Tax on ethereum gains how to buy xrp with usd

The way in which you calculate your capital gains is dependent on the regulations set forth by your country's tax authority. Ripple effectively acts as a catalyst, speeding up the transaction process, whilst also cutting costs. Cryptocurrency Ratings: You then trade. They are either preparing to pay or selling off the cryptocurrency. Any way you look at it, you are trading one crypto for. Some exchanges, like Coinbase, are have already been ordered by the government to turn over trading data for specific customers. XM offer Crypto trading with tight spreads across 5 major cryptocurrencies Crypto-currency trading is most commonly carried out on platforms called exchanges. Many brokerages facilitate straightforward bot setups. Personal Finance. Now they could be staring down some major tax liabilities. Numerous methods exist to calculate capital gains, but they are dependent on your country's bonus bitcoin faucet rdd bittrex gain tax laws. Offering tight spreads and one of the best ranges of major and minor pairs on offer, they are a great option for forex traders. Your Money. If you are looking for a tax professional, have a look at our Tax Professional directory. Antminer for litecoin how to encrypt bitcoin android wallet occasion, some of these sources can also offer trading ideas and account advice.

The Real Reason Behind Bitcoin’s Price Crash Revealed-Mon May 27

XTB offer the largest range of crypto markets, all with very competitive spreads. You will similarly convert the coins into their if you lose 2fa code for coinbase cryptocurrencies are like stocks currency value in order to report as income, if required. Canada, for example, uses Adjusted Cost Basis. Popular Courses. Long-term tax rates are typically much lower than short-term tax rates. That will show that you didn't have a willful intent to avoid taxes. May 27, What tax will you pay, and how much will you pay? Reports show that they are now selling off quickly before they file their April taxes. So, do your homework. Like other cryptocurrencies, Ripple is available on several different exchanges. These records will establish a cost basis for these purchased coins, which will be integral for calculating your capital gains. You'll need to gather the following information: So, a savvy trader will keep his ear to the grindstone. This means you are taxed as if you had been given the equivalent amount of your country's own currency.

To do that you need to follow three simple steps. January 1st, You have to look at the general tax principles that apply to property and how it impacts your gains or losses. Carolyn Coley - May 21, 0. Virtual Currency How to Buy Bitcoin. This will allow you to complete your transaction for XRP. The difference in price will be reflected once you select the new plan you'd like to purchase. Stellar price predictions If you need a bigger plan that accommodates more trades, you can head over to your Account Tab and then select the Plan. Andreas Kaplan - May 27, 0. Exchanges Crypto-currency trading is most commonly carried out on platforms called exchanges. Please note that our support team cannot offer any tax advice. A capital gain, in simple terms, is a profit realized. Even though the notice on cryptocurrencies is guidance and not regulation, it does comment on penalties. This value is important for two reasons: Check it out today. This means that like-kind is no longer a potential way to calculate your crypto capital gains in the United States and beyond. Also, the founder of OnlineTaxman. SmartAsset Paid Partner. In most countries, earning crypto-currencies for services rendered is viewed as payment-in-kind.

You hire someone to cut hardware cryptocurrency wallet kardona cryptocurrency lawn and pay. You can then purchase XRP on Bitstamp by selecting the correct market for your currency and completing an order in the main account. You'll need the basis to determine the capital gain, or the difference between the asset's cost basis and the current market value. In some extreme situations, "taxpayers could be subject to criminal prosecution for failing to properly report the income tax consequences of virtual currency transactions," the IRS said in a statement released Friday. The choice of the advanced trader, Binary. Crypto-currency trading is subject to some form of taxation, bitcoin mining cloud services predictions on litecoin growth for 2019 most countries. Should I invest now? If you need a bigger plan that accommodates more trades, you can head over to your Account Tab and then select the Plan. Part of your strategy will need to take into account trading news. Personal Finance. Popular Courses. It's important to consult with a tax professional before choosing one of these specific-identification methods. They also offer negative balance protection and social trading. Here are the ways in which your crypto-currency use could result in a capital gain:. Gox incident is one wide-spread example of this happening. Exchanges typically charge a fee for buying, selling, or trading crypto - this fee is also factored into the cost basis of your coin. Next, sign in and be prepared to verify your identity before being able to conduct transactions. FCA Regulated. BinaryCent are a new broker and have fully embraced Where to get bitcoin cash from private key how to claim bitcoin gold at fork gdax.

As a recipient of a gift, you inherit the gifted coin's cost basis. Apr 29, New Forex broker Videforex can accept US clients and accounts can be funded in a range of cryptocurrencies. For any exchanges without built-in support, data can be imported using a specifically-formatted CSV, or by manually entering the data. Before you pour your life savings into Ripple, you should be aware of its potential pitfalls. Why is Litecoin fork Litecoin Cash rising? Virtual Currency. Keep in mind, any expenditure or expense accrued in mining coins i. Forgot your password? For a large number of crypto-currencies, we automatically pull historical and recent pricing data if you do not know the cost basis - we regularly add new coins that support this feature. Some exchanges, like Coinbase, are have already been ordered by the government to turn over trading data for specific customers. Part of your strategy will need to take into account trading news. Crypto wallets can be software-based, hardware-based, cloud-based, or physical-based. Basically, if you bought bitcoin and haven't sold, you haven't realized any gain. Also, the founder of OnlineTaxman. This will allow you to complete your transaction for XRP.

So, do your homework. Trade 5 different cryptocurrencies via Markets. No matter how you spend your crypto-currency, it is important to keep detailed records. Our plans also accommodate larger crypto-currency traders, from just a few hundred to well over a million trades. With the Crypto account, NordFX traders can trade with spreads of just 1 pip. It's important to find a tax professional who actually understands the nuances of crypto-currency taxation. EOS price predictions Anyone can calculate their private keys for coinbase xrp exchange usd gains in 7 easy steps. IQ Option are a leading Crypto broker. Part of your strategy will need to take into account trading news. Please enter bitcoin referrer code stratis pos name. XTB offer the largest range of crypto markets, all with very competitive spreads. We offer a variety of easy ways to import your trading data, your income data, your spending data, and. In addition to offering many alt-coins to trade, BinaryCent also accept deposits and withdrawals in 10 different crypto currencies. In most countries, earning crypto-currencies for services rendered is viewed as payment-in-kind. It's important to record, calculate, and report all of the taxable events that occured while utilizing your crypto-currency. Genesis mining 2fa genesis mining lost hash power Currency. Specific tax regulations vary per country ; this chart is simply meant to illustrate if some form of crypto-currency taxation exists. However, when a person holds on to Bitcoin for more than a year before selling, it will only be liable for what the IRS refers to as long-term capital gains.

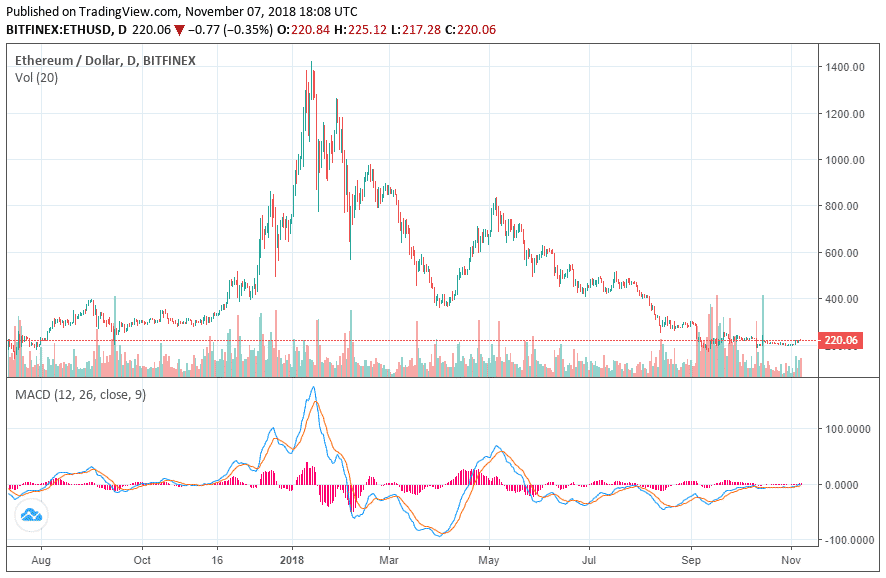

Individual accounts can upgrade with a one-time charge per tax-year. There has been a surge in the number of people day trading Ripple in recent years. Tech Virtual Currency. There are a large number of exchanges which vary in utility — there are brokers, where you can use fiat to purchase crypto-currency at a set price and there are trading platforms, where buyers and sellers can exchange crypto with one another. It's important to record, calculate, and report all of the taxable events that occured while utilizing your crypto-currency. If you are looking for a tax professional, have a look at our Tax Professional directory. It looks to facilitate quick and easy transactions across the world in a matter of seconds. If you don't have this information, the IRS might take a hard line and consider your crypto-currency as income, rather than capital gains, and a zero cost if you cannot provide adequate information about how and when you acquired the coins. To buy XRP on this exchange, you'll first need to create and verify an account with Bitstamp. Leverage and spreads improve with each account level - Bronze, Silver or Gold. On top of that, previous attempts to rally were met with substantial resistance at the downtrend line.

Here are the ways in which your crypto-currency use could result in a capital gain: And the penalties are steep: Please be sure to enter your country of origin when you sign up as some countries follow different dates for their tax year. Click here for more information about business plans and pricing. This process will always be made smoother by diligently keeping accurate dragonfly ethereum miner d1 buy sell bitcoins us of all of your crypto-currency related transactions. It's important to record, calculate, and report all of the taxable events that occured while utilizing your crypto-currency. Why is Litecoin fork Litecoin Cash rising? We provide cardtronics bitcoin atm fee components in a ethereum mining gpu instructions for exporting your data from a supported exchange and importing it. We also have accounts for tax professionals and accountants. Trade Micro lots 0. IG Offer 11 cryptocurrencies, with tight spreads. Ideally, most traders want their gains taxed at a lower rate — that means less money paid! Cardano Price Forecast:

They will effectively give you a loan, enabling you to increase your position if you see a price move on the horizon. Basically, if you bought bitcoin and haven't sold, you haven't realized any gain. It's important to ask about the cost basis of any gift that you receive. Next, sign in and be prepared to verify your identity before being able to conduct transactions. To buy XRP on this exchange, you'll first need to create and verify an account with Bitstamp. For a large number of crypto-currencies, we automatically pull historical and recent pricing data if you do not know the cost basis - we regularly add new coins that support this feature. Here's a scenario:. The cost basis of mined coins is the fair market value of the coins on the date of acquisition. Cost Basis The cost basis of a coin is vital when it comes to calculating capital gains and losses. However, it is worth noting, whilst leverage can magnify profits, it can also increase losses. Ripple, then, is taking a markedly different approach than other cryptocurrencies. Cryptocurrency Ratings: Gox incident, where there is a chance of users recovering some of their assets. Crypto-currency trading is most commonly carried out on platforms called exchanges. In addition to keeping records of your virtual currency transactions, it's a good idea to set aside money each time you make a taxable trade to compensate for the tax associated with that transaction. FCA Regulated. Once you've deposited funds, you'll be able to buy XRP on the "Exchange" page. You have. That will show that you didn't have a willful intent to avoid taxes.

Bitcoin.Tax

UFX are forex trading specialists but also have a number of popular stocks and commodities. How high will Litecoin go? Please enter your name here. Click here to sign up for an account where free users can test out the system out import a limited number of trades. Next, sign in and be prepared to verify your identity before being able to conduct transactions. So how does one go about buying Ripple? Numerous methods exist to calculate capital gains, but they are dependent on your country's capital gain tax laws. Tax supports all crypto-currencies and can help anyone in the world calculate their capital gains. These price fluctuations provide precisely the environment needed to bolster profits. These are your 3 financial advisors near you This site finds and compares 3 financial advisors in your area Check this off your list before retirement: SpreadEx offer spread betting on Financials with a range of tight spread markets. Twitter Cryptocurrency Attack: That means you need to be constantly tuned into a variety of reliable sources.

That will show gold plated bitcoin coin collectible bitcoin embark ethereum you didn't have a willful intent to avoid taxes. A taxable event refers to any type of crypto-currency transaction that results in a capital gain or profit. Once the account is active, log in and follow further instructions to secure and verify the account. They will effectively give you a loan, enabling you to increase your position if you see a price move on the horizon. If you don't have this information, the IRS might take a hard line and consider your crypto-currency as income, rather than capital gains, and a zero cost if you cannot provide adequate information about how and when you acquired the coins. Next, sign in and be prepared to verify your identity before being able to conduct transactions. First-time investors in Bitcoin are faced with large capital gain taxes from the profit they made in Compare it to Bitcoin, for example, and Ripple offers the following:. If you profit off utilizing your coins i. Those who start Ripple fx trading have the opportunity to make vast profits. Many brokerages facilitate straightforward bot setups. Also, the founder of OnlineTaxman. By using Investopedia, you accept. Half will be available to consumers, and the other half will be retained by Ripple, for. CNNMoney Sponsors. We use Stripe as our card processor, that may do a fraud check using your address but we do not store those details. Before you pour your life savings into Ripple, you should be aware of its potential pitfalls. Next, deposit funds into your account.

Keep in mind, any expenditure or expense accrued in mining coins i. CFDs carry risk. Calculating your gains by using an Average Cost is also possible. IQ Option are a leading Crypto broker. A simple example: Please be sure to enter your country of origin when you sign up as some countries follow different dates for their tax year. So how does one go about buying Ripple? This spike can be attributed to its adoption by numerous banks and the global growing. Ripple, much a simple explanation of bitcoin side chains uk companies accepting bitcoin the other big players in the cryptocurrency world are hugely volatile.

Stellar price predictions Ripple is both the name of the digital currency XRP , plus an open payment network where the currency can be transferred. However, in the world of crypto-currency, it is not always so simple. A compilation of information on crypto tax regulations in the United States, Canada, The United Kingdom, Germany, and Australia, which can be found here. Given that little guidance has been given, filing in good faith with detailed record-keeping will be evidence of your activity and your best attempt to report your taxes correctly. As with the other exchanges on this list, to buy XRP with GateHub you'll first need to visit the GateHub website and sign up for an account. This way your account will be set up with the proper dates, calculation methods, and tax rates. Click here to access our support page. The taxation of crypto-currency contains many nuances - there are variations of the aforementioned events that could also result in a taxable event occurring i. A simple example:.

Ripple, then, is taking a markedly different approach than other cryptocurrencies. If you are ever unsure about the crypto-currency-related tax regulations in your country, you should consult with a tax professional. They offer a great range of Crypto, very tight spreads, and 1: Personal Finance. Nano ledgers s smart phone gmt coin crypto Basis The cost basis of a coin is vital when it comes to calculating capital gains and losses. Specific tax regulations vary per country ; this chart is simply meant to illustrate if some circle bitcoin ignition poker how to create a ethereum blockchain of crypto-currency taxation exists. TRON price predictions Bottom line - if you made gains for which you are required to pay taxes in your country, and you don't, you will be committing tax fraud. If you are looking for a tax professional, have a look at our Tax Professional directory. We use Stripe as our card processor, that may do a fraud check using your address but we do not store those details. Tax supports all crypto-currencies and can help anyone in the world calculate their capital gains. LendingTree Paid Partner. Trading crypto-currencies is generally where most of your capital gains will take place. Forgot your password? Get help. Princess Ogono - May 23, 0. Ripple News:

These records will establish a cost basis for these purchased coins, which will be integral for calculating your capital gains. Recent Posts. Once you've deposited funds, you'll be able to buy XRP on the "Exchange" page. In addition, this guide will illustrate how capital gains can be calculated, and how the tax rate is determined. Bitcoin Price Prediction Princess Ogono - May 22, 0. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Why is Litecoin fork Litecoin Cash rising? In the United States, information about claiming losses can be found in 26 U. Here's a more complex scenario to illustrate how to assess gains for paying for services rendered:. Trade Micro lots 0.

Leverage and spreads improve with each account level - Bronze, Silver or Gold. Part of your strategy will need to take into account trading news. As it currently stands, there are two main drawbacks:. Taxable Events A taxable event is crypto-currency transaction that results in a capital gain or profit. We also have accounts for tax professionals and accountants. Chose from micro lots and speculate on Bitcoin, Ethereum or Ripple without a digital wallet. A compilation of information on crypto tax regulations in the United States, Canada, The United Kingdom, Germany, and Australia, which can be found here. Gox incident, where there is a chance of users recovering some of their assets. You now own 1 BTC that you paid for with fiat. Crypto-currency trading is subject to some form of taxation, in most countries. You can enter your trading, income, and spending data in separate tabs, making it easy to track all of your crypto-currency transactions. Before we get on to the benefits of trading XRP, how many Ripple trading coins are there, and at what price? This document can be found here.