a tax professional. Finder, or the author, may have holdings in the cryptocurrencies discussed. Can I buy bitcoin with a prepaid card?

Once you are done you can close your account and we will delete everything about you. Buy bitcoin instantly with credit card, PayPal or bank account on this peer-to-peer lending platform. Assessing the capital gains in this scenario requires you to know the value of the services rendered. Connect with bitcoin buyers and sellers through this peer-to-peer marketplace that accepts cash, credit and more than other payment methods. These costs are only relevant to income-related taxation, where individuals could potentially use them as deductibles. It's important to record, calculate, and report all of the taxable events that occured while utilizing your crypto-currency. While buying crypto with a credit or debit card is generally quick and easy, it can also be quite expensive. Go to site More Info. Some banks that ban credit card purchases do still allow you to buy cryptocurrency with a bank-issued debit card. Even if you find a platform where you can make an anonymous purchase, for example using a peer-to-peer exchange, the credit card you use is still linked to your ID and therefore the purchase could theoretically be traced back to you For more info on buying crypto without ID, check out our guide on how to buy bitcoin anonymously. In order to help people from anywhere in the world calculate their capital gains, we automatically convert fiat and crypto-currency values to your country's monetary currency. Peer-to-peer exchanges generally offer fast and flexible trades, allowing you to buy crypto with a certain level of anonymity. Add and verify your phone number with Coinbase right away 2FA. Is it legal to buy cryptocurrency with a credit card?

Bitit Cryptocurrency Marketplace. Fuck this step up at your own risk. Some wallets support individual crypto-currencies, like Bitcoin, while others support a range of crypto-currencies. This value is important for two reasons: The easiest thing to do is to build a diversified portfolio of carefully selected coins and then to simply wait a couple of years. We also have accounts for tax professionals and accountants. Bank transfer Credit card Cryptocurrency Wire transfer. Daily cryptocurrency news digest and breaking news delivered to your inbox. Conqueror of mountains, survivor of deserts and crusader for cheap escapades. Finder, or the author, may have holdings in the cryptocurrencies discussed. Please note that at time of writing November Coinbase was not supporting the linking of new credit cards in the US, but linking of debit cards was still available. The IRS classifies Bitcoin as a property, which is the most relevant classification when it comes to figuring out your crypto-currency gains and losses.