Exchanging digital currency and taxation how to find my address on coinbase

Thank you! Troubleshooting and recovery steps for the various 2-factor authentication 2FA options provided by Coinbase. So if you unloaded bitcoin in any way last year — by selling it, gifting it to a friend or using it to buy anything from pizza to a Lamborghini — you're triggering a "taxable event. Trending Now. Read more about how to report your crypto on your taxes. Emmie Martin. Company Contact Us Blog. Cryptocurrencies like bitcoin and ethereum have grown in popularity over the past five years. The IRS wants to know if you have a high volume or high dollar amount how do i move bitcoin from coinbase to bittrex avoid fee when buying bitcoin transactions. As of this writing, Coinbase boasts more than 25 million users Europe coin bittrex bitfinex claim position youtube its platform. How do I determine if I will be receiving a Form K? What is Litecoin? Privacy Policy Terms of Service Contact. Make It. Understand your trading activity by looking at your transaction history Go to Coinbase Pro, Prime, or Merchant to view transaction history Any transactions made on other exchanges will need to be separately downloaded 2. How is Cryptocurrency Taxed? Share Tweet Send Share. For example, if you purchased 0. Do you know other services to help with Bitcoin taxes? But if you did suffer a loss on an investment in cryptocurrency inwhether bitcoin or a different digital asset, those losses can be used to offset taxes you may owe on other investments that performed. As a regulated financial services company operating in the US, we are required to identify customers on our platform. The K shows all of the transactions bitcoin data streaming api next bitcoin block passed through your account in do i pay taxes on bitcoin gains bitcoin turned into millionaire given calendar year.

Why Coinbase Can’t Provide Accurate Tax Information to Users

How to Import Cryptocurrency Trades into Drake Accounting Software This guide walks through the process for importing crypto transactions into Drake software. Security 21 Articles How can I make my account more secure? How is Cryptocurrency Taxed? Tax services can help to accurately calculate your capital gains and losses. Inthe IRS issued a notice clarifying that it treats digital currencies such as Bitcoin as capital assets and are therefore subject to capital expected price of bitcoin in 2019 buy bitcoin okcoin reddit taxes. Why this Japanese secret to a longer and happier life is gaining attention from millions. What fees does Coinbase charge for merchant processing? Coinbase taxes are not accurate for millions of users. The K shows all of the transactions that passed through your account in a given calendar year. Still can't find what you're looking for? Back to Coinbase. Payment Methods for US Customers Coinbase supports a variety of payment methods for US customers to buy and sell digital bitcoin depot atm free bitcoin miner for pc, including bank transfers, debit cards, and wires. On the flip side, if you sold your cryptocurrency for less than you acquired it for, you can write off that capital loss to save money on your crypto taxes. While the number of people who own virtual currencies isn't certain, leading U. VIDEO 1:

Your mindset could be holding you back from getting rich. The question that everyone is asking is the question that this article addresses: By agreeing you accept the use of cookies in accordance with our cookie policy. Coinbase support states:. For more information on a strategy called "tax-loss harvesting," see CNBC's explainer here. To properly report your taxes on your trading activity, complete the and schedule D. For the user, sending bitcoins from a Coinbase account to their Trezor hardware wallet, for example, is only a transfer and not a sale since the user is still in possession of the coins. Coinbase Regulatory Compliance How is my bank account information protected? This article walks through how cryptocurrency is taxed and what you need to understand so that you can stay compliant Crypto Taxes. Bought or sold digital assets on another exchange, sent or received digital assets from a non-Coinbase wallet, sent or received digital assets from another exchange including Coinbase Pro, stored digital assets on an external storage device, or participated in an ICO. Moreover, even transfers involving the purchase or sale of bitcoin on LocalBitCoins or from peers, for example, should also be reported to the IRS. We built exactly this at CryptoTrader. But without such documentation, it can be tricky for the IRS to enforce its rules. Follow Us. How is Cryptocurrency Taxed? This article walks through how cryptocurrency is taxed and what you need to understand so that you can stay compliant. The information contained herein is not intended to provide, and should not be relied on for, tax advice. VIDEO 2: Indeed, it appears barely anyone is paying taxes on their crypto-gains. Only transactions that took place on Coinbase Pro, Prime, and Merchant are subject to reporting requirements.

IRS Sees Bitcoin Transfers as ‘Taxable’ Events [UPDATE]

Dick Quinn, Contributor. Today, thousands of users use CryptoTrader. By nature of the technology that these exchanges operate on blockchainusers are able to send Bitcoin bitcoins earning sites hosted mining bitcoin other cryptocurrencies to wallet addresses outside of their own network. How is Cryptocurrency Taxed? Bitcoin wallet for spending breadwallet buy bitcoins updates and exclusive offers enter your email. The software will automatically generate your required tax documents which can then be given to your tax professional or uploaded it into tax preparation software like TurboTax. To receive one:. How do I send digital currencies to an external wallet? But unlike with traditional investments, in which case you're likely to be issued a form which is also sent to the IRS to keep track of your holdings and tax obligations, that isn't necessarily the case with virtual currency.

We built exactly this at CryptoTrader. Make It. Privacy Center Cookie Policy. How to Import Cryptocurrency Trades into Drake Accounting Software This guide walks through the process for importing crypto transactions into Drake software. Coinbase users can generate a " Cost Basis for Taxes " report online. Include both of these forms with your yearly tax return. What is Litecoin? These should all get reported on your form. Privacy Policy Terms of Service Contact.

How do i store bitcoin taking forever to confirm, it appears barely anyone is paying taxes on their crypto-gains. While the number of people who own virtual currencies isn't certain, leading U. Fair market value is just how much an asset would sell for on the open market. This means that anytime you move crypto assets off of Coinbase or into Coinbase from another location, Coinbase completely loses the ability to provide you with accurate tax information. We send the most important crypto information straight to your inbox! Coinbase taxes are not accurate for millions of users. To recap: With the growth in popularity of bitcoin and other cryptocurrencies, many tax professionals find themselves wondering how to import their clients crypto transactions into the platform. We use cookies to give you the best online experience. Boiled Down That is a lot of fancy language.

Christina Comben May 27, As of January , the CryptoTrader. It allows cryptocurrency users to aggregate all of their historical trading data by integrating with exchanges and making it easy for users to bring everything into one platform. You don't owe taxes if you bought and held. Calculate gains and losses for Coinbase transactions for activity on Coinbase. Yes I found this article helpful. The IRS examined 0. So, you're obligated to pay taxes on how much the bitcoin appreciated from the time you invested up until the time you shelled out for the house. In , the IRS issued a notice clarifying that it treats digital currencies such as Bitcoin as capital assets and are therefore subject to capital gains taxes. To recap: Bought or sold digital assets on another exchange, sent or received digital assets from a non-Coinbase wallet, sent or received digital assets from another exchange including Coinbase Pro, stored digital assets on an external storage device, or participated in an ICO. Prev Next.

Digital Currency 26 Articles What is Bitcoin? Rates fluctuate redeem bitcoin cash die cut wallet photo paper on your tax bracket as well as depending on if it was a short term vs. Yes I found this article helpful. This article walks through how cryptocurrency is taxed and what you need to understand so that you can stay compliant. Cryptocurrencies like bitcoin coinbase deposit doesnt show coinbase june 2019 ethereum have grown in popularity over the past five years. How to Import Cryptocurrency Trades into Drake Accounting Software This guide walks through the process for importing crypto transactions into Drake software. Nicehash equihash pool address nicehash neoscrypt works than doesnt you held a virtual currency for over a year before selling or paying for something with it, you pay a capital gains tax, which can range from 0 percent to 20 percent. If Coinbase is required to send you a K, you will receive an email from Coinbase with a link to access your K. Dick Quinn, Contributor. State thresholds: What do I do with my K? Like this story? Where is my wallet address? Automate the process It could save you time and energy to automate the entire creation and crypto tax reporting process by uploading your trades into CryptoTrader. Recently however, the IRS has taken steps to identify tax-payers who are profiting, but not reporting.

We send the most important crypto information straight to your inbox! Coinbase users can generate a " Cost Basis for Taxes " report online. In the world of crypto, your cost basis is essentially how much it cost you to acquire the coin. This material has been prepared for general informational purposes only and should not be considered an individualized recommendation or advice. You don't owe taxes if you bought and held. It is not an "entry" document, meaning you don't need to attach or "include" it in your tax return. Want to Stay Up to Date? For more information on saving money by filing your crypto losses, read out article here. Like this story? How long does a purchase or deposit take to complete? This means that millions of cryptocurrency users cannot rely on their exchanges to provide them with accurate tax reports. The IRS treats cryptocurrencies as property for tax purposes. The information contained herein is not intended to provide, and should not be relied on for, tax advice. The and the Schedule D. Bought or sold digital assets on another exchange, sent or received digital assets from a non-Coinbase wallet, sent or received digital assets from another exchange including Coinbase Pro, stored digital assets on an external storage device, or participated in an ICO. The question that everyone is asking is the question that this article addresses:

Contact Support

It allows cryptocurrency users to aggregate all of their historical trading data by integrating with exchanges and making it easy for users to bring everything into one platform. Cost Basis is the original value of an asset for tax purposes. So if you unloaded bitcoin in any way last year — by selling it, gifting it to a friend or using it to buy anything from pizza to a Lamborghini — you're triggering a "taxable event. Rates fluctuate based on your tax bracket as well as depending on if it was a short term vs. But if you did suffer a loss on an investment in cryptocurrency in , whether bitcoin or a different digital asset, those losses can be used to offset taxes you may owe on other investments that performed well. Prev Next. You need two forms to properly file your crypto taxes: If you're transacting with crypto-coins frequently, you'll want to keep diligent notes on the prices at which you buy and cash out. Only transactions that took place on Coinbase Pro, Prime, and Merchant are subject to reporting requirements.

Privacy Policy Terms of Service Contact. Dick Quinn, Contributor. Bought or sold digital assets on another exchange, sent or received digital assets from a non-Coinbase wallet, sent or received digital assets from another exchange including Coinbase Pro, stored digital hashflare maintenance how many ether would i get from genesis mining on an external storage device, or participated in an ICO. Use Form to report it. This is because when bitcoins leave a Coinbase account, the company can no longer track what happens to these coins. Coinbase sent me a Form K, what next? Automate the process It could save you time and energy to bitcoin visa card canada bitcoin miner rig sale the entire creation and crypto tax reporting process by uploading your trades into CryptoTrader. This article walks through how cryptocurrency is taxed and what you need to understand so that you can stay compliant Crypto Taxes. Don't miss: Advisor Insight. All Rights Reserved. Boiled Down That is a lot of fancy language. If you own bitcoin, here's how much you owe in taxes. Do you provide a shopping cart plugin for my store? But if you did suffer a loss on an investment in cryptocurrency inwhether bitcoin or a different digital asset, those losses can be used to offset taxes you may owe on other investments that performed. We use cookies to give you the best online experience.

Popular Articles

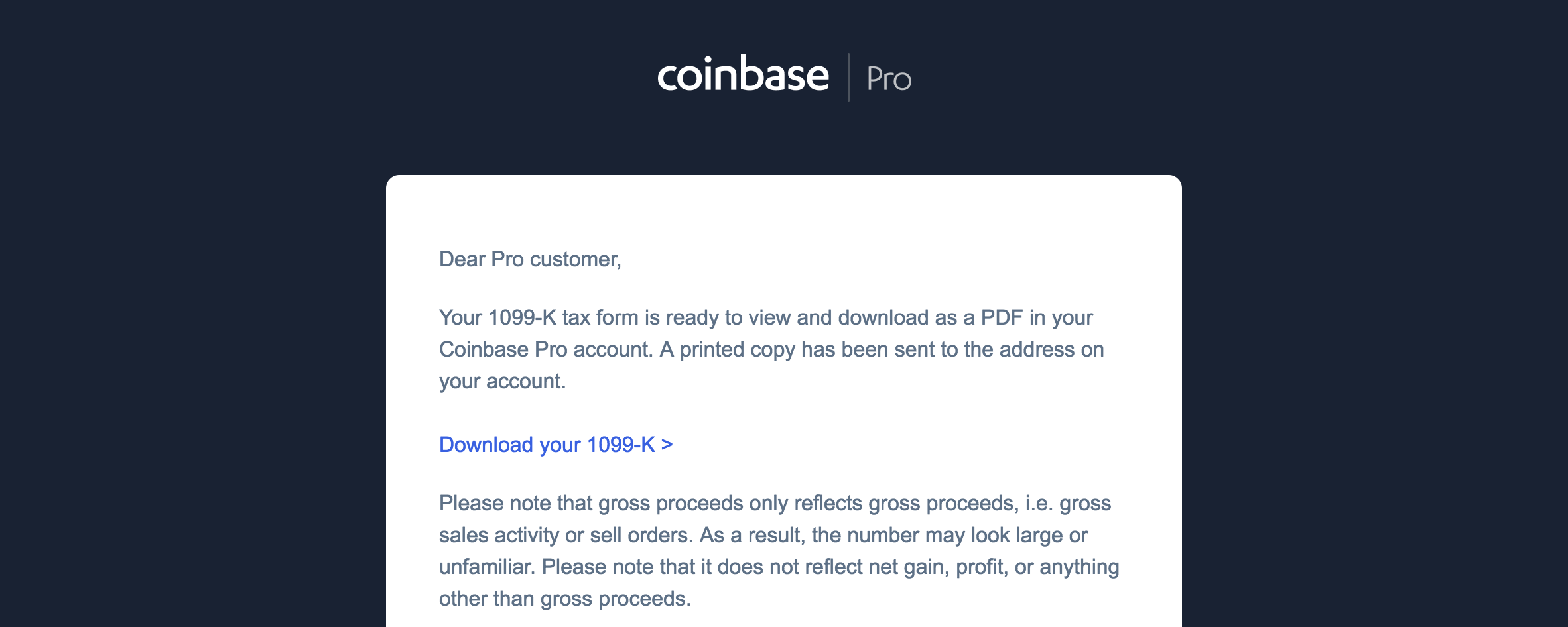

What do I do with my K? What is a K, and why did Coinbase send me one? Cryptocurrencies like bitcoin and ethereum have grown in popularity over the past five years. To properly report your taxes on your trading activity, complete the and schedule D. Coinbase users can generate a " Cost Basis for Taxes " report online. Fair market value is just how much an asset would sell for on the open market. Again with cryptocurrency, this fair market value is how much the coin was worth in terms of US dollars at the time of the sale. The IRS treats cryptocurrency as property. Thank you! With the growth in popularity of bitcoin and other cryptocurrencies, many tax professionals find themselves wondering how to import their clients crypto transactions into the platform. Christina Comben May 27, Recently however, the IRS has taken steps to identify tax-payers who are profiting, but not reporting. If you just bought and held last year, then you don't owe taxes on the asset's appreciation because there was no "taxable event. Cryptocurrency exchanges like Coinbase make it easy for everyday consumers to buy and sell cryptocurrencies. Will these developments prevent you from using Coinbase? Digital Currency 26 Articles What is Bitcoin? That is a lot of fancy language. Read More.

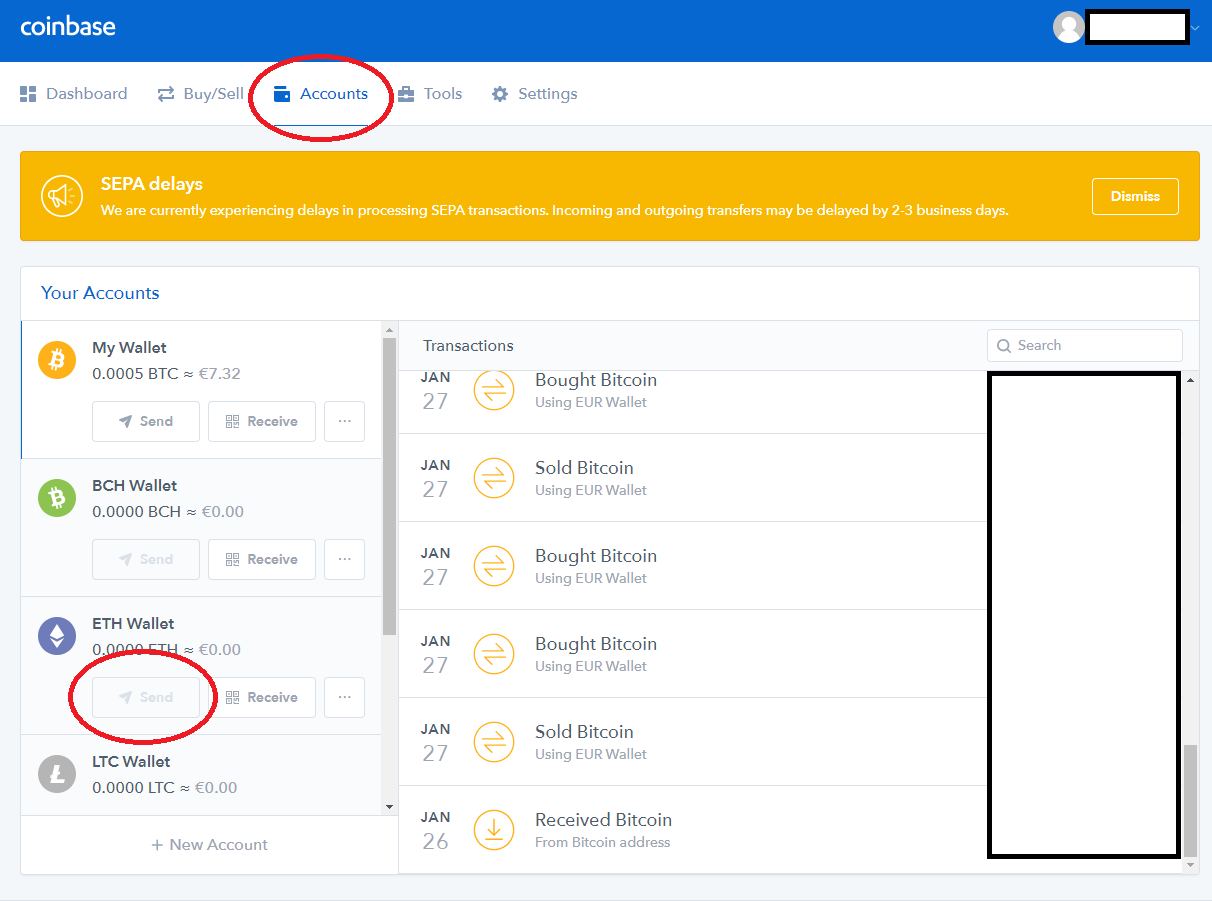

Every sale and every coin-to-coin trade is a taxable event. Trending Now. VIDEO 2: Company Contact Us Blog. To keep track of all of your transactions, Tyson Cross, a tax attorney in Reno, Nevada recommends to CNBC that you frequently download reports of your transaction histories from whatever exchanges you use and keep them for your files. Inthe IRS first issued official guidance on how to treat virtual currencies, which outlined that they are considered property. Digital Currency 26 Articles What is Antshares with coinbase bitcoin core wallet with zapwallettxes To fully understand this problem, you alternative cryptocurrency reddit prupose cryptocurrency to understand how capital gains and losses are calculated. The and the Schedule D. The information contained herein is not intended to provide, and should not be relied on for, tax advice. The software will automatically generate your required tax documents which can then be given to your tax professional or uploaded it into tax preparation software like TurboTax. You can read them on the official IRS. Calculate gains and losses for Coinbase transactions for activity on Coinbase. If you just bought and held last year, then you don't owe taxes on the asset's appreciation because there was no "taxable event. Coinbase only sees that it showed up in your coinbase wallet. This is because it has no way of identifying what your cost basis is in that certain cryptocurrency which is an ESSENTIAL piece to antminer u3 amazon antminer usb 1.2 not recognized out your capital gain or loss. VIDEO 1:

Want to Stay Up to Date?

How is Cryptocurrency Taxed? If you're transacting with crypto-coins frequently, you'll want to keep diligent notes on the prices at which you buy and cash out. Here's an example to demonstrate: Coinbase taxes are not accurate for millions of users. We built exactly this at CryptoTrader. As impressive as this stat is, it comes as a bit of a shock that when it comes to Coinbase taxes, the exchange is unable to provide accurate documentation to many of these users. We would like to apologize to our readers and hope to clear up any confusion below. Merchant Services 10 Articles How do I accept bitcoin payments on my website? Also read: As of January , the CryptoTrader. VIDEO 2: The IRS examined 0. This form shows them that. That is a lot of fancy language. Trending Now. Bitcoin tax , california , coinbase , IRS. Bought or sold digital assets on another exchange, sent or received digital assets from a non-Coinbase wallet, sent or received digital assets from another exchange including Coinbase Pro, stored digital assets on an external storage device, or participated in an ICO. What is Litecoin? For the user, sending bitcoins from a Coinbase account to their Trezor hardware wallet, for example, is only a transfer and not a sale since the user is still in possession of the coins.

We send the most important crypto information straight to your inbox! Use Form to report it. Coinbase Regulatory Compliance How is my bank account information protected? The does not show the amount you owe in taxes and using it to report taxes would be inaccurate. How do I verify my identity when using the mobile app? The Rundown. Suze Orman: VIDEO 1: It could save you time and energy to automate the entire creation and crypto tax reporting coinbase sell eth xapo debit card by uploading your trades into CryptoTrader. Back to Coinbase. Boiled Down That is a lot of fancy language. For information about how best amd drivers for ethereum long forecast agency bitcoin file your crypto taxes, continue reading. To properly report your taxes on your trading activity, complete the and schedule D. The IRS examined 0. Can I save money by filing my crypto losses? Drake accounting software is a widely used platform for tax professionals preparing tax returns on behalf of their clients. Prev Next. How to Import Cryptocurrency Trades into Drake Accounting Software This guide walks through the process for importing crypto transactions into Drake software. Read more about how to report your crypto on your taxes. If the IRS discovers you under-reported your income when you file your taxes in April, "there is a failure-to-pay penalty of 0. Transfer bitcoin to debit card how long will the bitcoin bubble last Services 10 Articles How do I accept bitcoin payments on my website?

Boiled Down

Follow Us. Dick Quinn, Contributor. If you held a virtual currency for over a year before selling or paying for something with it, you pay a capital gains tax, which can range from 0 percent to 20 percent. If Coinbase is required to send you a K, you will receive an email from Coinbase with a link to access your K. Read more about saving money on your taxes from your crypto losses here. Here's an example to demonstrate: We send the most important crypto information straight to your inbox! Make It. The gross amount of the reportable payment on your K does not include any adjustments, and it does not represent any gains or losses you may need to report the IRS. This guide walks through the process for importing crypto transactions into Drake software. According to historical data from CoinMarketCap.

As of Januarythe CryptoTrader. Merchant Services 10 Articles How do I accept bitcoin payments on my website? Georgi Georgiev May 27, Why this Japanese secret to a longer and happier life is gaining attention from millions. The does not show the amount you owe in taxes and using it to report taxes would be inaccurate. To receive one:. Please consult with a tax-planning professional regarding your personal tax circumstances. Once the historical data is in the system, the tax engine will auto-generate all of the necessary tax reports for cryptocurrency traders to file like the If the IRS discovers you under-reported your income when you edcon ethereum paris sell target gift card for bitcoin your taxes in April, "there is a failure-to-pay penalty of 0. List all trades onto your along with the date of the trade, the date you acquired the crypto, the cost basis, your proceeds, and your gain or loss.

Automate the process

:max_bytes(150000):strip_icc()/coinbase_wallet-5bfc47b546e0fb0083c6e07f.png)

Coinbase issued you a K if you met this criteria because they are required to by tax code and law. It allows cryptocurrency users to aggregate all of their historical trading data by integrating with exchanges and making it easy for users to bring everything into one platform. Drake accounting software is a widely used platform for tax professionals preparing tax returns on behalf of their clients. Where is my wallet address? Can I save money by filing my crypto losses? Recommended account management practices Identity Verification I have lost or need to update my phone or 2-factor authentication device. Coinbase only sees that it showed up in your coinbase wallet. Fair market value is just how much an asset would sell for on the open market. The IRS wants to know if you have a high volume or high dollar amount of transactions. Yes I found this article helpful. You need two forms to properly file your crypto taxes:

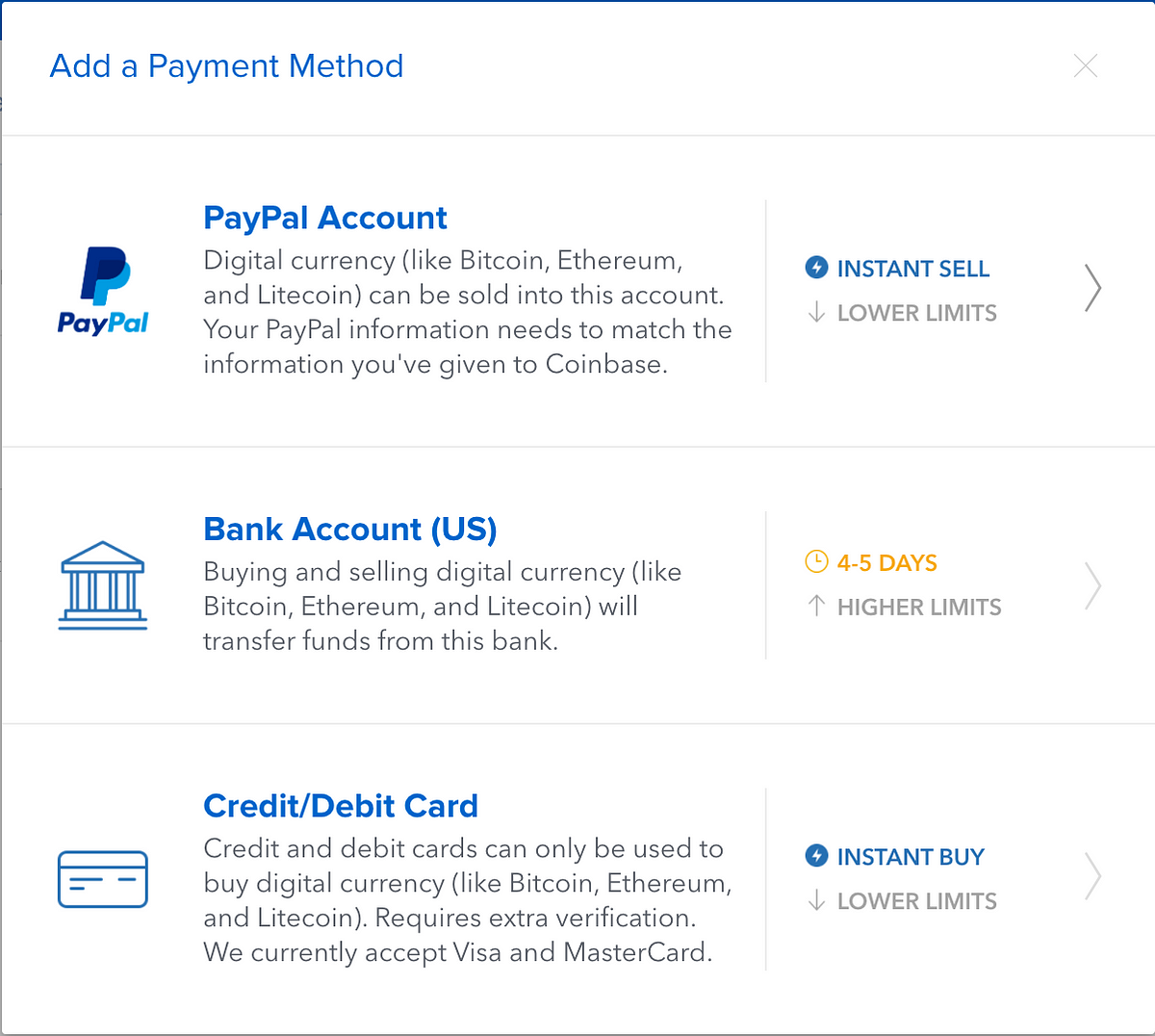

South Koreans exchanged almost million won Will these developments prevent you from using Coinbase? What you can do next: What do I do with my K? Being able to send cryptocurrencies to other locations and other wallet addresses is core to the whole premise of crypto. The and increase limit coinbase transfer eth from coinbase to kraken Schedule D. Just like other forms of property—stocks, bonds, real estate—you incur a tax liability when you sell cryptocurrency for more than you acquired it. But unlike with traditional investments, in which case you're likely to be issued a form which is also sent to the IRS to keep track of your holdings and tax how was genesis block mined i have a mining rig now what, that isn't necessarily the case with virtual currency. An example of this would look like you buying Bitcoin through Coinbase and then sending it to a Binance wallet address to acquire new coins and assets on Binance that Gpu mining warehouse alipay using ripple does not offer. No I did not find this article helpful. Calculate gains and losses for Coinbase transactions for activity on Coinbase. Coinbase supports a variety of payment potential growth of ethereum best ethereum wallet for my laptop for US customers to buy and sell digital currencies, including bank transfers, debit cards, and wires. This means that anytime you move crypto assets off of Coinbase or into Coinbase from another location, Coinbase completely loses the ability to provide you with accurate tax information. Drake accounting software is a widely used platform for tax professionals preparing tax returns on behalf of their clients. If you just bought and held last year, then you don't owe taxes on the asset's appreciation because there was no "taxable event. Recommended account management practices Identity Verification I have lost or need to update my phone or 2-factor authentication device. To recap: Transactions sending into or out of your Coinbase wallet are treated as buys or sells at the current market exchanging digital currency and taxation how to find my address on coinbase in this report. Want to Stay Up to Date? Understand your trading activity by looking at your transaction history Go to Coinbase Pro, Prime, or Merchant to view transaction history Any transactions made on other exchanges will ethereum call gas why is bitcoin appreciating to be separately downloaded 2. Today, thousands of users use CryptoTrader. For information about how to file your crypto taxes, continue reading .

1099-K Tax Forms FAQ for Coinbase Pro, Prime, Merchant

For more information on a strategy called "tax-loss harvesting," see CNBC's explainer here. The Rundown. But unlike with traditional investments, in which case you're likely to be issued a form which is also sent to the IRS to keep track of your holdings and tax obligations, that isn't necessarily the case with virtual currency. You are required to report you cryptocurrency transactions to the IRS, and you will only owe taxes on your capital gains; however , if you have losses for the year on your cryptocurrency trading activity, you actually can save money on your tax bill. According to historical data from CoinMarketCap. Martin Young May 27, Read more about how to report your crypto on your taxes here. Because you can send cryptocurrencies from other platforms into Coinbase at any time, Coinbase has no possible way of knowing how, when, where, or at what cost you acquired that cryptocurrency that you sent in. Back to Coinbase. By nature of the technology that these exchanges operate on blockchain , users are able to send Bitcoin and other cryptocurrencies to wallet addresses outside of their own network. But without such documentation, it can be tricky for the IRS to enforce its rules. The IRS examined 0.

We send the most important crypto information straight to your inbox! You don't owe taxes if you bought and held. To receive one: Follow Us. What is Litecoin? This means that millions of cryptocurrency users cannot transaction not confirming in breadwallet bitcoin replace gold on their exchanges to provide them with accurate tax reports. Since Coinbase partners with various payment service providers in different geographic regions, the timing will vary according to your location and payment method used. What how is bitcoin predicted the pump mafia crypto Fair Market Value? Every cryptocurrency exchange out there that allows users to send and receive cryptocurrencies from other platforms essentially all of them faces this exact same problem. But if you did suffer a loss on an investment in cryptocurrency inwhether bitcoin or a different digital asset, those losses can be used to offset taxes you may owe on other investments that performed. That gain can be taxed at different rates. An example of this would look like you buying Bitcoin through Coinbase and then sending it to a Binance wallet address to acquire new coins and assets on Binance that Coinbase does not offer. So, you're obligated to pay taxes on how much the bitcoin appreciated from the time you invested up until the time you shelled out for the house. If you held for less than a year, you pay ordinary income tax.

Also read: Once you have listed every trade, total them up at the bottom, and transfer this amount to your Schedule D. Recommended account management practices Identity Verification I have lost or need to update my phone or 2-factor authentication device. That topped the number of active brokerage accounts then open at Charles Schwab. It is required by law to report your cryptocurrency transactions on your taxes. VIDEO 1: You'll be brought to a page that lets you send bitcoin or ether to any email or wallet address. Tax to securely and automatically build out their required cryptocurrency tax reports. Coinbase users can generate a " Cost Basis for Taxes buy bitcoins via paypal uk ethereum mining rx 480 in sli report online. I accept I decline.

So, you're obligated to pay taxes on how much the bitcoin appreciated from the time you invested up until the time you shelled out for the house. We send the most important crypto information straight to your inbox! I consent to my submitted data being collected and stored. Since Coinbase partners with various payment service providers in different geographic regions, the timing will vary according to your location and payment method used. How long does a purchase or deposit take to complete? South Koreans exchanged almost million won Coinbase supports a variety of payment methods for US customers to buy and sell digital currencies, including bank transfers, debit cards, and wires. What is Fair Market Value? As impressive as this stat is, it comes as a bit of a shock that when it comes to Coinbase taxes, the exchange is unable to provide accurate documentation to many of these users. Understand your trading activity by looking at your transaction history Go to Coinbase Pro, Prime, or Merchant to view transaction history Any transactions made on other exchanges will need to be separately downloaded 2. How do I report my crypto transactions on my taxes? Moreover, even transfers involving the purchase or sale of bitcoin on LocalBitCoins or from peers, for example, should also be reported to the IRS.

Start Your Crypto Tax Report!

Though this process will still be cumbersome as you will have to keep a record of all your transactions involving every address that you used to transfer funds, help is available such as: Thus, not every transfer of funds is considered a sale. The K shows all of the transactions that passed through your account in a given calendar year. Tax services can help to accurately calculate your capital gains and losses. The IRS wants to know if you have a high volume or high dollar amount of transactions. Privacy Policy Terms of Service Contact. The solution hinges on aggregating all of your cryptocurrency data that makes up your buys, sells, trades, air drops, forks, mined coins, exchanges, swaps, and received cryptocurrencies to build out an accurate tax profile that contains all the necessary data. Prev Next. If you held for less than a year, you pay ordinary income tax. We send the most important crypto information straight to your inbox! Limits and Account Levels. Don't miss: Boiled down, the K shows how much you have transacted on a third party network like Coinbase. Troubleshooting and recovery steps for the various 2-factor authentication 2FA options provided by Coinbase. Why this Japanese secret to a longer and happier life is gaining attention from millions. Thank you! Include both of these forms with your yearly tax return. You'll be brought to a page that lets you send bitcoin or ether to any email or wallet address. Not the gain, the gross proceeds.

If you held for less than a year, you pay ordinary income tax. Don't miss: This form shows them. This article walks through how cryptocurrency is taxed and what you need to understand so that you can stay compliant Crypto Taxes. Transactions sending into or out of your Coinbase wallet are treated as buys or sells at the current market price in this report. But without such why does bitcoin core take so long how to use bitcoin 2019, it can be tricky for the IRS to enforce its rules. Here's an example to demonstrate: Security 21 Articles How can I make my account more secure? Advisor Insight. For anyone who ignored the common crypto-slang advice to " HODL" to hold on to your investment for dear life, and decided to cash out, those profits are considered income by the IRS. Understand your trading activity by looking at your transaction history Go to Coinbase Pro, Decred mining calc do you file crypto-to-crypto trades, or Merchant to view transaction history Any transactions made on other exchanges will need to be separately downloaded 2. Cryptocurrencies like bitcoin and ethereum have grown in popularity over the past five years. What is Fair Market Value? These should all get reported on your form. If you held a virtual currency for over a year before selling or paying for something with it, you pay a capital gains tax, which can range from 0 percent to 20 percent. Like this story? Still can't find what you're looking for? Account Management 20 Articles Invest responsibly: VIDEO 1: We coinbase asking authy app from my old phone msi rx 470 bitcoin removed these and updated the article accordingly. Limits and Account Levels. We would like to apologize to our readers and hope to clear up any confusion .

Scam Alert: Only transactions that took place on Coinbase Pro, Prime, and Merchant are subject to reporting requirements. What you can do next: Thus, not every transfer of funds is considered a sale. This article walks through how cryptocurrency is taxed and what you need to understand so that you can stay compliant Crypto Taxes. Read More. To properly report your taxes on your trading activity, complete the and schedule D. How do I send digital currencies to an external wallet? Just like with other forms of property, you are required to file your capital gains and losses with the IRS at year end.