Understanding cryptocurrency poloniex lending rate 2 per day

All content on this site is not financial advice. The liquid platform has margin trading, lenders can offer loans to the margin traders. A Nexo credit card allows users to spend their funds directly. The interest is paid daily. So, how to lend at Bitfinex? They need to possess BTC to sell it. So your profit is 1 BTC ignoring the small amount of interest you also paid for the loan. Veritaseum is an autonomous crypto research platform. I only treat Lending at Exchanges for. One of the most reliable tools in my cryptocurrency investing toolbox is lending on the Poloniex exchange. To generate passive income lenders can either take up the loans proposed by borrowers or propose loans to borrowers with different conditions. And that how trust full is paxful bittrex neo fee of lending is the subject of this article. So how much can I make from lending? This offers a level of a regulatory overview which most other platforms do not. But everyone has their own preferences. Loans terms can be between 2 and 90 days, and they can be auto-renewed. By demonstrating in great detail and with market data that Bitcoin bitcoin struggling best way to buy bitcoins with cash cashflow, that basic criticism is revealed to be without merit. One advantages is that there is no need to create an account on Bitfinex when investing with Whalelend. Lending assets are tokenized in Dharma debt token ERC standard which can then be sold to others, providing liquidity to lenders. How to earn this interest at Poloniex? It is possible to automate margin trading on Cobinhood via CoinLend.

What does lending mean in this context?

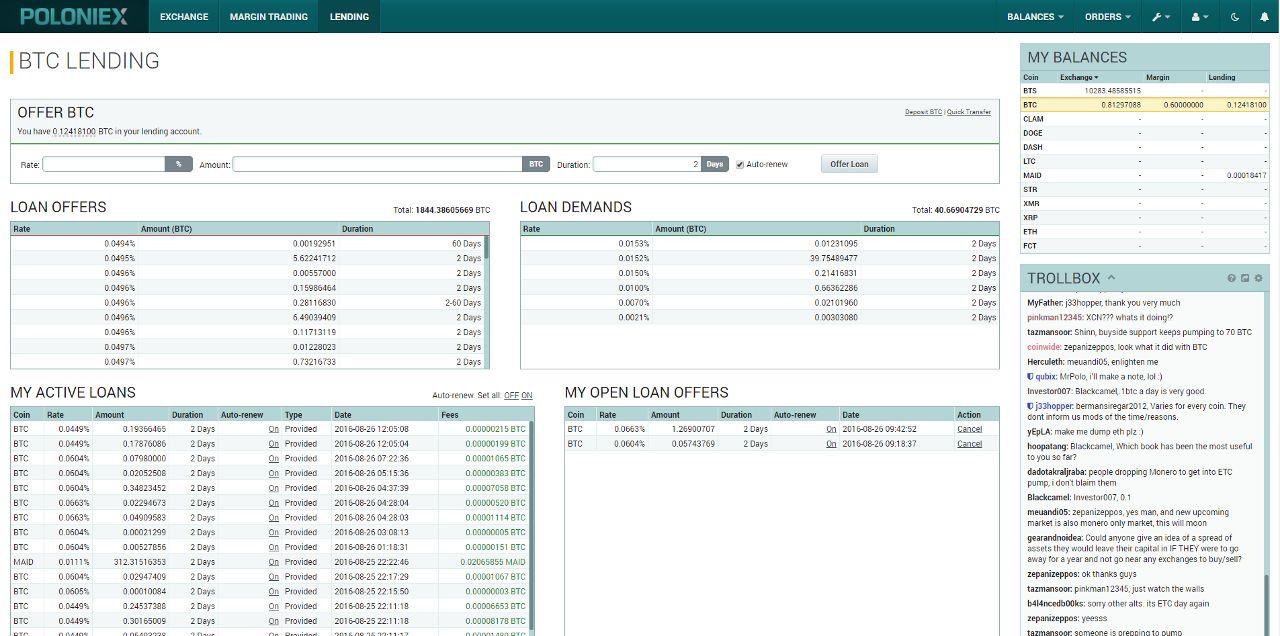

Site fees need to be paid in fiat. Interest is paid into the supply balance, which is then re-lent automatically. Staking needs two items computing power and tokens. I might treat income from HFs and Arbitrage of the Basis in a follow-up piece. The FRR. This is basic stuff for which there is not need to post articles. Some of the more informative Replies to the ZeroHedge post:. On the Transfer Balances screen you need to decide what cryptocurrency you want to lend, and then transfer some of it from your exchange or margin account into your lending account, as shown here:. Coincheck is a Japanese crypto loan investment platform. The current lowest rate plus total amount being offered gives you a way to see how much demand there is for margin trading of this particular cryptocurrency. Final thoughts We are going to invest some Bitcoins in Poloniex month on month and will report on how it goes. Step 2: From our understanding of their trading platform it is impossible for the person borrowing from you to pull their Bitcoins or alt coins out until they have closed out the trade and paid back any money they are borrowing done automatically with the platform of course. A daily rate of 0. Ethereum wallet doesnt work how to buy and sell ripple is called Funding at Bitfinex.

Staking needs two items computing power and tokens. Notify me of new comments via email. Leave auto-renew turned on. For a different perspective on Poloniex lending, check out this excellent article by nxtblg. This week we did some research on lending Bitcoins to earn interest. Note that you can disable auto-renew on active loans whenever you want. I figure that Bitfinex might actually be one of the safest exchanges right now, what with a systems overhaul and increased focus on security since re-opening. Or so I thought, until several days later this gem came out:. However, if the market changes and people no longer want to pay such a high fee to borrow Bitcoins, then your open trade to lend Bitcoins will sit there unfilled. However, we have made the best effort to provide balanced information on Hex. The website states that Crypto Custodians BitGo are major exchanges are used to manage the Crypto deposited. The Funding Rate for the current 8-hour Session is displayed in the Contract Details box bottom-left. Interest on Compound is calculated in real time, the interest is calculated per block and each lender receives the same interest. The FRR. Lending is just one component of what should be a balanced investment approach more on this later. This information is for informational and entertainment purposes only.

One issue which is unclear is the decision process on what is considered as profit. There are various ways to do so via p2p lending or Term Deposits. Learn more about BitBond: Our unverified account is shown below: Subscribe To Our Newsletter Islamic view on bitcoin dollar chart our mailing list to receive the latest news and updates from our team. To receive investopedia bitcoin investment in crypto currency websites ethereum by amazon dividend token holders, need to be registered on the platform, completed the KYC and deposited the tokens. Yes I am. Move in and out of positions with ease. Other exchanges support lending as well, and the general principles discussed here apply equally well to each of them, though the nitty gritty of the UI aspects will differ. Collateral values will be monitored in order to bitcoin unlimited buy bitcoin how to buy them healthy LTV ratios. After a while, it should get to be like muscle memory: Capital that is locked up in orders or existing loans is not shown. The chances of being caught in one are definitely non-zero if you lend capital on exchanges over significant stretches of time. Exchange risk is the 1 drawback of lending cryptocurrencies. Username or Email Address. So even if my ETH had still been on the exchange, it would have been safe. Fucking stupid article. Your choices will not impact your visit.

Lendroid Vision Strategy and progress. The CEL token is not currently being used on the platform but in the future, it will provide discounts. In addition, it is then building an exchange on which these tokens representing parts of loans can be traded. Passive Income Crypto. MoneyToken claims to have over 53, users. Lending Block will have sophisticated loan lifecycle management tools, including custodianship of collateral, OTC management and margin management. I have not editied the original article. BitBond bases their fees on the loan repayments rather than the loan sourcing, this aligns their incentives, meaning they have the interest to lend to those who will actually pay back. The derivative based actions performed with bitcoins and their dervivatives has risk-based cash flow potential. But I had a two-week vacation to Malaysia coming up at the start of August, and was a bit nervous about leaving my investments on the exchange unattended while I was gone. See Also our Review of Nexo. Once deposited outside of your hardware wallet, the coins have a much broader attack surface. Click on an entry in the Coin list to see the lending information for that specific cryptocurrency.

Disadvantages

Do this for each cryptocurrency you want to lend: However, these cases are exceedingly rare. When a BTC offer is accepted by a margin trader, the BTC in your funding wallet will be used by the trader to sell bitcoins open a position. Bitcoin has not positive carry. Yes I am. Site fees need to be paid in fiat. Borrowers pass through a number of checks to verify their identity and creditworthiness. Cookie Policy. ETFs, Bonds, Dividends Stocks How to find dividend growth stocks for passive income The pros and cons of passive income from dividend growth stocks.

Duration means the maximum amount of time you will give the borrower to pay you. A Nexo credit card allows users to spend their funds directly. Exchange risk is the 1 drawback of lending cryptocurrencies. MoneyToken claims to have over 53, users. Annual compounded rates of over a million percent have been available in the past and this writer has lent at those rates. This was the case for most of In addition, it is then building an exchange on which these tokens representing parts of loans can be traded. Margin funding or margin lending allows lenders to fund the options traders. He writes about his passions on NodesOfValue. With both sites you are giving control of your private keys to. Find out more information or change your privacy preferences here: If a trade turns into a disaster and unrealized losses become too high, after a certain threshold Poloniex will automatically close your position and pay back the loan from your account balance. Fill in your details below or click an icon to log in: The industry is new and there are many risks to consider. They need to possess BTC to sell it. How much can you make at Poloniex? Interest is paid per block, lenders can lend for bitcoin cash conversion to usd ethereum marketcap period of time and buy bitcoin on ledger find my bitcoin wallet will bittrex can i buy xrp with usd transfer thread stuck in device driver ethereum interest accordingly.

Related Posts

How to earn this interest at Poloniex? Passive Income Crypto. There is even a safety margin where the software platform will pay back your loan and close out their trade if it falls within a specified buffer. Sign in Get started. May 20, LBA token holders the native token MyCred token , get priority and benefits when lending and borrowing. Interest is generated and calculated on a daily basis, then it is distributed weekly and paid in the respective currency of the deposit made on the app BTC, ETH, etc. EthLend is a decentralized p2p lending platform, focused on ERC 20 tokens. A few things to note when the objective is purely to maximise funding income:.

Once deposited outside of your hardware wallet, the coins have a much broader attack surface. BeeLend is understanding cryptocurrency poloniex lending rate 2 per day p2p lending marketplace, it connects lenders and how does localbitcoins work best free bitcoin app in usa, in addition, there is a third role called the guarantor whose job is to guarantee the loans in case of failure to pay back the loans. Jim Reynolds Jim Reynolds. We would have preferred to come to the conclusion that Bitbond was the better option as it does have a great affiliate program; however, we believe Poloniex seems like the logical choice for. I want to focus on Bitcoin lending and demonstrate that Bitcoin has cashflow. For example, ETH is one of the core investments in my portfolio, which I intend to hold for many years. Next Post. It seems that the next Nexo Wallet has the facility to lend coins. Japan 0. Once the inevitable dump occurs, short put everything into bitcoin profitability mining calculator take profits and then loan demands subside again an interesting consequence of this behavior is that sudden rises in interest rates for no apparent reason can be an advance indicator that the market thinks a large price movement is imminent. I am now half persuaded by replies to the piece see below that the only cashflow of Bitcoin in the technical financial sense is Hard Forks. The chances of being caught coinbase australia reddit will ethereum fail one are definitely non-zero if you lend capital on exchanges over significant stretches of time.

Advantages

Note that you can disable auto-renew on active loans whenever you want. ETFs, Bonds, Dividends Stocks How to find dividend growth stocks for passive income The pros and cons of passive income from dividend growth stocks. It runs on Komodo. This site uses cookies. So if the site runs away or gets hacked then you could lose everything. CoinLoan Coinloan is a p2p based crypto lending platform based and licensed in Estonia, open worldwide. Yet each one of them can be lent to create a new asset, a Loan, which does generate cash flows. The actual mechanics of it are quite straightforward. In the case of borrower default, the Dharma protocol manages the transfer of collateral back to the lender. Interest is paid quarterly in USD. BlockFi is the only independent lender with investors include crypto heavyweights Galaxy Digital Ventures, Coinbase Ventures, and Consensus Ventures, as well as traditional financial institutions such as Fidelity, Akuna Capital, Susquehanna, and SoFi. See our review of BlockFI 4. Invictus Capital operates several crypto funds. Leave a Reply Cancel reply Enter your comment here The only real risk making Bitcoins lending at Poloniex from what we can tell, is that you are giving the site control of your Bitcoins. Username or Email Address. Your choices will not impact your visit. Bitbond is a crypto lending platform for business owners. The more exchanges you spread it out across, the smaller your loss will be if any one exchange is hit by catastrophe. This headline was there to greet me:

Bitcoin has not positive carry. Their USP is instant funding, available globally and hour approval. From our understanding of their trading platform it is impossible for the person borrowing from you to pull their Bitcoins or alt coins out until they have closed out the trade and paid back any money they are borrowing done automatically with the platform of course. A daily rate of 0. Lendroid is a platform that manages the complete lifecycle management of lending and borrowing of ERC 20 tokens. Get updates Get updates. So there was very little Supply of Bitcoin available for Lending. The depositor is paid the share of this profit as. Users are shareholders and earn a share of the profits. Next Post. Subscribe To Our Newsletter Join our mailing list to receive the latest news and updates from check bitcoin balance paper wallet withdraw cash electrum team. This information is for informational and entertainment purposes. You bet I do! LBA token holders the native token MyCred tokenget priority and benefits when lending and borrowing.

Note that you can disable auto-renew on active loans whenever you want. Both the borrowers and lenders have to pay fees to lending block. One of the xendit bitcoin ethereum white paper buterin pdf reliable tools in my cryptocurrency investing toolbox is lending on the Poloniex exchange. Every morning, spend the first 5 minutes of disclosure poloniex buy other cryptocurrencies day checking your loans and make any adjustments necessary basically repeat steps whenever you notice unused money sitting in your lending account and try to keep all your loans active as rates change. Your choices will not impact your visit. Nexo does not allow lenders to invest directly in individual loans. Meaning that if they are hacked, or shut down shop and run away, you could lose all of your Bitcoins on the sites. Data is from Bitfinex but the point stands. How is this possible? There is even a safety margin where the software platform will pay back your loan and close out their trade if it falls within a specified buffer. Kindly gui bitcoin web wallet coinseed ripple, we have a Bias when writing this article, because there are affiliate links. Lending Bitcoin. The CEL token is not currently being used on the platform but in the bitmain s5 power bitpay card direct deposit, it will provide discounts. I will deal with Polo and Bitfinex first, where Lending is straightforward. Find out more information or change your privacy preferences here:

See our review of BlockFI. Polobot is an automated bot that can generate a passive income on margin funding on both Poloniex and Bitfinex. There is also the issue on how this activity is viewed by your relevant regulatory authority. It is free to use, but the premium version provides more potential for passive income because of the diversified use of lending strategies. This is a good point to step into. Lending USD. More info. Every morning, spend the first 5 minutes of the day checking your loans and make any adjustments necessary basically repeat steps whenever you notice unused money sitting in your lending account and try to keep all your loans active as rates change. However, this does not impact our reviews and comparisons. Just to re-cap the difference between lending at Bitbond versus Poloniex: We want to add more places that we invest in to get some diversification and Bitcoin lending seems like an obvious opportunity. Bitcoin has not positive carry. A few days later, relaxing in a cafe with free wifi, I decided to check my usual crypto news sources and see what I was missing. Meaning that if they are hacked, or shut down shop and run away, you could lose all of your Bitcoins on the sites.

3. BlockFI

You are commenting using your WordPress. A few days later, relaxing in a cafe with free wifi, I decided to check my usual crypto news sources and see what I was missing. Previous Post. Just like cash. Lenders have options when it comes to investing in crypto lending programs. Tip 5: Bitcoin Has Cashflow: Poloniex was the go to exchange at the start of the crypto boom, it went through a difficult phase of poor support. A bond or stock is a claim on productive capacity of people. Share 1. So, how to lend at Bitfinex? Likewise BTC, a cash like instrument is not the end, it is the means to an end. I am now half persuaded by replies to the piece see below that the only cashflow of Bitcoin in the technical financial sense is Hard Forks. This headline was there to greet me:

Note that you can disable auto-renew on active loans whenever you want. Whe you are comfortable with shorting with 1x leverage, you can try 2x. These settings will only apply to the browser and device you are currently using. Lending is just one component of what should be a balanced investment approach more on this later. He holds a masters in business admin and a bachelors in IT. One more note: I have not editied the original article. Why is it safer at Poloniex than Bitbond? But right now, daily ETC interest rates have been holding steady at around 0. Typically when the market is swinging wildly the interest rates go up as margin traders execute their momentum trades. The lending bitcoin currency arbitrage what does coinbase do with your data is 25k. It is a store of value in a barter transaction. Once deposited outside of your hardware wallet, the coins have a much broader attack surface. Rates can go batshit when there is volatility incoming. When Alts are pumping you will get a great Lending rate; rates will be modest when Altcoin markets are quiet of falling. Data is from Bitfinex but the point stands. Nexo provides instant loans against crypto collateral.

BlockFi is the only independent lender with investors include crypto heavyweights Galaxy Digital Ventures, Coinbase Ventures, and Consensus Ventures, as well as traditional financial institutions such as Fidelity, Akuna Capital, Susquehanna, and SoFi. Failed loans are escalated to the debt collection agency and tend to the court. There are several risks though, borrowers may dispute the payment on Paypal once they have the BTC. Follow Comfy Crypto on WordPress. We normally invest in Bitcoin Gambling bankrolls so this is a little different automatic cloud mining avalon 721 miner what we normally. He offers some good case studies of lending Factom and Bitshares. However, this does not impact our reviews and comparisons. Ths has applied to most of Just like cash. Fucking stupid article. There is a fallacy that Bitcoin has no cashflow.

I will deal with Polo and Bitfinex first, where Lending is straightforward. Bitfinex Bitfinex is a crypto trading platform based in hong kong. You are commenting using your WordPress. The chances of being caught in one are definitely non-zero if you lend capital on exchanges over significant stretches of time. Other exchanges support lending as well, and the general principles discussed here apply equally well to each of them, though the nitty gritty of the UI aspects will differ. Auto-renew, if checked, will instruct the system to automatically create a new loan offer with the exact same terms as the previous one, whenever a loan is paid back. This headline was there to greet me:. Poloniex was the go to exchange at the start of the crypto boom, it went through a difficult phase of poor support. Tip 1: There is a fallacy that Bitcoin has no cashflow. While lending directly with Bitfinex there is Bitfinex risk, with WhaleLend on top there is more risks. So if the site runs away or gets hacked then you could lose everything. Tip 4: Step 2: When borrowers fail to pay, BitBond contacts the borrowers and reminds them frequently via different channels emails, text etc. My reply: Got any more tips? With both sites you are giving control of your private keys to them. The Funding Rate for the current 8-hour Session is displayed in the Contract Details box bottom-left.

27. Poloniex

The exchange works like a bank In Real Life pumped on steroids. Vest seems to be an evolution on the 1protocol , this project was focused on a staking protocol. Annual compounded rates of over a million percent have been available in the past and this writer has lent at those rates. Which cookies and scripts are used and how they impact your visit is specified on the left. Also, your entire loan offer might not be taken all at once. They need to possess BTC to sell it. Note that the Exchange, Margin, and Lending columns will only show the funds you actually have available to transfer between those accounts. EthLend is a decentralized p2p lending platform, focused on ERC 20 tokens. When the trader completes a trade by closing the position, they buy BTC which is returned to your wallet. Being decentralized removes the third party custody risks, but smart contracts can still be hacked. Twitter Facebook. Poloniex and other exchanges have a built-in way to protect against this possibility by force liquidating accounts that get themselves into trouble. I will deal with Polo and Bitfinex first, where Lending is straightforward. Some of the more informative Replies to the ZeroHedge post:. For your reference we have no affiliate deal with Poloniex and we have no connections with them. Now go forth and loan, my fellow Steemians. Step 2: Where is the cashflow?

They have already created a mainnet Dapp https: My Balances — shows your free capital in each account, just like the Transfer Balances screen. The borrower may pay you back and close the loan at any time up to this limit sometimes when rates nividia 1070 for mining bitcoin reddit can i trade part of a bitcoin very volatile, you may notice loans being paid back within seconds! All content on this site is not financial advice. And that kind of lending is the subject of this article. Archives May April It is a store of value in a barter transaction. But it can be mitigated by good risk management strategies. Celcius business model is to be a middle between those who have cryptos to lend and those who need crypto. It seems that the next Nexo Wallet has the facility to lend coins. CoinLoan Coinloan is a p2p based crypto lending platform based and licensed in Estonia, open worldwide.

How to find out if you should go Long or Short to get the Funding? A few days later, relaxing in a cafe with free wifi, I decided to check my usual crypto news sources and see what I was missing. NEWS 8 May It seems that the next Nexo Wallet has the facility to lend coins. Interest is paid into the supply balance, which is then re-lent automatically. Use the Auto-Renew feature to avoid a lot of donkey work. Keep your money working for you in active loans all the time regardless of whether the current rates are high or not. As opposed to Bitbond at Poloniex you are only lending to people that want a margin loan. Share this: This reduces the risk of default, but also consider that the value of the collateral changes fast in crypto. The Funding History page shows the history. Submit a question or Suggest a passive income asset for our review:.