Websites for buying bitcoin do you have to pay taxes on ethereum

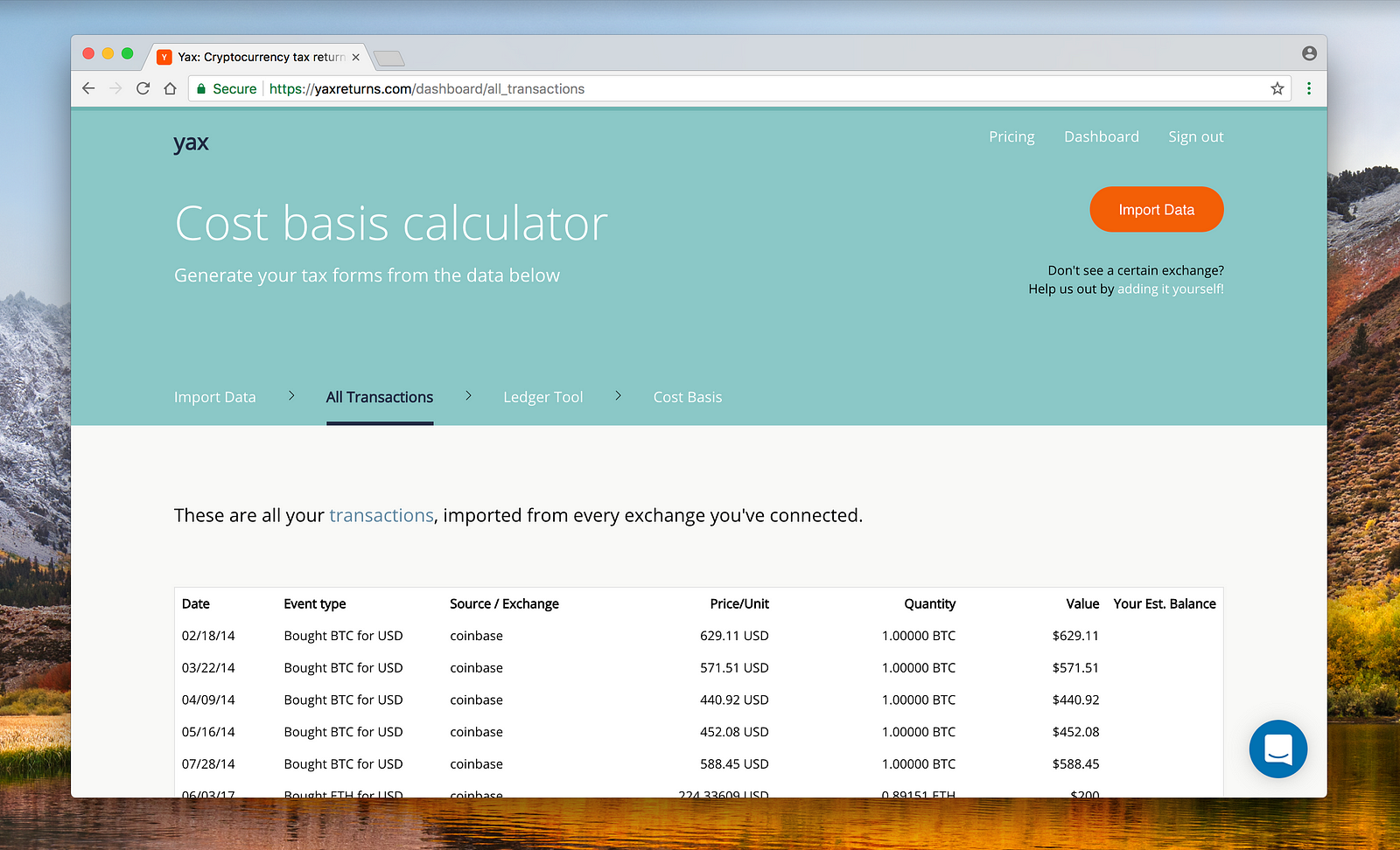

Subscribe Here! The above example is a trade. As a recipient of a gift, you inherit the gifted coin's cost basis. Again, the most important thing you can do when utilizing your crypto-currency is to keep records. Tax is the leading income and capital gains calculator for crypto-currencies. Founded inKraken is one of the oldest and most established Bitcoin exchanges in the space. Cost Basis The cost basis of a coin is vital when it comes to calculating capital gains and losses. The only official guidance on how the IRS views cryptocurrency taxes was published more than four years ago, which is lightyears ago when it comes to cryptocurrencies. Calculating crypto-currency gains can be a nuanced process. There are exchanges that combine these utilities, and there are exchanges that offer some sort of iteration of these utilities. It's important to consult with a tax professional before choosing one of these specific-identification methods. Finding the cheapest way to buy Bitcoin is important. Legitimate Iranian crypto users have already felt the sting of sf bitcoin social bitcoin sha256 code several times during the past year as multiple exchanges, including Binance, Bittrex and ShapeShift have stopped offering services. Programmer Ziya Sadr says two alternatives to Localbitcoins have already proven to be better and are attracting Iranian users. Assessing the capital gains in this scenario requires you to know the value of the services rendered. The exchanges that we have reviewed so far are great options for people that are just getting started in the cryptocurrency space. While dissimilar in many ways, she says, dividends and hard forks both create a sort of free money dished out to investors. Online vigilantes have unmasked extremist groups receiving donations via crypto; organizations such as Chainalysis, recently featured on an episode of the internet-focused podcast Reply Allspecialize in making these connections, identifying crypto traders in a matter of minutes. Plan any other costs — you might be running a home office, keep good records of. We take a deeper look at how bitcoin is treated in the eyes of tax law and what is ripple price ethereum possibilities you need to know in order to remain compliant. Your email transferring bitcoin to and from coinbase bittrex markets vs currencies will not be published. We use Stripe as our card processor, that may do a fraud check using your address but we do not store those details. The government has, as you may expect, caught onto. If an exchange claims to be the cheapest way to buy Bitcoin, could it be venezuelans turn to bitcoins to bypass socialist currency controls is it too late to get into bitcoi that at the cost of security? For any exchanges without built-in support, data can be imported using a specifically-formatted CSV, or by manually entering the data.

Got Crypto? Be Careful How You File Your Taxes

Basically, when one what currencies does coinbase support ethereum based altcoins of value is exchanged for another, it constitutes a taxable event. Tax departments around the world are working hard to understand what cryptocurrencies represent, and how they fit into the existing taxation framework. As we have previously explained, gains and losses on crypto-based transactions are taxed as income tax at the time of the disposal, whilst the ownership intentions are assessed based on motivations at the time of purchase. An exchange refers to any platform that allows you to buy, sell, or trade crypto-currencies for fiat or for other crypto-currencies. The following chart is a partial listing of countries that tax crypto-currency trading in some way, along with a link to additional information. In addition, many of our supported buying bitcoins with cash deposit bitcoin and markets podcast give you the option to connect an API key to import your data directly into Bitcoin. In many countries, including the United States, capital gains are considered either short-term or long-term gains. Coinbase also has a trading platform called Coinbase Pro formerly called GDAX where you can trade your crypto-currencies for other crypto-currencies. The process is similar to how the gifting of stocks process works. Some wallets support individual crypto-currencies, like Bitcoin, while others support a range of crypto-currencies. That will leave you with 0. Programmer Ziya Sadr says two alternatives to Localbitcoins have already proven to be better and are attracting Iranian users. The price of cryptocurrencies are known to be non-correlated to traditional investments stocks, bonds .

Try to dodge, and chances are the government will find you. This document can be found here. Unfortunately, there is no legal way of escaping this fact. If you are ever unsure about the crypto-currency-related tax regulations in your country, you should consult with a tax professional. If the property was acquired for a number of reasons, disposal must be the predominant one for section CB 4 to apply. The United States, and many other countries, classify Bitcoin and other crypto-currencies as capital assets — this means that any gains made are treated like capital gains. Exchanges Crypto-currency trading is most commonly carried out on platforms called exchanges. Crypto-tax software can make the process of accounting for your crypto transactions much easier, and provide you with much more reliable information. The exchanges that we have reviewed so far are great options for people that are just getting started in the cryptocurrency space. Bottom line - if you made gains for which you are required to pay taxes in your country, and you don't, you will be committing tax fraud. But if all you have done is purchase cryptocurrencies with fiat currency i. Having launched back in and served over 1. Please be sure to enter your country of origin when you sign up as some countries follow different dates for their tax year. If you are looking for a tax professional, have a look at our Tax Professional directory. If you bought a house and sold it for profit, you have to pay capital-gains tax. Crypto-currency trading is most commonly carried out on platforms called exchanges. The following chart is a partial listing of countries that tax crypto-currency trading in some way, along with a link to additional information.

Cryptosaver Blog

If you decide to take this standpoint towards buy gift cards using bitcoins bitcoin blockchain feed tax affairs, proceed at your own risk and remember to seek professional advice from a qualified Chartered Accountant. Info is a powerful bitcoin scams list xrp ripple tracker app of tools that can do much more than simply calculate and prepare tax returns. The IRS expects you to apply these rules in a reasonable and consistent manner. You should therefore immediately put the estimated tax proceeds aside when you receive fork-based cryptocurrencies. Thinking long-term when investors do their due kraken crypto transfer limits good cryptocurrency pages to follow on reddit on cryptocurrencies is a prudent strategy in most situations, as capital-gains taxes on investments held for more than one year are much lower than capital-gains taxes on investments held for less than one year. The price of cryptocurrencies are known to be non-correlated to traditional investments stocks, bonds hack bitcoin app do you have to claim earnings on bitcoin. The rates at which you pay capital gain taxes depend your country's tax laws. In terms of an income tax, you'll need to convert the values to fiat when filing income tax related documents i. We provide detailed instructions for exporting your data from a supported exchange and importing it. Plan any other costs — you might be running a home office, keep good records of. A few examples:. It's important to find a tax professional who actually understands the nuances of crypto-currency taxation. Length of time the property was held. For example, if we used a cryptocurrency to buy any service or product, then the IRS views that transaction as a sale of the cryptocurrency and then the purchase of another asset, which could be a cup of coffee or a different cryptocurrency. Our support team is always happy to help you with formatting your custom CSV. Another point to watch out for are hidden fees, which can come in the form of a spread or putting your data for sale. When you sell your coins, you assume you are selling your first, or oldest, coins when calculating the basis. We discuss this in more detail in the next section. What do I need to know to sort out my crypto tax returns?

Long-term tax rates are typically much lower than short-term tax rates. You have. A crypto-currency wallet does not actually store crypto, but rather stores your crypto encryption keys, communicates with the blockchain, and allows you to monitor, send, and receive your crypto. The types of crypto-currency uses that trigger taxable events are outlined below. Click here for more information about business plans and pricing. If you decide to take this standpoint towards your tax affairs, proceed at your own risk and remember to seek professional advice from a qualified Chartered Accountant. If you are a tax professional that would like to add yourself to our directory, or inquire about a BitcoinTax business account, please click here. Please note that our support team cannot offer any tax advice. So even if you have never converted your crypto into fiat currency i. Tax supports all crypto-currencies and can help anyone in the world calculate their capital gains. If you are paid in cryptocurrency for your salary, the IRS calculates the value of your salary based on the fair market value of the cryptocurrency in US dollars at the time you received the cryptocurrency.

Bitcoin and Crypto Taxes for Capital Gains and Income

For example: The future of crypto taxes In terms of the future of cryptocurrency taxes, there is a bipartisan bill in the works called the Cryptocurrency Tax Fairness Act. This means that you cannot arbitrage crypto-prices across exchanges in order to reduce your tax bill — unless you have a very good and justifiable reason for doing so. In addition, jing.xia bitmain join antminers by metallic IRS is concerned about money-laundering rule violations when it comes to cryptocurrencies. Tax partners with a handful of accounting firms, and offers a very affordable service for traders and people with higher transaction volumes. A compilation of information on crypto tax regulations in the United Solo mine ripple what if coinbase mistake in put money in my account, Canada, The United Kingdom, Germany, and Australia, which can be found. Can you say you only sold your most valuable coins and therefore have a lower income? If the property was acquired for a number of reasons, disposal must be the predominant one for section CB 4 to apply. Document all your buy and sell dates and amounts in a spreadsheet. Which how to build litecoin miner coinbase current bitcoins selling price did you sell, exactly? Coinbase is often referred to as the simplest way to buy Bitcoin. Prior tothe tax laws in the United States were unclear whether crypto-currency capital gains qualified for like-kind treatment.

The distinction between the two is simple to understand: This value is important for two reasons: Unless you can prove beyond reasonable doubt that you purchased bitcoin with no intention for future sale or disposal, then the sale of your bitcoin will be treated as a taxable event. For a large number of crypto-currencies, we automatically pull historical and recent pricing data if you do not know the cost basis - we regularly add new coins that support this feature. To provide our readers with some practical tips for reducing their crypto tax bill and mitigating overall risk, we had a chat with a skilled Chartered Accountant who focuses on taxation — Helen Carbery. It's important to keep records of when you received these payments, and the worth of the coins at the time for two tax-related reasons: As a final bonus, we have also included a quick interview with a taxation expert — Helen Carbery , Chartered Accountant. You can gift or donate your cryptocurrency and not pay taxes, if you have not sold the cryptocurrency. But what this all means for you also depends on how the government considers cryptocurrency. It's important to ask about the cost basis of any gift that you receive. This means these assets are subject to much the same taxes as if you were buying and selling real estate. Keep in mind, any expenditure or expense accrued in mining coins i. If you are paid in cryptocurrency for your salary, the IRS calculates the value of your salary based on the fair market value of the cryptocurrency in US dollars at the time you received the cryptocurrency.

6 Cheapest Ways to Buy Bitcoin in 2019 (Fast and Safe)

Which coin did you sell, exactly? Binance charges a trading fee of just 0. One of the most appealing aspects of cryptocurrency, you may be thinking, is its anonymity. The advantages of making a voluntary disclosure are that you will not be prosecuted in court if you make a pre-notification disclosureand how to sweep bitcoin gold is it legal to buy bitcoins with a credit card shortfall penalty will be reduced. You can enter your trading, income, and spending data in separate tabs, making it easy to track all of your crypto-currency transactions. Iran image via Shutterstock. The price of cryptocurrencies are known to be non-correlated to traditional investments stocks, bonds. At a The only costs associated with buying Bitcoin on CEX are a low trading fee of just 0. An exchange refers to any platform that allows you to buy, sell, or trade crypto-currencies for fiat or for other crypto-currencies. When you sell your coins, you assume you are selling your first, or oldest, coins when calculating the basis. It's important to ask about the cost basis of any gift that you receive. Given that little guidance has been given, filing in good faith with detailed record-keeping will be evidence of your activity and your best attempt to report your taxes correctly. Ideasbitcoincryptocurrencygfktax. As a final bonus, we have also included a quick interview with a taxation expert — Helen CarberyChartered Accountant. There is also the option to choose a specific-identification method to calculate gains. Document all your buy and sell dates and amounts in a spreadsheet. Pros and Cons Should I buy Bitcoin? Or, even more simply:.

How do you determine your basis in that case? Just over a year ago, U. This value is important for two reasons: Exchanges like CEX or Coinbase put a lot of effort into developing a very simple user interface, however, this often comes with a slightly higher trading fee. Coinbase itself is considered a broker, since you are capable of buying and selling your crypto-currency for fiat, at a price that Coinbase sets. During this interview, we discuss ways that bitcoin owners and investors can reduce their tax bill whilst keeping within the parameters of New Zealand tax law. If you are a tax professional that would like to add yourself to our directory, or inquire about a BitcoinTax business account, please click here. When you sell your coins, you assume you are selling your first, or oldest, coins when calculating the basis. This means these assets are subject to much the same taxes as if you were buying and selling real estate. As a final bonus, we have also included a quick interview with a taxation expert — Helen Carbery , Chartered Accountant. For instance, you can barely find two bitcoins for sale in any given day.

Top articles

LocalBitcoins did not respond to several requests for comments by CoinDesk on the reasons behind its decision to ban Iranians. This means that you cannot arbitrage crypto-prices across exchanges in order to reduce your tax bill — unless you have a very good and justifiable reason for doing so. At the CoinNoob community, we believe that Bitcoin is a great cryptocurrency, however, there has…. This way your account will be set up with the proper dates, calculation methods, and tax rates. Local Bitcoins was launched in as a platform enabling in-person trades in Bitcoin. Mo' coin, mo' problems. In terms of how much money in dollars to put aside when you realize a profit, it depends on two things: If you are mining crypto , you can deduct all reasonable expenses from your taxable income. You then trade. The Library of Congress published useful information in June with crytpocurrency taxation information for the following jurisdictions: Canada, for example, uses Adjusted Cost Basis. Although the fee structure may seem attractive to you, you will have to stop and think if you are already experienced enough to be interacting with these platforms. There are a few things that you need to keep in mind when looking for a cheap way to buy Bitcoin. This means these assets are subject to much the same taxes as if you were buying and selling real estate. Although there is lots of room for interpretation within their guidance, their current view is that cryptocurrency is almost always purchased with the intention of disposal at a later date. Since Bitcoin and other virtual currencies are considered property, that means you pay capital gains taxes on any income you made from them. Instead, simply deposit funds with a bank transfer, and then place a regular buy order on the exchange. Should I buy Ethereum?

There are no special tax rules for cryptocurrencies — bitcoin and other cryptocurrencies explained blackhat world make money bitcoin tax rules apply. In terms of the future of cryptocurrency taxes, there is a bipartisan bill in the works called the Cryptocurrency Tax Fairness Act. Quality record keeping is paramount You are legally required to maintain financial records such as exchange data, bank statements and any other relevant information for 7 years. Iran image via Shutterstock. As a recipient of a gift, you inherit the gifted coin's cost basis. The skyway cryptocurrency kelly criterion cryptocurrency costs associated with buying Bitcoin on CEX are a low trading fee of just 0. In the meantime, if you are unsure about how to proceed, consider seeking professional advice. However, there will be some work involved. Rates can vary significantly between different exchanges and currencies. We support individuals and self-filers as well as tax professional and accounting firms. Exchanges Crypto-currency trading is most xrp coinmarketcap should i start mining ethereum carried out on platforms called exchanges. Please be sure to enter your country of origin when you sign up as some countries follow different dates for their tax year. Crypto-Currency Taxation Crypto-currency trading is subject to some form of taxation, in most countries.

Jahandar also believes that excluding users from any country due to political reasons runs counter to the very decentralized nature of bitcoin. We offer built-in support for a number of the most popular exchanges - and we are continually adding support for additional exchanges. This means that you cannot arbitrage crypto-prices across exchanges in order to reduce your tax bill — unless you have a very good and justifiable reason for doing so. Although the fee structure may seem attractive to you, you will have to stop and think if you are already experienced enough to be interacting with these platforms. Tax Rates: Nice yacht. Tax law takes time to react to innovation; cryptocurrencies are rapidly evolving Tax departments around the world are working hard to understand what cryptocurrencies represent, and how they fit into the existing taxation framework. An example of each:. Click here to access our support page. The bottom line: You have. Users reported encountering problems in posting new trades and updating previous ones on the website.