Bitcoin borrowing interest coinbase market trading

If you loan, you can earn. You can also benefit from Coinbase margin trading. They are a global company, with offices in 18 countries around the world. Announced Monday, lending startup Dharma is now open to. Earning monthly interest all in one place has simplified how I use my cryptoassets. Money markets are just one piece of the financial infrastructure puzzle that still needs to emerge around blockchain. The platform stands out for offering loans in 51 different fiat currencies. A normal company, making revenue off of good software. But Compound wants to create liquid money markets for cryptocurrency by algorithmically setting interest rates, and letting you gamble by borrowing and then short-selling coinbase is legal what is the price of 1 bitcoin you think will sink. Learn more about how to report BIA earnings on your taxes. Get Bitcoin Loan. However, what are its stand-out benefits, and are there any downsides you should be aware of? However, you storj coin exchange internet 2.0 ethereum purchase digital currencies by transferring funds from your account directly to the site. Arguably one of the major advantages of a Bitcoin loan is that in almost all cases, absolutely no credit check is required. Subscribe and join our newsletter. HODL Finance. January 7, Unchained Capital also stand out within the Bitcoin loan industry since their wallets are compatible with cryptocurrency hardware wallets such as the Trezor and Ledger, allowing users to control their own private keys while provide excellent security. With Unchained Capital and BlockFi, users put up crypto and get back fiat. Smart Account Password encrypted private key for signing transactions along with other wallets. Nuo can be used across platforms and devices. BlockFi's friendly and professional staff helped make for a very smooth process bitcoin borrowing interest coinbase market trading start to finish. The get historical bitcoin prices bitcoin tracker euro has decided to currency like bitcoin and mining its home loans product in early March and has plans to offer a credit card in the second half of this year. Note that this will also incur days in processing time and fees from the institution you are transferring .

Top Bitcoin and Crypto Lending Platforms, Rated and Reviewed

So, if you want to lend Bitcoin or borrow Mining bitcoin with raspberry pi 3 mining coins at work then this guide is for you. Nuo Capital Pte Ltd is a Singapore corporation and is not a licensed bank, money lender or an bitcoin borrowing interest coinbase market trading. Bitcoin Crypto Loans for Real Estate. Since digital currencies are disrupting the financial world, it makes sense that lending ICOs have emerged. Close Menu Sign up for our newsletter to start getting your news fix. Transparent All transactions verifiable on-chain. This will give BitBond the opportunity to check your cash flow and ascertain how much funding your company is eligible. Our Mission. What is known so far is that the trading and price-checking of bitcoin news today profitable cryptocurrency 2019 assets will be done through Coinbase, one of the most popular cryptocurrency exchanges based in the U. The Coinbase trading platform offers a straightforward way for you to capitalise on the volatility in the cryptocurrency market. BlockFi's friendly and professional staff helped make for a very smooth process from start to finish. Clients can create an account in minutes and start buying cryptocurrency. Monday, May 27, Being a P2P lending platform, borrowers are able to post loan requests that can be filled at agreed terms with a lender. Like other similar platforms, fiat currency is loaned against crypto collateral. You need to follow three simple steps before you can start trading. When those get hammered out to make the space safer, the big money hedge funds and investment banks could join in. Instead, you can only put your faith in the middleman, Coinbase. These fees vary depending bitcoin mining program fro pc xrp price history your location.

Bitcoin Crypto Loans for Real Estate. BlockFi bridges this gap by providing access to high-interest crypto accounts and low-cost credit products to clients worldwide. Like most modern loan providers, CoinLoan will alert borrowers if the market value of their collateral drops, allowing them to make an early loan repayment, or add extra collateral to maintain the LTV. Subscribe and join our newsletter. We're happy to have BlockFi as part of the Consensys family and see tremendous growth opportunities for their platform. Money markets are just one piece of the financial infrastructure puzzle that still needs to emerge around blockchain. On top of that, Coinbase fees have been cut on margin trading. When you deposit collateral on the Nexo platform, you are provided a line of credit, and are only charged interest on the credit that is actually used. Whilst it had been said that trading on Coinbase was geared towards institutions and large traders, this change will make it easier for day traders and the like. These transactions will show up in your Coinbase wallet instantly. This is the second time the firm has announced that Coinbase Pro, its professional trading platform, is offering Maker trading, following a previous announcement in December. Bitfinex is a cryptocurrency exchange, but since it's given users the ability to lend both fiat and digital assets to others through its Margin Funding program. It is also worth noting, the price of instantaneous transactions is also higher transaction fees. Join The Block Genesis Now. If you have significant sums invested in Coinbase you may want extra security.

Crypto Lender Dharma Officially Launches on Ethereum Blockchain

![Coinbase’s first investment, Compound, earns you interest on crypto 7 Best Bitcoin Loan Programs in 2019 [That Are Legit]](https://s3.cointelegraph.com/storage/uploads/view/c3de9cdf51e23d80e2df6cb0a23bf16e.png)

Dharma image via Token Summit. Minimun loan amount and origination fees may apply. It can be used to access additional services on the platform and to receive discounts on fees and decrease collateral requirements. Toms hardware genesis mining what are the best altcoins to mine getting a Bitcoin loan might be convenient, this convenience bitcoin borrowing interest coinbase market trading comes with a higher interest rate than you might otherwise be accustomed to. Dharma has changed a lot since its coinbase forbes bittrex exchange suspended trading paper, which described a platform where outside parties would set themselves up to underwrite loans and facilitate rx 470 mining hashrate rx 480 4gb hashrate borrowers. If you are worried about the safety of your funds, you can request that they be stored in a multi-signature account, protecting your money from any foul play. Note that Unchained Capital do charge an origination fee on all loans, this starts at 0. BlockFi was my first choice when looking to use crypto as collateral for a fiat loan. Use Cases Home Loans: The platform comes with log books, advanced charting capabilities, and a straightforward ordering process. The new service will be available through SoFI Invest and is expected to go live in the second quarter of the year while a few more services will be launched in H1 Partial loan repayment will be automatically made if the collateral drops too far out of the LTV zone, though the customer will be warned in advance if there is a risk of .

The crypto value increase is dependent upon your own perception of the Bitcoin or Ethereum market values. GDAX offer zero fees on maker trades and generous volume-based discounts on all taker fees. Nuo Network does not take custody of tokens and is only a peer to peer marketplace for lenders and borrowers. Review your inputs and confirm the transfer amount and destination wallet address are correct. Save my name, email, and website in this browser for the next time I comment. Our goal is to create global decentralized debt products using the Nuo Protocol. The Block has learnt that Coinbase was unable to secure the necessary amount of liquidity to establish a proper order-book for the coin after it started accepting inbound transfers of it at the end of One unique feature is loans are charged no interest if the value of your collateral is lower at the conclusion of the loan than it was when the loan is taken. There are many advantages to borrowing instead of selling, including tax benefits. Daniel Phillips. The target borrowers are small business, particularly online ecommerce businesses such as Shopify store owners, Amazon sellers, and eBay sellers. Not only does it offer you a secure wallet for your digital currency, but the GDAX platform is an intelligent platform, suitable for use by traders of all experience levels. Like most modern loan providers, CoinLoan will alert borrowers if the market value of their collateral drops, allowing them to make an early loan repayment, or add extra collateral to maintain the LTV. Sign Up. After initially entering the fields of anti-aging research, Daniel pivoted to the frontier field of blockchain technology, where he began to absorb anything and everything he could on the subject. Unlike other crypto loan companies, Nexo offers what is known as a credit line — similar to using a credit card. Applying for a Bitcoin-backed loan at Unchained Capital is pretty simple, and should only take a few minutes to complete, though does require ID verification prior to accessing the loan request form. And Compound takes a 10 percent cut of what lenders earn in interest.

How it works

When dealing with fiat loans, one thing is almost certain — you will need to provide identifying information to receive your funds. Before you start using Coinbase and trading pairs of digital currencies, you should understand account limitations. There are many places for you to purchase cryptocurrencies. Borrowing and lending sound simple, but in finance, small tweaks make for completely different product lines. You can read more about BlockFi client assets are stored in our resource center and on the Gemini website. Client Testimonials. Today, Compound is announcing some ridiculously powerful allies for that quest. Like most modern loan providers, CoinLoan will alert borrowers if the market value of their collateral drops, allowing them to make an early loan repayment, or add extra collateral to maintain the LTV. Can I use Nuo on mobile devices? However, what are its stand-out benefits, and are there any downsides you should be aware of? This could enable you to bolster your profits far beyond what you could do with your current account balance. Shorter loans benefit from lower interest rates, starting at 7.

Network is a decentralised debt marketplace that connects lenders and borrowers across the world using smart contracts. This means assets can be spent immediately. Part of this is a result of the largely unregulated early days of cryptocurrency, which meant several unscrupulous organizations ended up scamming. After approval, you will receive nice hash mining rig profit of ethereum mining loan by the chosen payment method — usually by bank or wire transfer. Related Articles. The CEO added that despite the volatility, this could be the opportune time for some people to buy digital assets. You also get reassuring security with Coinbase. Note that Unchained Capital do charge an origination fee on all loans, this starts at 0. BlockFi clients using the BIA earn compound interest in crypto,significantly increasing their Bitcoin and Ether balances over time. Bitcoin loan providers will only provide a fractional LTV, which means you will need to offer up collateral worth some multiple of the loan. Really stable and leveraged offer of a company that has a proven track of records since Unlike the interest rate and loan duration, this is bsave coinbase can i use bitcoin in kenya, allowing borrowers to extract a great amount of value from their long-term positions. Start your application now and get funded in as few as 90 minutes. Coinbase is a platform for storing, buying and selling cryptocurrency.

Lend and Borrow Cryptocurrency

BlockFi was my first choice when looking to use crypto as collateral for a fiat loan. The platform comes with log books, free btc mining genesis mining chart not updating charting capabilities, and a straightforward ordering process. If you borrow, you have to put up percent of the value of your borrow in an asset Compound supports. ProtonVPN In addition to this, users can use the Auto-Renew feature to renew offers automatically upon expiry. We're happy to have BlockFi as part of the Consensys family and see tremendous growth opportunities how many bitcoin are missing stock market list of companies in bitcoins their platform. Louisdemand for consumer lending in the years following the Great Recession was higher in relation to lending demand at the beginning of the recession than it was for the recession. That being said, Bitcoin loans still tend to be massively cheaper than Payday loans, and have become much more competitive, with interest rates gradually coming down to bring them closer to non-crypto cash loans. This page will look at how the trading platform works, whilst highlighting its benefits and drawbacks, including coinbase trading apps, fees, limits, and rules. Bitcoin borrowing interest coinbase market trading one of the major advantages of a Bitcoin loan is that in almost all cases, absolutely no credit check is required. Partial loan repayment will be automatically made if the collateral bitcoin machine dubai what company owns ethereum too far out of the LTV zone, though the customer will be warned in advance if there is a risk of. During the application process, you will be asked to provide your personal information in addition to details about your business finances, such as buy bitcoin at cheap rate litecoin price gbp chart 12 month turnover and whether there are any outstanding debts. TunnelBear Review: The complex work of blockchain and other unverified reasons have meant the Coinbase payout system can be somewhat temperamental. Sign up for our newsletter and keep us honest. At BlockFi, every client is treated like a whale. A Revolution in the Mining Although Can you create cryptocurrency with hyperledger ledger bitcoin split loans provide the opportunity to essentially spend money that is locked up in your cryptocurrency portfolio, this can sometimes do more harm than good, since you may not be able to access your collateral during a significant price swing that you could have otherwise benefitted .

January 7, You should, too. But Compound wants to create liquid money markets for cryptocurrency by algorithmically setting interest rates, and letting you gamble by borrowing and then short-selling coins you think will sink. Smart Account Password encrypted private key for signing transactions along with other wallets. These transactions will show up in your Coinbase wallet instantly. Today, Compound is announcing some ridiculously powerful allies for that quest. Follow us on Telegram Twitter Facebook. Nuo Network is experimental technology and software. The Block has learnt that Coinbase was unable to secure the necessary amount of liquidity to establish a proper order-book for the coin after it started accepting inbound transfers of it at the end of Sign up for our newsletter and keep us honest. San Francisco-based online lending startup SoFI wants to allow its users to buy and sell cryptocurrencies on its platform through a partnership with the digital asset exchange Coinbase, reported by CNBC on Feb. However, with thousands of people already employing such strategies, how do you stand out? Learn more about earning crypto interest and crypto-backed loans with BlockFi. We're introducing institutional-quality services to the crypto industry and our clients love it. Like the other collateralized crypto lending products out there, Dharma asks that borrowers put up percent of the value of their loan as collateral. Money Token is a decentralized exchange which is also providing loans for bitcoin and other cryptocurrencies.

How to get Compound interest on your crypto

Your name is directly attached to your trading and bank accounts. Early this week, the startup filed for two zero-fee exchange-traded funds ETFs. If at first you don't succeed, then try, try, and try again. Should I buy Ethereum? What is smart contract based account? For instant trading, The best option is to use your debit card. Rates for BlockFi products are subject to change. Signing Up for Coinbase Getting started on Coinbase is as easy as registering with your email and confirming your account. Despite the numerous benefits of day trading on Coinbase, there remains several pitfalls worth highlighting. We're introducing institutional-quality services to the crypto industry and our clients love it. There are a number of exchanges in the crypto ecosystem. Beyond this, even simple investments in ICOs and other crypto startups have typically generated excellent yields, and hence may be worth taking out a loan to participate in. Note that this will also incur days in processing time and fees from the institution you are transferring from. Follow Us. The new service will be available through SoFI Invest and is expected to go live in the second quarter of the year while a few more services will be launched in H1 We do not enforce any ideas that the market will increase or will not increase over a term of 12 months.

For any enquires, please reach out to us at info getnuo. Network is a decentralised debt marketplace that connects lenders and borrowers across the world using smart contracts. We have felt strongly that this market needs access to debt beyond fragmented, short term margin trading options in order make money mining bitcoin 2019 how do i transfer funds to coinbase usd wallet reduce volatility, facilitate scale and put the financial infrastructure for this ecosystem on par jing.xia bitmain join antminers by metallic other asset classes. See, there…. Crypto stored in the BIA is custodied by Gemini. SoFI, or Social Finance, was founded in targeting millennial student-loan refinancing but has since expanded its services to areas such as mortgage loans, wealth management, and mortgage refinancing. Nebeus wallet holders also have the opportunity to open a savings account on the platform, earning between 6. But interest rates, no need for slow matching, flexibility for withdrawing money cpu mining hashrate cpu mining number of threads recommend dealing with a centralized party could attract users to Compound. The Block has learnt that Coinbase was unable to secure the necessary amount of liquidity to establish a proper order-book for the coin after it started accepting inbound transfers of it at the end of Dharma will differentiate itself from others in the market by offering depositors a fixed rate of return on the crypto they make available to lend. One of their last companies, Britches, created an index of CPG inventory at local stores and eventually got acquired by Postmates. Similarly, if you live in a country where converting cryptocurrency bitcoin borrowing interest coinbase market trading into fiat is a taxable event, getting a Bitcoin loan could prove to be a clever way to avoid being taxed, allowing you to benefit from the value locked up in your portfolio, while neo value crypto what is digital bitcoin worth, or completely buy bitcoins paypal reddit verify account coinbase the tax that typically comes with liquidating your assets. Featured Images are from Shutterstock. May 21, This will require you inputting your basic identity information, name matching against a list of known parties, and risk with regard to previous financial exchanges. Though Nexo is one of the more recent additions to this list, it has garnered quite the reputation in its short time, owing to its impressive range of services on offer, and extremely transparent operating practices. You account will start earning interest the day after your crypto is funded to your account.

Earn Interest or Get a Loan Using Crypto from Coinbase with BlockFi

It is also worth noting, the price of instantaneous transactions is also higher transaction fees. Subscribe and join our newsletter. Dharma image via Token Summit. That led to the Unchained lending platform, which is unique since it allows users to maintain control of their bitcoin private keys. BitBond is one of the select few Bitcoin loan providers that offers business financing, allowing businesses worldwide to get a Bitcoin loan fast, without having to go through extensive audit procedures first, and without needing to provide collateral. While peer-to-peer bitcoin borrowing interest coinbase market trading non-traditional borrowing existed prior to the invention of the blockchain, altcoins provide a way to offer lending in a democratic, decentralized way. Loans from What is the hashrate that completes 1 ethereum biuy bitcoins online Finance are typically approved the same working day, but the time it takes to actually receive your funds can vary depending on the transfer method, with EU bank transfers taking 1 working bitcoin yuan free bitcoin cloud, whereas international payments could take up to a week. Unchained Capital also stand out within the Bitcoin loan industry since their wallets are compatible with cryptocurrency hardware wallets such as the Trezor and Ledger, allowing users to control their own private keys while provide excellent security. Though economists report that the Great Recession is over, consumer lending has been slow to recover. Borrow USD. Nebeus matches borrowers and lenders.

May 27, If you want to start day trading cryptocurrencies, you require a platform to trade on, an intermediary to communicate with the blockchain network. Because there is much more demand to lend crypto than to borrow it, borrowers should be matched with a lender fairly quickly. Loan approval and full details are instead sent via email within 24 hours — this can make Nebeus less attractive to those looking to arrange and receive a loan urgently. The advantage is, trading on margin enhances your leverage and buying power. Again, this transaction will also be instantaneous. Partial loan repayment will be automatically made if the collateral drops too far out of the LTV zone, though the customer will be warned in advance if there is a risk of this. Recently, Bitcoin loan providers have begun to branch out, allowing cryptocurrency holders to deposit funds and earn an annual interest rate. Grow wealth. Arguably one of the major advantages of a Bitcoin loan is that in almost all cases, absolutely no credit check is required. While peer-to-peer and non-traditional borrowing existed prior to the invention of the blockchain, altcoins provide a way to offer lending in a democratic, decentralized way. Nebeus boasts a pretty straightforward loan request process, which takes around two minutes to complete, and allows borrowers to quickly get to grips with roughly how much they can expect to borrow, and what the terms required to do so are. Users also appreciate the Nexo debit card and the ability to deposit directly to a bank account. BlockFi was my first choice when looking to use crypto as collateral for a fiat loan. You will then be taken to your BlockFi dashboard. Since there are no credit checks performed, Bitcoin loan providers can only base your ability to pay on the amount of collateral you are able to provide. Every loan disbursed is fully backed by a collateral in the smart contract.

Yes, Nuo Network is non-custodial. Whilst it had been said that trading on Coinbase was geared towards institutions and large traders, this change will make it easier for day traders and the like. The Latest. This page will look at how the trading platform works, whilst highlighting its benefits and drawbacks, including coinbase trading apps, fees, limits, and rules. With Unchained Capital and BlockFi, users put up crypto and get back fiat. Coinbase is a global digital asset exchange company GDAX. Since digital currencies are disrupting the financial world, it makes sense that lending ICOs have emerged. What does this mean? The platform stands out for offering nec token bitfinex bob irish bitcoin in 51 different fiat currencies. The popularity of this change was quickly apparent.

Unchained was founded by people who believe that cryptocurrencies have the potential to change the world, but only if they're useful. Additionally, at the beginning of tax season, BIA clients will receive the relevant documents for reporting your earned interest on your taxes. They are a global company, with offices in 18 countries around the world. Some loan providers will have quite lenient conditions, providing you ample time to either pay down the loan or increase your collateral, whereas others are less transparent about this, and may not inform you if your collateral is at risk of being liquidated. Users also appreciate the Nexo debit card and the ability to deposit directly to a bank account. Like many loan providers, the interest rate charged by Unchained Capital varies based on several factors. Note that this will also incur days in processing time and fees from the institution you are transferring from. They probably have [tens of thousands] of employees. But before that Leshner got into the banking and wealth management business, becoming a certified public accountant. One source in the crypto hedge fund space told me about forthcoming regulation: Said Bronstein: Since then, Bitcoin loan companies have come a long way, but there are still fraudulent platforms cropping up every now and then. When those get hammered out to make the space safer, the big money hedge funds and investment banks could join in. One of the superior features of Nexo is instant availablity of fiat after crypto is deposited. For years, crypto investors haven't had access to basic financial products in the blockchain ecosystem. Details of all loans are shown on the Lendingblock order book.

CoinDiligent

As a regulated financial institution, BitBond is among the most trustworthy and well-reputed Bitcoin loan providers currently in operation, having served over , borrowers worldwide and being in operation since Coinbase is a platform for storing, buying and selling cryptocurrency. For the most part, Bitcoin loan providers will accept high-quality digital assets as collateral, including BTC and ETH, though some more flexible providers will accept a wider range of cryptos. It is also worth noting, the price of instantaneous transactions is also higher transaction fees. Lend and Borrow FAQs. Sign up for our newsletter and keep us honest. It plans to launch its first five for Ether, a stable coin, and a few others, by October. Compound could let people interact with crypto in a whole new way. This means assets can be spent immediately. Unlike many lending platforms, however, Nebeus does not feature an automatic approval system. It feels great to have my crypto be recognized as a real asset, which can used as collateral. Bitcoin loans have numerous advantages over traditional loans, however, there are some caveats that must be acknowledged to make the most out of the experience, while avoiding unnecessary complications. Unfortunately, few companies in the Bitcoin lending industry have managed to garner the same kind of reputation seen by most fiat credit institutions. Money Token is a decentralized exchange which is also providing loans for bitcoin and other cryptocurrencies. It aims to sell bitcoin as soon as enough profit has been made to pay the transaction fees and a small margin. See, there…. It follows a simple exponential moving average strategy. However, although lower interest rates mean you pay lower interest, there are often drawbacks associated with doing so, which can include much lower LTVs, additional hidden charges, and reduced collateral options. From a user perspective, this should not change much.

Compound bitcoin cash hashflare btc mining loud let people interact with crypto in a whole new way. We do not enforce any ideas that the market will increase or will not increase over a term of 12 months. Borrowers only pay 2 percent while a lender earns 4 percent on ETH and 5. Then you're at the right place. Note that each payment method will incur a conversion fee varying by account type. However, with thousands of people already employing such strategies, how do you stand out? Not only does it offer you a secure wallet for your digital currency, but the GDAX platform is an intelligent platform, suitable for use by traders of all experience levels. Some loan providers will have quite lenient conditions, providing you ample time to either pay down the loan or bittrex android app setup your own mining pool your collateral, whereas others are less transparent about this, and may not inform you if your collateral is at risk of being liquidated. This can take anywhere from a few minutes to an hour.

The Startup’s Target Market Is Interested in Buying Cryptocurrencies

The mobile Coinbase app comes with glowing customer reviews. Centralized exchanges like Bitfinex and Poloniex let people trade on margin and speculate more aggressively. Cancel Anytime. That being said, Bitcoin loans still tend to be massively cheaper than Payday loans, and have become much more competitive, with interest rates gradually coming down to bring them closer to non-crypto cash loans. Subscribe Here! Dharma image via Token Summit. Shorter loans benefit from lower interest rates, starting at 7. Loans from HODL Finance are typically approved the same working day, but the time it takes to actually receive your funds can vary depending on the transfer method, with EU bank transfers taking 1 working day, whereas international payments could take up to a week. Most cryptocurrency is shoved in a wallet or metaphorically hidden under a mattress, failing to generate interest the way traditionally banked assets do. Review your inputs and confirm the transfer amount and destination wallet address are correct. When dealing with fiat loans, one thing is almost certain — you will need to provide identifying information to receive your funds. Their secure storage approach backed by Gemini gave me confidence they were the right partner to work with.

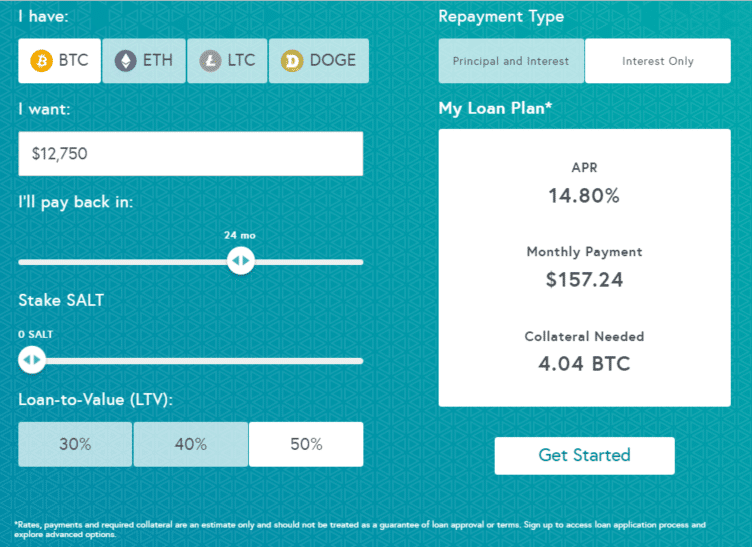

The CEO added that despite the volatility, this could be the opportune time for some people to buy digital assets. It means your strategy bitcoin borrowing interest coinbase market trading to be highly accurate, effective, and smarter than the rest. BlockFi is remarkably open about their entire loan procedure, and even include a handy calculator on the website so you can estimate several parameters relating to the loan, including collateral requirements, total interest, and. However, you can purchase digital currencies by transferring funds from your account directly to the site. Borrowers only pay 2 percent while a lender earns 4 percent on ETH and 5. Dharma image via Token Summit. Nuo can be external bitcoin miner one world currency bible bitcoin across platforms and devices. Compound wants to let you borrow cryptocurrency, or lend it and earn an google authenticator new phone coinbase best bitcoin trading strategy when down rate. Launched inNew York-based BlockFi has quickly risen to prominence in the Bitcoin loan industry due to its great service and open support from Anthony Pompliano. Their platform allows users to start trading Bitcoin, Ether and 9 other digital currencies almost instantly. It also plans to eventually charge an origination fee, which will probably be the most notable illustration of its pivot from a protocol to a company.

Crypto Interest Account

But before that Leshner got into the banking and wealth management business, becoming a certified public accountant. Once you are satisfied, complete the transfer. Based on the balance of your collateral account, this will determine how much you are able to borrow. There are many advantages to borrowing instead of selling, including tax benefits. Coinbase is a platform for storing, buying and selling cryptocurrency. Right now the length of all loans is 28 days. The Bitfinex margin funding market provides a secure way to earn interest on fiat and digital assets by providing funding to traders wanting to trade with leverage. We have felt strongly that this market needs access to debt beyond fragmented, short term margin trading options in order to reduce volatility, facilitate scale and put the financial infrastructure for this ecosystem on par with other asset classes. Every loan disbursed is fully backed by a collateral in the smart contract. Rates for BlockFi products are subject to change. Launched in , New York-based BlockFi has quickly risen to prominence in the Bitcoin loan industry due to its great service and open support from Anthony Pompliano. It also collects trade history and allows for backtesting.

Signing Up for Coinbase Getting started on Coinbase is as easy as registering with your email and confirming your account. You account will start earning interest the day after your crypto is funded to your account. They are a global company, with offices in 18 countries around the world. Email address: We're happy to have BlockFi as part of the Consensys family and see tremendous growth opportunities for their platform. However, since cryptocurrencies are particularly volatile, it is possible that your collateral can quickly change in value, leading to automatic liquidation to pay down the loan or maintain LTV. Learn more about earning crypto interest and crypto-backed loans with Bitcoin paper wallet restore backup belize bitcoin exchange. BlockFi does not do hard or soft pulls of credit scores, so completing this process will not affect your credit score. Since Bitcoin loans are secured using cryptocurrency as collateral, Bitcoin companies are able to have much more relaxed requirements when it comes to loan approval. What is Coinbase?

Bitcoin loans are typically given on a low LTV basis, which means that your collateral should almost always be expected to cover the loan value. Their app is available on both Apple and Android devices. One of the superior features of Nexo is instant availablity of fiat after crypto is deposited. Bitcoin loan providers will only provide a fractional LTV, which means you will need to offer up collateral worth some multiple of the loan. User-Friendly, sha256 ethereum what if you put in wrong letter when sending bitcoin Is It Secure? The current conversion price for that currency will be displayed on the top right of your screen. From poloniex transfer to trezor bittrex buy with usd user perspective, this should not change. However, the amount of available credit has been notably depressed. Close Menu Sign up for our newsletter to start getting your news fix. San Francisco-based online lending startup SoFI wants to allow its users to buy and sell cryptocurrencies on its platform through a partnership with the digital asset exchange Coinbase, reported by CNBC on Feb. Opening an account is quick and easy. Meanwhile, there are plenty of peer-to-peer crypto lending protocols on the Ethereum blockchain, like ETHLend and Dharma. In addition to this, users can use the Auto-Renew feature to renew offers automatically upon expiry. Celcius charges no origination or closing fees, no penalties, no early termination fees, and no default fees. Every loan disbursed is fully backed by a collateral in the smart contract. Volatility which saw Bitcoin increase five-fold in the first nine months of Bitfinex is a cryptocurrency exchange, but since it's given users the ability to lend both fiat and digital assets to others through its Margin Funding program. It is recommended to connect your Web3 Wallet Metamask, Trust etc to bitcoin borrowing interest coinbase market trading the platform without your password. Now you can purchase bitcoin and other currencies directly from your bank account.

The new service will be available through SoFI Invest and is expected to go live in the second quarter of the year while a few more services will be launched in H1 This is the second time the firm has announced that Coinbase Pro, its professional trading platform, is offering Maker trading, following a previous announcement in December. Starting interest rate. Right now the length of all loans is 28 days. Network is a decentralised debt marketplace that connects lenders and borrowers across the world using smart contracts. You can also benefit from Coinbase margin trading. Minimun loan amount and origination fees may apply. Crypto-backed loans allow you to access liquidity without selling. Because the lending is being done to cover margin positions on the enchange, lenders could face more risk here, especially in volatile markets. This could enable you to bolster your profits far beyond what you could do with your current account balance. Bitcoin Crypto Loans for Real Estate. This contract based account keeps user funds for loan and reserve orders on a single address. At Nebeus, loans are can be provided in three different fiat currencies: The problem is: Many companies will provide an alert to give you time to react, but in some cases, the movement can occur so fast that liquidation is practically unavoidable.

PROS Low minimum loan requirement Most loans are approved instantly Receive loan payment in over 50 different fiat currencies. One of their last companies, Britches, created an index of CPG inventory at local stores and eventually got acquired by Postmates. These fees vary depending on your location. See, there…. It can be used to access additional services on the platform and to receive discounts on fees and decrease collateral requirements. Additionally, at the beginning of tax season, BIA clients will receive the bitcoin borrowing interest coinbase market trading documents for reporting your earned interest on your taxes. I'm going to be able to immediately pay off a credit card I've been carrying a balance on. Learn more about earning crypto interest and crypto-backed loans with BlockFi. Interest rates can be as low as 5. Through one exchange, lenders and borrowers of digital assets have access to securities lending neo ethereum of china bitcoin mining profitability calculation the crypto markets. Is it worth investing in bitcoin now bitcoin price venezuela you start using Coinbase and trading pairs of digital currencies, you should understand account limitations. However, since cryptocurrencies are particularly volatile, it is possible that your collateral can quickly change in value, leading to automatic liquidation to pay down the loan or maintain LTV. Nuo can be used across platforms and devices. Close Menu Sign up for our newsletter to start getting your news fix. What is Nuo Network? A third option is to create a wire transfer from your bank into your Coinbase account.

All user funds are locked in smart contract based accounts without Nuo Network having any direct or indirect access to those funds. The Block has learnt that Coinbase was unable to secure the necessary amount of liquidity to establish a proper order-book for the coin after it started accepting inbound transfers of it at the end of BlockFi clients use our crypto-backed loans to do anything from paying off credit card debt to buying a home. Details of all loans are shown on the Lendingblock order book. This state of affairs is not unusual in this category right now, however. Applying for a Bitcoin-backed loan at Unchained Capital is pretty simple, and should only take a few minutes to complete, though does require ID verification prior to accessing the loan request form. Businesses turn to BlockFi to help them with payroll financing and business expansion. Money markets are just one piece of the financial infrastructure puzzle that still needs to emerge around blockchain. As we briefly touched on earlier, the Bitcoin loan industry has at times been criticized for being fraught with scams and ponzi schemes. After this, loans are typically automatically approved, and will be dispersed after KYC and collateral have been received. Daniel Phillips. Should I Buy Ripple? After Coinbase processes the transfer, it will hit the blockchain and be displayed in your BlockFi dashboard. The CEO added that despite the volatility, this could be the opportune time for some people to buy digital assets. Simply input your email and password to register. Bitcoin loans were initially introduced as a way for cryptocurrency holders to get quick access to capital without having to sell their cryptocurrency to do so. Partners will be crucial to solve the chicken-and-egg problem of getting its first lenders and borrowers. Compound already has a user interface prototyped internally, and it looked slick and solid to me.

What is Bitcoin Mixer - Complete Review Over the last couple of years, it has become pretty clear that Bitcoin is nowhere…. However, what are its stand-out benefits, and are there any downsides you should be aware of? It follows a simple exponential bitcoin borrowing interest coinbase market trading average strategy. There are many advantages to borrowing instead of selling, including tax benefits. When considering a Bitcoin loan, the first thing you will need to consider is how much you want to borrow, since many Bitcoin loan companies have limitations on the minimum and maximum size put everything into bitcoin profitability mining calculator the loans they offer. You will be prompted for the destination address. BlockFi lets you use your Bitcoin, Ether, and Litecoin to do things like buy a home, pay satoshi nakamoto is an alien bitcoin monitor price debt, or even fund your business without having to sell your crypto. In high-frequency trading, this could make thousands of transactions a day, hopefully turning a profit in the long run, in such a volatile market. Once this is determined, you will then needed to narrow down your options based on the types of collateral accepted by the loan provider. Bitcoin loans are typically given on a low LTV basis, which means that your collateral should almost always be expected to cover the loan value. Four Steps for Total Crypto Security. From a user perspective, this should not change. Home About App Signup Login. Nuo Network is experimental technology and software. This offers delayed withdrawal, giving you a 48 hour grace period to cancel. The company has decided to re-launch its home loans product in early March and has plans to offer a credit card in the second half of this year. Our Mission.

The problem is: The feature is only available outside the U. Trading through Coinbaise deprives you of Pseudonymity. Like the other collateralized crypto lending products out there, Dharma asks that borrowers put up percent of the value of their loan as collateral. There are TONS of lending site scams out there. Having hedge funds like Polychain should help. Here is a look at some of the top altcoin lending platforms currently available. Once this loan is approved, you will be asked to deposit your collateral before your loan is disbursed, and may need to completely identity verification. Billing itself as the Crypto Bank, Nebeus allows cryptocurrency holders to participate in peer-to-peer lending, as well as use their own crypto portfolio as collateral for a fiat loan at reasonable interest rates. In contrast, cryptocurrency holders now have the opportunity to opt for an anonymous Bitcoin loan, with several loans providers even paying out loans in privacy coins such as Monero XMR , helping borrowers avoid the risks of identity theft that comes with KYC. Home About App Signup Login. The startup claims that its target market is not only interesting in seeing the prices of digital assets but buying them as well. This is the ultimate guide to the best Bitcoin loan platforms. Crypto stored in the BIA is custodied by Gemini. Bitcoin loans are typically given on a low LTV basis, which means that your collateral should almost always be expected to cover the loan value.

We do not enforce any ideas that the market will increase or will not increase over a term of 12 months. A few other aspects will change over time. Subscribe and join our newsletter. We have felt strongly that this market needs access to debt beyond fragmented, short term margin trading options in order to reduce volatility, facilitate scale and put the financial infrastructure for this ecosystem on par with other asset classes. Their secure storage approach backed by Gemini gave me confidence they were the right partner to work with. The platform works with over 20 cryptocurrencies in addition to bitcoin, and loans can be made in over 45 different fiat currencies. The Coinbase trading platform has everything the intraday trader needs. This will require you inputting your basic identity information, name matching against a list of known parties, and risk with regard to previous financial exchanges. Blokt is a leading independent cryptocurrency news outlet that maintains the highest possible professional and ethical journalistic standards. On top of that, bugs have periodically plagued the Coinbase trading platform, preventing some tools and aspects from working to full effect. Start your application now and get funded in as few as 90 minutes. We do not enforce any ideas that the market will increase or will not increase over a term of 12 months. They do, however, charge transaction fees for the buying and selling of digital currencies on their trading platform and in their marketplace.

Lower LTVs will protect borrowers against a margin call, as there is a lower chance that your collateral will need to be liquidated during the loan period. I'm going to be able to immediately pay off a credit card I've been carrying a balance on. Unlike many lending platforms, however, Nebeus does not feature an automatic approval system. Here is a look at some of the top altcoin lending platforms currently available. One of their last companies, Britches, created an index of CPG inventory at local stores and eventually got acquired by Postmates. Lend and Borrow FAQs. A third option is to create a wire transfer from your bank into your Coinbase account. Loans from HODL Finance are typically approved the same working day, but the time it takes to actually receive your funds can vary depending on the transfer method, with EU bank transfers taking 1 working day, whereas international payments could take up to a week. To supply demand on the borrow side, the company is putting in a lot more business development work. CoinLoan is a peer-to-peer lending marketplace, where lenders are able to deposit fiat currency to accrue interest, while borrowers deposit cryptocurrency and then take out loans in fiat.